Alabama Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding versions you can trust isn't simple.

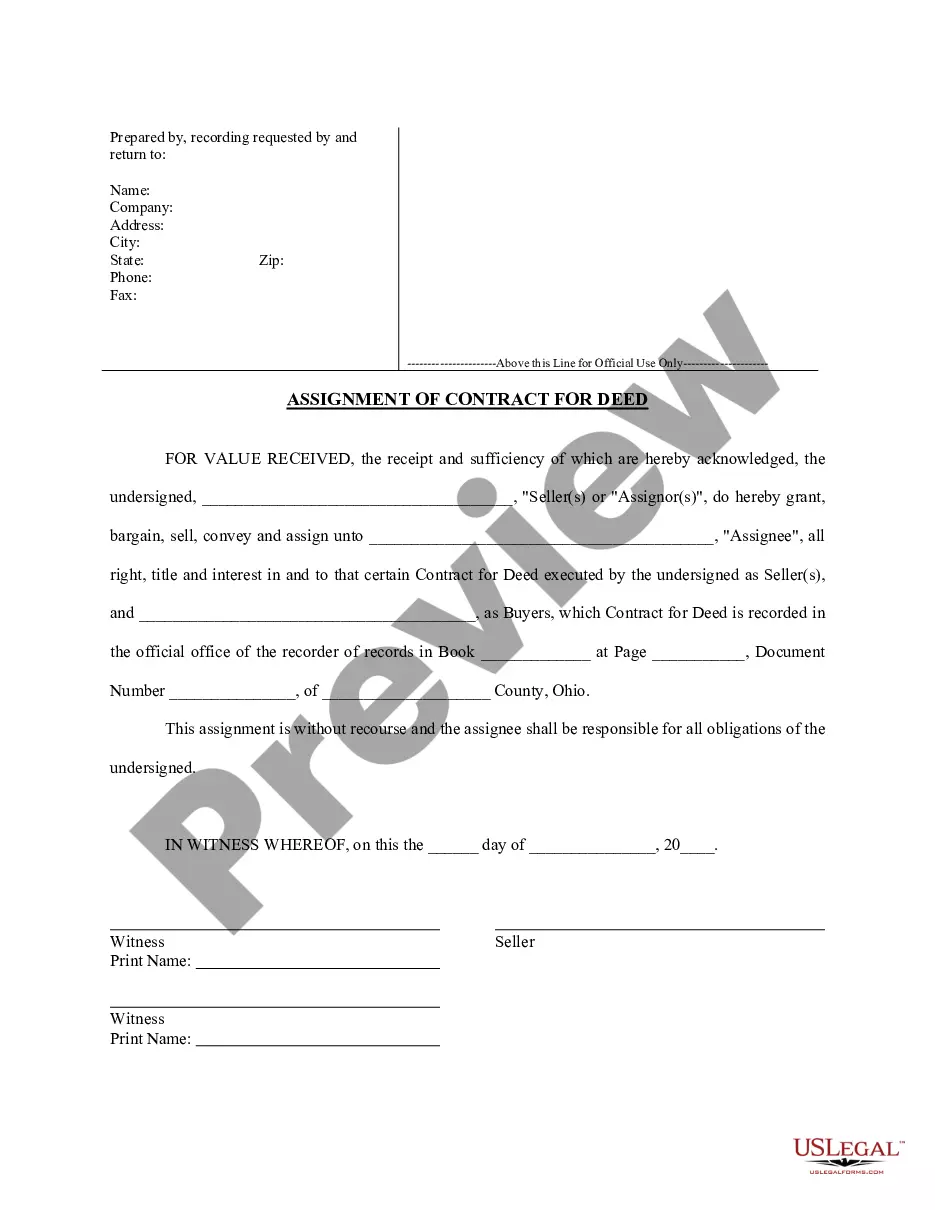

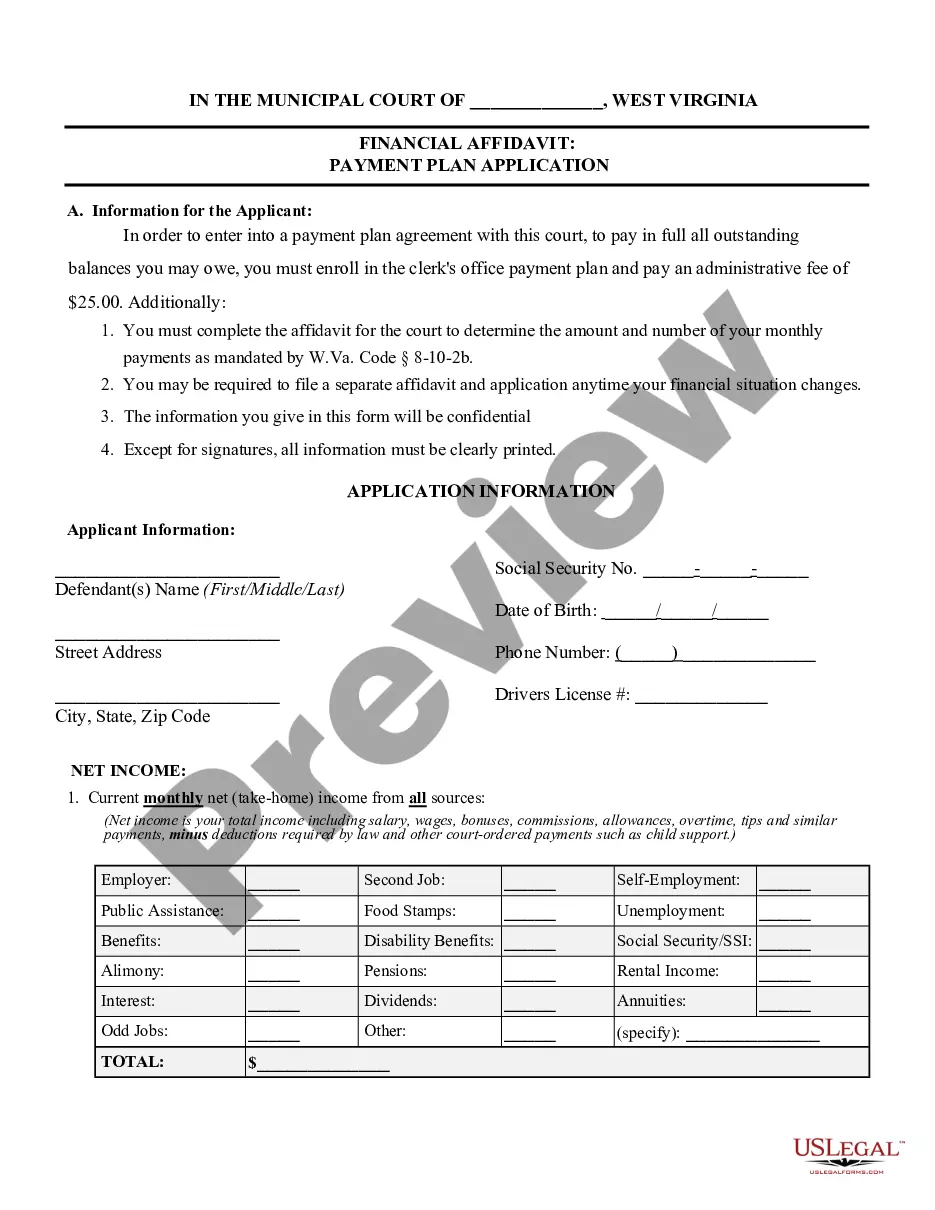

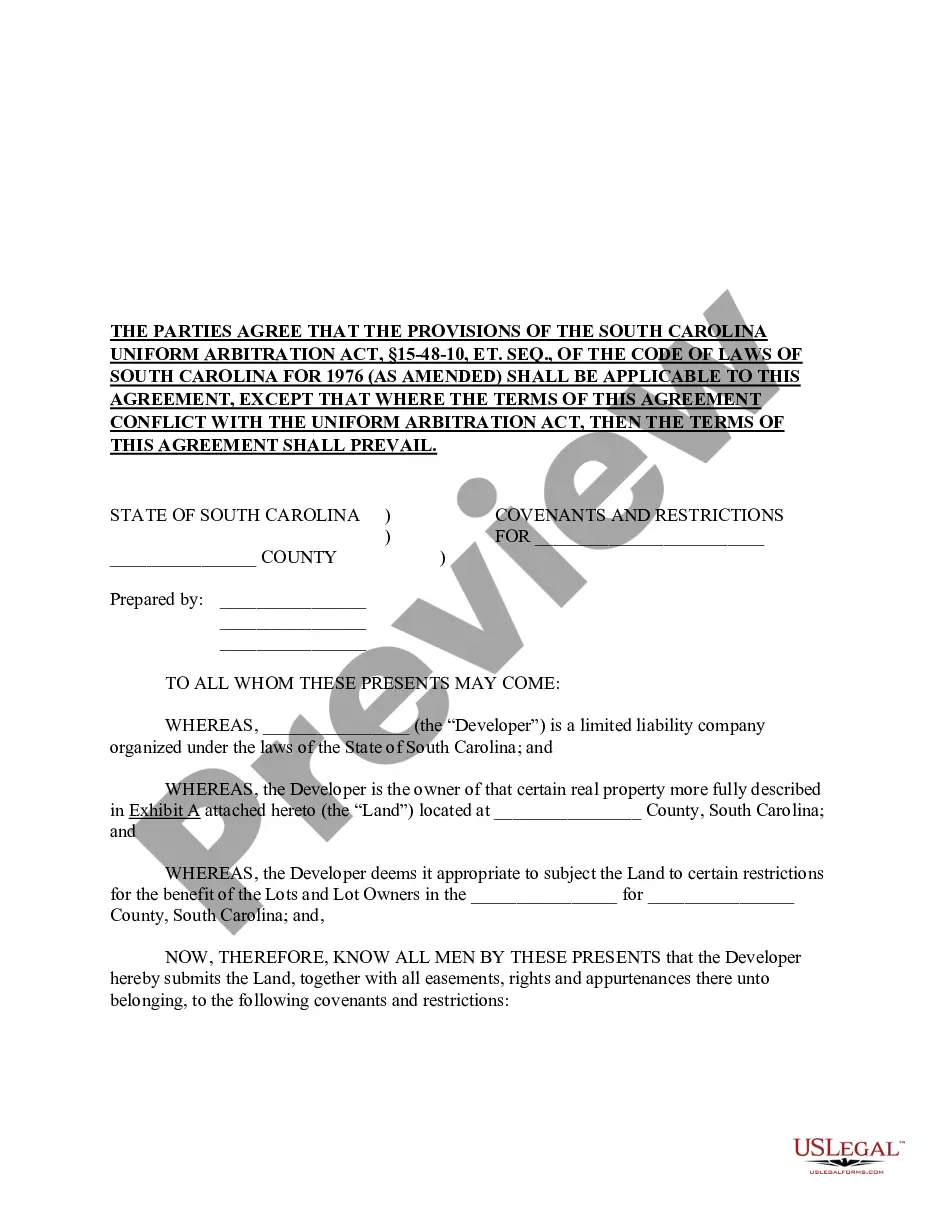

US Legal Forms provides a vast selection of form templates, such as the Alabama Multistate Promissory Note - Secured, which are designed to meet state and federal requirements.

Once you find the correct form, click Acquire now.

Select the payment plan you desire, fill in the necessary information to create your account, and make a purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Alabama Multistate Promissory Note - Secured template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to review the form.

- Read the description to make sure you have selected the correct form.

- If the form isn’t what you’re seeking, utilize the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

Promissory notes have limitations, such as enforceability against third parties and the necessity for clear terms to avoid ambiguity. For an Alabama Multistate Promissory Note - Secured, understanding these limits is vital to ensure proper legal standing. Additionally, without proper documentation, you may face challenges in collecting on the note if disputes arise.

The statute of limitations for a written contract in Alabama is six years. This means you have six years from the breach of the contract to file a lawsuit. Knowing this is important, especially when dealing with an Alabama Multistate Promissory Note - Secured, as it helps you take timely action to protect your rights.

