Alaska Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Selecting the appropriate authorized document format may be challenging. Clearly, there is a range of templates accessible online, but how can you locate the official form you require? Use the US Legal Forms website.

The service provides thousands of templates, such as the Alaska Notice of Default on Promissory Note Installment, suitable for business and personal purposes. All forms are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the Alaska Notice of Default on Promissory Note Installment. Use your account to browse the legal documents you have previously purchased. Visit the My documents tab in your account and retrieve another copy of the document you need.

Select the file format and download the authorized document format to your device. Complete, modify, print, and sign the acquired Alaska Notice of Default on Promissory Note Installment. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state standards.

- First, ensure you have selected the correct form for your city/county.

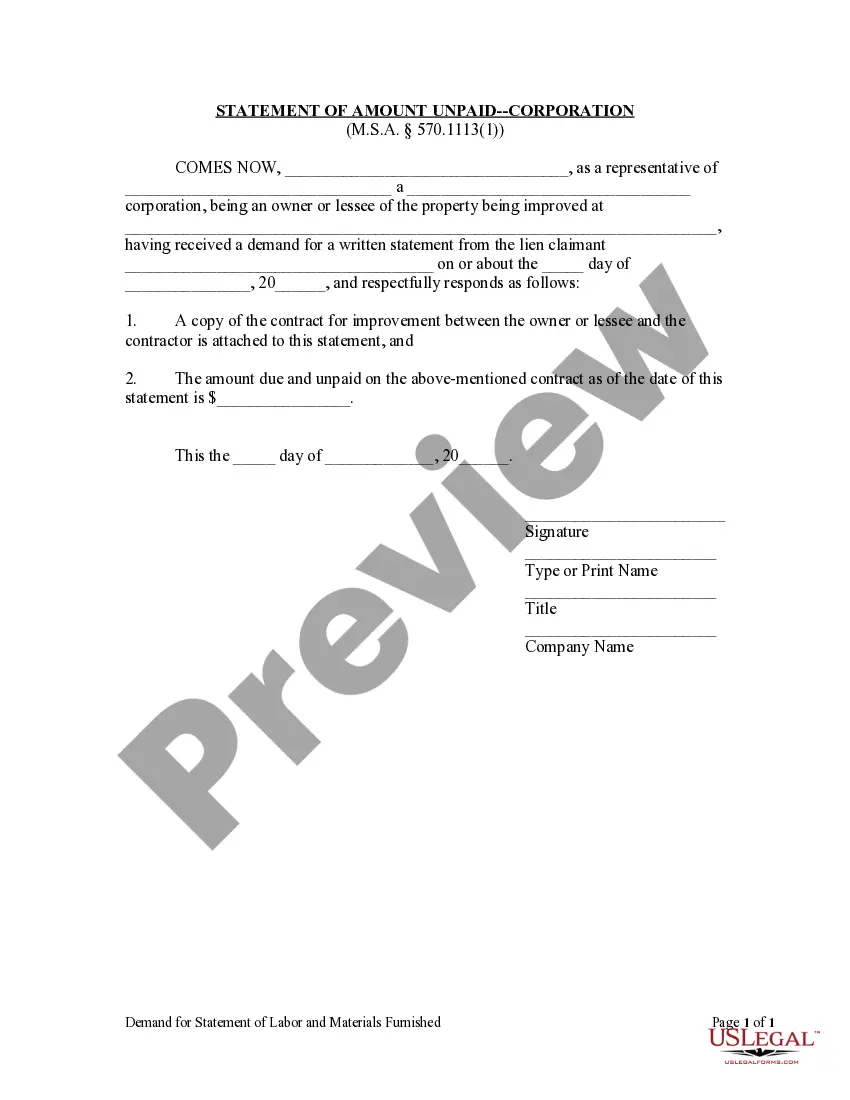

- You can examine the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are convinced that the form is acceptable, click the Get now button to acquire the form.

- Choose the pricing plan you need and enter the required information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

When facing default on a promissory note, the lender has several remedies available under an Alaska Notice of Default on Promissory Note Installment. These can include demanding immediate payment of the full balance, negotiating a repayment plan, or potentially pursuing legal action to recover owed amounts. It’s essential to understand your options and act promptly to protect your rights as a lender.

Writing an Alaska Notice of Default on Promissory Note Installment involves a few key steps. Start by clearly identifying the parties involved, including the borrower and lender. Next, outline the specific details of the default, such as missed payments or breach of terms. Finally, deliver the notice according to state requirements, ensuring the method of delivery is legally compliant.

When you get a notice of default, it indicates a failure to fulfill your financial obligations as specified in a promissory note. This document details the missed payments and may outline the consequences of continued non-payment. It is crucial to address the issues stated in the notice immediately to avoid escalation, such as legal action. Consulting resources like USLegalForms can provide templates and guidance for effectively responding to an Alaska Notice of Default on Promissory Note Installment.

Receiving a default notice signifies that you have not met the repayment terms outlined in your promissory note. It is vital to read the document carefully to understand the specifics of the default as well as the potential next steps. Responding promptly can often lead to alternative solutions, like negotiating a payment plan. Taking action quickly is essential to mitigate further complications related to the Alaska Notice of Default on Promissory Note Installment.

When someone defaults on a promissory note, the lender may initiate a series of actions depending on the terms of the note. This often involves sending an Alaska Notice of Default on Promissory Note Installment, which officially documents the failure to comply with payment terms. Following this, the lender may seek repayment through legal channels, which could result in significant financial consequences for the borrower. Understanding these outcomes can help both parties navigate the situation effectively.

If someone defaults on a promissory note, it’s crucial to review the terms outlined in the note first. Consider sending an Alaska Notice of Default on Promissory Note Installment to formally notify the borrower of the default. This document serves as a warning and states any outstanding amounts, and it prompts the borrower to take corrective action. Additionally, you may explore negotiation options to reach a resolution that benefits both parties.

Writing a default notice requires clarity and specificity. Start by including the details of the agreement, such as the date and the parties involved. Clearly state the default and outline the amount owed, along with any relevant payment terms. Ending the notice with a call to action, such as a request to remedy the situation, is essential when addressing the Alaska Notice of Default on Promissory Note Installment.

Yes, a notice of default can become part of the public record, depending on state laws. Once filed, it may be accessible to potential lenders or interested parties, which can affect the borrower's credit standing. Understanding how this process works in Alaska is vital for both lenders and borrowers. By using USLegalForms, you can navigate the necessary forms and understand the implications of public records related to notices of default.

To legally enforce a promissory note, start by ensuring documentation is complete and clear. You may need to issue an Alaska Notice of Default on Promissory Note Installment if the borrower fails to meet payment obligations. If amicable resolution fails, consult with a legal professional to file a lawsuit for recovery. Seeking assistance from resources like USLegalForms can streamline the creation of legal documents required for enforcement.

When someone defaults on a promissory note, the first step is to communicate with the borrower to understand their situation. Next, consider sending a formal notice, such as the Alaska Notice of Default on Promissory Note Installment, to document the default. If necessary, explore legal options for collection, which may involve negotiation or initiating legal proceedings. Utilizing a reliable platform like USLegalForms can help you draft the proper documents needed in this process.