Alabama NQO Agreement

Description

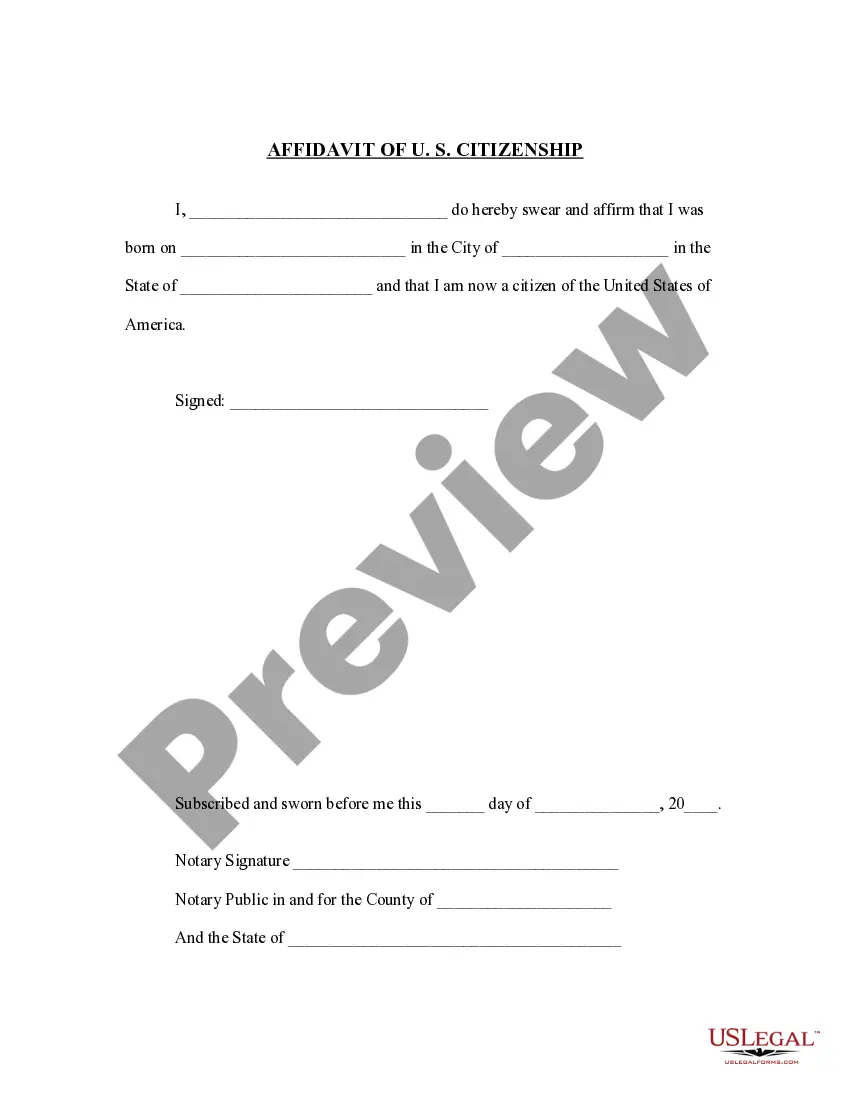

How to fill out NQO Agreement?

