Alabama Receiving Order

Description

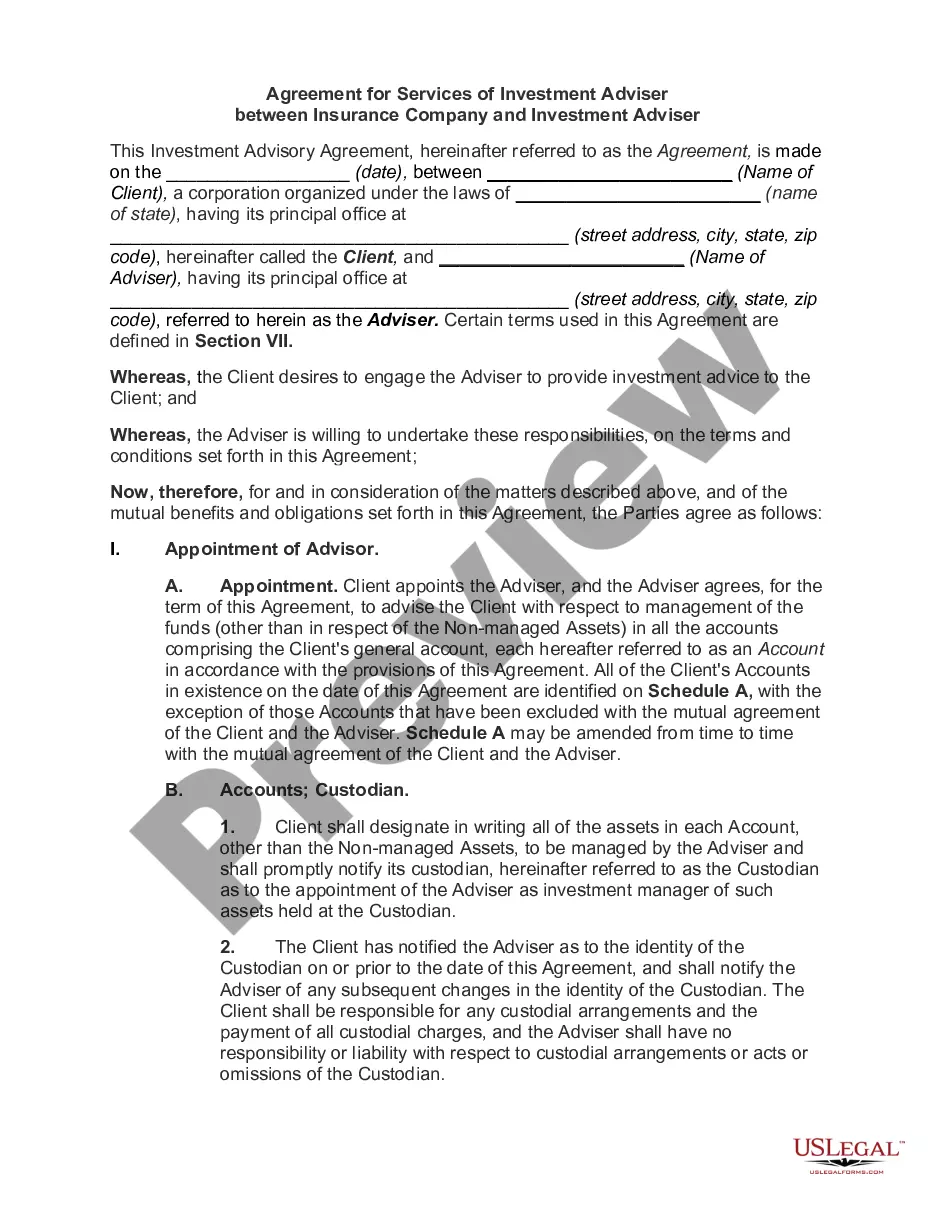

How to fill out Receiving Order?

It is feasible to spend hours online trying to locate the valid document template that satisfies the federal and state requirements you need.

US Legal Forms provides thousands of valid forms that are reviewed by professionals.

