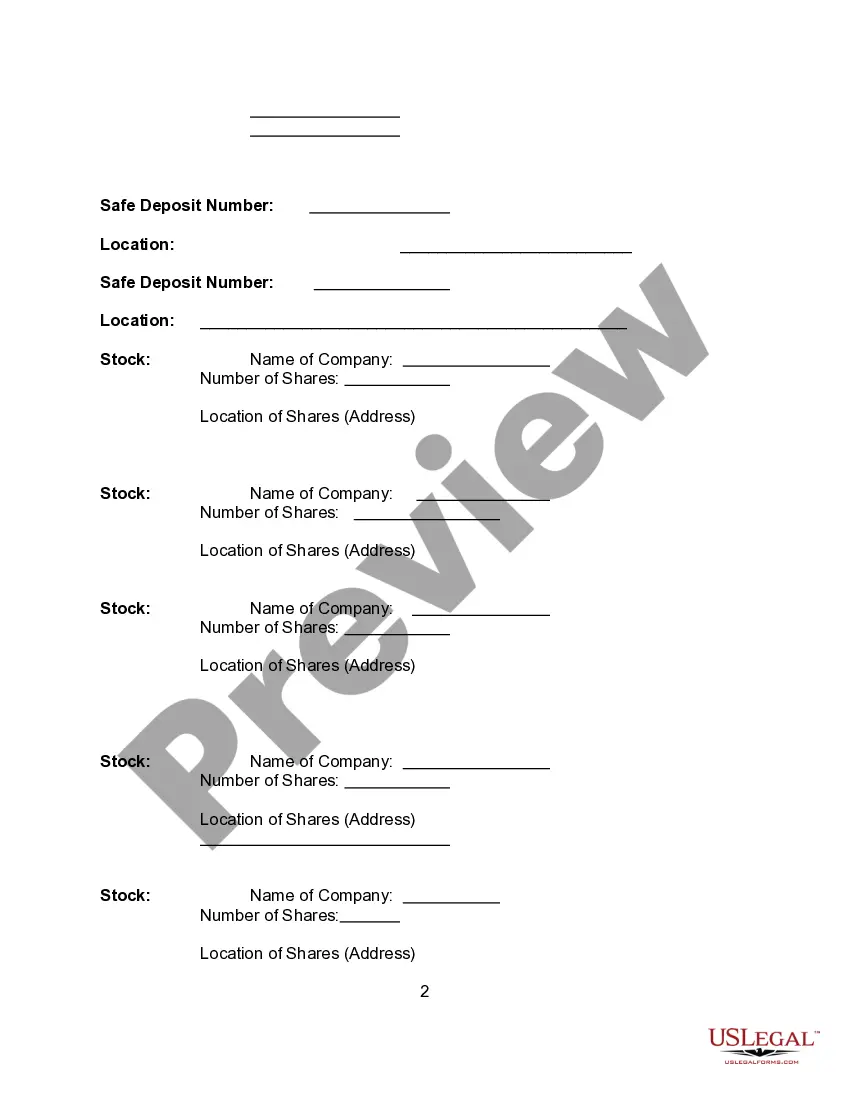

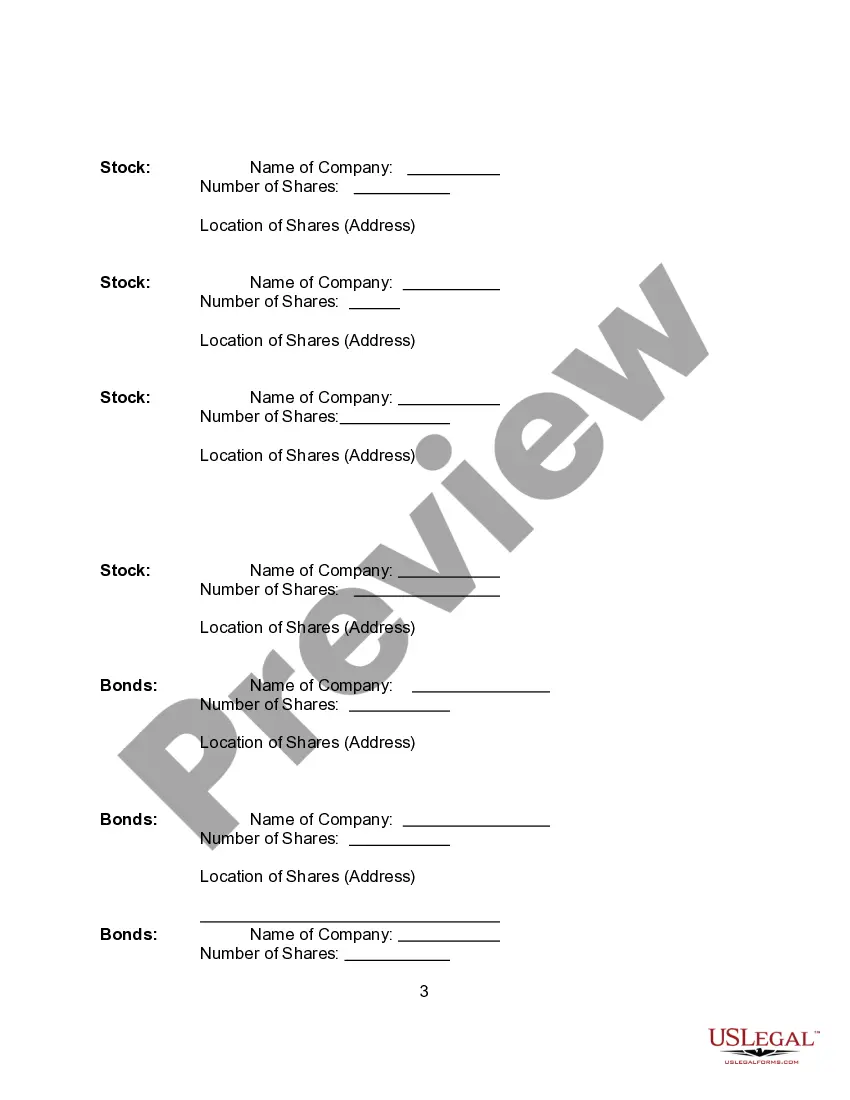

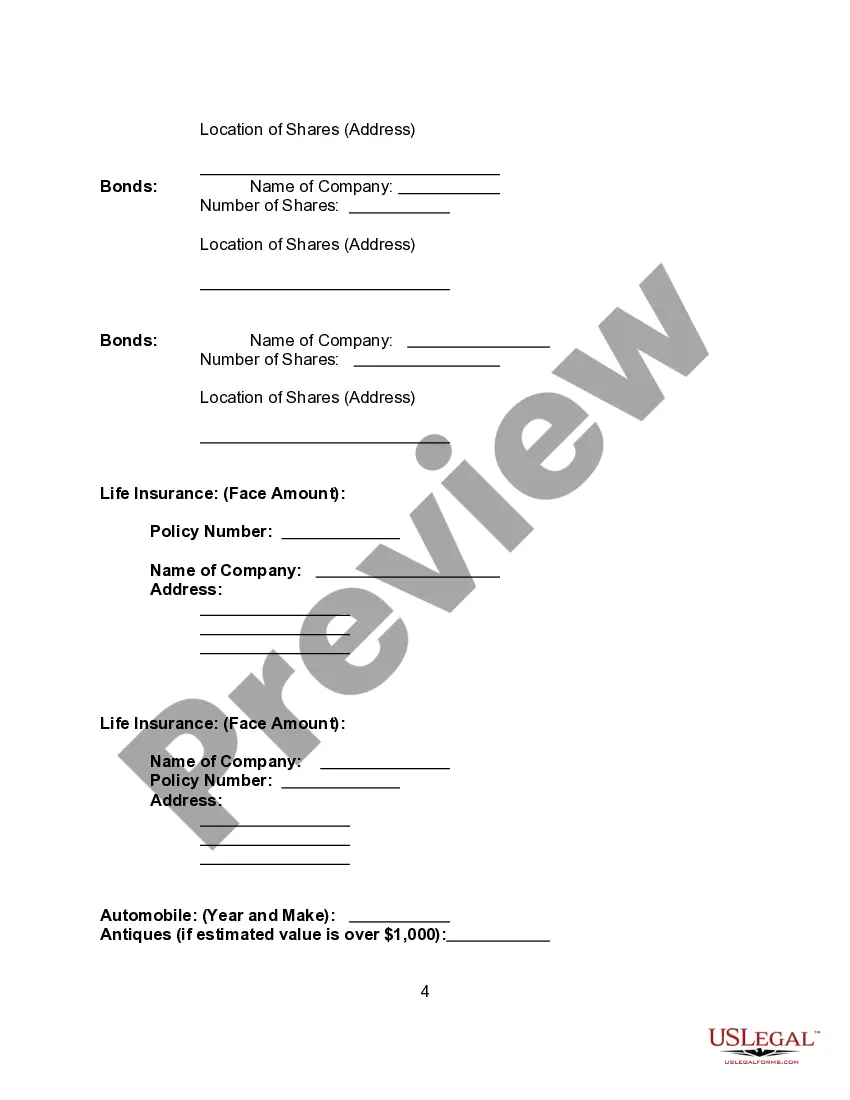

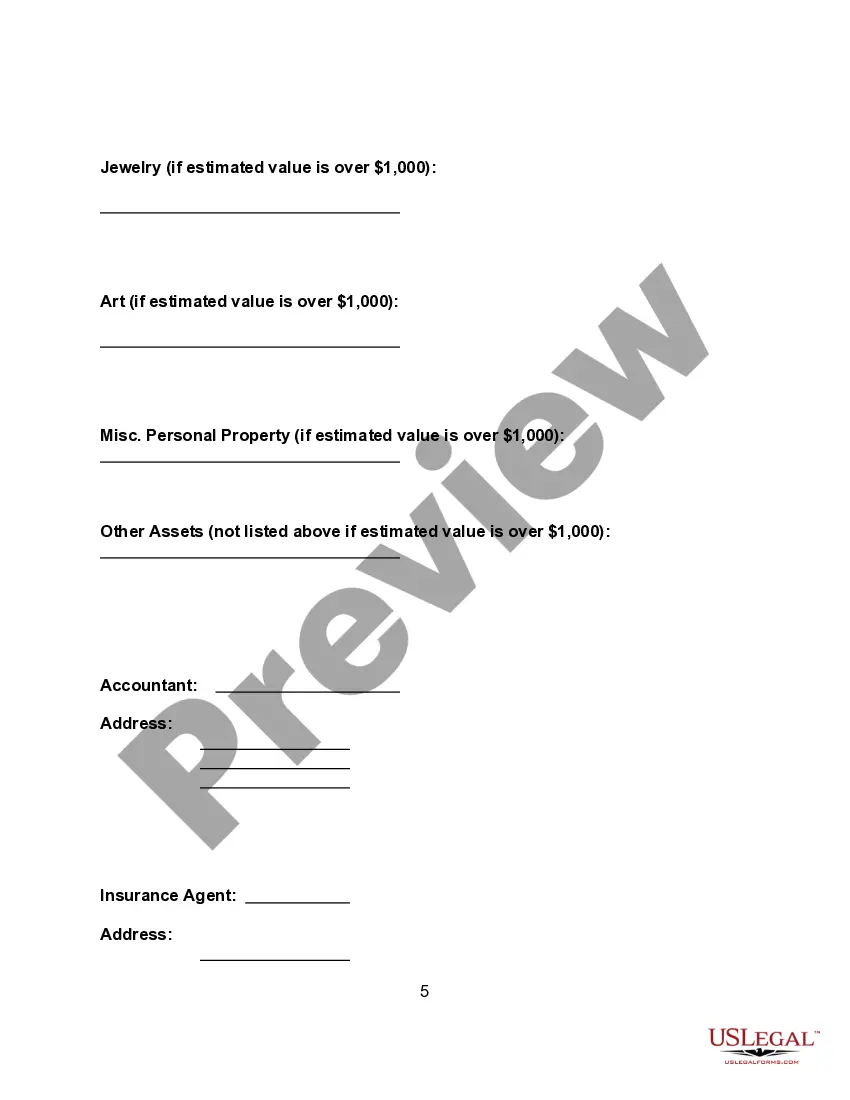

Alabama Asset Information Sheet

Description

How to fill out Asset Information Sheet?

If you want to finalize, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and practical search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Alabama Asset Information Sheet with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Complete and download, and print the Alabama Asset Information Sheet with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click the Acquire button to locate the Alabama Asset Information Sheet.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alabama Asset Information Sheet.

Form popularity

FAQ

The self-employment tax in Alabama consists of Social Security and Medicare taxes that apply to individuals who work for themselves. This tax is