Alaska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

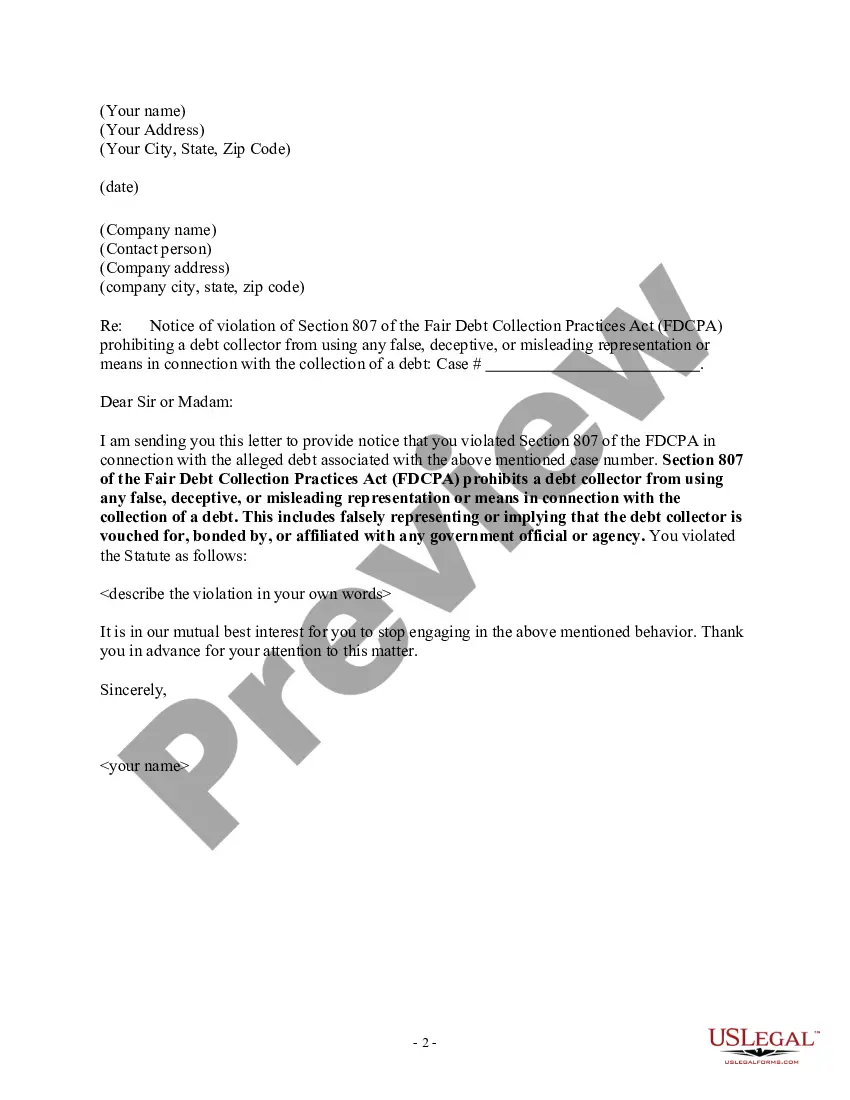

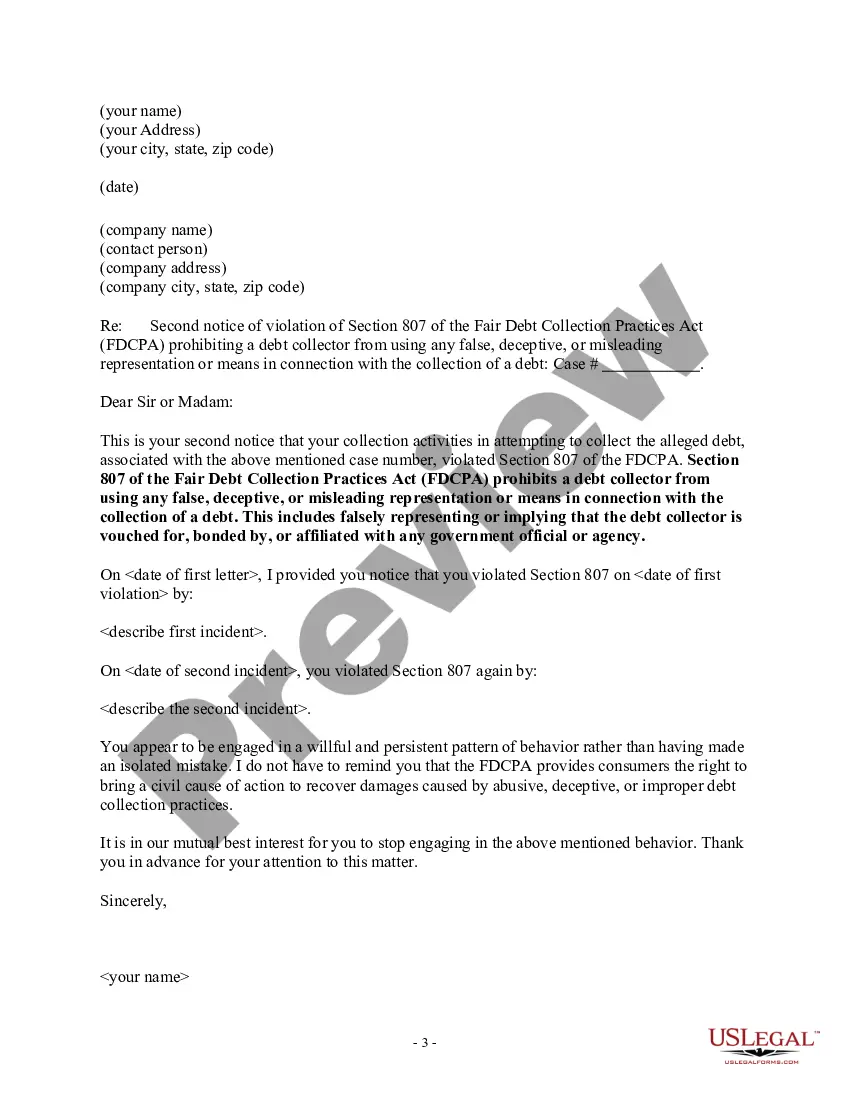

How to fill out Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

It is feasible to spend hours online searching for the permitted document format that meets your federal and state requirements.

US Legal Forms offers a vast selection of legal documents that are vetted by experts.

You can effortlessly obtain or create the Alaska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself through their services.

First, confirm that you have chosen the correct document template for your state/city of preference. Review the document description to ensure you have selected the right form.

- If you already have a US Legal Forms account, you can Log In and select the Obtain button.

- After that, you can fill out, modify, create, or sign the Alaska Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

- Every legal document template you receive is yours permanently.

- To obtain an additional copy of any downloaded form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

If they can't validate the debt, the credit bureau cannot list it as a negative mark on your credit report. With debt validation, you're requesting that the debt collector proves they have the legal right to collect the money. It also confirms that you agreed to pay the debt and the amount owed is accurate.

Federal law says that after receiving written notice of a debt, consumers have a 30-day window to respond with a debt dispute letter.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Unless your state law provides otherwise, the FDCPA only requires debt collectors, not original creditors, to verify debts in certain circumstances. This requirement includes law firms that are routinely engaged in collecting debts.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

You have 30 days to dispute a debt or part of a debt within 30 days from when you first receive the required information from the debt collector.