You can easily download or print the Alabama Receiving Order from your service.

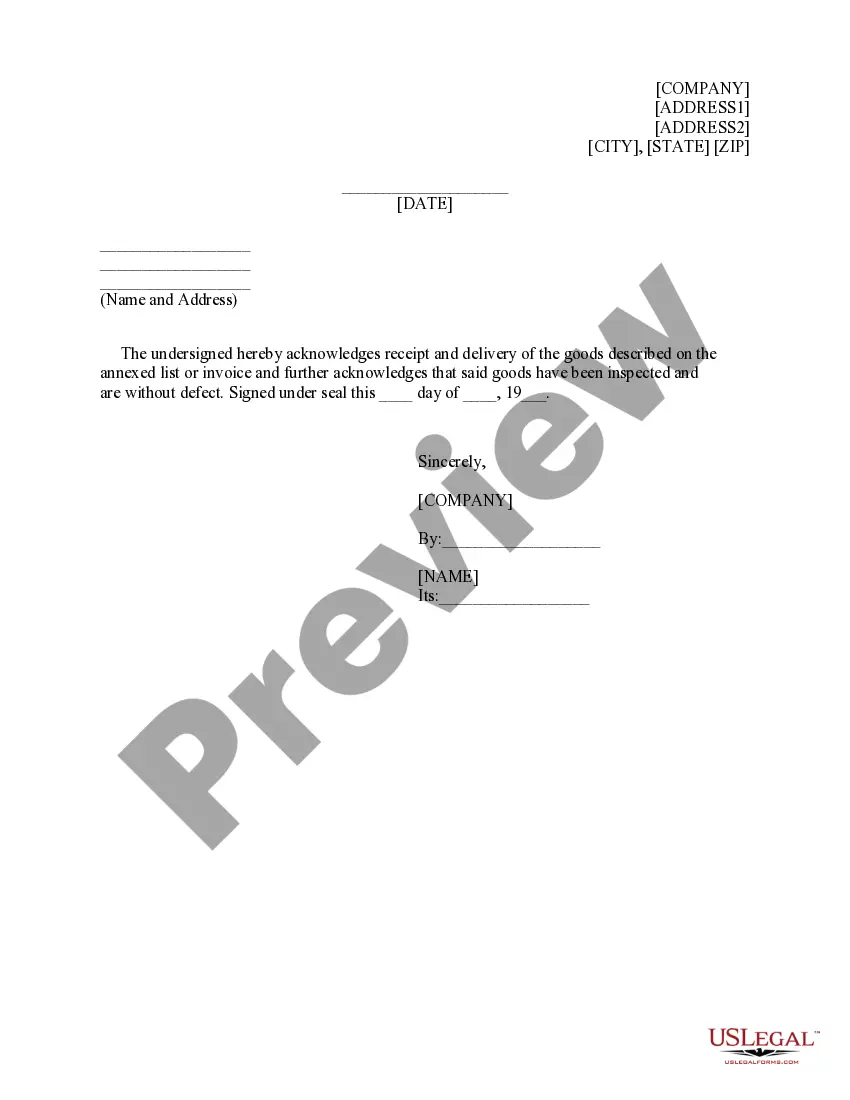

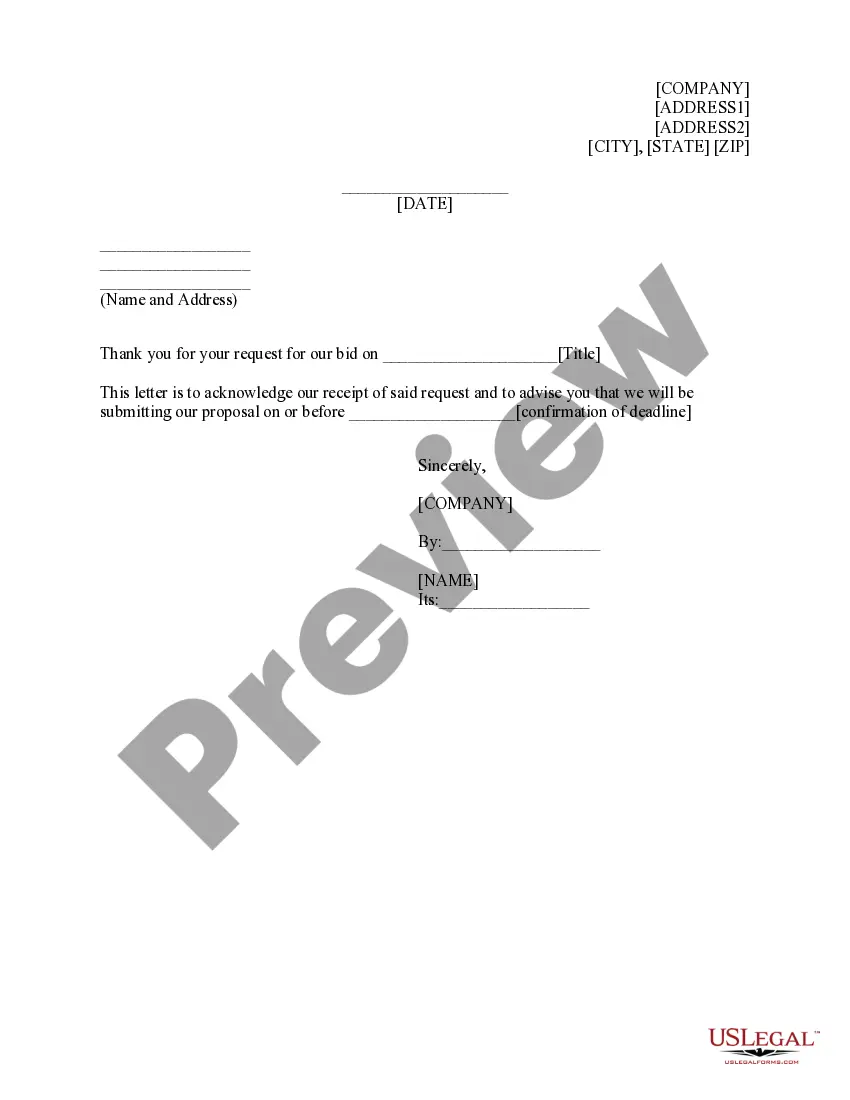

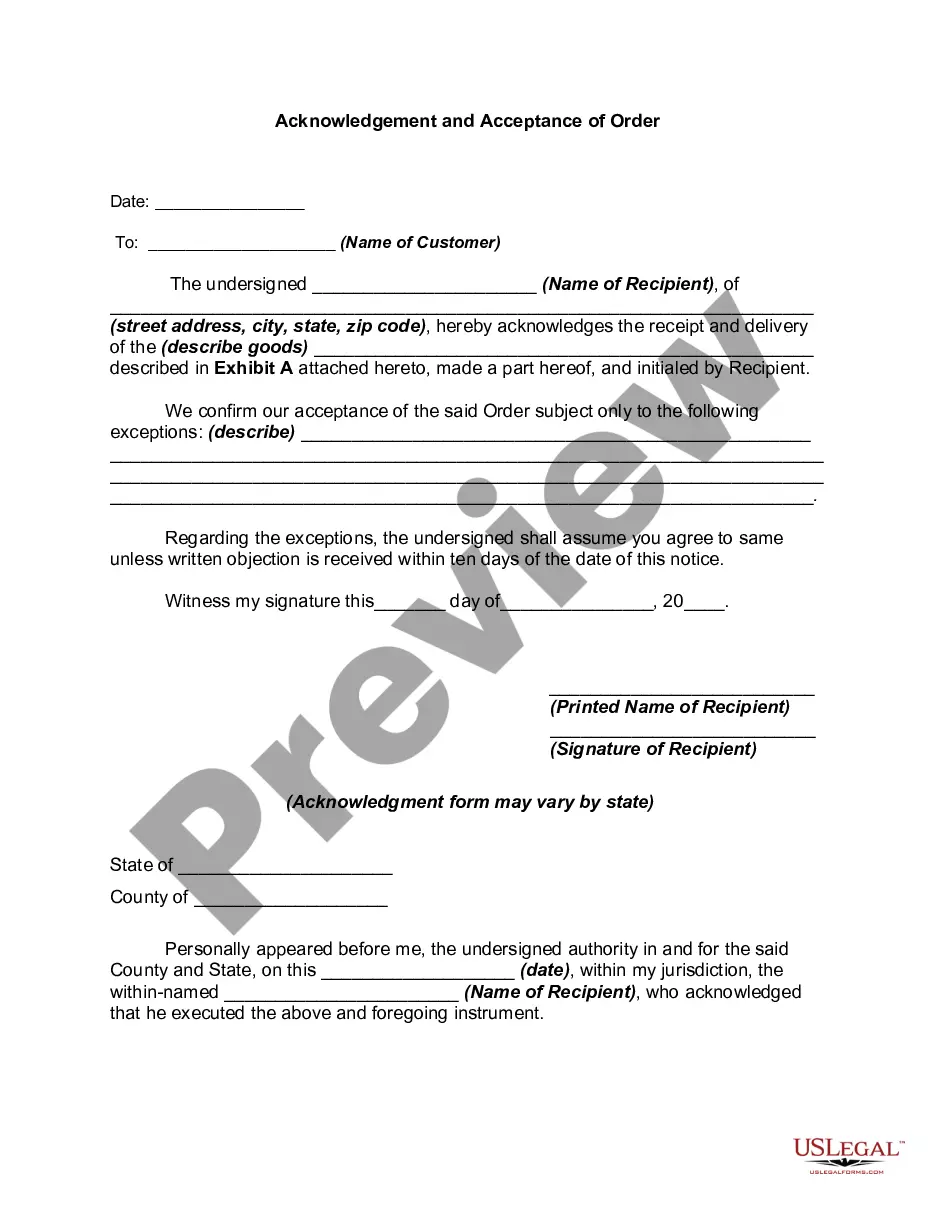

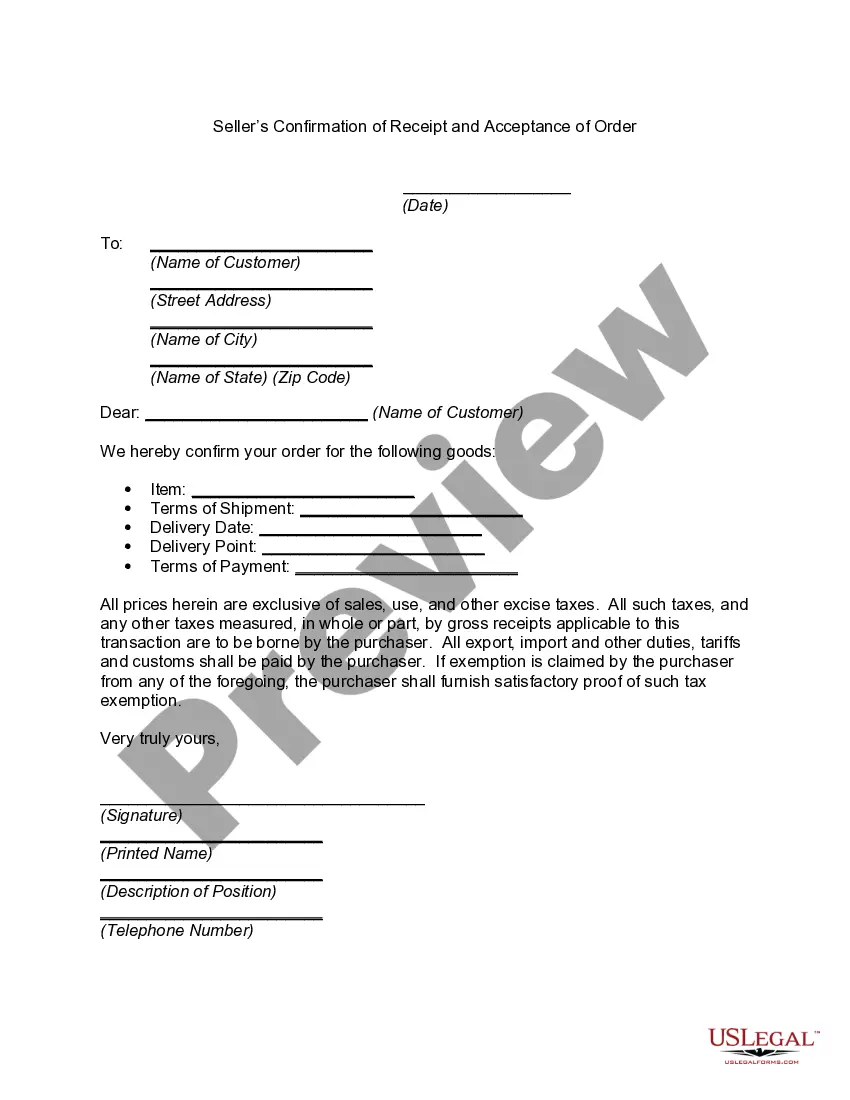

If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Alabama Receiving Order.

- Each valid document template you obtain is yours permanently.

- To get another copy of the acquired form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the state/region that you select.

- Review the form outline to confirm you have selected the appropriate template.

Form popularity

FAQ

Filing requirements for Alabama include providing your income information, any deductions, and necessary forms related to your specific tax situation. Each taxpayer’s criteria may vary based on residency status, income level, and eligibility for credits. Staying informed of these requirements helps ensure compliance and timely filing. Incorporating uslegalforms aids in organizing your filings related to your Alabama Receiving Order.

