Alabama Self-Employed Seasonal Picker Services Contract

Description

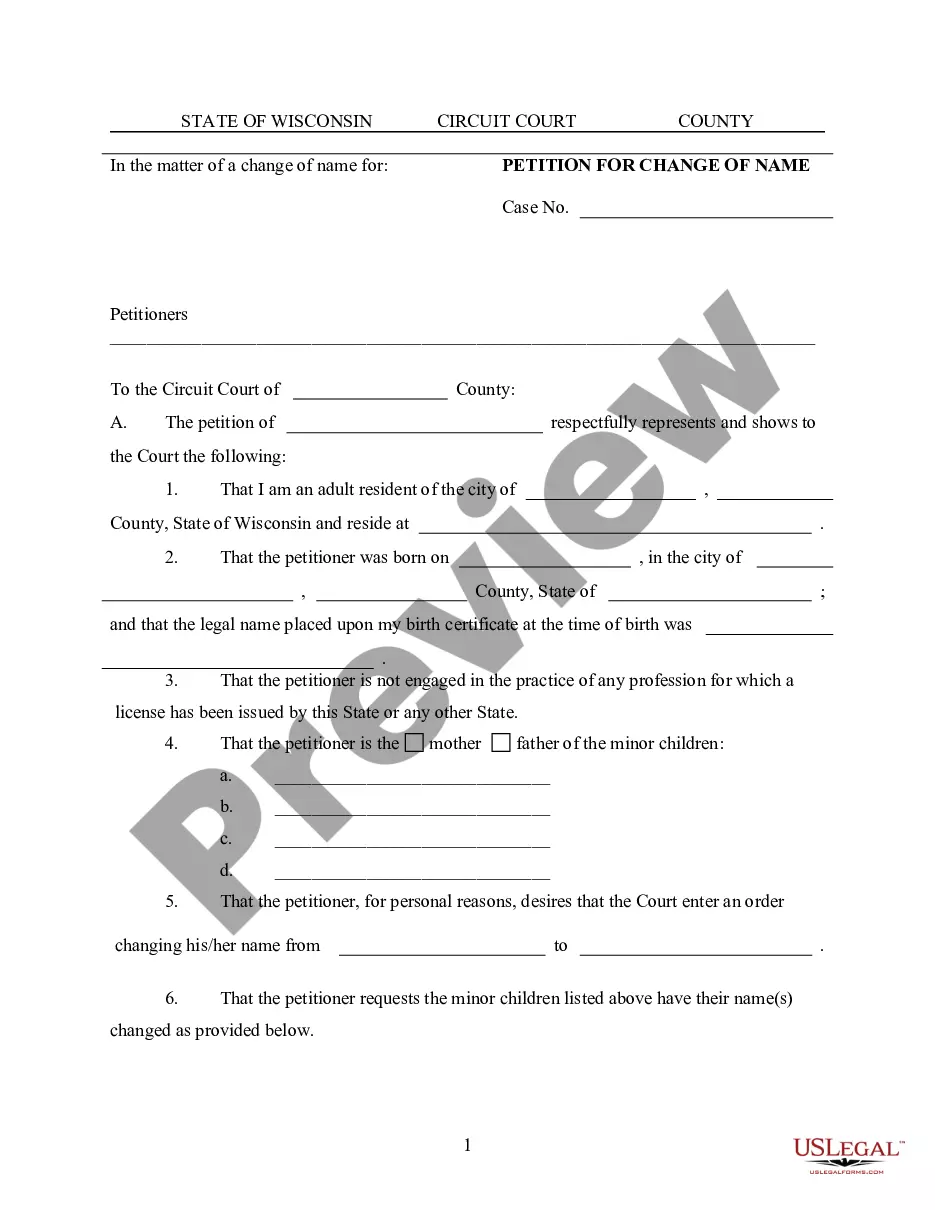

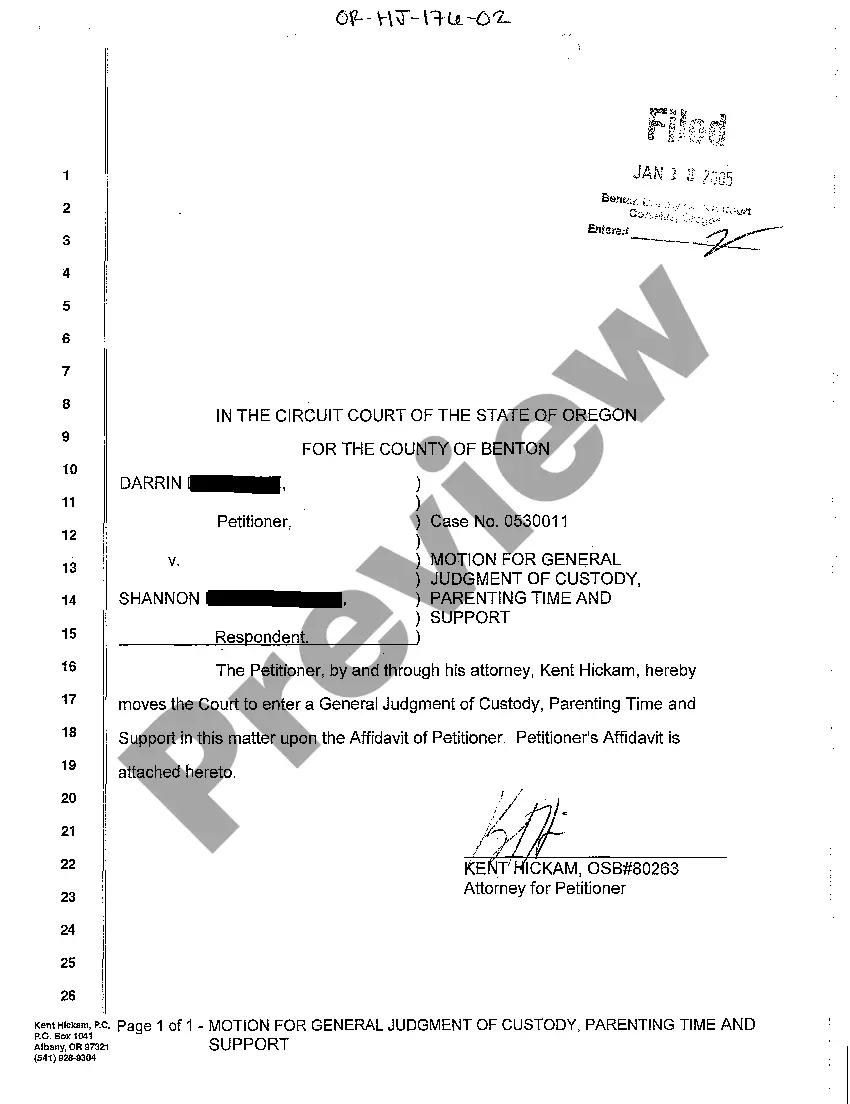

How to fill out Self-Employed Seasonal Picker Services Contract?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print. By utilizing the site, you can discover thousands of forms for business and personal use, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the Alabama Self-Employed Seasonal Picker Services Contract in just a few minutes. If you already have a subscription, Log In and download the Alabama Self-Employed Seasonal Picker Services Contract from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/region. Click the Preview button to examine the form's details. Read the form description to confirm you have chosen the right document. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your information to register for the account. Complete the transaction. Use your credit card or PayPal account to finalize the payment. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Alabama Self-Employed Seasonal Picker Services Contract. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Alabama Self-Employed Seasonal Picker Services Contract through US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Independent contractors must adhere to various rules, including maintaining their own business operations, paying their own taxes, and providing their own tools and equipment. It is essential to have a clear contract, such as an Alabama Self-Employed Seasonal Picker Services Contract, that outlines the terms of your work. This contract should specify payment, responsibilities, and timelines to avoid any misunderstandings with clients.

To qualify as an independent contractor, you must typically demonstrate a level of control over your work. This means you set your own hours, choose your projects, and operate independently without direct oversight from a client. If you are engaging in services under an Alabama Self-Employed Seasonal Picker Services Contract, ensure your work arrangement reflects these characteristics to avoid misclassification.

In Alabama, the statute of limitations for most contracts is typically six years. This means you have six years from the date of the breach to file a lawsuit if one party does not fulfill their obligations. Understanding this timeframe is important for anyone involved in an Alabama Self-Employed Seasonal Picker Services Contract to ensure you protect your rights effectively. Always consider consulting a legal expert for specific situations.

