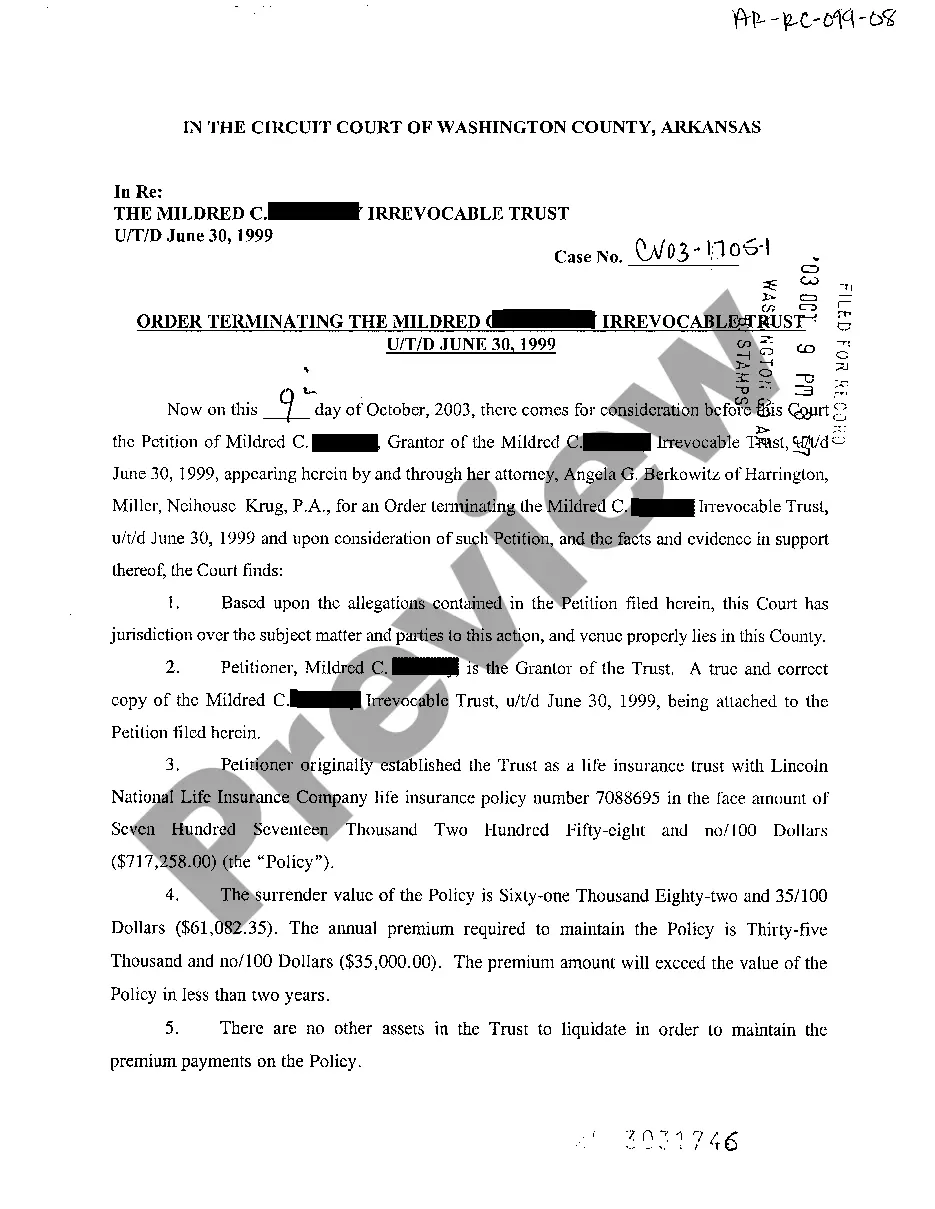

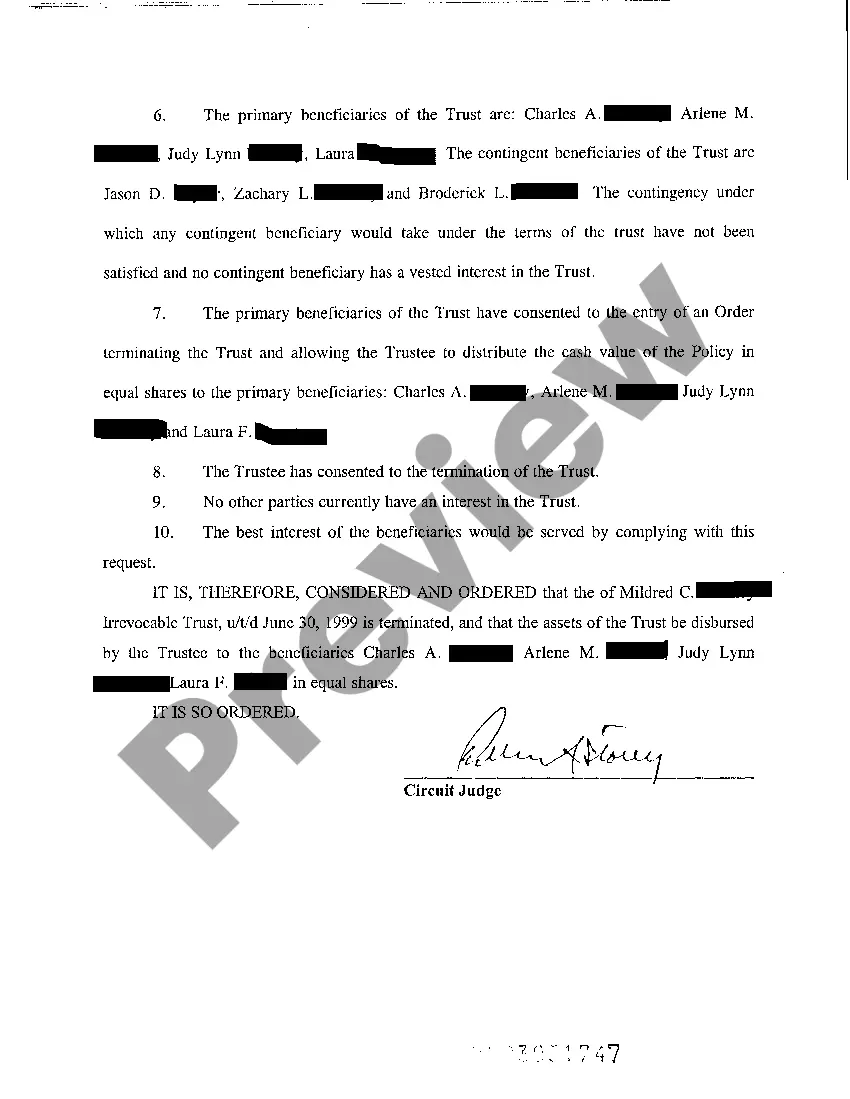

