Alabama Work for Hire Addendum - Self-Employed

Description

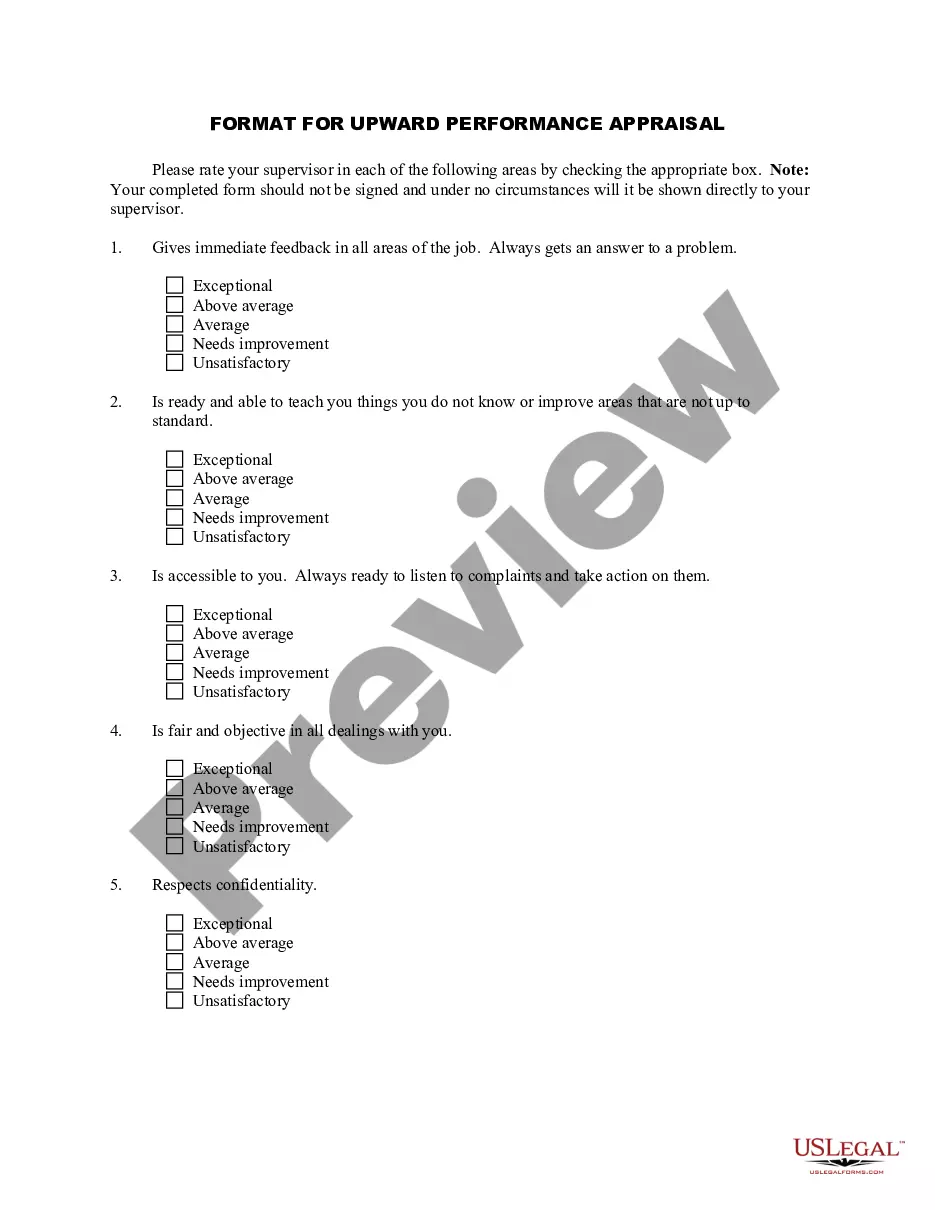

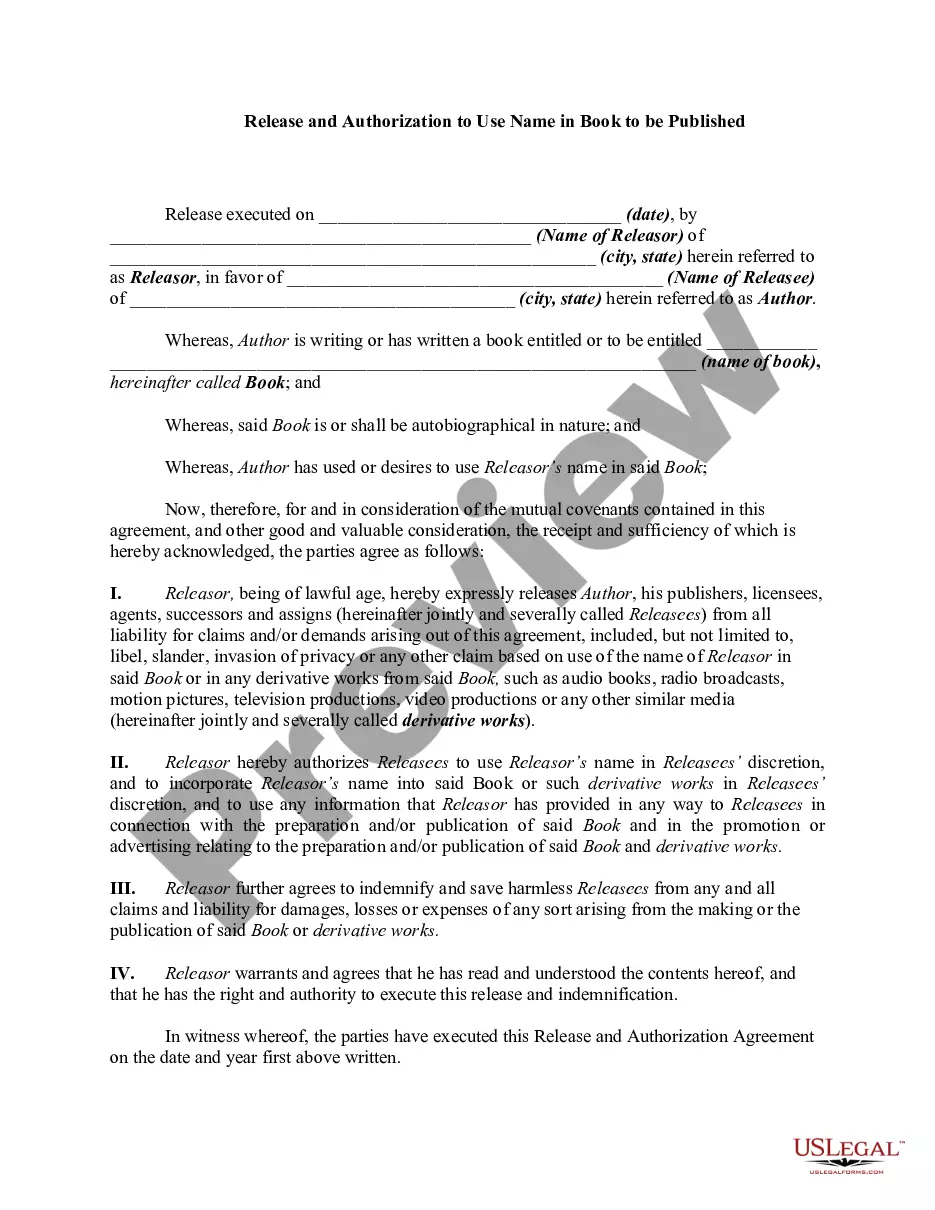

How to fill out Work For Hire Addendum - Self-Employed?

You might spend hours online searching for the authentic document template that meets the federal and state regulations you require.

US Legal Forms provides thousands of legal forms that have been evaluated by professionals.

You can easily download or print the Alabama Work for Hire Addendum - Self-Employed from our platform.

To find another version of your form, use the Lookup field to locate the template that fits your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain option.

- Then, you can complete, modify, print, or sign the Alabama Work for Hire Addendum - Self-Employed.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/region of choice.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

The self-employment tax in Alabama mirrors the federal self-employment tax rate, which is currently 15.3%. This tax applies to net earnings from self-employment. As a self-employed individual, using the Alabama Work for Hire Addendum - Self-Employed can help clarify your tax obligations and assist in proper reporting.

When reporting new hires in Alabama, employers need to complete the New Hire Reporting Form. This form captures essential information about the employee and helps the state monitor child support obligations. It is advisable to also include the Alabama Work for Hire Addendum - Self-Employed to outline work arrangements clearly.

Sole traders are always self employed. Although they can employ other people, they cannot employ themselves. The reason being that a limited company is classified as a separate legal entity in its own right. This means that a company can have a contract of employment with its own director(s).

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Although rare, it is possible for a worker to have two separate and distinct contracts with the same payer, where one contract could be seen as an employer-employee relationship with the other employment being considered as self-employed.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

If you are an independent contractor, a gig worker, or are self-employed in Texas, and you are out of work due to COVID-19, you may qualify for unemployment benefits through Pandemic Unemployment Assistance (PUA).