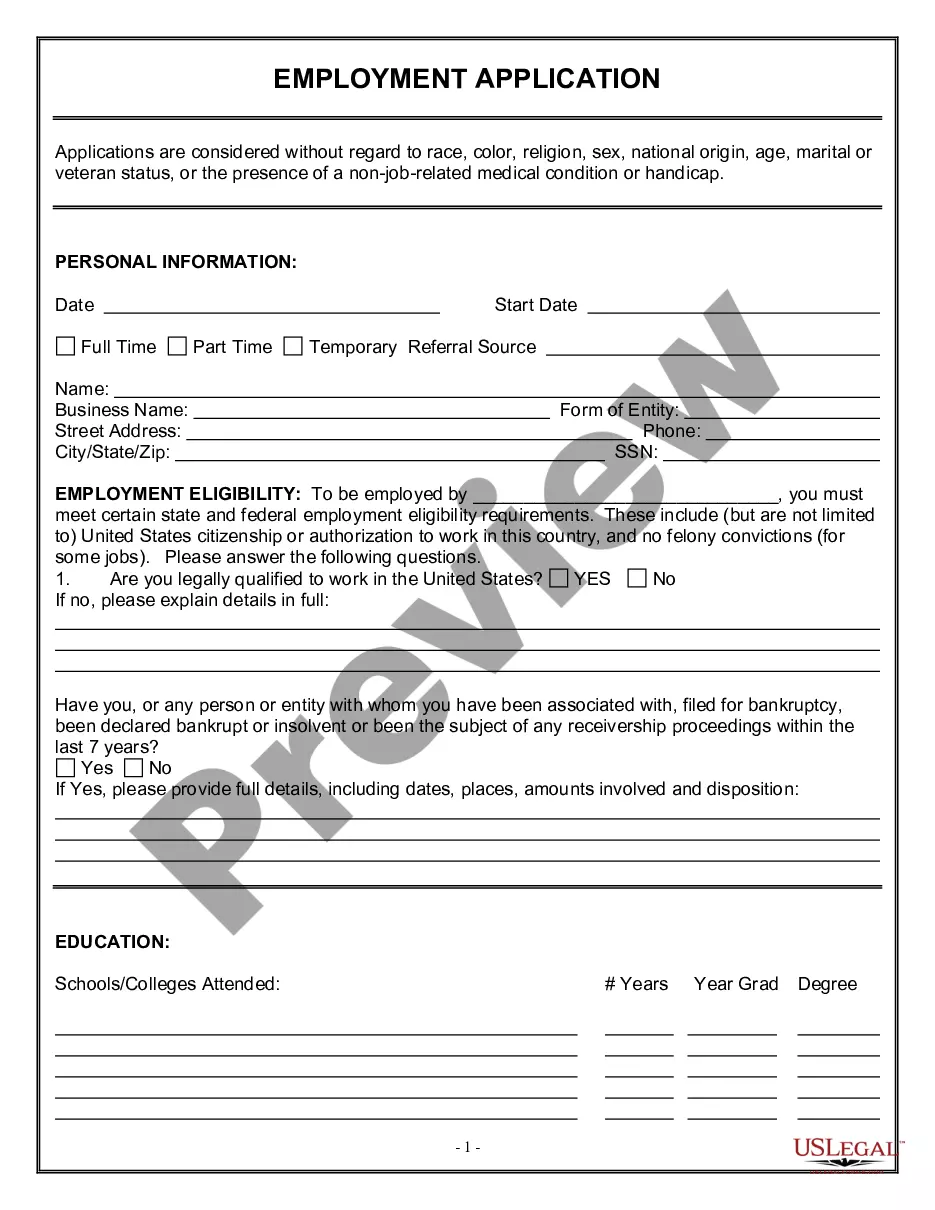

Are you currently inside a situation the place you require documents for both organization or person uses almost every time? There are plenty of lawful record layouts available on the net, but discovering types you can depend on isn`t simple. US Legal Forms provides 1000s of form layouts, like the Alabama NQO Agreement, that happen to be published to fulfill state and federal requirements.

When you are currently knowledgeable about US Legal Forms internet site and also have a merchant account, merely log in. Next, you are able to download the Alabama NQO Agreement design.

Unless you come with an bank account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you want and make sure it is for the right metropolis/region.

- Make use of the Preview button to analyze the form.

- Browse the description to ensure that you have selected the proper form.

- In the event the form isn`t what you are seeking, utilize the Look for field to get the form that meets your needs and requirements.

- When you discover the right form, click on Purchase now.

- Choose the rates program you want, fill in the specified info to generate your money, and pay money for the order making use of your PayPal or bank card.

- Choose a convenient paper file format and download your version.

Discover all the record layouts you possess purchased in the My Forms menus. You can obtain a extra version of Alabama NQO Agreement whenever, if needed. Just select the needed form to download or printing the record design.

Use US Legal Forms, the most substantial collection of lawful varieties, in order to save time as well as stay away from mistakes. The services provides appropriately produced lawful record layouts which can be used for an array of uses. Create a merchant account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

Withholding Formula (Effective Pay Period 7, 2008) If the Employee Claims the Following Withholding Exemption Status:The Personal Exemption Allowance Is:Zero$0Single or Married Filing Separate1,500Married or Head of Household3,000

You MUST Use Both Form 40 and Form 40NR If: The part year resident return should include only income and deductions during the period of residency, and the nonresident return should include only income and deductions during the period of nonresidency.

If you have unpaid taxes in Alabama, the ALDOR can ask the sheriff to auction off your property on the courthouse steps to the highest bidder. For real property, you can redeem your property if you pay the total tax liability, the cost of the sale, and the accrued interest. You cannot redeem personal property.

If you are interested in requesting for a payment plan please complete the Collection Information Statement ? Form C:41E(6/06). §40-2A-4(b) (6), Code of Alabama 1975, authorizes the Department of Revenue to enter into a payment agreement when it will facilitate collection of a tax liability.

Please visit My Alabama Taxes (MAT) at to submit a payment plan request. You will need to provide the last 4 digits of your Social Security Number in addition to the letter ID of any letter received from the Alabama Department of Revenue (ADOR).

Go to . You may also choose to use your Discover/Novus, Visa, Master Card, or American Express card. Call Official Payments Corporation at 1-800-272-9829 or visit .officialpayments.com.

Pay your taxes due on E-Filed and Paper Returns, Assessments and Invoices. Pay via Credit/Debit card and ACH online with MyAlabamaTaxes or Pay Bill. Mail your payment. Payments for Billing Letters, Invoices or Assessments should be mailed to the address found on the letter, invoice or assessment. Mailing Addresses.

To obtain a withholding tax account number, employers must complete the Application available online at MyAlabamaTaxes.alabama.gov. (MAT) Please go to ?I Want To? then ?Obtain a new Tax Account?.