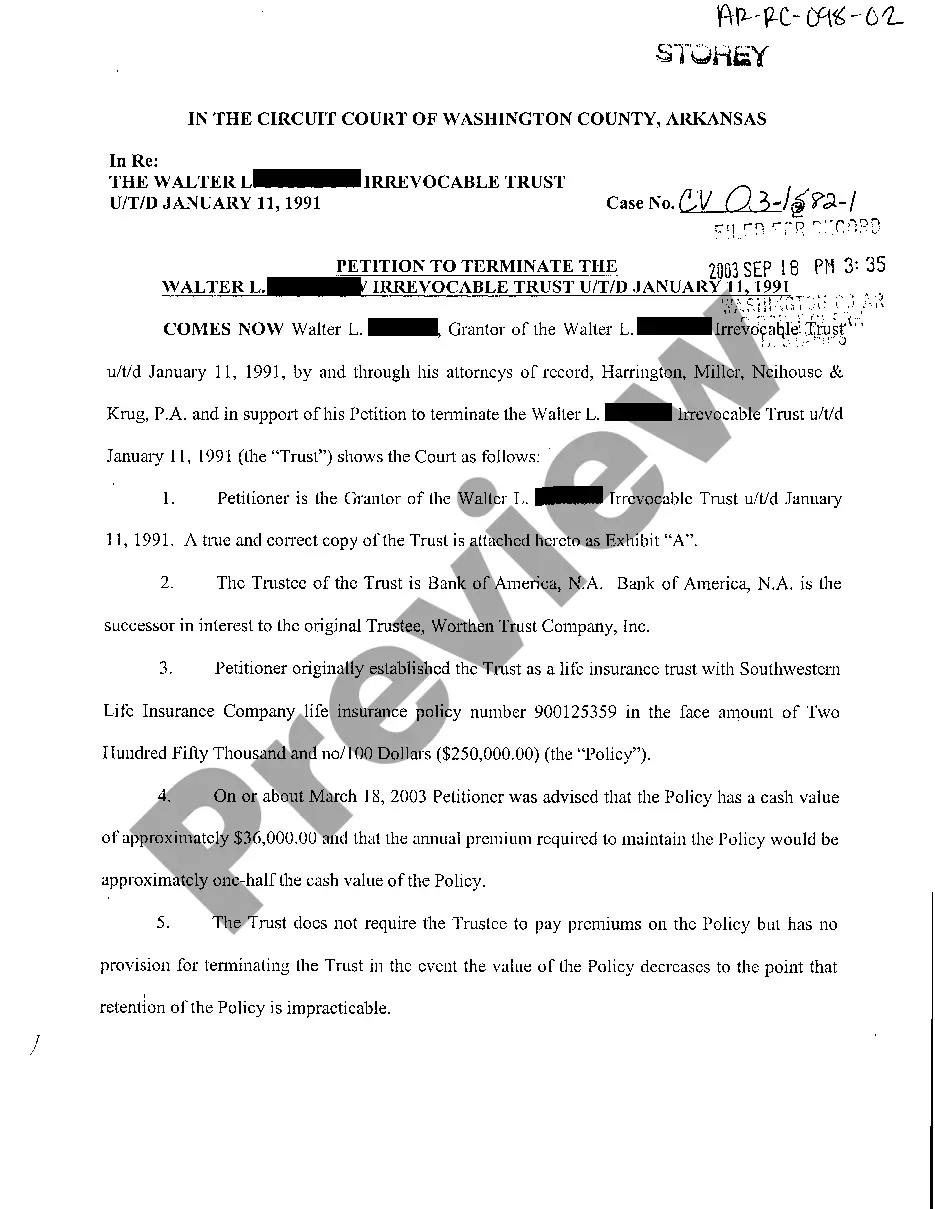

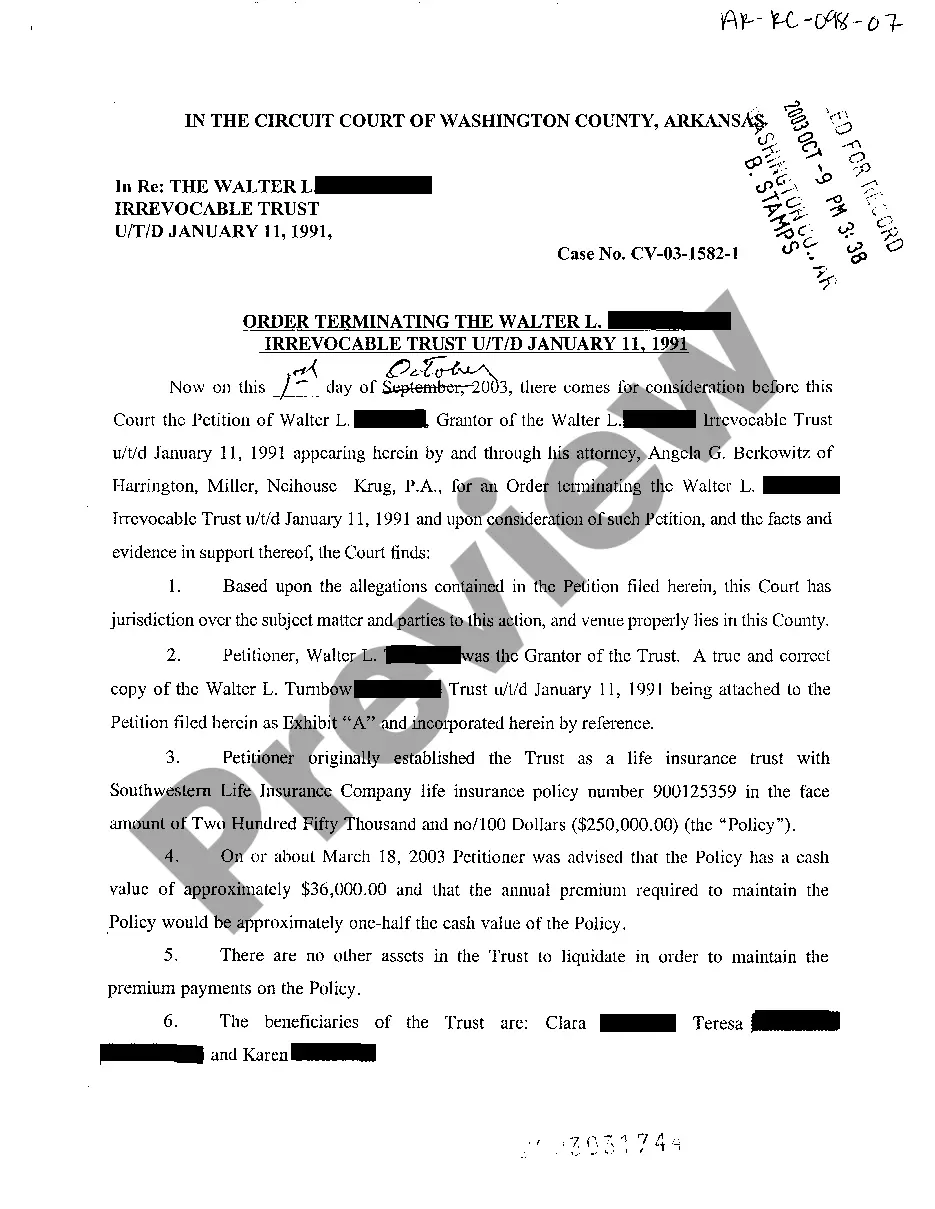

Arkansas Order Terminating Irrevocable Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Order Terminating Irrevocable Trust?

