Alaska Hourly Employee Evaluation

Description

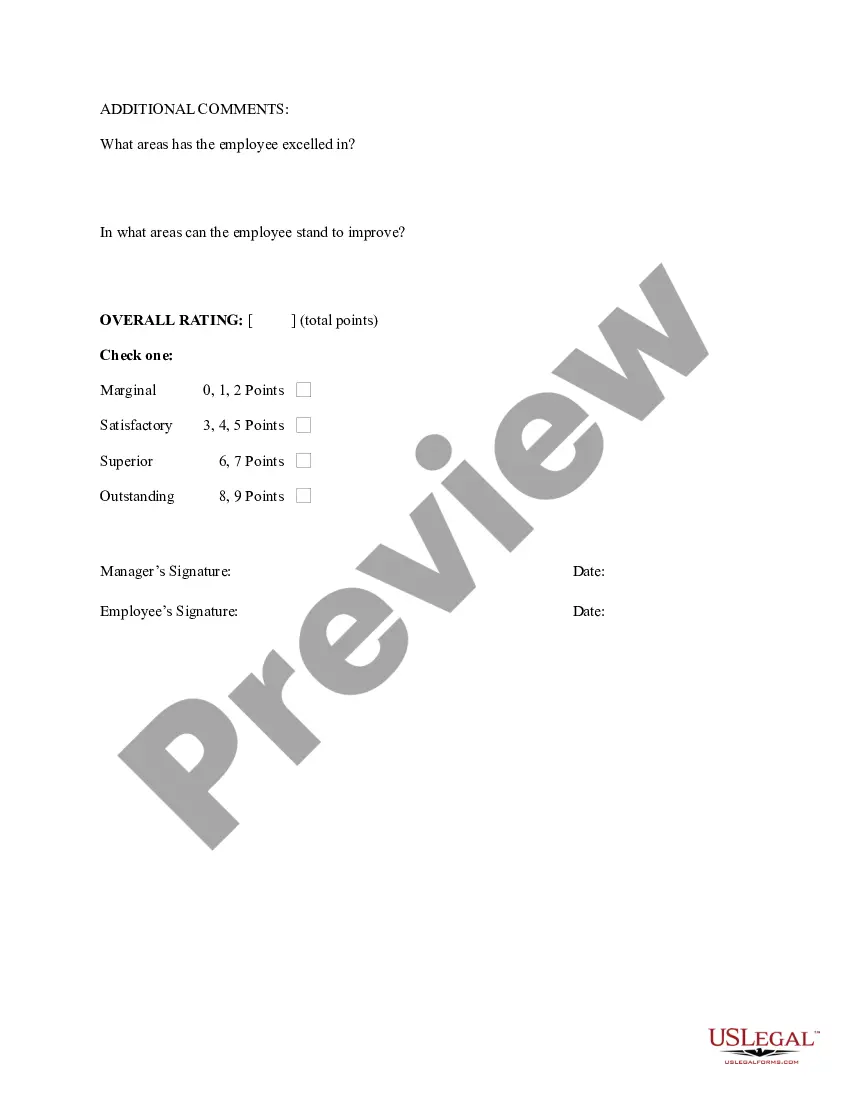

How to fill out Hourly Employee Evaluation?

You have the capability to spend time online looking for the proper document format that meets the state and federal requirements you seek. US Legal Forms offers a wide array of legal forms that have been reviewed by experts.

You can easily download or print the Alaska Hourly Employee Evaluation from our platform.

If you already possess a US Legal Forms account, you can sign in and then click the Download button. Afterwards, you can fill out, modify, print, or sign the Alaska Hourly Employee Evaluation. Every legal document format you obtain is yours forever.

Select the format of the document and download it to your device. Make changes to the document if needed. You can fill out, modify, sign, and print the Alaska Hourly Employee Evaluation. Download and print a variety of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To acquire an additional copy of the purchased document, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, confirm that you have chosen the correct document format for the region/city of your choice. Check the document description to ensure you have selected the appropriate form.

- If available, utilize the Preview button to review the document format as well.

- If you wish to find another version of the document, use the Search section to locate the template that satisfies your needs and requirements.

- Once you have found the format you desire, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your details, and register for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to acquire the legal document.

Form popularity

FAQ

New laws set to take effect on July 1, 2025, encompass several employment regulations aimed at improving worker protections. These laws include updates on wage regulations and rights regarding employee leave. Staying ahead of these changes in your Alaska Hourly Employee Evaluation strategy will ensure compliance and promote a positive work environment.

Effective Jan. 1, 2021, Alaska's minimum wage is $10.34 per hour. This is calculated by multiplying all hours worked in the pay period by $10.34. This amount is the least amount that can be paid to an employee as wages.

You also have the right not to engage in conversations or communications about your wages. When you and another employee have a conversation or communication about your pay, it is unlawful for your employer to punish or retaliate against you in any way for having that conversation.

Use these six steps to determine a pay rate for new employees.Write a job description. A job title isn't enough.Consider experience and training. Determine the minimum experience and education necessary for the position.Check out industry rates.Factor in benefits and perks.Set a salary range.Be flexible.

Question: How often do you get a raise at Alaska Airlines? every 6 month to a year depending on the place you are in with your contract.

Under Alaska law, if an employee works more than eight hours in one day or more than 40 hours in a week, then they are entitled to 1.5 times their normal hourly pay rate for all time worked over those limits. For all other aspects of overtime law, Alaska follows the federal Fair Labor Standards Act (FLSA).

1 time per year, or when certain (criteria) are met.

Employment Status Permanent Full-time: Work hours per week. For health insurance and retirement benefits purposes only, 30 hours is considered full-time. Supervisory (SU) and Labor, Trades and Crafts (LTC) employees are regularly scheduled to work 40 hours per week.

Most employers are more likely to give you a raise if you have been with the company for at least a year or more. If you have been with the company for multiple years, then you can ask once a year. This "rule" may differ if your employer plans to discuss your compensation during a performance review.

Full Time in California According to the California Department of Industrial Relations, working 40 hours per week qualifies employees as full-time workers.