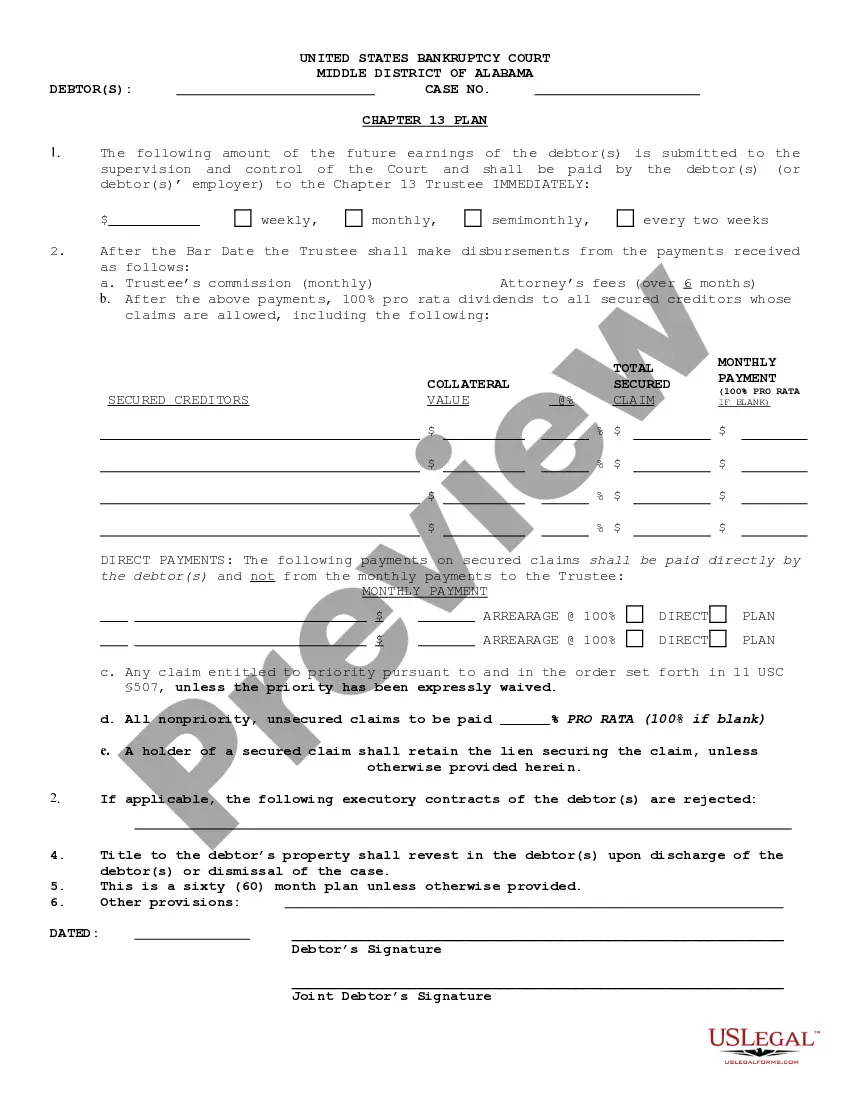

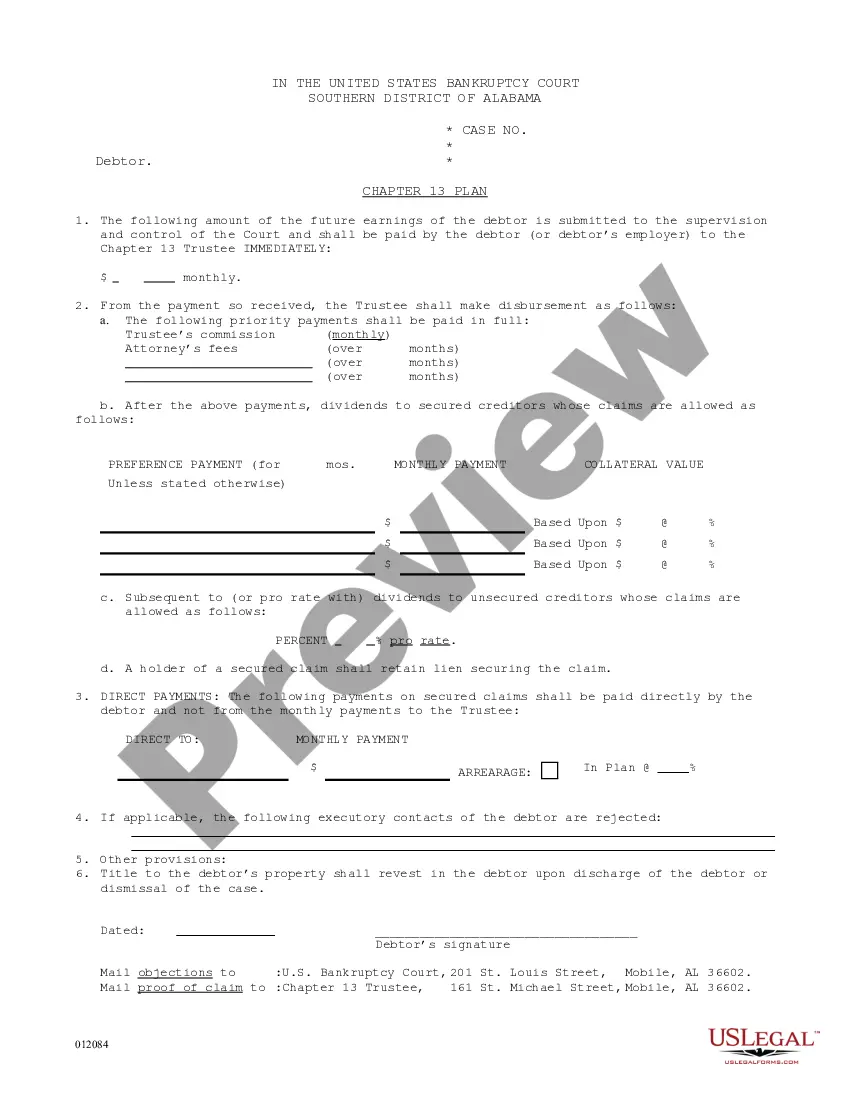

The debtor may use the chapter 13 plan to disclose when the payment of funds will be made by the debtor to the trustee for distribution to the creditors. The form is also a summary of the plan developed under chapter 13.

Alabama Chapter 13 Plan Summary

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Chapter 13 Plan Summary?

Utilizing examples of the Alabama Chapter 13 Plan Summary prepared by experienced attorneys provides you with the chance to avert complications when filling out forms.

Simply obtain the document from our site, complete it, and ask a lawyer to review it.

This can assist you in saving significantly more time and expenses than having an attorney create a file entirely from the beginning for you would.

Utilize the Preview feature and review the description (if available) to determine if you require this specific sample, and if so, simply click Buy Now.

- If you already possess a US Legal Forms subscription, just Log In to your account and return to the template page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a template, you will find your saved examples in the My documents section.

- If you do not have a subscription, that's not an issue.

- Just adhere to the step-by-step instructions below to register for an online account, obtain, and complete your Alabama Chapter 13 Plan Summary template.

- Ensure that you are downloading the correct state-specific form.

Form popularity

FAQ

Clearing an Alabama Chapter 13 Plan Summary can take anywhere from three to five years, depending on your payment plan's structure and your financial situation. Once you complete all payments, the court will discharge your remaining qualifying debts, allowing you to move forward. Staying committed to your plan plays a crucial role in successful completion. Utilizing services like USLegalForms can keep you organized and informed throughout the process.

Many Chapter 13 bankruptcies fail due to missed payments, changes in financial circumstances, or improper planning. Individuals might underestimate their living expenses or overestimate their ability to repay debts. Additionally, a lack of a solid support system can complicate adherence to the plan. The Alabama Chapter 13 Plan Summary underscores the importance of accurate budgeting, and tools from USLegalForms can assist you in crafting a sustainable plan.

Filing an Alabama Chapter 13 Plan Summary starts with collecting necessary financial documents, including income statements and lists of debts. Then, you will prepare the plan and file it with the bankruptcy court, along with the required forms. It is advisable to seek help from professionals or platforms like USLegalForms to streamline this process and ensure accuracy in your filings.

