Alabama Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a broad selection of legal form templates available for download or printing.

By using the website, you can discover a multitude of forms for both business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Alabama Unrestricted Charitable Contribution of Cash in just moments.

If you hold a monthly subscription, Log In to acquire the Alabama Unrestricted Charitable Contribution of Cash from the US Legal Forms repository. The Download button will be visible on every template you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make adjustments. Fill out, modify, and print as well as sign the downloaded Alabama Unrestricted Charitable Contribution of Cash.

Every template added to your account does not have an expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Alabama Unrestricted Charitable Contribution of Cash through US Legal Forms, the most extensive collection of legal document templates. Utilize a wide range of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your region/state.

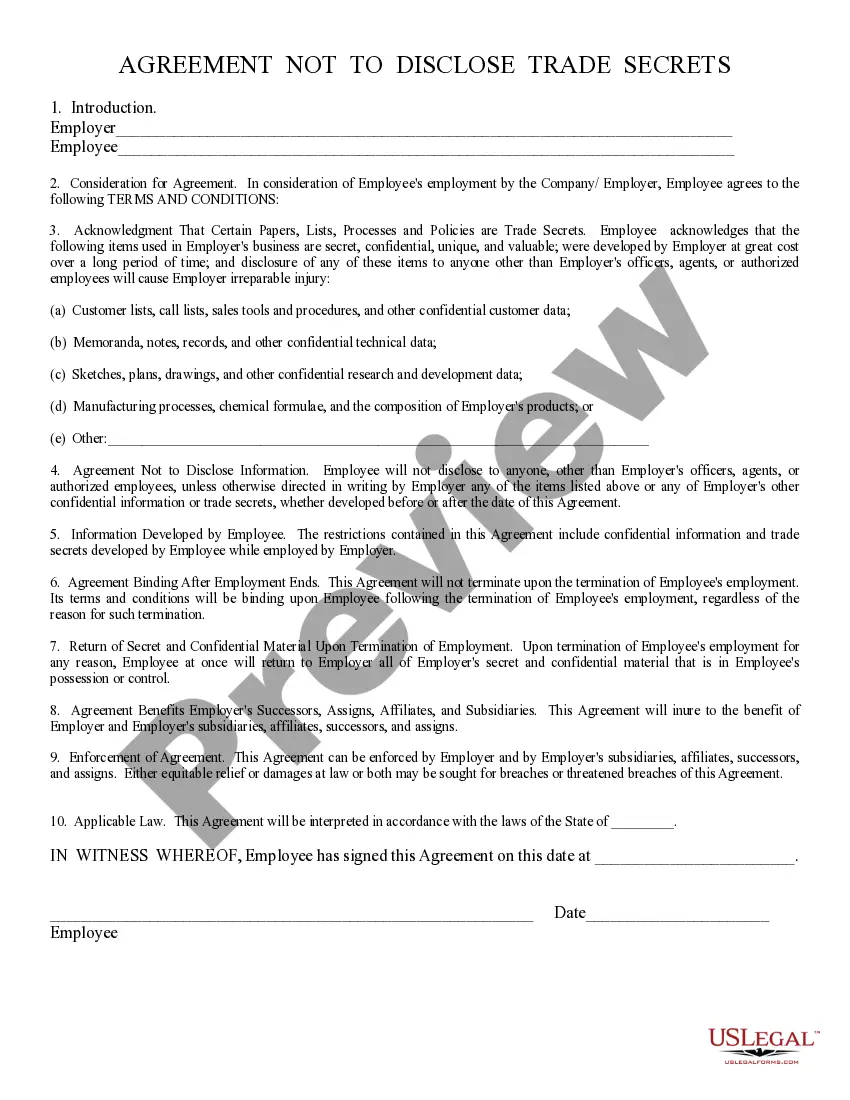

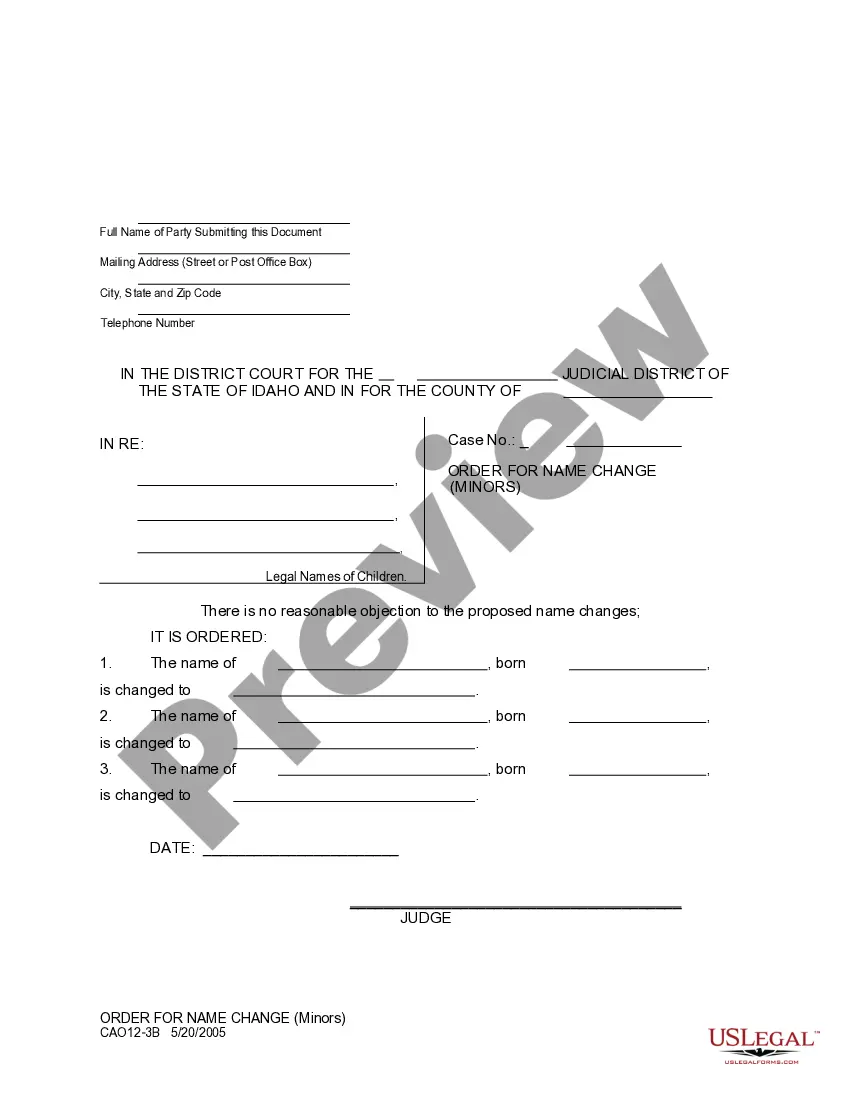

- Click the Review button to examine the form’s contents.

- Check the form description to confirm that you have chosen the right document.

- If the form doesn’t suit your requirements, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, validate your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your details to set up your account.

Form popularity

FAQ

Yes, Alabama does allow qualified charitable distributions. These contributions enable individuals to give directly from their retirement accounts to qualified charities without incurring income tax. This aligns with the concept of Alabama Unrestricted Charitable Contribution of Cash, allowing for greater contributions while maintaining tax efficiency. Using platforms like USLegalForms can assist you in ensuring compliance and simplifying the process.

