Alabama Appliance Refinish Services Contract - Self-Employed

Description

How to fill out Appliance Refinish Services Contract - Self-Employed?

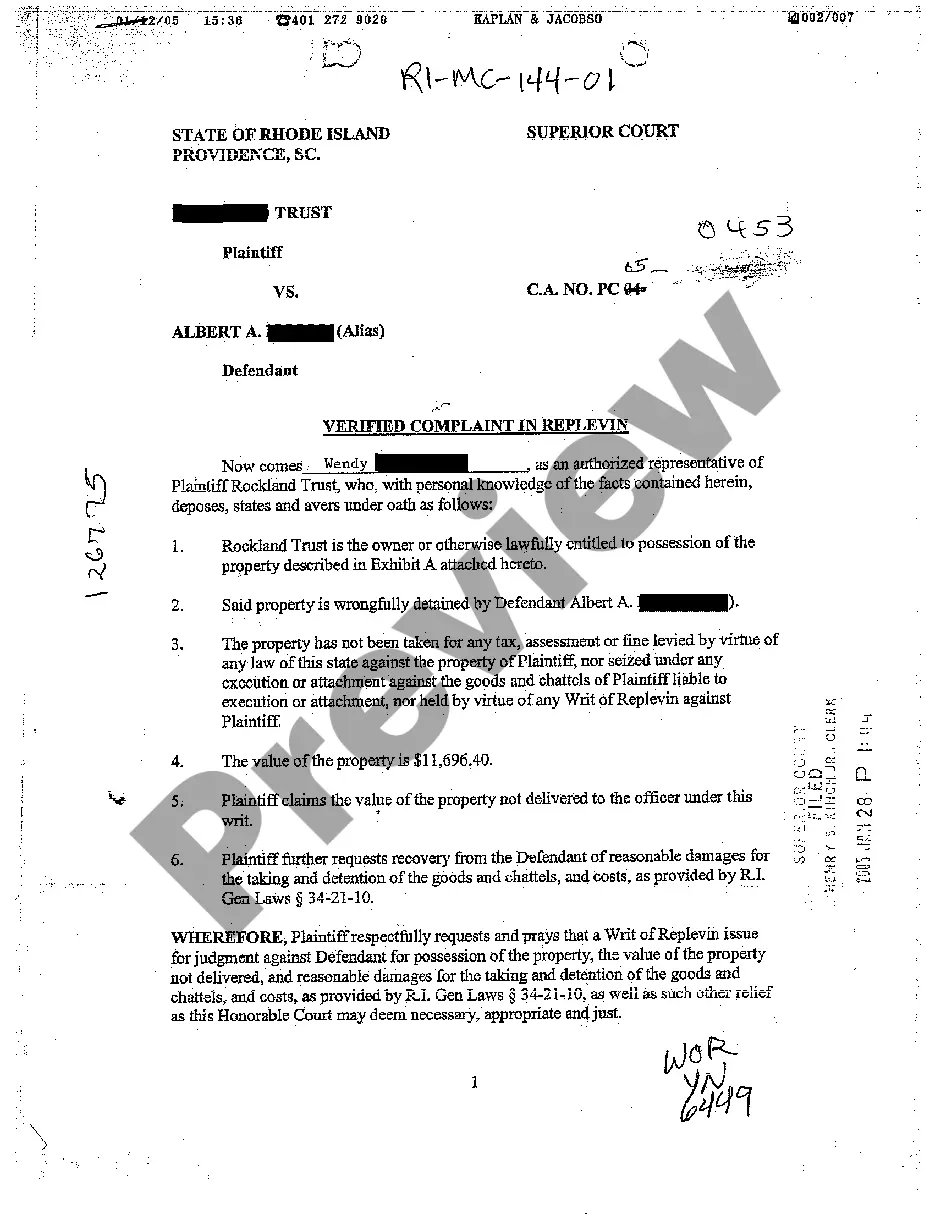

Selecting the optimal legitimate document template can be challenging. Certainly, there are many designs accessible online, but how do you find the authentic version you need? Utilize the US Legal Forms platform. This service offers thousands of templates, such as the Alabama Appliance Refinishing Services Agreement - Self-Employed, that can be utilized for business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Alabama Appliance Refinishing Services Agreement - Self-Employed. Use your account to browse the legitimate documents you have purchased previously. Visit the My documents section of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct document for your city/state. You can examine the form using the Review button and read the form description to confirm it suits your needs. If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are confident that the form is accurate, click the Get now button to acquire the document. Choose the pricing plan you prefer and enter the necessary details. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legitimate document template to your device. Complete, edit, and print and sign the acquired Alabama Appliance Refinishing Services Agreement - Self-Employed.