calculated based on net earnings from self-employment. For whether you're preparing your Alabama Asset Information Sheet or your tax return, it’s vital to factor in any self-employment tax incurred.

Non-residents who earn income from sources in Alabama must file an Alabama non-resident tax return, using Form 40NR. This obligation ensures that all taxable income is reported correctly. If this applies to you, refer to the Alabama Asset Information Sheet for detailed guidelines.

The tax rate for business privilege tax is graduated, based on the entity's federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama. The minimum business privilege tax is $100.

How far back can the IRS go to audit my return? Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years.

Form PPT is to be filed by Pass-through Entities only. BUSINESS PRIVILEGE TAX PAYMENT. Payment of the total tax due must be received on or before the original due date of the return. Form BPT-V must accompany all business privilege tax pay- ments, unless payments are made electronically.

Total Alabama Net Worth Multiply line 8 (Net Worth Subject to Apportionment) by line 9 (Apportionment Factor).Deductions.Computation of Privilege Tax Due.Federal Taxable Income for C-corporations, Real Estate Investment.Line 17b. Tax Rate Federal Taxable Income Apportioned and Allocated to Alabama.

In most cases, the Department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due.

Time Limitations A taxpayer also generally has three years to claim a refund of any tax overpaid.

The Alabama Business Privilege Tax is levied for the privilege of being organized under the laws of Alabama or doing business in Alabama (if organized under the laws of another state or country).

PPT S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-CAR form, which is used for the annual report. Both are filed with Alabama's Department of Revenue.