Among numerous complimentary and paid samples that you find online, you cannot guarantee their precision.

For instance, who composed them or if they are adequately qualified to handle what you need them for.

Always remain composed and utilize US Legal Forms!

Once you’ve registered and completed your subscription, you can utilize your Arkansas Order Terminating Irrevocable Trust as frequently as you wish or for as long as it remains valid in your state. Modify it with your preferred editor, complete it, sign it, and print it. Achieve much more for less with US Legal Forms!

- Obtain Arkansas Order Terminating Irrevocable Trust templates crafted by experienced lawyers and evade the expensive and lengthy process of searching for an attorney and then compensating them to draft a document that you can conveniently find yourself.

- If you already possess a subscription, Log In to your account and locate the Download button near the file you’re searching for.

- You'll also be able to retrieve your previously obtained examples in the My documents section.

- If you are visiting our website for the first time, adhere to the following instructions to acquire your Arkansas Order Terminating Irrevocable Trust swiftly.

- Ensure that the document you see is legitimate in your state.

- Examine the file by reviewing the details using the Preview feature.

Form popularity

FAQ

The primary benefit of an irrevocable trust lies in its ability to bypass probate and facilitate direct asset distribution to beneficiaries. This ultimately saves time and costs associated with the probate process. Furthermore, it offers protection from estate taxes in specific situations. By exploring the Arkansas Order Terminating Irrevocable Trust, you can uncover how this vehicle can enhance your estate planning strategy.

Certain assets cannot be held in a trust, including personal property that may not convey easily, such as vehicles or collectibles, unless specified in the trust terms. Additionally, some retirement accounts and insurance policies have specific regulations that may restrict their inclusion in a trust. If you plan to manage assets through the Arkansas Order Terminating Irrevocable Trust, be aware of these restrictions.

One significant downside of an irrevocable trust is the lack of flexibility. Once you place assets into this type of trust, you cannot easily alter the terms or reclaim those assets. While this can secure asset protection, it also means you must think carefully about your decisions. The Arkansas Order Terminating Irrevocable Trust offers pathways for those seeking to navigate these limitations.

The greatest advantage of an irrevocable trust is asset protection. Once assets are transferred into the trust, they are shielded from creditors and legal claims, allowing beneficiaries to benefit without risk to those assets. This feature is particularly valuable in estate planning. The Arkansas Order Terminating Irrevocable Trust can help you understand how to leverage these benefits effectively.

Removing someone from an irrevocable trust can be complex, as the grantor generally cannot modify the trust once it is established. However, under certain conditions, a court may allow changes, or the trust document itself may detail a process for removal. If you need guidance with this situation, exploring the Arkansas Order Terminating Irrevocable Trust through uslegalforms can provide clarity.

When the grantor of an irrevocable trust passes away, the trust usually continues to exist and operates according to its terms. The assets within the trust are transferred to the beneficiaries as specified in the trust document without going through probate. This can provide an efficient way to manage and distribute assets. Utilizing the Arkansas Order Terminating Irrevocable Trust may streamline this process further.

In an irrevocable trust, the ultimate beneficial owner is often the beneficiaries named in the trust document. These individuals receive the income or assets held in the trust, subject to the terms set forth by the grantor. It is important to note that the grantor typically relinquishes control over the assets once the trust is established. If you are looking into Arkansas Order Terminating Irrevocable Trust, understanding ownership can help clarify your options.

Adding and removing assets from an irrevocable trust is typically restricted. Once assets are placed into the trust, they usually cannot be taken out easily. However, if circumstances change, you might consider obtaining an Arkansas Order Terminating Irrevocable Trust, allowing you to manage assets more flexibly in accordance with Arkansas law.

Making changes to an irrevocable trust can be complicated. Generally, since these trusts are designed to be unchangeable after execution, you may need to pursue legal remedies. An Arkansas Order Terminating Irrevocable Trust could be an effective solution, allowing you to implement desired changes while remaining compliant with state laws.

To remove assets from a trust, you must follow the trust's rules and state laws. Typically, this may involve obtaining permission from beneficiaries or going through a more complex legal process. In Arkansas, seeking an Arkansas Order Terminating Irrevocable Trust could simplify the process and help ensure that asset removal occurs according to legal standards.