The purpose of Form 8453 is to provide taxpayer authorization for e-filing and confirm the accuracy of their electronic tax return. It acts as a safeguard ensuring that all relevant information is submitted correctly. Correctly filing this form supports adherence to IRS regulations and regulations for your Alabama Receiving Order. You can find useful templates on uslegalforms for easier handling.

Form AL8453 is a tax declaration form specifically used for Alabama tax purposes. This form is important for those filing taxes electronically, as it helps certify that the taxpayer's identity and the tax return details are correct. Completing this form accurately is vital to protect your tax interests. Use tools like uslegalforms for assistance when managing your Alabama Receiving Order and related filings.

TurboTax prompts you to mail Form 8453 if there are documents or signatures that need physical submission for validation of your electronically filed return. This process ensures that the IRS has all required paperwork and prevents delays in processing your return. Adhering to these steps is crucial for maintaining compliance with your Alabama Receiving Order.

Form 8453 OL is used for electronically filed returns, serving as the declaration for individuals who e-file their tax returns. It allows taxpayers to authorize the e-filing and confirm their identity. By utilizing this form, you can ensure that your tax information is secure and valid. Consider using uslegalforms to help file your Alabama Receiving Order while managing e-filing effectively.

Any business operating in Alabama subject to the Business Privilege Tax (BPT) must file this form. This includes corporations and certain pass-through entities regardless of income. If your business falls within the parameters set by the Alabama Department of Revenue, ensure you file your BPT to avoid penalties. Properly managing your business taxes aligns with your Alabama Receiving Order requirements.

If you fail to file Form 8843, you may face penalties and complications with your tax status. This form is essential for certain non-resident aliens to maintain compliance with IRS regulations. Additionally, it can affect your eligibility for tax benefits. Remember, filing your Alabama Receiving Order correctly can prevent such issues.

You should file Alabama Form 40 with the Alabama Department of Revenue. This can be done electronically through the state’s online portal or by mailing a completed paper form to the appropriate address. Be sure to verify that you’re using the correct address based on your specific county. Utilizing platforms like uslegalforms can help you prepare and file your Alabama Receiving Order efficiently.