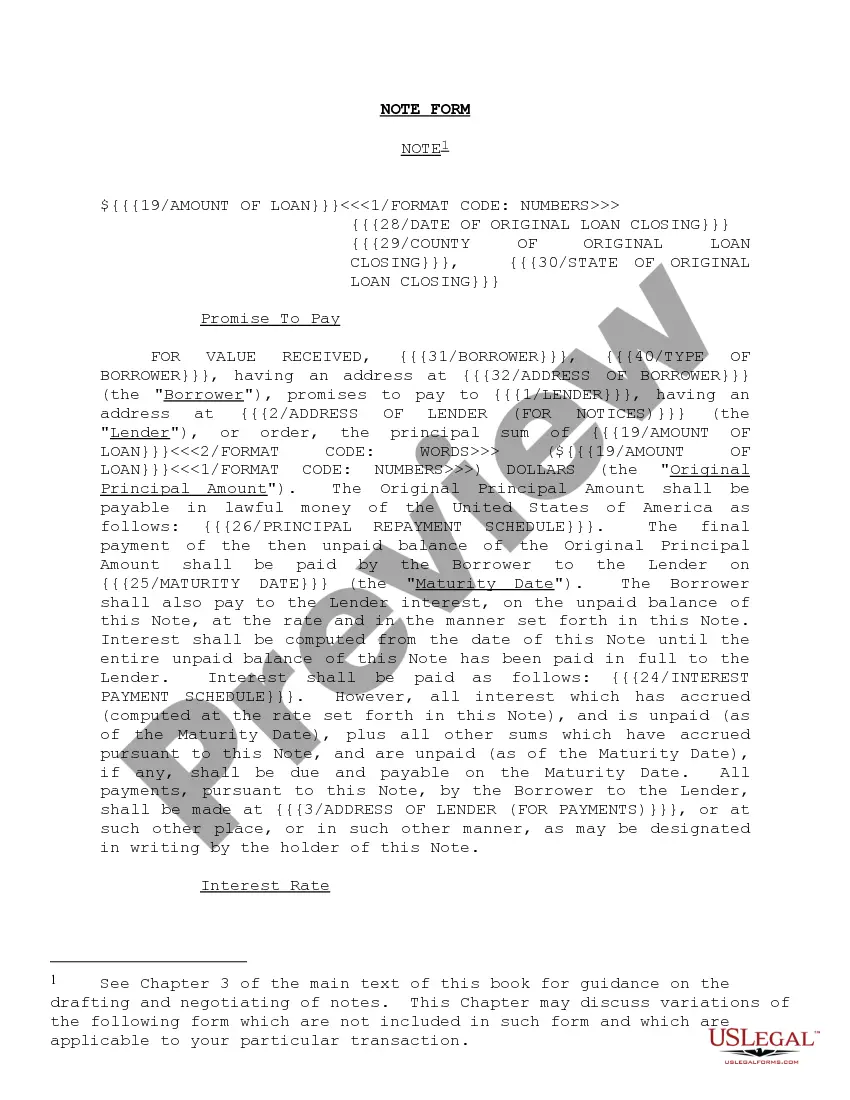

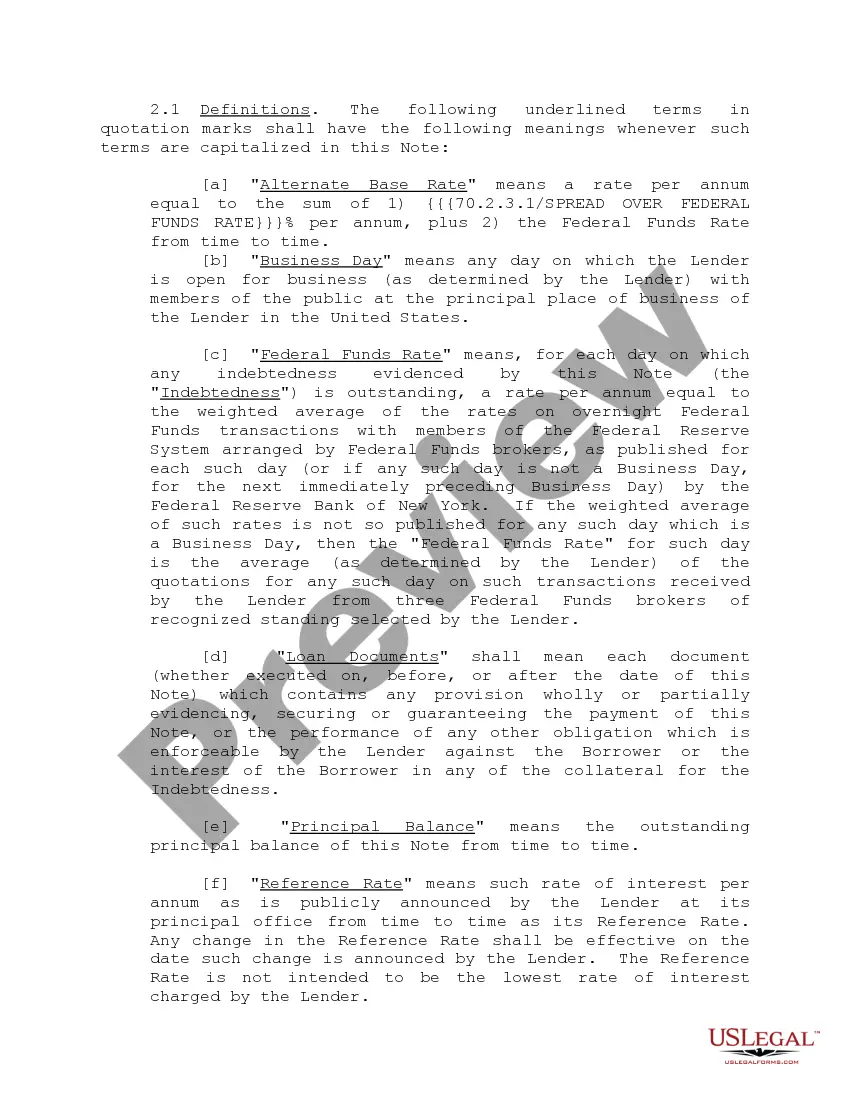

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Alabama Note Form and Variations

Description

How to fill out Note Form And Variations?

You are able to commit hrs on the web looking for the legitimate file design that suits the state and federal requirements you want. US Legal Forms gives a huge number of legitimate forms that happen to be analyzed by professionals. It is simple to download or printing the Alabama Note Form and Variations from our support.

If you currently have a US Legal Forms bank account, you can log in and click the Acquire key. Afterward, you can comprehensive, change, printing, or sign the Alabama Note Form and Variations. Each legitimate file design you get is your own property for a long time. To obtain another copy associated with a obtained form, visit the My Forms tab and click the related key.

If you work with the US Legal Forms site the very first time, follow the simple recommendations below:

- First, make certain you have selected the proper file design to the county/city of your choosing. See the form information to make sure you have selected the correct form. If offered, use the Review key to check with the file design too.

- If you would like find another model from the form, use the Lookup industry to discover the design that meets your needs and requirements.

- Once you have located the design you need, click on Purchase now to move forward.

- Choose the pricing program you need, type in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your bank card or PayPal bank account to purchase the legitimate form.

- Choose the structure from the file and download it to your gadget.

- Make alterations to your file if necessary. You are able to comprehensive, change and sign and printing Alabama Note Form and Variations.

