Alaska General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

In case you need to obtain, download, or print official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site's user-friendly and efficient search to find the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 5. Process the transaction. You can use your Visa, MasterCard, or PayPal account to complete the payment.

Step 6. Choose the format of the legal form and download it onto your device. Step 7. Complete, edit, and print or sign the Alaska General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

- Utilize US Legal Forms to access the Alaska General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to obtain the Alaska General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

- You can also retrieve forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

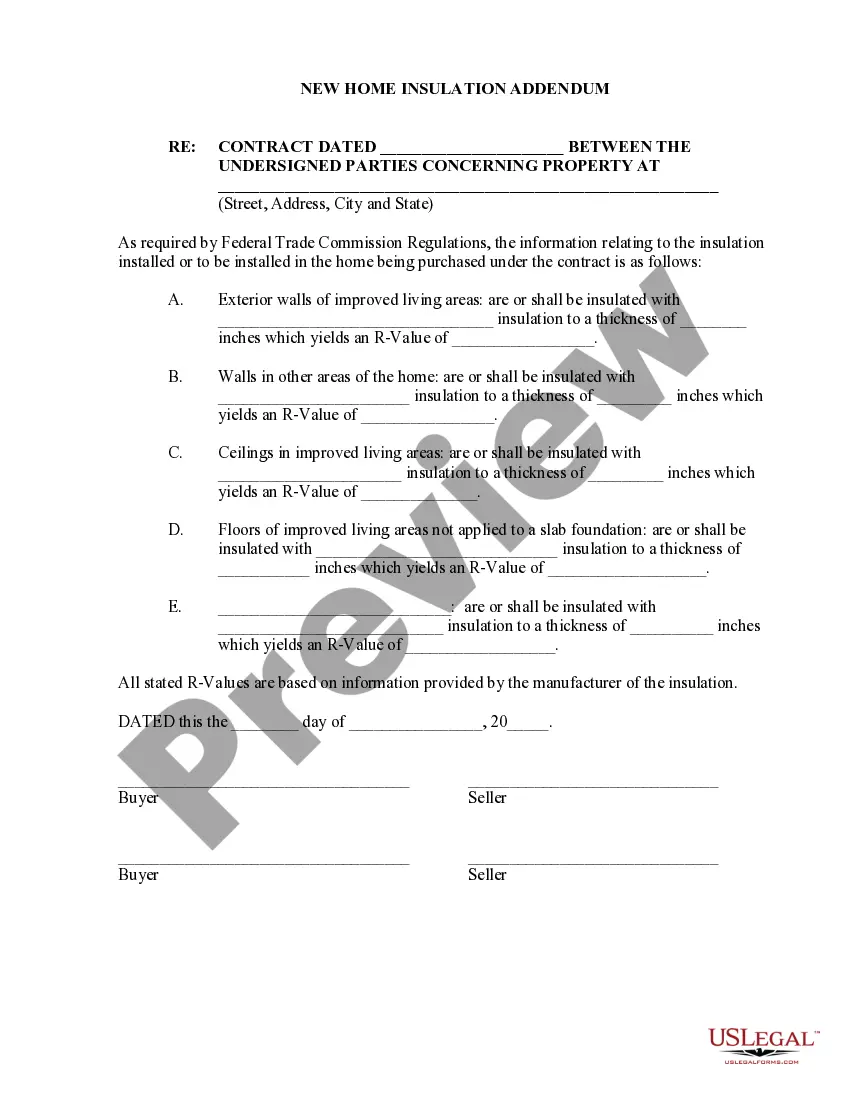

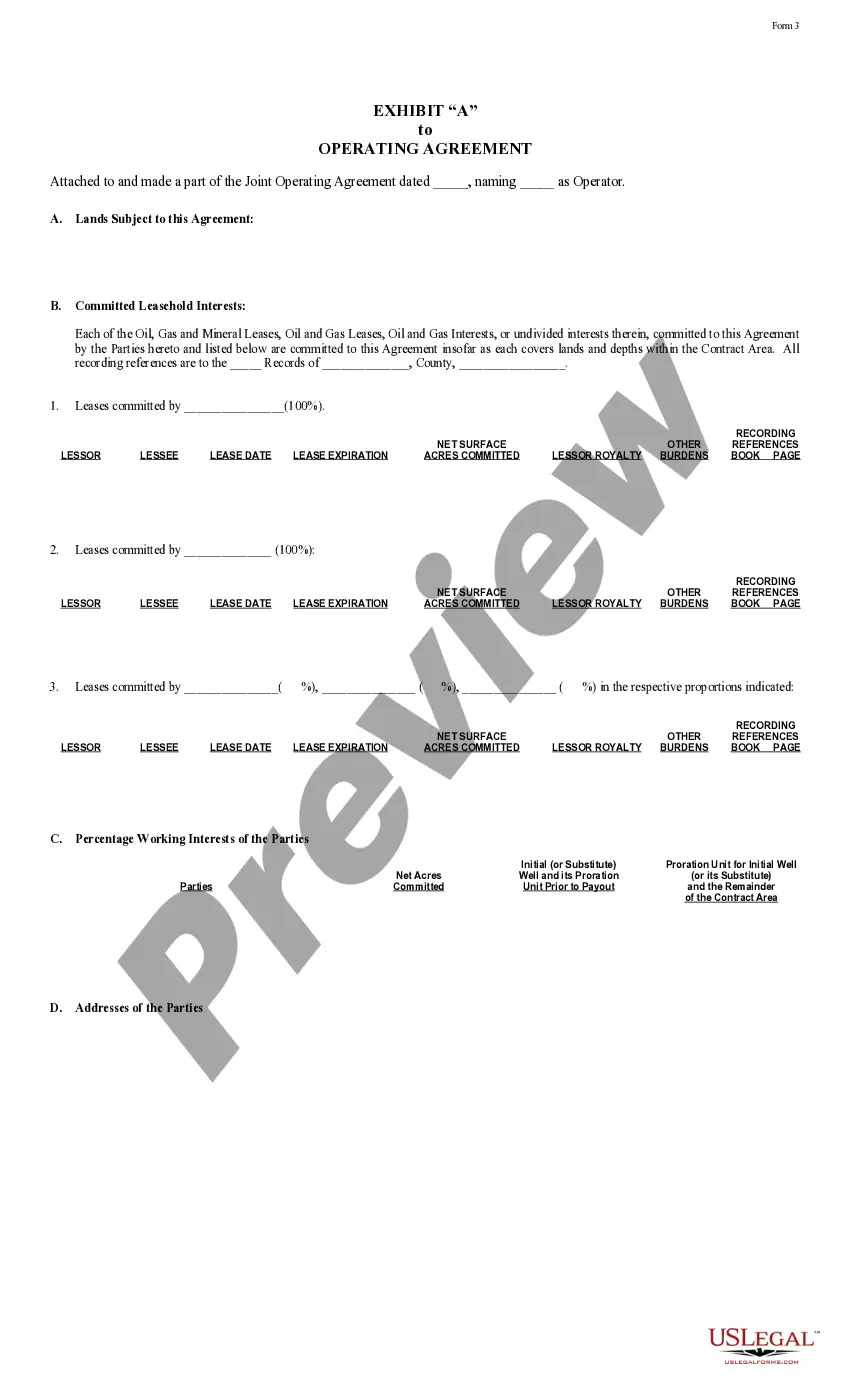

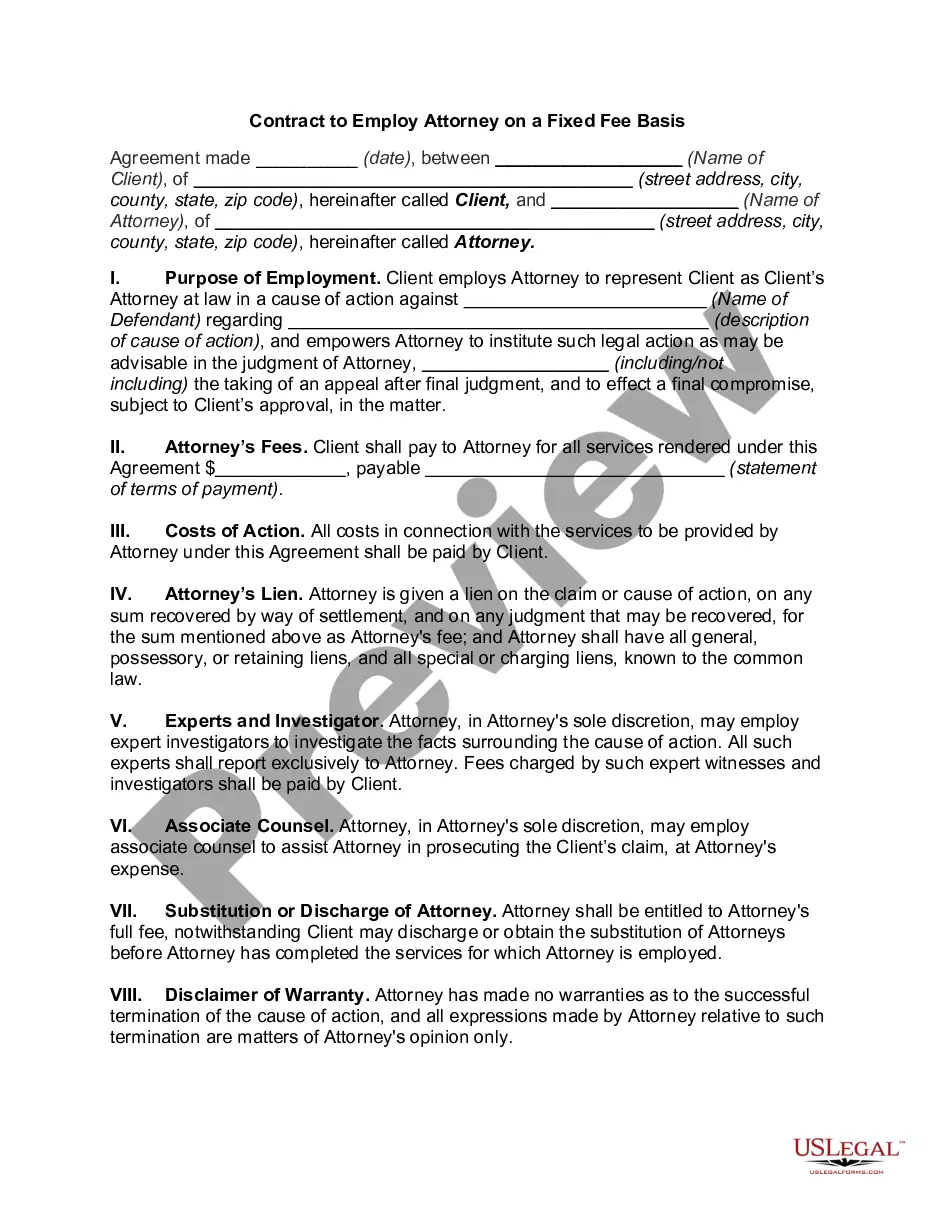

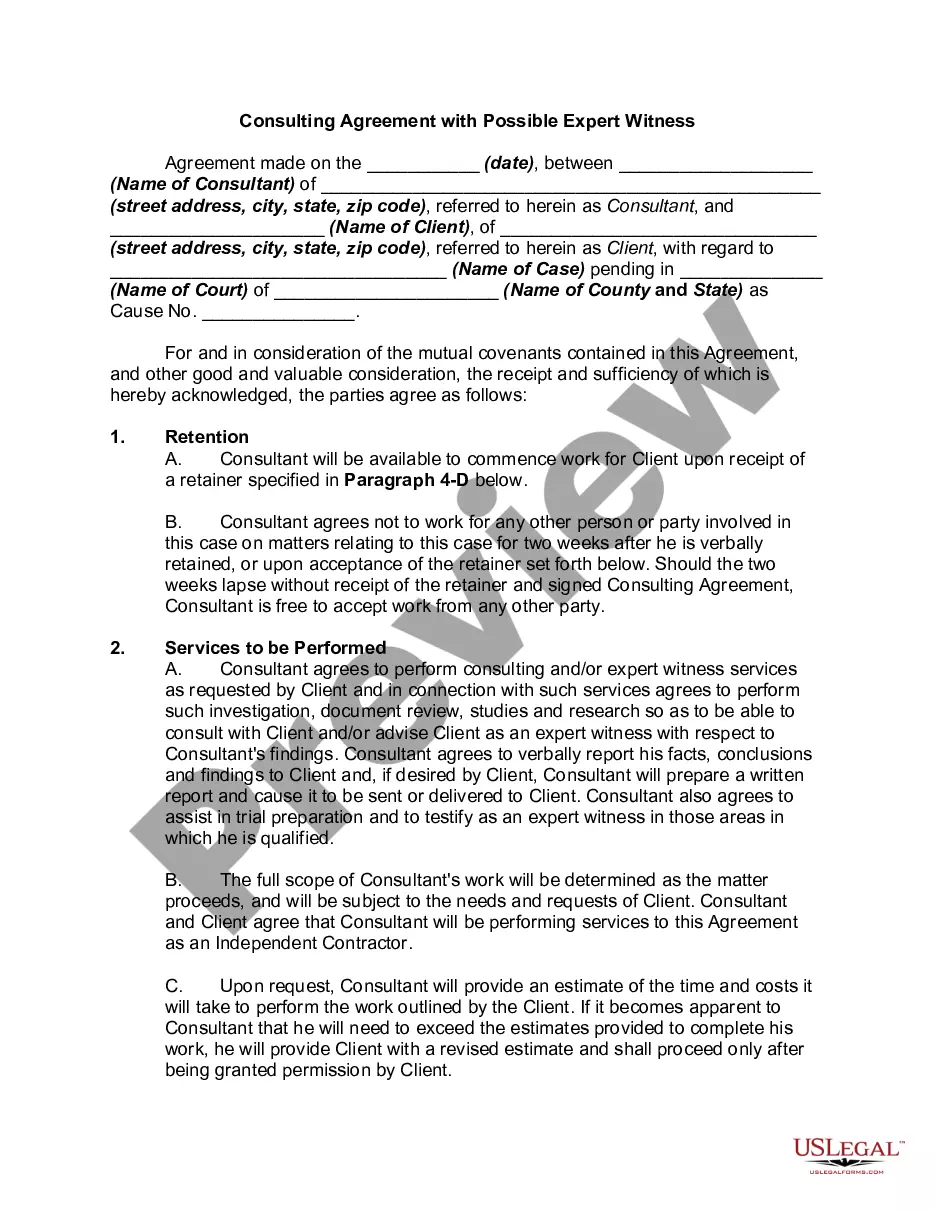

- Step 2. Use the Preview option to review the form’s content. Be sure to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate other types of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

Form popularity

FAQ

Yes, gifts can be held in trust, and doing so can provide added benefits like asset protection and controlled distribution. Establishing an Alaska General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion allows you to confidently manage how and when your gifts are distributed to minors. This ensures that your intentions are respected and can significantly benefit the recipient over time.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want.

The Tax Court held that the withdrawal rights provided in a trust declaration were not illusory and that therefore a married couple's gifts to the trust were gifts of present interests in property that qualified for the annual exclusion.

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

Qualifying gifts to an irrevocable trust for the annual gift tax exclusion will involve giving the beneficiary either the right, for a limited time, to withdraw assets given to the trust (a "Crummey withdrawal right") or the use of a trust that lasts only until the beneficiary reaches age 21.

The IRS requires that any gifts be made out of a trust be under the beneficiary's full control immediately. This present interest rule means that if a gift is made with conditions and the beneficiary does not have control over it at the time its made then it doesn't qualify for the annual exclusion amount.

The IRS does not levy gift taxes on trusts, nor does it consider payments from the trust to a beneficiary as a gift (it may be taxable income to the beneficiary, however).