Alabama Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

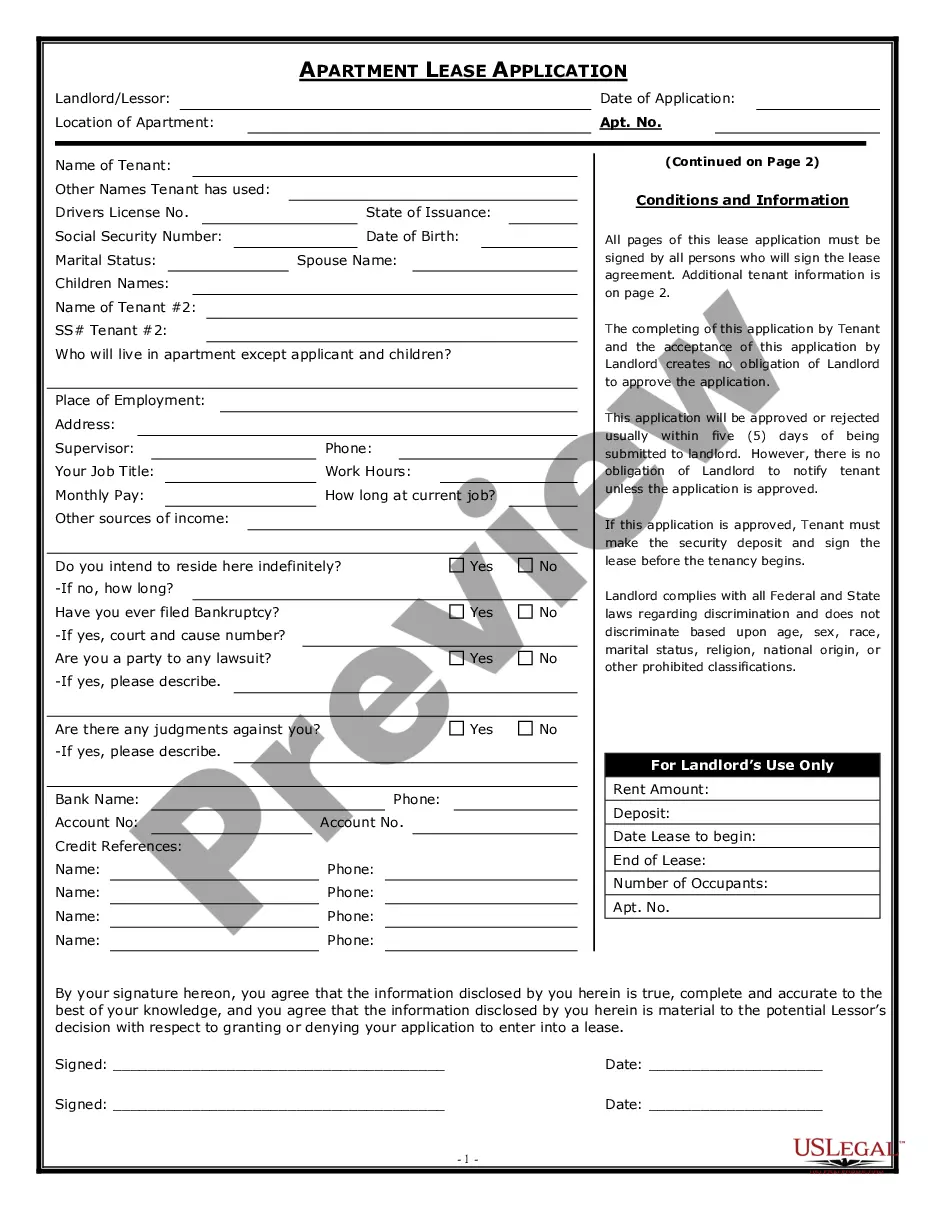

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

US Legal Forms - one of several largest libraries of legal varieties in the United States - provides a variety of legal papers web templates you can download or printing. Making use of the web site, you can get thousands of varieties for organization and individual functions, sorted by types, claims, or key phrases.You will discover the most up-to-date variations of varieties like the Alabama Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form in seconds.

If you currently have a monthly subscription, log in and download Alabama Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form in the US Legal Forms catalogue. The Obtain key will show up on each form you look at. You get access to all previously acquired varieties in the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, listed here are simple guidelines to get you started off:

- Ensure you have picked the proper form to your metropolis/region. Go through the Preview key to analyze the form`s information. Look at the form description to ensure that you have chosen the right form.

- In the event the form doesn`t match your needs, use the Look for field near the top of the display screen to find the one who does.

- If you are satisfied with the form, confirm your choice by simply clicking the Get now key. Then, select the pricing program you prefer and provide your credentials to sign up on an profile.

- Process the purchase. Make use of charge card or PayPal profile to accomplish the purchase.

- Select the file format and download the form in your system.

- Make modifications. Fill up, revise and printing and indicator the acquired Alabama Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

Every single design you put into your account lacks an expiration particular date and is your own eternally. So, if you would like download or printing yet another copy, just visit the My Forms portion and click about the form you want.

Gain access to the Alabama Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form with US Legal Forms, one of the most considerable catalogue of legal papers web templates. Use thousands of specialist and state-distinct web templates that meet your small business or individual requirements and needs.

Form popularity

FAQ

The Court enters an order discharging individual Debtors after all requirements are met, but no sooner than the last day to object to the Debtor's Discharge. This is usually 60 days after the 1st setting of the 341 Meeting of Creditors unless a motion is filed with the court to extend that time.

In most cases, a Chapter 7 bankruptcy can stay on your credit reports for up to 10 years from the date you file bankruptcy. Once the 10-year period ends, the bankruptcy should fall off your credit reports automatically.

A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Chapter 7 Doesn't Wipe Out Mortgage Liens Even though a Chapter 7 bankruptcy discharge wipes out your obligation to pay back the loan, it doesn't eliminate the mortgage lien. If it did, everyone could file bankruptcy and own their homes free and clear.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

A Chapter 7 bankruptcy can take four to six months to do, from the time you file to when you receive a final discharge ? meaning you no longer have to repay your debt. Various factors shape how long it takes to complete your bankruptcy case. You will have to take care of some tasks before you file.

A Chapter 7 bankruptcy is also called a liquidation bankruptcy because you have to sell nonexempt possessions and use the proceeds to repay your creditors. You do get to keep exempt assets and possessions, up to a limit. Once the process is complete, the remainder of your included debts is discharged.

CHAPTER 7 BANKRUPTCY TIMELINE Day 1: File Bankruptcy Petition with Court & Pay Filing Fees. Day 13 to 33: (7 Days BEFORE Meeting of Creditors) Deadline to Provide Tax Returns to Trustee. Day 20 to 40: Meeting of Creditors - also called 341(a) Meeting. Day 80 to 100: (60 Days AFTER First Date Set. ... DISCHARGE GRANTED.