Alaska Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Business

Definition and meaning

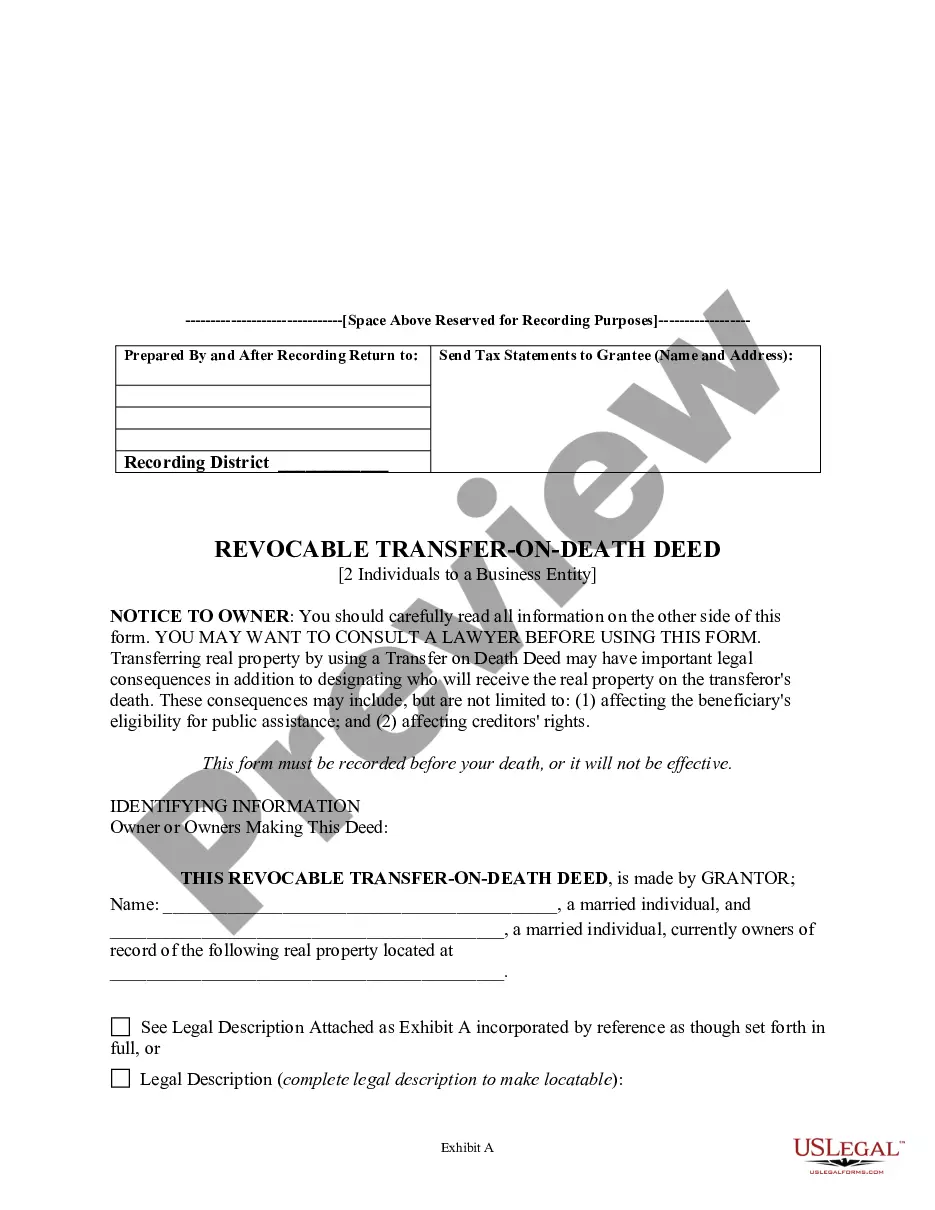

The Alaska Transfer on Death Deed, also known as a Transfer on Death (TOD) or Beneficiary Deed, allows married individuals to transfer ownership of real property to a designated beneficiary upon their death. This deed is revocable and does not take effect until the death of the property owner, providing a straightforward way to pass property without going through the probate process.

How to complete a form

To properly complete the Alaska Transfer on Death Deed, you should follow these steps:

- Identify Owners: Include the names of both property owners currently on record.

- Property Description: Provide a complete legal description of the property, ensuring it is locatable.

- Designate Beneficiaries: Clearly name the primary and any alternate beneficiaries who will inherit the property upon death.

- Sign and Notarize: Both owners need to sign the deed in the presence of a notary to validate it.

- Record the Deed: File the deed with the appropriate recording district to ensure it takes effect.

Who should use this form

This form is beneficial for married individuals in Alaska who wish to designate a beneficiary for their property, providing them with a way to transfer real estate without complications after their death. It is particularly useful for couples seeking to avoid probate for their assets.

Legal use and context

The Alaska Transfer on Death Deed is governed by state law and is designed to simplify the transfer of property upon death. By using this deed, individuals retain control over their property while alive, ensuring that it passes seamlessly to their chosen beneficiary without the need for probate proceedings.

State-specific requirements

In Alaska, it is essential to record the Transfer on Death Deed before the owner's death. The law mandates that each property must be recorded in the district where it is located. Additionally, both owners must sign the deed before a notary public for it to be legally recognized.

Benefits of using this form online

Utilizing online templates for the Alaska Transfer on Death Deed offers several advantages:

- Convenience: Users can complete the form at their own pace, reviewing each section thoroughly.

- Accessibility: Online forms are easily accessible from any location with internet access.

- Guidance: Many online platforms provide step-by-step instructions and legal insights, helping users to fill out the form correctly.

Common mistakes to avoid when using this form

When completing the Alaska Transfer on Death Deed, it's important to avoid the following errors:

- Failing to provide a complete legal description of the property.

- Not signing the document in the presence of a notary.

- Neglecting to record the deed in the appropriate recording district.

- Forgetting to designate an alternate beneficiary, which could lead to complications if the primary beneficiary does not survive.