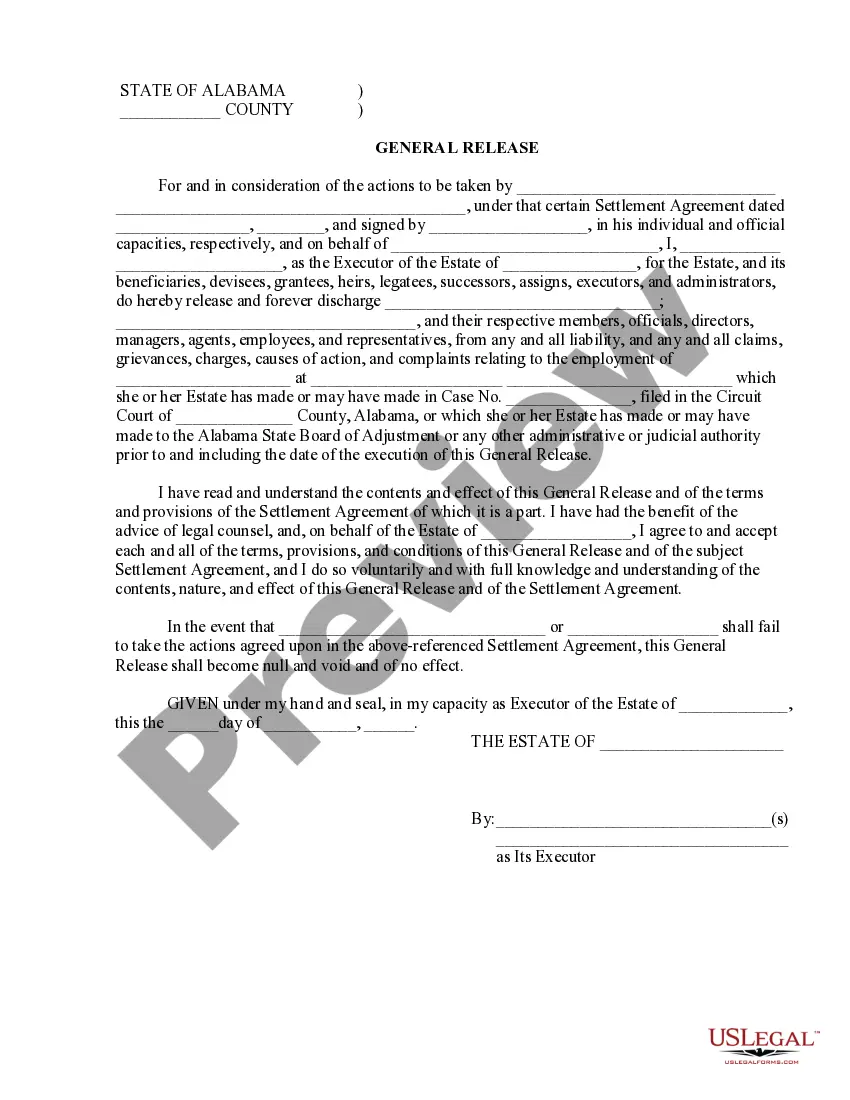

This form is a general release. As a stipulation of a settlement agreement, the executor of a certain estate releases from liability a particular company from any and all liability, or complaints, relating to the employment of the decedent at the company. The executor of the estate acknowledges that he/she has consulted an attorney and fully accepts all terms, provisions, and conditions of the release.

Alabama General Release by Executor of Employment Claim for Estate of Deceased - Pending Litigation

Description

How to fill out Alabama General Release By Executor Of Employment Claim For Estate Of Deceased - Pending Litigation?

Leveraging Alabama General Release by Executor of Employment Claim for Estate of Deceased - Pending Litigation documents crafted by skilled attorneys allows you to sidestep complications when filing paperwork. Simply acquire the sample from our site, complete it, and ask a legal expert to validate it.

Doing so can assist you in saving significantly more time and expenses compared to having a legal advisor create a file from scratch to meet your specifications.

If you have already obtained a US Legal Forms subscription, just Log In to your account and navigate back to the form page. Locate the Download button adjacent to the template you are reviewing. After acquiring a file, you can access all your stored templates in the My documents section.

Once you have completed all the aforementioned steps, you will be able to fill out, print, and sign the Alabama General Release by Executor of Employment Claim for Estate of Deceased - Pending Litigation sample. Remember to double-check all entered information for accuracy before submitting or dispatching it. Minimize the time spent on document completion with US Legal Forms!

- If you don't have a subscription, that’s not a major issue.

- Simply follow the outlined steps below to register for your account online, obtain, and fill out your Alabama General Release by Executor of Employment Claim for Estate of Deceased - Pending Litigation template.

- Verify and confirm that you’re obtaining the correct state-specific document.

- Utilize the Preview function and read the description (if present) to determine if you require this specific template and if so, just click Buy Now.

- Use the Search bar to find another file if necessary.

- Choose a subscription that fits your requirements.

- Initiate the process using your credit card or PayPal.

Form popularity

FAQ

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

The simple answer is that, either through specific will provisions or applicable state law, an executor is usually entitled to receive compensation. The amount varies depending on the situation, but the executor is always paid out of the probate estate.

By law, the probate of an estate in Alabama will take at least six months. This period gives creditors and others with a claim on the estate time to receive notice that the estate is being probated and to submit a claim.

If a will's executor dies or is unable to serve for other reasons, the court appoints another person.An executor's duties include identifying and protecting your assets, finalizing your taxes, paying outstanding bills, and distributing assets to your beneficiaries.

Both the executor and the attorney for the executor would be entitled to $25,000 each for administration of this estate. These fees are paid from the estate assets, not from your own money. So you as the client should never pay these fees yourself. They are paid from the estate before distribution of the assets.

An executor cannot simply gather assets, pay bills and expenses and then distribute the remaining assets to the beneficiaries.Beneficiaries often have the right to request an accounting of estate property and funds even before the estate is ready to close, in order to make sure everything is on the up-and-up.

There is a strict time limit within which an eligible individual can make a claim on the Estate. This is six months from the date that the Grant of Probate was issued. For this reason, Executors are advised to wait until this period has lapsed before distributing any of the Estate to the beneficiaries.

Can I sue the executor of a will or administrator of the estate? Yes, an executor or administrator can be sued, just like anyone else. However, if what you are looking to do is challenge the distributions of a will or trust, then you will need to contest the will or trust via probate or trust litigation.

State law typically provides for payment of the executor. By Mary Randolph, J.D. Most executors are entitled to payment for their work, either by the terms of the will or under state law.