An Alabama Chapter 13 Plan Summary generally includes a payment plan lasting three to five years. The length is determined by your income, debt level, and the repayment amount required for your creditors. This structured approach offers a clear pathway to financial recovery while allowing you to keep your assets. Consider USLegalForms to help you draft an appropriate plan tailored to your situation.

The time it takes to finalize an Alabama Chapter 13 Plan Summary typically ranges from three to five years. This duration allows you to make manageable monthly payments towards your debts, ensuring you can maintain necessary living expenses. It's important to stay current with your payments to avoid complications in the process. Using resources like USLegalForms can help you navigate the timeline effectively.

The summary for Chapter 13 highlights its function as a tool for debtors to repay their debts over time while safeguarding their assets. This process focuses on creating an affordable repayment plan that suits your financial situation, as described in the Alabama Chapter 13 Plan Summary. This option not only helps eliminate debt but also offers a structured approach to regaining financial stability. Engaging with a knowledgeable service like uslegalforms can simplify this process significantly.

In Alabama, Chapter 13 allows individuals to reorganize their debts into a manageable payment plan while keeping their assets. The Alabama Chapter 13 Plan Summary outlines how your debts will be repaid over three to five years. You will propose this plan to the court, which must approve it. Throughout this period, you make regular payments to a trustee, who distributes the funds to your creditors.

To file for Chapter 13 bankruptcy in Alabama, your secured debts must be less than $1,257,850, while unsecured debts should not exceed $419,275. This limit helps determine your eligibility under the Alabama Chapter 13 Plan Summary. If your debts fall within these limits, you can create a repayment plan to manage your financial responsibilities more effectively. If you're uncertain about your debt levels, consider consulting a professional for guidance.

Filling out Chapter 13 paperwork requires you to provide detailed information about your income, expenses, assets, and debts. Comprehensive forms must be completed, and it's essential to ensure accuracy to avoid delays or rejections. You can simplify this process by using US Legal Forms, which offers resources to help guide you through filling out the necessary documentation for your Alabama Chapter 13 Plan Summary. This support can make the filing process easier and more efficient.

The average monthly payment for a Chapter 13 plan varies based on your total debt, income, and the repayment term you choose. Typically, payments range from $200 to $1,200 or more, depending on individual circumstances. Understanding these averages can help you prepare your budget as you draft your Alabama Chapter 13 Plan Summary. Utilizing resources from US Legal Forms can assist you in calculating a realistic payment plan.