Alabama Equipment Inventory List

Description

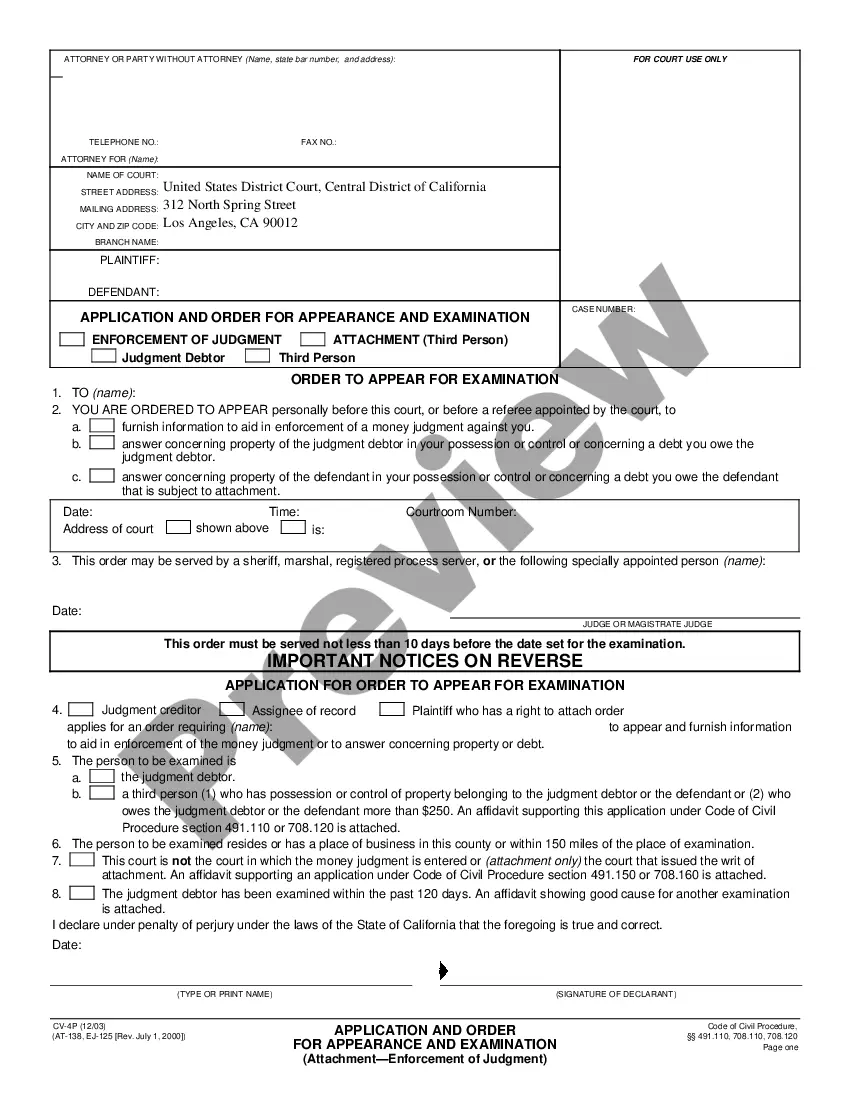

How to fill out Equipment Inventory List?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can purchase or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest forms such as the Alabama Equipment Inventory List within moments.

If you hold a membership, Log In and access the Alabama Equipment Inventory List from the US Legal Forms library. The Download option will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device.

- Ensure you have selected the correct form for your locality/region.

- Click the Preview button to check the form's content.

- Review the form overview to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, you must report your inventory on your tax returns in Alabama. Failing to do so can lead to penalties, making accurate reporting vital. Keeping an up-to-date Alabama Equipment Inventory List will streamline this process, ensuring you never miss an important detail during tax time.

In Alabama, property tax is assessed on real estate, personal property, and certain inventory items that businesses hold. This tax funds public services like schools and roads. To ensure compliance, having a detailed Alabama Equipment Inventory List is helpful, as it allows you to quickly determine which items belong to taxable property.

Yes, Alabama does have an inventory tax that applies to businesses holding inventory. It is crucial to be aware of this tax to plan your finances effectively. Utilizing an Alabama Equipment Inventory List can help you keep track of what inventory you hold, making it easier to manage your tax obligations and avoid surprises.

In Alabama, the responsibility for paying inventory tax typically falls on business owners. If you hold stock or inventory for your business, you are likely liable for this tax. It’s essential to maintain an accurate Alabama Equipment Inventory List to ensure you report your inventory correctly. This list can help keep your tax obligations transparent and manageable.

Calculating property tax in Alabama involves determining the value of the property and applying the local tax rate. You will need to obtain an assessment of your property, which may include equipment and inventory items. Using an Alabama Equipment Inventory List can streamline this process, making sure you account for all taxable items accurately, thereby avoiding any potential tax discrepancies.

The business privilege tax in Alabama is calculated based on the net worth of the business and is due annually. The tax amount varies depending on the amount of capital employed in the business. For accurate calculations, it is beneficial to maintain a detailed Alabama Equipment Inventory List that tracks your business's assets and capital.

Business personal property tax in Alabama is calculated based on the fair market value of the personal property owned by the business. Local assessors evaluate this value and apply the appropriate tax rate. To ensure accurate calculations, you should regularly update your Alabama Equipment Inventory List, as it provides a reliable basis for determining your taxable personal property.

In Alabama, certain items are exempt from sales tax, including some food items, prescription medications, and specific types of machinery and equipment. It's important for business owners to research these exemptions thoroughly. An effective way to manage the tax status of your inventory is to keep an Alabama Equipment Inventory List, which helps to identify any items that may qualify for tax exemption.

Yes, inventory is generally taxable in Alabama. This includes the equipment and other items that businesses hold for sale. By maintaining an up-to-date Alabama Equipment Inventory List, businesses can keep track of their taxable inventory, which is essential for accurate tax reporting and financial planning.

Filling out an Alabama bill of sale is a straightforward process that requires specific information about the transaction. You need to include details like the buyer's and seller's names, addresses, and the description of the equipment being sold. Utilizing the Alabama Equipment Inventory List helps to accurately represent the items involved, ensuring clarity about ownership and any relevant taxes.