"Data Input Sheet" is a American Lawyer Media form. This is a form is an instructional form on how to fill out the different real estate forms.

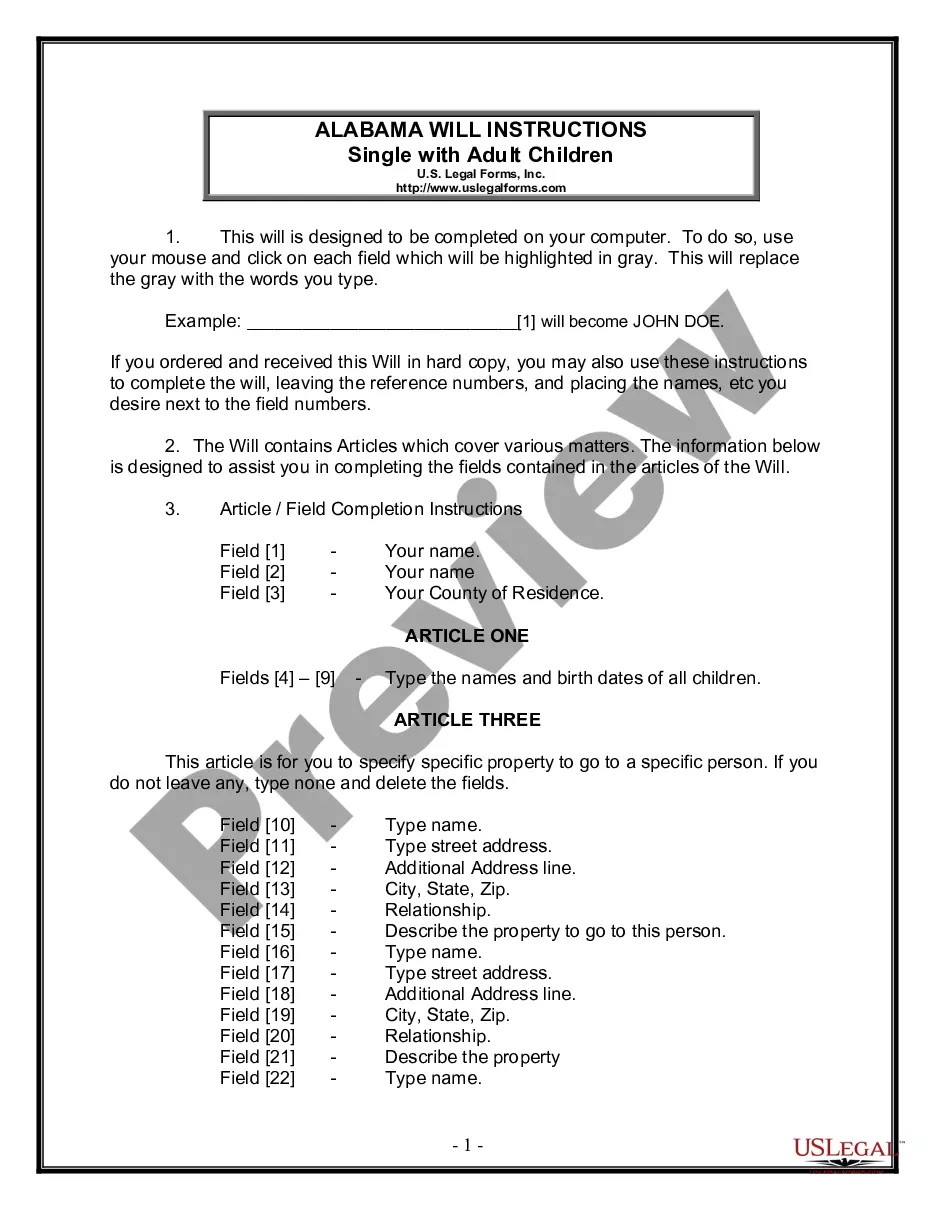

Alabama Data Input Sheet

Description

How to fill out Data Input Sheet?

Are you in a position in which you require documents for either organization or specific uses almost every working day? There are plenty of legal record themes available online, but getting kinds you can trust isn`t effortless. US Legal Forms offers 1000s of kind themes, like the Alabama Data Input Sheet, which can be created in order to meet state and federal needs.

If you are previously informed about US Legal Forms internet site and get a free account, merely log in. After that, you may down load the Alabama Data Input Sheet template.

Unless you have an profile and need to start using US Legal Forms, follow these steps:

- Get the kind you need and ensure it is to the proper metropolis/county.

- Make use of the Review button to examine the form.

- See the description to actually have chosen the proper kind.

- In the event the kind isn`t what you`re searching for, make use of the Search industry to get the kind that meets your needs and needs.

- When you get the proper kind, click Purchase now.

- Select the pricing program you desire, fill out the required info to generate your money, and pay for your order utilizing your PayPal or credit card.

- Decide on a handy file format and down load your backup.

Locate all of the record themes you might have purchased in the My Forms food selection. You can aquire a further backup of Alabama Data Input Sheet at any time, if required. Just click on the necessary kind to down load or produce the record template.

Use US Legal Forms, the most substantial selection of legal varieties, in order to save time and steer clear of faults. The services offers professionally created legal record themes which can be used for an array of uses. Make a free account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

To obtain a withholding tax account number, employers must complete the Application available online at MyAlabamaTaxes.alabama.gov. (MAT) Please go to ?I Want To? then ?Obtain a new Tax Account?.

Your AGI is on your Form 1040, Line 11 and says "This is your adjusted gross income."

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Step-by-Step Guide Step 1: FEIN Number. ... Step 2: Registration with the State of Alabama. ... Step 3: Payroll Process Creation. ... Step 4: Employees to Fill out Relevant Forms. ... Step 5: Tracking Employee Working Time. ... Step 6: Calculation of Employee's Gross Pay and Taxes. ... Step 7: Employee Benefits, Wages, and Taxes Payment.

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.

First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

All income is subject to Alabama income tax unless specifically exempted by state law. The term ?income? includes, but is not limited to: Wages including salaries, fringe benefits, bonuses, commissions, fees, and tips.

Making the Election A pass-through entity must submit Form PTE-E online if they want to make the election to be treated as an Electing Pass-Through Entity. The election must be filed no later than the 15th day of the 3rd month following the close of the tax year.

You can determine your AGI by calculating your annual income from wages and other income sources (gross income), then subtracting certain types of payments, such as student loan interest, alimony, retirement contributions, or health savings account contributions, you've made during the year.

Withholding Requirement on Sales/Transfers of Real Property & Tangible Personal Property by Nonresidents. Section 40-18-86, Code of Alabama 1975, provides for income tax withholding at a rate of 3% or 4% on sales or transfers of real property and associated tangible personal property by nonresidents of Alabama.