Alabama Jury Instruction - Failure To File Tax Return

Description

How to fill out Jury Instruction - Failure To File Tax Return?

You are able to devote several hours on-line trying to find the authorized papers web template that meets the state and federal specifications you will need. US Legal Forms provides thousands of authorized kinds that are analyzed by specialists. It is possible to download or print out the Alabama Jury Instruction - Failure To File Tax Return from the service.

If you already have a US Legal Forms accounts, you are able to log in and click on the Obtain switch. Following that, you are able to total, edit, print out, or indicator the Alabama Jury Instruction - Failure To File Tax Return. Each and every authorized papers web template you get is yours eternally. To have yet another duplicate for any purchased type, proceed to the My Forms tab and click on the related switch.

Should you use the US Legal Forms site initially, keep to the simple instructions beneath:

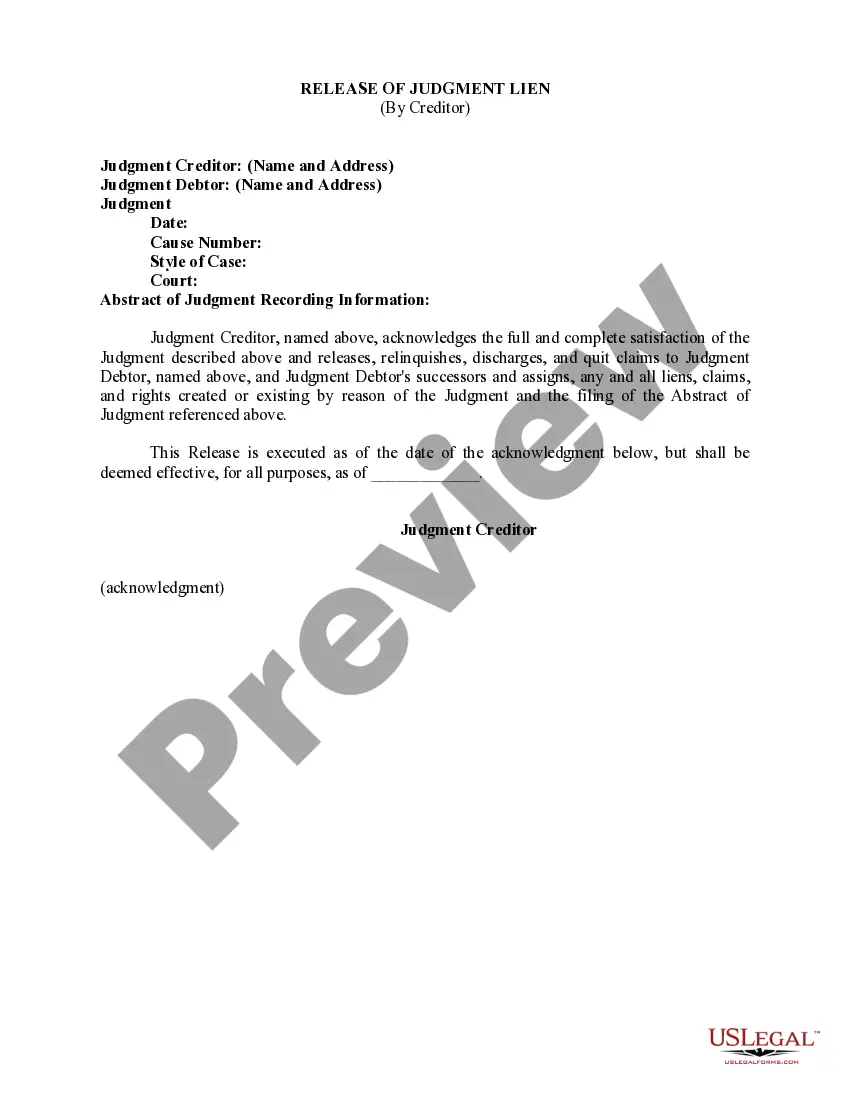

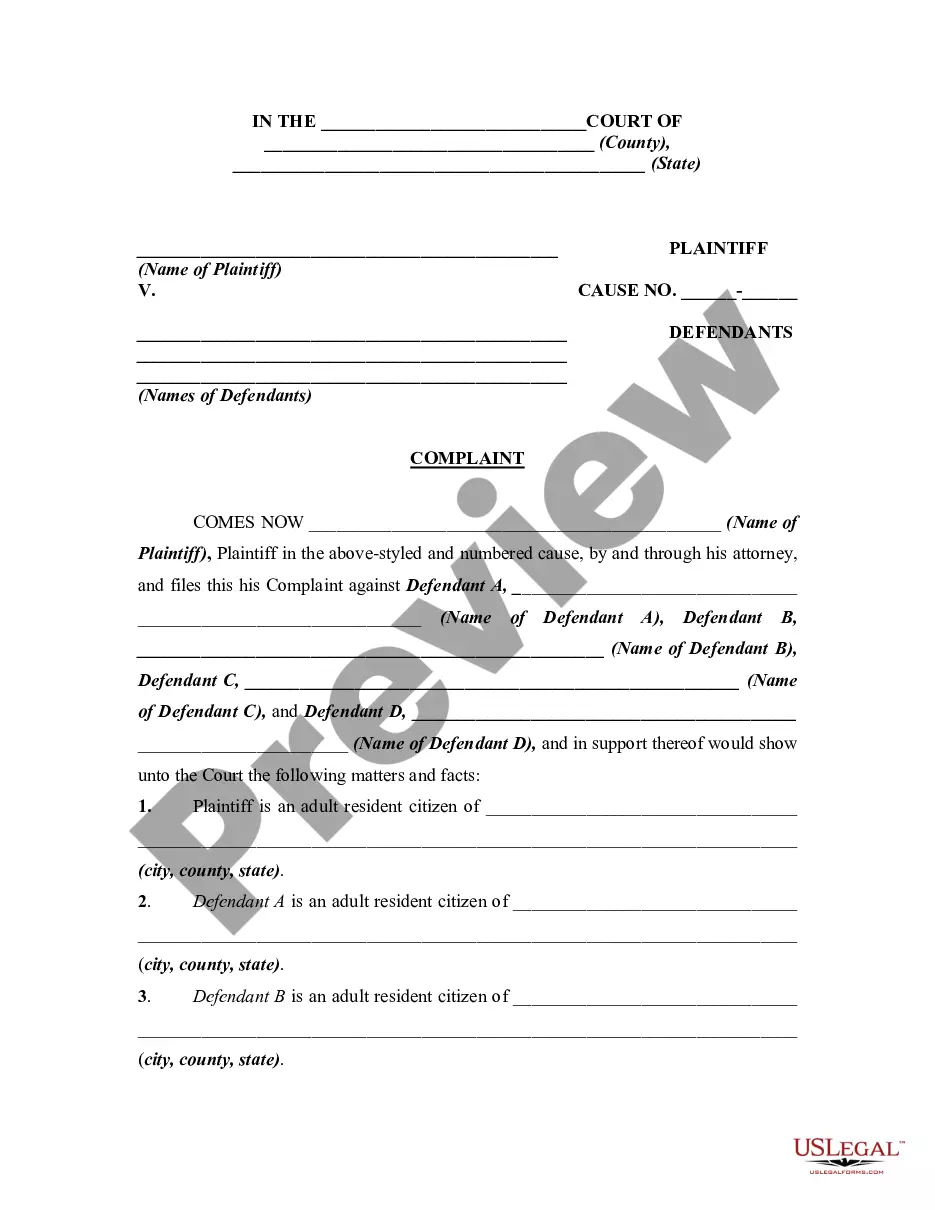

- Initially, make certain you have chosen the best papers web template for the region/city of your choice. Browse the type description to make sure you have picked the appropriate type. If accessible, take advantage of the Review switch to appear with the papers web template too.

- In order to discover yet another version from the type, take advantage of the Research area to find the web template that fits your needs and specifications.

- After you have located the web template you need, click Buy now to continue.

- Find the pricing strategy you need, type in your credentials, and register for a free account on US Legal Forms.

- Total the deal. You may use your Visa or Mastercard or PayPal accounts to cover the authorized type.

- Find the structure from the papers and download it to your gadget.

- Make adjustments to your papers if possible. You are able to total, edit and indicator and print out Alabama Jury Instruction - Failure To File Tax Return.

Obtain and print out thousands of papers layouts using the US Legal Forms site, that offers the greatest assortment of authorized kinds. Use specialist and status-certain layouts to tackle your business or person requirements.

Form popularity

FAQ