Independent contractors must meet specific legal requirements, which can vary by state. Generally, you need to have a valid business license and comply with local regulations. Additionally, having a well-drafted Alabama Self-Employed Seasonal Picker Services Contract can help clarify your relationship with clients and protect your rights. It's wise to consult legal resources to ensure adherence to all guidelines.

When you operate as your own contractor, you are referred to as an independent contractor. This means you work for yourself, providing services to clients without being an employee. Independent contractors often have the flexibility to choose their projects and set their own hours. If you’re looking to establish your own Alabama Self-Employed Seasonal Picker Services Contract, understanding this term is essential.

As an independent contractor in the United States, you can earn up to $600 in a tax year without needing to report that income. However, if you make more than this amount, you must report your income and may owe taxes. It's important to keep accurate records of your earnings. For those working under an Alabama Self-Employed Seasonal Picker Services Contract, understanding tax obligations is crucial.

Yes, contract workers are often classified as self-employed, as they usually provide their services based on an agreement rather than a traditional employer-employee relationship. This classification allows for more flexibility and autonomy. With an Alabama Self-Employed Seasonal Picker Services Contract, you can clearly outline your duties and expectations while enjoying the benefits of being self-employed.

Yes, if you work under a contract that allows you to operate independently, you are generally considered self-employed. This is common in various industries, including seasonal picking services. An Alabama Self-Employed Seasonal Picker Services Contract solidifies your self-employed status, ensuring you understand your obligations and benefits.

Contract employees are typically regarded as self-employed, as they usually work independently and manage their own schedules. However, the specifics can vary based on the nature of the contract. An Alabama Self-Employed Seasonal Picker Services Contract establishes your independence while detailing your responsibilities and rights.

A contract is a formal agreement outlining the terms of work between parties. While a contract often indicates a self-employed status, it does not automatically mean you are self-employed. For example, an Alabama Self-Employed Seasonal Picker Services Contract clearly defines your role as an independent worker, setting you apart from employees who work under direct supervision.