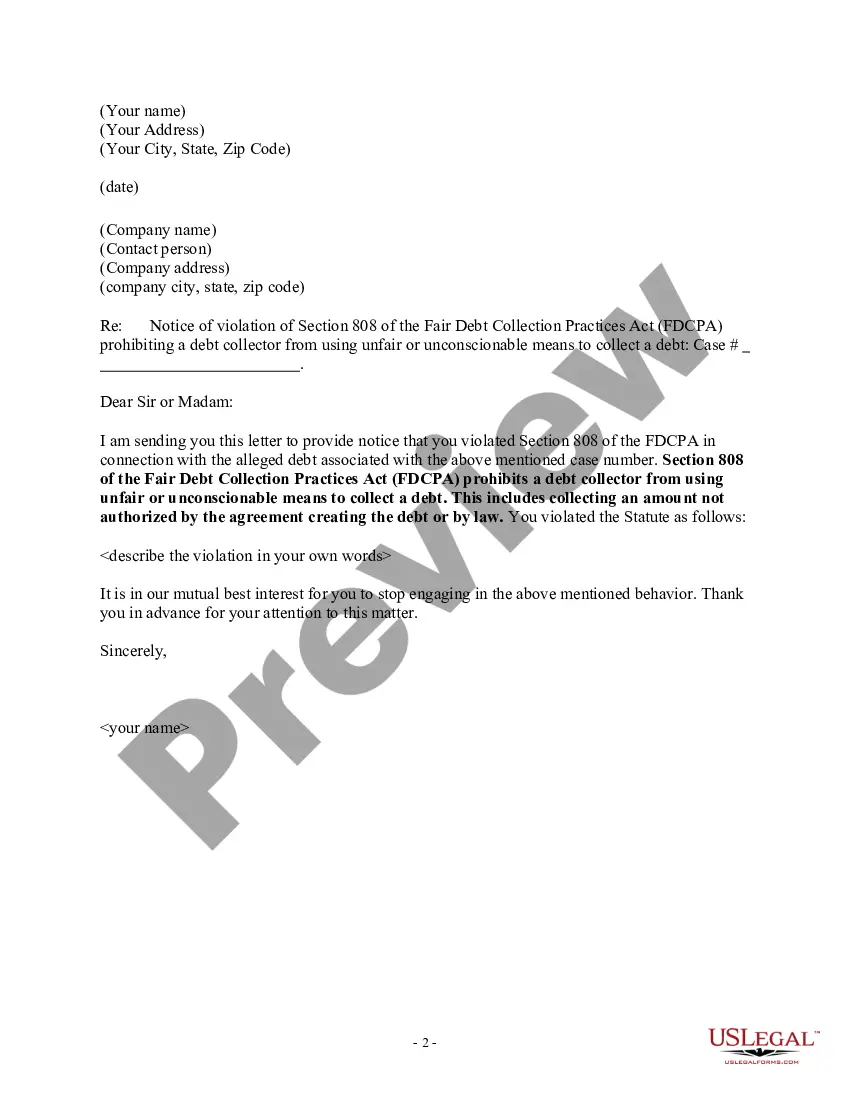

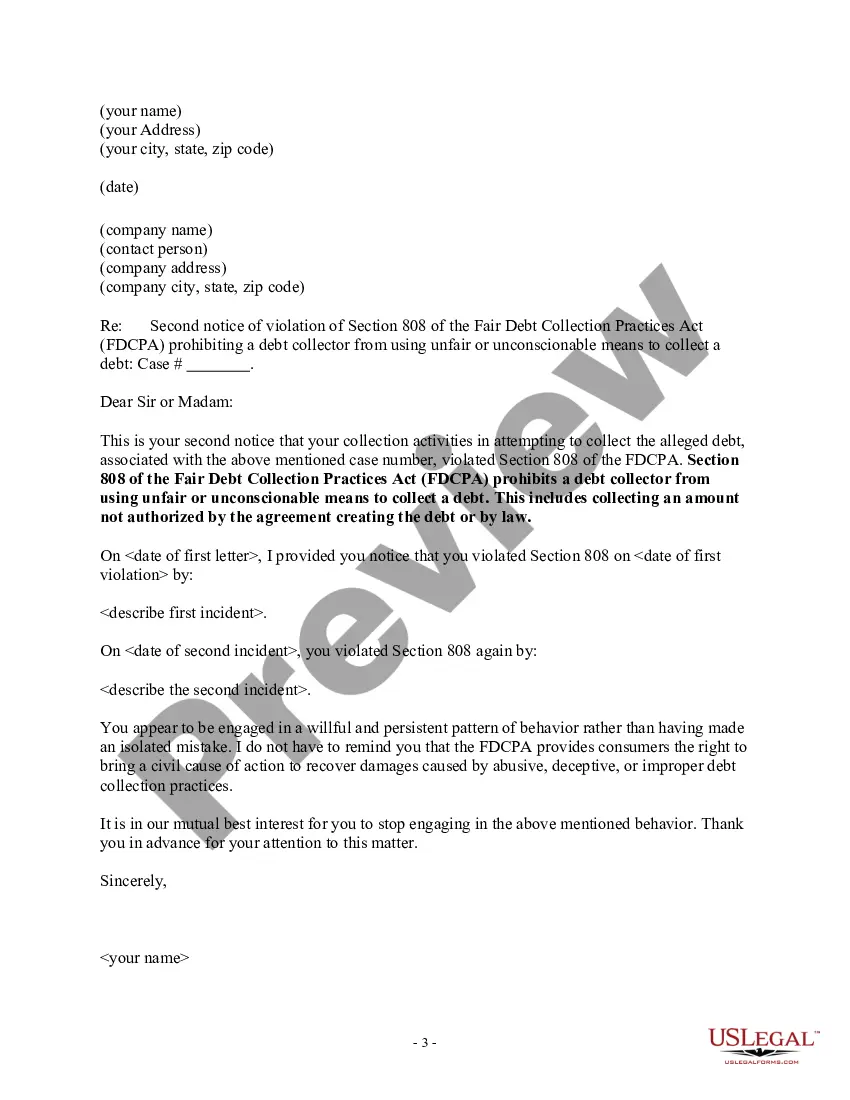

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Alabama Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents accessible online.

Utilize the website's straightforward and user-friendly search feature to locate the document you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Utilize US Legal Forms to locate the Alabama Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click on the Acquire button to download the Alabama Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the summary.

Form popularity

FAQ

The 11-word phrase to stop debt collectors is, 'I do not acknowledge this debt and request verification.' Using this phrase can be a powerful tool in asserting your rights. This phrase aligns with the principles outlined in the Alabama Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

How Long Do Creditors Have to File Claims Against the Estate? In general, creditors have 6 months from the date that Letters Testamentary or Letters of Administration are issued to file claims against the estate. For this reason an estate in Alabama must remain open for at least six months.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

The time it takes to administer an estate in Alabama will vary depending on the complexity of the estate and the diligence of the personal representative. But since the estate must remain open for six months to allow creditors to submit claims, it is not possible to close the estate in less than six months.

According to the Alabama Small Estates Act, you must petition for probate within five (5) years of the decedent's death. Otherwise, you cannot transfer assets to beneficiaries if there are any left behind in the will.