Acquire and printing a huge number of file web templates making use of the US Legal Forms web site, that provides the greatest variety of legitimate forms. Use expert and state-certain web templates to deal with your business or individual demands.

Form popularity

FAQ

In Alabama, only the borrower and their co-signer have to sign the document. However, the lender can add their signature to it as well. Though not required by Alabama law, you can choose to have the promissory note notarized. Notarization could be helpful in the event of a lawsuit.

LIABILITY FOR FILING RETURNS. Alabama Form 20S is to be used only by corporations doing business in Alabama that have elected to be treated as an S cor- poration for federal income tax purposes.

Ing to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.

If you itemize, you can deduct part of your medical and dental expenses, part of your unreimbursed employee business expenses, amounts you paid for certain taxes, interest, contributions, and other miscellaneous expenses. You may also deduct certain casualty and theft losses. Married, Filing Separate Returns.

The Alabama Form 65 is similar to the federal Form 1065 in many ways. And, the Form 65 requires that an Alabama Schedule K-1 be completed for any entity that was a partner or owner during the taxable year.

The Alabama Department of Revenue may charge your business TWO different late fees if you file late and/or don't pay your taxes on time. If your return is filed late, you will be assessed 10% of the total tax due OR $50, whichever is greater.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

Proforma Form 20C for corporations filing the Alabama Consolidated Corporate Income Tax Return.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.