Have you been in the position in which you need paperwork for either enterprise or personal purposes virtually every day? There are tons of lawful papers layouts accessible on the Internet, but discovering types you can rely is not effortless. US Legal Forms delivers a huge number of kind layouts, such as the Alabama Mortgage Loan Commitment for Home Equity Line of Credit , that are published in order to meet state and federal specifications.

Should you be currently knowledgeable about US Legal Forms web site and also have an account, merely log in. Following that, you may down load the Alabama Mortgage Loan Commitment for Home Equity Line of Credit design.

Unless you come with an account and would like to begin using US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is to the proper city/area.

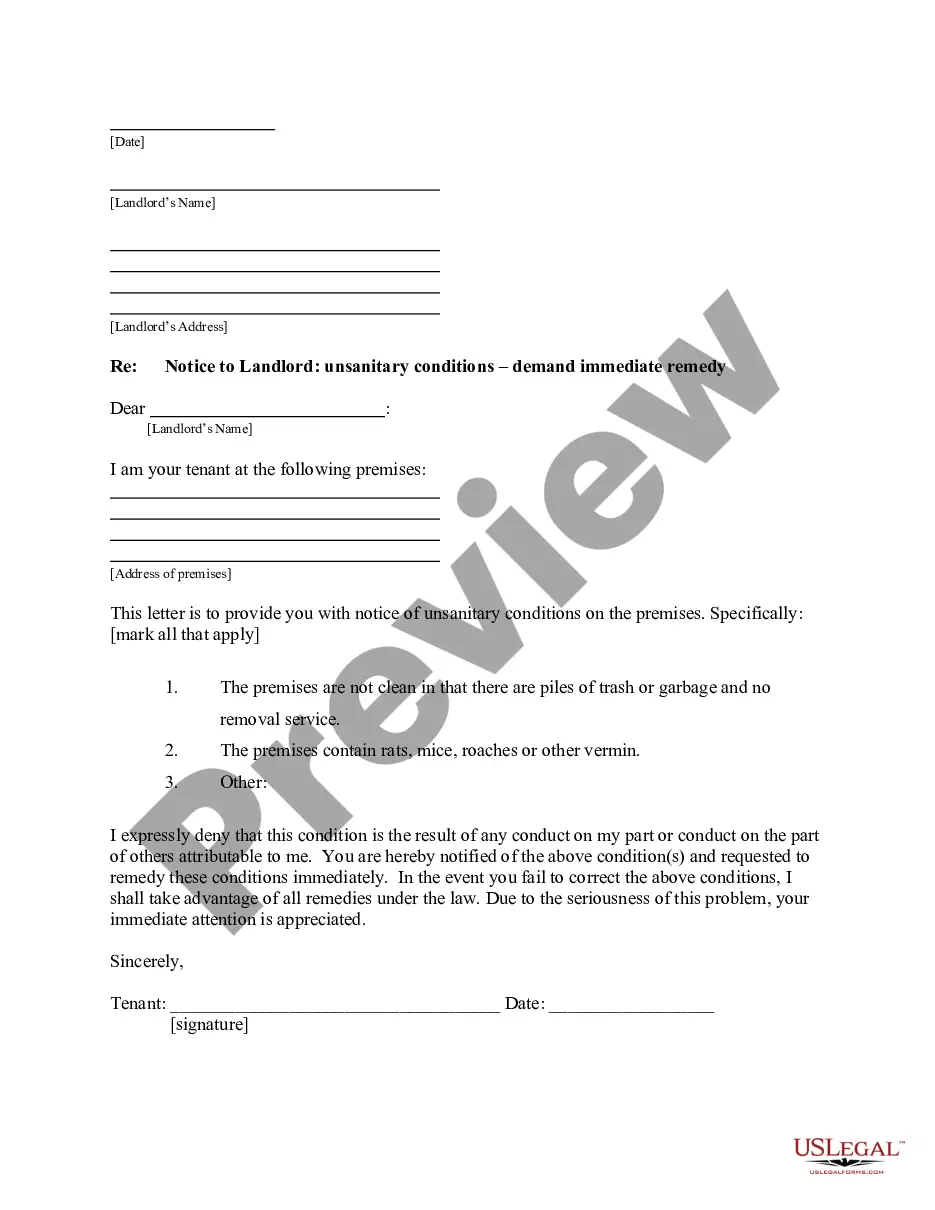

- Take advantage of the Preview option to review the shape.

- Read the description to ensure that you have chosen the correct kind.

- In case the kind is not what you`re searching for, utilize the Search area to obtain the kind that suits you and specifications.

- When you discover the proper kind, simply click Purchase now.

- Opt for the prices program you want, fill in the specified details to produce your bank account, and pay for your order utilizing your PayPal or bank card.

- Select a hassle-free paper structure and down load your version.

Discover each of the papers layouts you may have purchased in the My Forms menus. You can aquire a additional version of Alabama Mortgage Loan Commitment for Home Equity Line of Credit whenever, if necessary. Just select the required kind to down load or printing the papers design.

Use US Legal Forms, the most considerable collection of lawful types, to save lots of some time and prevent faults. The support delivers appropriately made lawful papers layouts that you can use for a variety of purposes. Produce an account on US Legal Forms and start making your life a little easier.