In Alabama, debts typically become uncollectible after the statute of limitations expires, which is generally six years for written agreements. This means that if a creditor does not initiate legal action within this time frame, they can no longer enforce the debt. Understanding the timeline surrounding your Alabama Multistate Promissory Note - Secured can help you manage your financial obligations more effectively.

In Alabama, a promissory note generally remains valid for six years from the date it was executed, provided there are no payments made toward the debt. This duration is crucial because it establishes how long creditors can seek repayment. It’s essential to keep records of your Alabama Multistate Promissory Note - Secured for future reference, ensuring you know your rights and obligations.

If you lose your promissory note, you should notify the lender immediately to discuss the next steps. They may require you to sign an affidavit or issue a replacement note. Managing your affairs with a clear understanding of your obligations under the Alabama Multistate Promissory Note - Secured can ease this process, and platforms like U.S. Legal Forms can provide support in recreating necessary documents.

To obtain your promissory note, first check with the lender who issued it. They should be able to provide you with a copy or guide you on how to access it online. If you're using an Alabama Multistate Promissory Note - Secured, you may find that the U.S. Legal Forms platform offers simple access and templates for managing your documents efficiently.

In Alabama, the statute of limitations for enforcing an Alabama Multistate Promissory Note - Secured is typically six years. This means the lender must file a lawsuit within six years of the due date of the note if payment has not been received. However, it is important to note that this time frame may vary based on specific circumstances. Always consult a legal expert for personalized advice regarding your situation.

Yes, a promissory note can be secured by collateral, providing the lender with greater protection. When structuring your note, especially with an Alabama Multistate Promissory Note - Secured, be sure to clearly describe the collateral involved. This not only protects the lender but also clarifies the terms of the agreement for both parties.

In Alabama, a promissory note does not typically require notarization to be legally binding. However, having a note notarized can provide additional legal protection and verification for both parties. If structured as an Alabama Multistate Promissory Note - Secured, notarization may offer extra assurance for the lender.

To fill a demand promissory note, list the names and addresses of both parties and state the principal amount and interest rate. It's important to clarify that the lender can demand repayment at any moment. This type of note can be reinforced by using an Alabama Multistate Promissory Note - Secured, providing additional security through collateral.