Alaska Affidavit of Heirship for Motor Vehicle

Description

How to fill out Affidavit Of Heirship For Motor Vehicle?

Are you presently within a placement the place you require papers for possibly organization or specific uses just about every working day? There are a variety of legitimate file layouts available on the net, but getting types you can rely on is not effortless. US Legal Forms offers a huge number of type layouts, such as the Alaska Affidavit of Heirship for Motor Vehicle, that happen to be published to fulfill federal and state demands.

In case you are already acquainted with US Legal Forms site and possess your account, simply log in. Following that, you can obtain the Alaska Affidavit of Heirship for Motor Vehicle format.

If you do not have an bank account and would like to start using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is to the appropriate area/state.

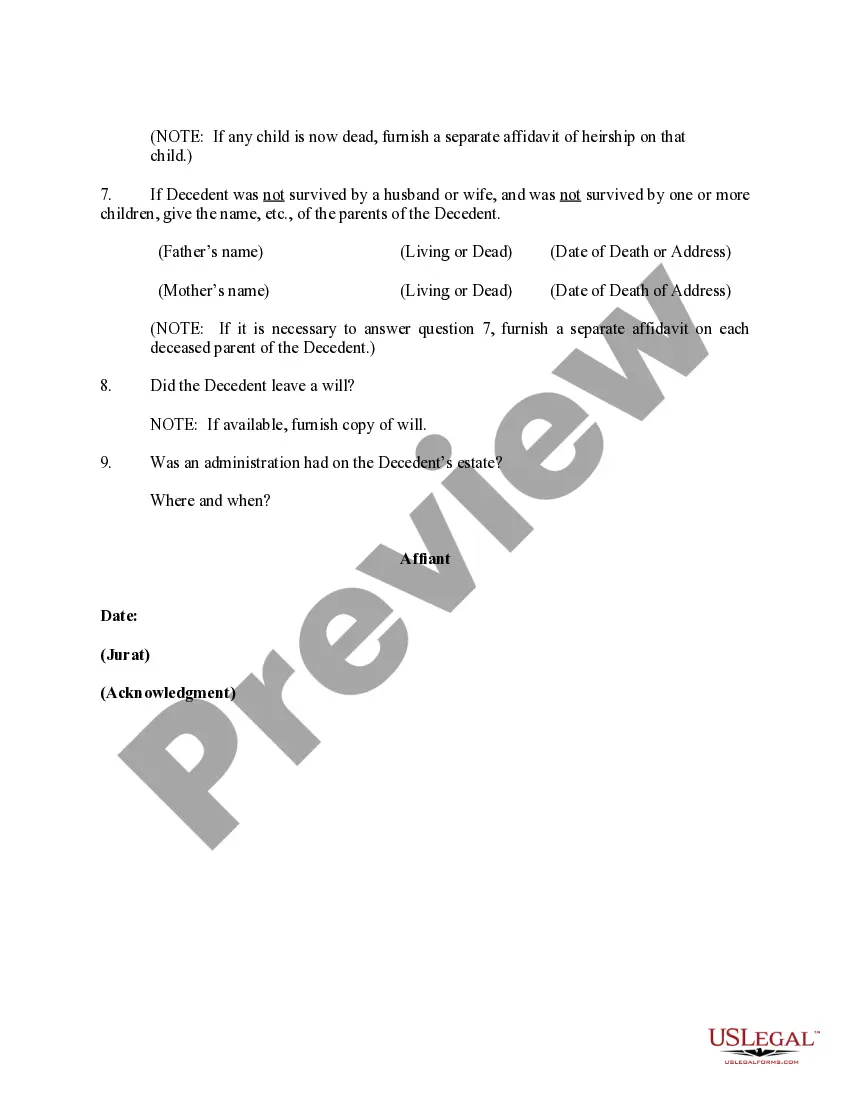

- Use the Review switch to examine the form.

- Browse the description to actually have chosen the proper type.

- When the type is not what you are trying to find, take advantage of the Look for area to get the type that meets your requirements and demands.

- Whenever you obtain the appropriate type, just click Buy now.

- Choose the costs prepare you want, complete the required information to make your account, and purchase the order using your PayPal or credit card.

- Decide on a practical paper structure and obtain your version.

Discover each of the file layouts you may have bought in the My Forms food selection. You can obtain a additional version of Alaska Affidavit of Heirship for Motor Vehicle anytime, if required. Just click the necessary type to obtain or printing the file format.

Use US Legal Forms, by far the most considerable assortment of legitimate types, to save lots of time as well as steer clear of blunders. The services offers expertly made legitimate file layouts that can be used for a selection of uses. Create your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

If the property is held as tenants by the entirety or as Alaska Community Property with a right of survivorship, it passes automatically to the spouse who survives the person who died. There is no need to do anything to transfer the real property to the surviving spouse.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

If you die without a will in Alaska, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have, whether you are married, and whether your children are also your spouse's children.

In fact, many estates can be settled without any court involvement at all. Estates valued at less than $50,000, plus $100,000 worth of motor vehicles, can often avoid the probate process in court, provided the estate contains no real property (land or a home).

You need to file within the three years after the deceased's passing to qualify for informal probate. Anything after three years will automatically end up in formal probate court.

If you create a revocable trust, you will need to choose a Trustee and decide how the property will be managed after you die. If you want to avoid probate, you will also need to transfer ownership of all of your property to the revocable trust or name the revocable trust as a beneficiary of your property.

Exempt property is personal property of the person who died, worth up to $10,000, that the Personal Representative must give to certain family members.