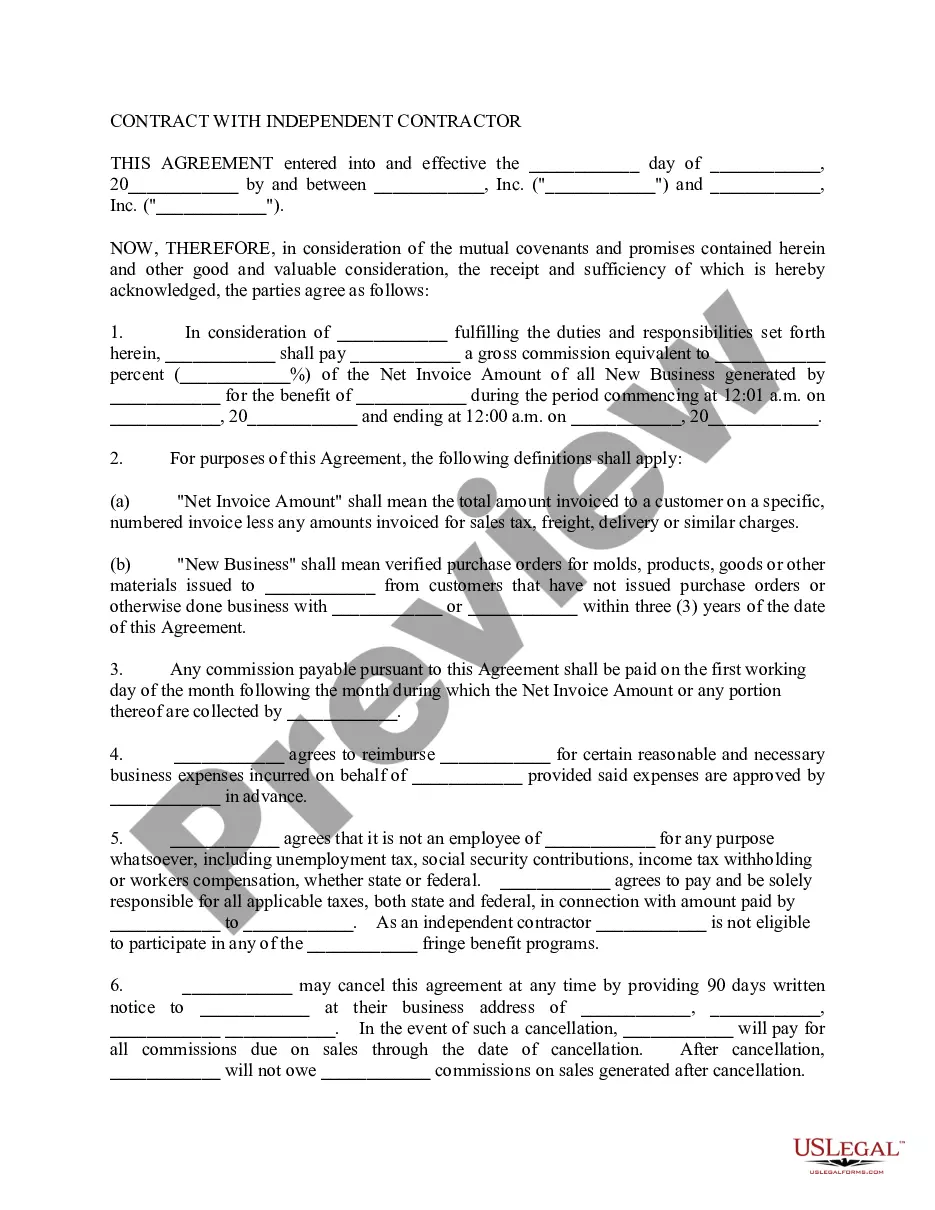

Alaska Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

You may commit several hours on the web looking for the legal file template which fits the federal and state specifications you will need. US Legal Forms provides 1000s of legal forms which are evaluated by specialists. You can easily download or print out the Alaska Self-Employed Independent Contractor Employment Agreement - commission for new business from my support.

If you have a US Legal Forms bank account, it is possible to log in and then click the Acquire button. Next, it is possible to total, revise, print out, or indication the Alaska Self-Employed Independent Contractor Employment Agreement - commission for new business. Every legal file template you get is yours permanently. To obtain yet another version of any obtained kind, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms site the very first time, keep to the basic instructions listed below:

- First, be sure that you have chosen the best file template for your region/metropolis that you pick. Browse the kind information to ensure you have chosen the proper kind. If readily available, utilize the Review button to look from the file template at the same time.

- If you wish to find yet another edition of your kind, utilize the Look for area to get the template that suits you and specifications.

- Once you have identified the template you want, click on Buy now to carry on.

- Choose the pricing plan you want, enter your references, and register for an account on US Legal Forms.

- Total the purchase. You should use your Visa or Mastercard or PayPal bank account to cover the legal kind.

- Choose the formatting of your file and download it for your gadget.

- Make alterations for your file if required. You may total, revise and indication and print out Alaska Self-Employed Independent Contractor Employment Agreement - commission for new business.

Acquire and print out 1000s of file layouts while using US Legal Forms website, that offers the biggest selection of legal forms. Use professional and status-certain layouts to deal with your organization or personal demands.

Form popularity

FAQ

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.