Alabama Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

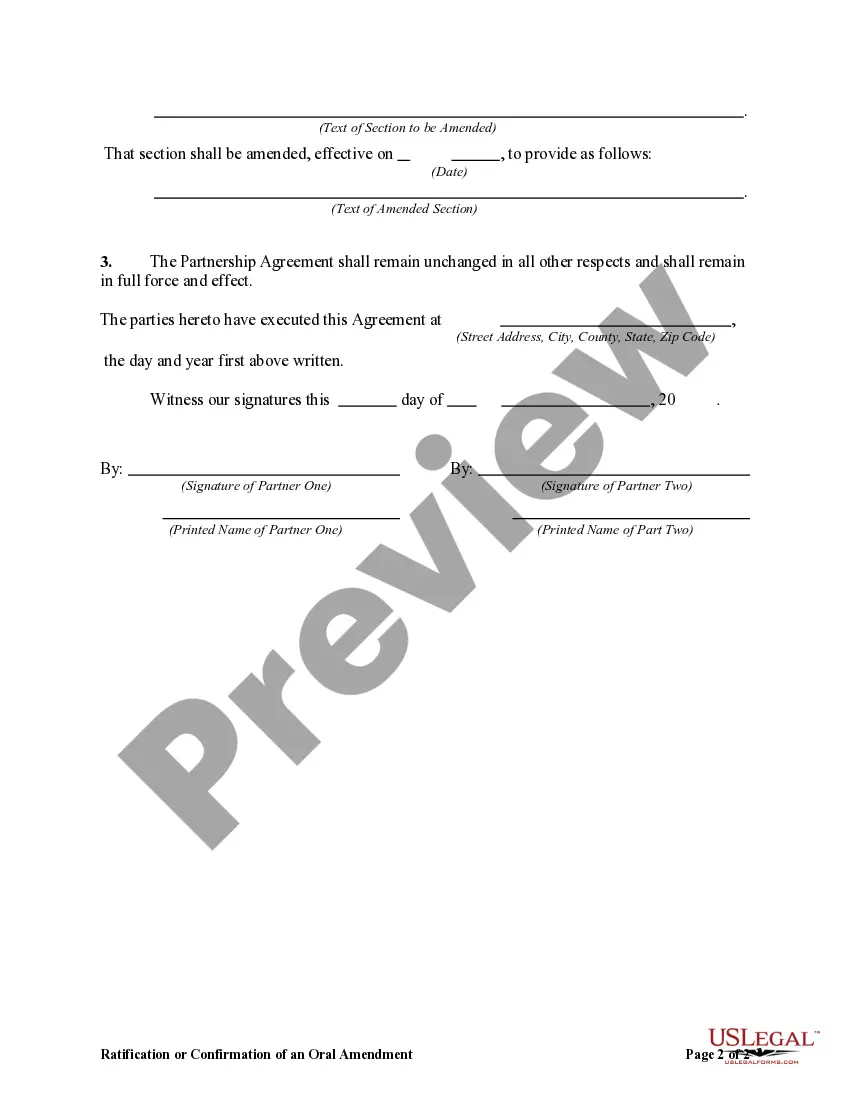

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can purchase or print.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Alabama Ratification or Confirmation of an Oral Amendment to a Partnership Agreement in moments.

If you have an account, Log In and obtain the Alabama Ratification or Confirmation of an Oral Amendment to a Partnership Agreement from the US Legal Forms library. The Download option will be available on each form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Alabama Ratification or Confirmation of an Oral Amendment to a Partnership Agreement. Every template you save in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Alabama Ratification or Confirmation of an Oral Amendment to a Partnership Agreement with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a wide array of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview option to check the content of the form.

- Review the form summary to confirm you have chosen the correct one.

- If the form doesn’t meet your requirements, utilize the Search box at the top of the screen to find a suitable one.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for your account.

Form popularity

FAQ

A ratification request is a formal petition made to the partners to approve an amendment to their partnership agreement. This request typically outlines the proposed changes and seeks consent from all parties involved. In Alabama, submitting a ratification request is crucial for ensuring alignment among partners. Using a streamlined platform such as uslegalforms can aid in crafting and submitting a comprehensive ratification request.

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

Because it is a legally binding document, you should consult a lawyer before drafting your partnership contract. You are not required to create a partnership agreement. Some partners decide to enter into a partnership with a verbal agreement or handshake.

There are 4 steps to follow for changing the partnership deed:Step 1: Take the mutual consent of partners.Step 2: Prepare for making a supplementary partnership deed.Step 3: Executing supplementary partnership deed.Step 4: Do the filing with Registrar of Firm (RoF).

Without a written agreement in place, the partnership will be governed by the default rules of the state where it's based. Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary.

1. Changing partners. When a new partner comes into the partner or when an existing partner leaves, you may want to amend the partnership agreement. This may be desirable to reflect new roles in the business, as well as new allocations of partnership items for tax purposes.

A legally binding partnership, however, requires that each partner is assigned specific roles and responsibilities, financial expectations, and future planning expectations for the business. The partnership should also have an agreement as to handling the exit of one of the business partners.

Some examples of reasons to amend your Partnership agreement could be:A new person or entity enters into the partnership.An existing partner leaves the business.The company adapts new accounting policies.There are changes in the capital contributions by one or more partners.Profit and loss distribution changes.

Overview. A domestic limited partnership may amend its Certificate of Limited Partnership from time to time by filing a Certificate of Amendment pursuant to Section 121-202 of the New York State Revised Limited Partnership Act.