Using US Legal Forms simplifies the process of obtaining legal documents, ensuring you have access to quality templates that meet all necessary regulations.

- US Legal Forms is the largest repository of legitimate documents where you can find numerous paper templates.

- Leverage the service to obtain properly crafted documents that adhere to state requirements.

- Make sure to check the specifications of each template before downloading.

- Consider your needs carefully to select the right type of document.

- Review all information before finalizing your purchase.

- Keep track of your downloaded documents for future reference.

Form popularity

FAQ

The Alabama Business Privilege Tax (BPT) requires filing from businesses operating within the state. If you are self-employed and have entered into an Alabama Appliance Refinish Services Contract - Self-Employed, you may need to file depending on your gross receipts. It's crucial to understand your business structure and revenue thresholds, as these determine your filing requirements. Consult guides from UsLegalForms for comprehensive information and assistance with compliance.

Cleaning services in Alabama are typically taxable, but there are exceptions. If you offer Alabama Appliance Refinish Services Contract - Self-Employed that includes cleaning, ensure you are aware of local regulations detailing the tax status. Clients often appreciate transparency about potential fees, so being informed will boost your credibility. Be sure to check the Alabama Department of Revenue’s publications for the most updated tax information.

As an independent contractor, filing taxes involves reporting your income and deductions accurately. You should collect all relevant documents, including any Alabama Appliance Refinish Services Contract - Self-Employed that evidences your earnings. Typically, you will use IRS Schedule C for business income and expenses, plus any self-employment taxes on your earnings. For additional guidance, consider consulting resources like UsLegalForms.

In Alabama, certain services are exempt from taxation. For example, educational services and some healthcare-related services do not attract sales tax. When you engage in Alabama Appliance Refinish Services Contract - Self-Employed, identify which components of your service may fall under these exemptions to minimize your tax obligations. Understanding these details will help you in financial planning and compliance.

Failing to file a 1099 for a contractor can have significant implications. If you do not report payments made under an Alabama Appliance Refinish Services Contract - Self-Employed, you risk penalties from the IRS and state authorities. Moreover, the contractor may face tax consequences, as they won't have proper documentation for their income. It's vital to maintain good records and file all necessary forms on time.

In Alabama, various services are taxable, including repair and installation services. If your work involves providing Alabama Appliance Refinish Services Contract - Self-Employed, it's essential to understand if local regulations classify those services as taxable. Typically, professional services such as consulting may not be taxable, but tangible goods involved in the service may incur tax. Always check with state guidelines to ensure compliance.

The best warranty on appliances often depends on specific brands and models, as manufacturers offer several options. Companies like Whirlpool, GE, and LG typically have favorable warranties that cover a range of issues over extended periods. As a self-employed provider of Alabama appliance refinish services, you can recommend appliances with strong warranties to your clients to instill confidence in their purchases. Ensuring your customers make informed decisions can drive your reputation and business growth.

When you are your own contractor, you are typically referred to as a self-contractor or owner-builder. This role allows you to directly manage projects like Alabama Appliance Refinish Services Contract. Embracing this title often signifies a commitment to overseeing every aspect of your work, from planning to execution.

No, you do not necessarily need an LLC to be a contractor in Alabama. You can operate as a sole proprietor, but forming an LLC for your Alabama Appliance Refinish Services Contract may protect your personal assets and offer credibility to your business. It’s essential to weigh the benefits of forming an LLC against the simplicity of being a sole proprietor.

To contract yourself out, you first need to identify the services you can offer, such as Alabama Appliance Refinish Services Contract. You should then create a detailed proposal outlining your services, costs, and timelines. Platforms like uslegalforms can help you draft official contracts to formalize your agreements.