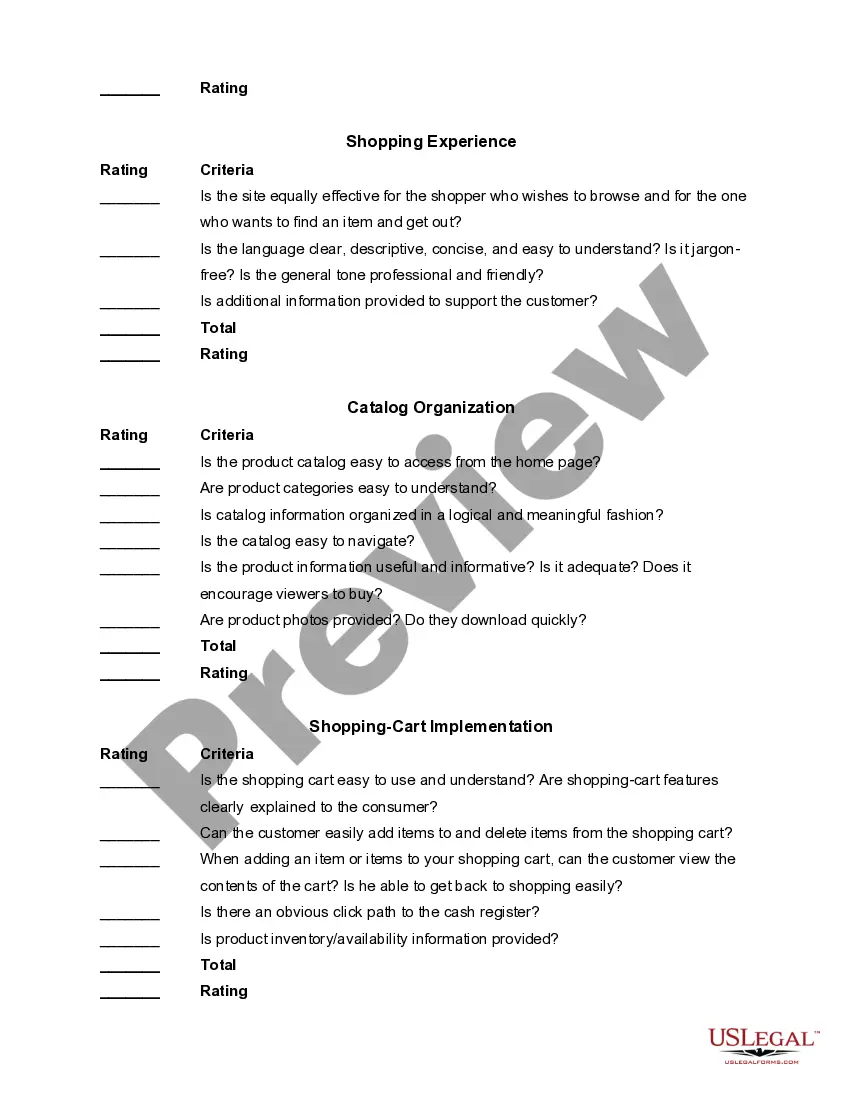

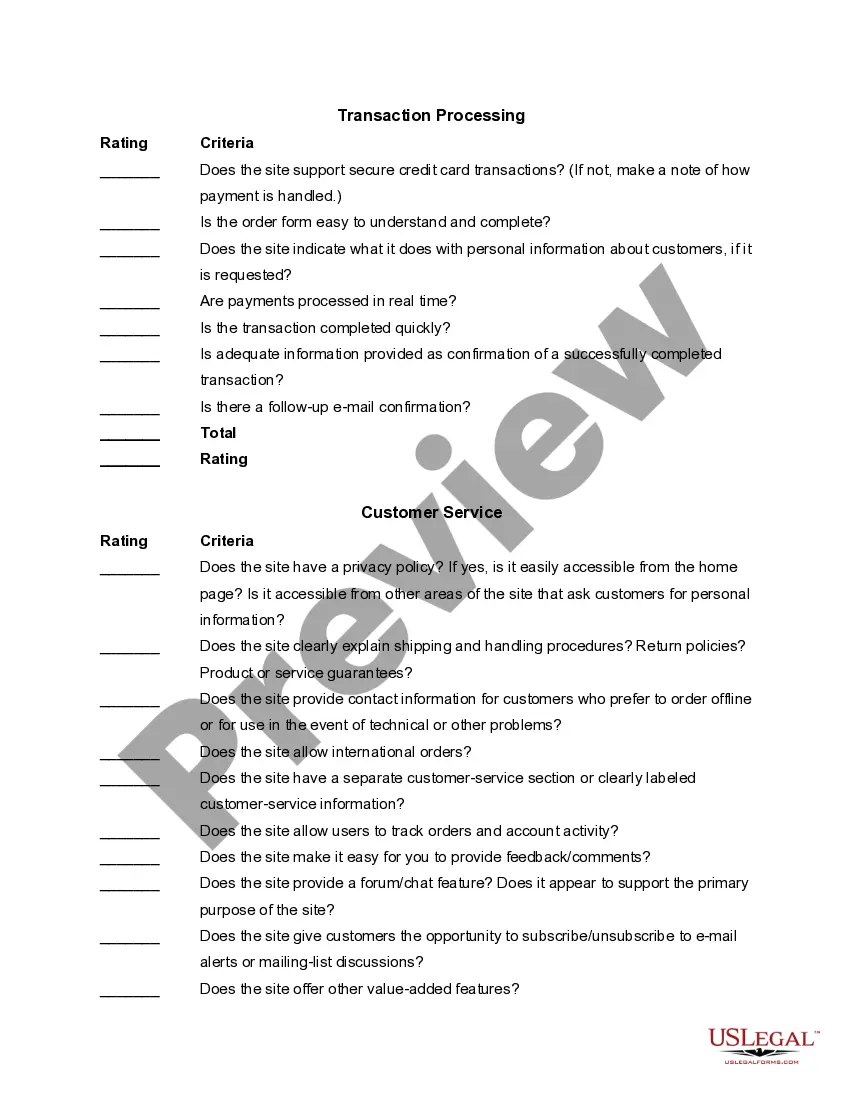

Alabama Web-Site Evaluation Worksheet

Description

How to fill out Web-Site Evaluation Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can quickly find the latest versions of forms like the Alabama Web-Site Evaluation Worksheet.

Click on the Preview option to review the content of the form.

Review the form details to confirm that you have selected the appropriate document.

- If you already have a subscription, Log In and download the Alabama Web-Site Evaluation Worksheet from the US Legal Forms library.

- The Download option will appear on every document you review.

- You can access all previously downloaded forms within the My documents section of your account.

- If you are a first-time user of US Legal Forms, here are some simple steps to get started.

- Ensure you have selected the correct form for your location/state.

Form popularity

FAQ

To respond to an income tax notice, first, carefully review the notice to understand its content and any required actions. It’s important to collect necessary documents and information that may support your response or clarify discrepancies. Consider templates and worksheets, like the Alabama Web-Site Evaluation Worksheet, to help structure your reply efficiently. Timely and accurate responses can prevent further issues from arising.

Form 40 is the Alabama income tax return form for all full-time and part-time state residents (non-residents must file a Form 40NR). This tax return package includes Form 4952A, Schedules A, B, CR, D, E and OC. Form 40 requires you to list multiple forms of income, such as wages, interest, or alimony .

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

(a) Section 40-14A-22, Code of Alabama, 1975, levies the annual Alabama business privilege tax on every corporation, limited liability entity, and disregarded entity doing business in Alabama, or organized, incorporated, qualified or registered under the laws of Alabama.

Alabama Tax Rates, Collections, and Burdens Alabama has a 6.50 percent corporate income tax rate. Alabama has a 4.00 percent state sales tax rate, a max local sales tax rate of 7.50 percent, and an average combined state and local sales tax rate of 9.24 percent.

Time Limitations A taxpayer also generally has three years to claim a refund of any tax overpaid. However, if the tax was paid by withholding or estimated payments, and you failed to timely file a return, any refund must be claimed within two years from the original due date of the return.

According to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.

Privilege taxes are usually based on the gross receipts or net worth of a business, but some are levied as a flat fee. States often use terms like franchise tax, business entity tax, or business and occupation tax to refer to their local privilege tax.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

To calculate your total business privilege tax due, you'll need to multiply your total net worth ($1,000,000) by your assigned tax rate (. 00125). So, in this case, your business privilege tax would be $1,250. The minimum tax payment for all entities is $100.