To claim charitable contributions, you should first ensure that your donation qualifies as an Alabama Unrestricted Charitable Contribution of Cash. Gather your receipts and documentation for the donations made throughout the year. When filing your taxes, complete Schedule A of IRS Form 1040 to itemize your contributions. Keep in mind that using a service like US Legal Forms can simplify the process, providing you with the necessary documents and guidance to maximize your contributions.

The maximum you can write off for charitable donations primarily depends on your AGI and the type of organization you donate to. For example, cash contributions to qualifying charities can be deducted up to 60% of your AGI. If you're considering an Alabama Unrestricted Charitable Contribution of Cash, understanding these limits will help you maximize your deductions.

The charitable contribution limit in Alabama generally follows federal guidelines, allowing a maximum deduction depending on your AGI. However, state-specific tax rules may also apply, making it essential to stay informed. When making an Alabama Unrestricted Charitable Contribution of Cash, verify the state regulations to optimize your tax return.

The maximum allowed for charitable donations usually varies based on the type of donation and the organization. For cash contributions to public charities, the limit is generally up to 60% of your AGI. Be sure to consult with a tax professional to figure out how your Alabama Unrestricted Charitable Contribution of Cash aligns with these limits.

The maximum qualified charitable contribution typically depends on your Adjusted Gross Income (AGI). Generally, taxpayers can contribute up to 60% of their AGI for cash donations to qualifying charities. It's crucial to understand these limits, especially when considering an Alabama Unrestricted Charitable Contribution of Cash, which can maximize your tax benefits.

To deduct charitable contributions, you must report them on your federal tax return. Keep accurate records of your donations, including receipts and acknowledgment letters from charities. For cash contributions, the IRS requires you to have documentation that verifies the donation amount. This is especially important when making an Alabama Unrestricted Charitable Contribution of Cash.