Have you been in the placement that you need paperwork for sometimes company or person purposes almost every day? There are a variety of legitimate document layouts available online, but getting versions you can rely on isn`t effortless. US Legal Forms offers 1000s of type layouts, such as the Alabama Lis Pendens Notice in Connection with Action to Foreclose, that happen to be published to fulfill state and federal demands.

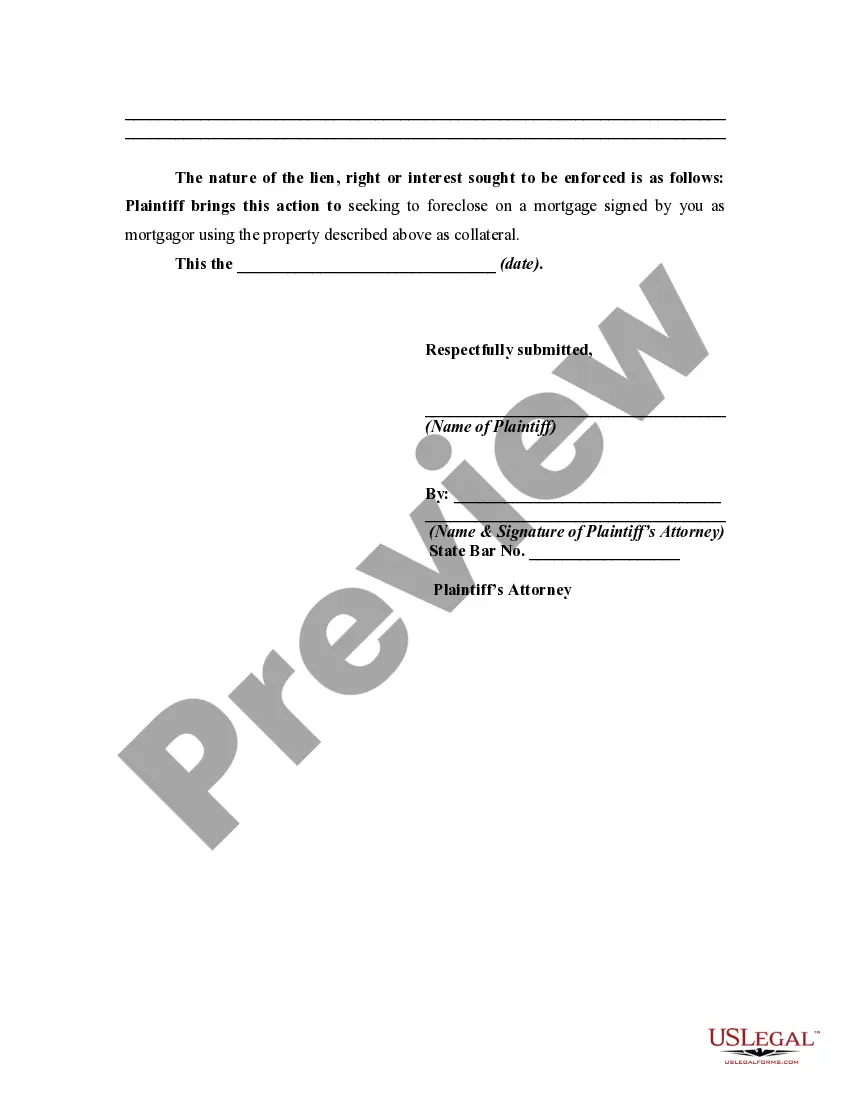

Should you be currently informed about US Legal Forms web site and also have an account, simply log in. Afterward, it is possible to down load the Alabama Lis Pendens Notice in Connection with Action to Foreclose template.

Unless you provide an profile and would like to start using US Legal Forms, adopt these measures:

- Discover the type you want and ensure it is for your right town/area.

- Take advantage of the Preview key to analyze the shape.

- Look at the description to actually have chosen the right type.

- When the type isn`t what you`re searching for, use the Search industry to get the type that meets your needs and demands.

- Once you discover the right type, click Purchase now.

- Opt for the costs program you need, submit the necessary information and facts to make your account, and purchase your order making use of your PayPal or Visa or Mastercard.

- Pick a convenient document format and down load your version.

Locate all the document layouts you have bought in the My Forms menu. You can obtain a more version of Alabama Lis Pendens Notice in Connection with Action to Foreclose at any time, if necessary. Just click the required type to down load or print the document template.

Use US Legal Forms, by far the most substantial collection of legitimate types, to save lots of efforts and stay away from blunders. The service offers expertly created legitimate document layouts that can be used for a range of purposes. Make an account on US Legal Forms and commence producing your life a little easier.