Alabama Self-Employed Drywall Services Contract

Description

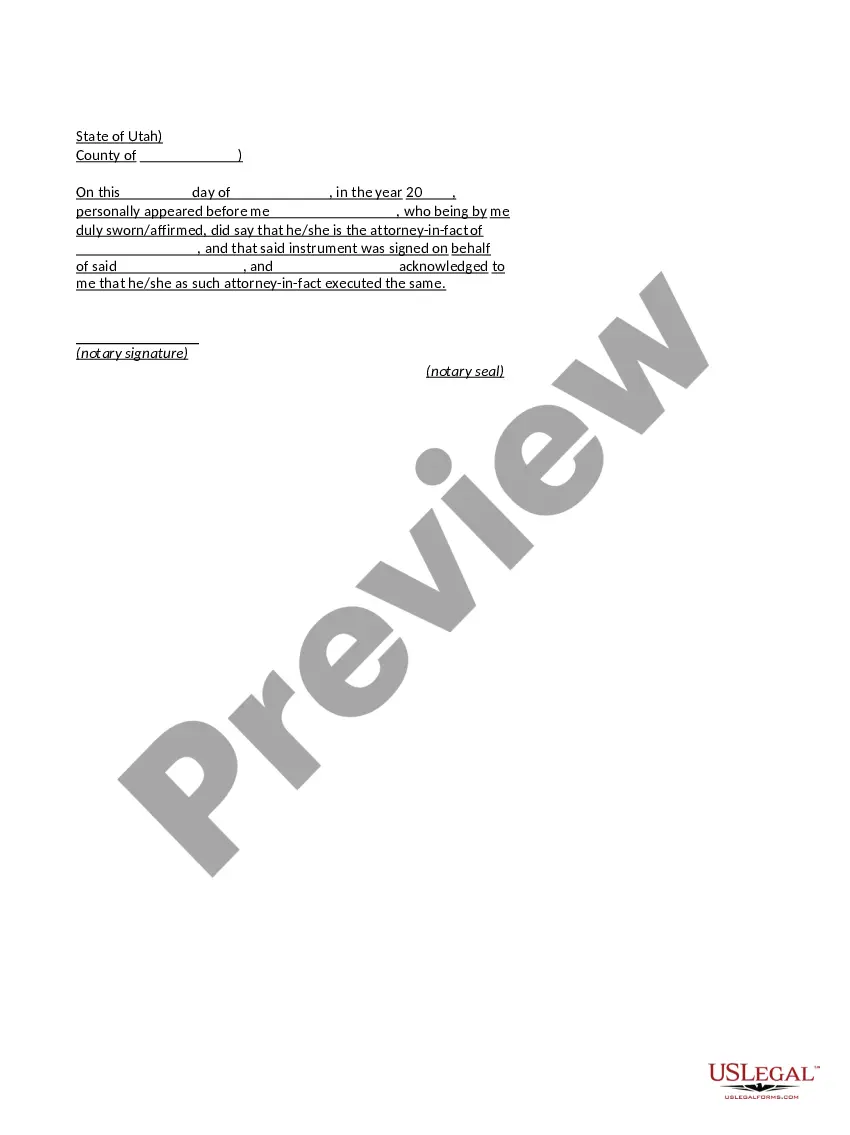

How to fill out Self-Employed Drywall Services Contract?

If you require to total, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s straightforward and convenient search to find the documents you need. Various templates for business and personal purposes are categorized by groups and states, or keywords. Use US Legal Forms to obtain the Alabama Self-Employed Drywall Services Contract in just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Alabama Self-Employed Drywall Services Contract. You can also access forms you previously saved in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for your specific city/state. Step 2. Utilize the Preview option to review the form’s content. Don’t forget to read the description. Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template. Step 4. Once you have found the form you want, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase. Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Alabama Self-Employed Drywall Services Contract.

Ensure you complete all steps to successfully obtain the legal forms you need.

US Legal Forms provides a vast selection of templates to meet various legal requirements.

- Every legal document template you acquire is yours permanently.

- You have access to every form you saved in your account.

- Select the My documents section and choose a form to print or download again.

- Complete and download, and print the Alabama Self-Employed Drywall Services Contract with US Legal Forms.

- There are millions of professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

In Alabama, the retainage law allows contractors to withhold a portion of payment until the completion of a project. Typically, this retainage is set at 10% of the contract amount. This practice ensures that self-employed drywall services contractors, including those working under an Alabama Self-Employed Drywall Services Contract, have an incentive to finish the job to standard. For those navigating these laws, using platforms like USLegalForms can provide valuable resources and templates to ensure compliance.

Yes, subcontractors in Alabama are required to be licensed for most construction-related work. This requirement helps maintain industry standards and ensures that subcontractors are competent and reliable. When entering into an Alabama Self-Employed Drywall Services Contract, make sure to check that all subcontractors involved have the necessary licenses to operate legally.

Yes, it is illegal to perform contractor work without a proper license in Alabama, especially for projects exceeding the legal threshold. Working without a license can lead to fines, penalties, and potential legal action. To protect yourself and your clients, always ensure your Alabama Self-Employed Drywall Services Contract work is licensed and compliant with state laws.

In Alabama, you can perform a limited amount of work without a contractor license, but the specific amount varies based on the type of work. Generally, for projects exceeding $50,000, a license is required. If you're planning to take on an Alabama Self-Employed Drywall Services Contract, ensure you understand the limits to avoid any legal issues.

Yes, subcontractors typically need a license to operate legally, particularly for construction-related tasks. Licensing helps protect clients by ensuring that subcontractors are qualified and adhere to local regulations. When working under an Alabama Self-Employed Drywall Services Contract, having the proper license not only builds trust but also contributes to the professionalism of your services.

In Alabama, subcontractors are generally required to have a license if they are performing work that exceeds a certain monetary threshold. This requirement ensures that subcontractors meet specific standards for quality and safety. If you are engaging in Alabama Self-Employed Drywall Services Contract work, it is essential to verify licensing requirements to avoid penalties and ensure compliance.

Yes, construction services are generally taxable in Alabama, with specific exceptions. This includes many services rendered under an Alabama Self-Employed Drywall Services Contract. It is crucial to determine if your service falls under taxable categories, as this could impact your overall project costs. For reliable information and assistance in navigating these regulations, consider utilizing resources from USLegalForms to ensure compliance.

In Alabama, various services are taxable, particularly those related to tangible personal property and specific construction services. Services like installation, repair, and maintenance fall under taxable categories, including the services detailed in an Alabama Self-Employed Drywall Services Contract. Understanding what services are taxable helps you plan your budget more effectively. Always consider consulting a tax professional or using platforms like USLegalForms for clarity.

In Alabama, the service tax on construction work varies based on the type of service provided. Generally, you can expect a 4% state sales tax applied to construction services, including those outlined in an Alabama Self-Employed Drywall Services Contract. Additionally, local municipalities may impose their own taxes, which can raise the overall rate. It's essential to check with local tax authorities for the most accurate information.

In Alabama, a handyman can perform a variety of tasks without a license, including simple repairs, maintenance, and minor alterations. However, jobs that require extensive knowledge or skill, like those detailed in an Alabama Self-Employed Drywall Services Contract, usually need a licensed contractor. Always check local laws to ensure compliance. For assistance in understanding your rights and responsibilities, consider using the US Legal Forms platform.