Any person summoned for jury service who fails to appear as directed may be ordered by the district court to appear and show cause for his or her failure to comply with the summons. Any person who fails to show good cause for noncompliance may be fined, imprisoned, and/or ordered to complete community service. Frequently Asked Questions | Northern District of Alabama uscourts.gov ? frequently-asked-questi... uscourts.gov ? frequently-asked-questi...

You cannot serve on a jury if you have been convicted of a felony and your civil rights have not been restored. Jury Service - Circuit Court of Montgomery County, Alabama Circuit Court of Montgomery County, Alabama (.gov) ? jury-service Circuit Court of Montgomery County, Alabama (.gov) ? jury-service

Any person summoned for jury service who fails to appear as directed may be ordered by the district court to appear and show cause for his or her failure to comply with the summons. Any person who fails to show good cause for noncompliance may be fined, imprisoned, and/or ordered to complete community service.

On individual request, a person may be excused from jury service indefinitely or for a particular term or terms of court if such person: (1) is an actively practicing physician, dentist, or registered nurse; (2) is 70 years of age or older; (3) has active care and custody of a child under 10 years of age, or of an aged ...

Generally, there is a six-year statute of limitations on collecting delinquent taxes in Alabama. However, the statute can vary based on the situation. If you omit more than 25% of your income or if you commit state tax fraud, the state may be able to assess and collect taxes owed for an indefinite period of time.

You are not required to serve jury duty more than once in a twelve month period. If you are summoned for a date within a year of the last time you served, please call our office at 256-532-3641 to be excused. Jury Duty - 23rd Judicial Circuit | 23rd Judicial Circuit | ? ... 23rd Judicial Circuit | ? ...

Alabama Pattern Jury Instruction 11.36 In the event a vehicle is classified as a total loss, the owner may collect ?the amount of money that compensates the owner for its loss of use during the period of time reasonably necessary to get a replacement vehicle.? Alabama Pattern Jury Instruction 11.38.

Every four years prospective jurors are selected randomly from the voter registration lists in the respective counties and their names are put into what is known as the divisional "Master Jury Wheel." After the creation of the Master Jury Wheel prospective jurors are sent a Juror Qualification Questionnaire. Jury FAQ | Southern District of Alabama Southern District of Alabama (.gov) ? jury-faq Southern District of Alabama (.gov) ? jury-faq