Alaska Contract for Part-Time Assistance from Independent Contractor

Description

How to fill out Contract For Part-Time Assistance From Independent Contractor?

US Legal Forms - one of the largest collections of authentic documents in the USA - provides a vast selection of valid form templates that you can download or print.

While using the website, you will find thousands of forms for business and personal purposes, categorized by categories, states, or keywords. You can access the latest versions of forms like the Alaska Contract for Part-Time Assistance from Independent Contractor in just moments.

If you already possess a subscription, Log In and download the Alaska Contract for Part-Time Assistance from Independent Contractor from the US Legal Forms library. The Obtain button will be available on every form you view. You can find all previously acquired forms in the My documents tab of your account.

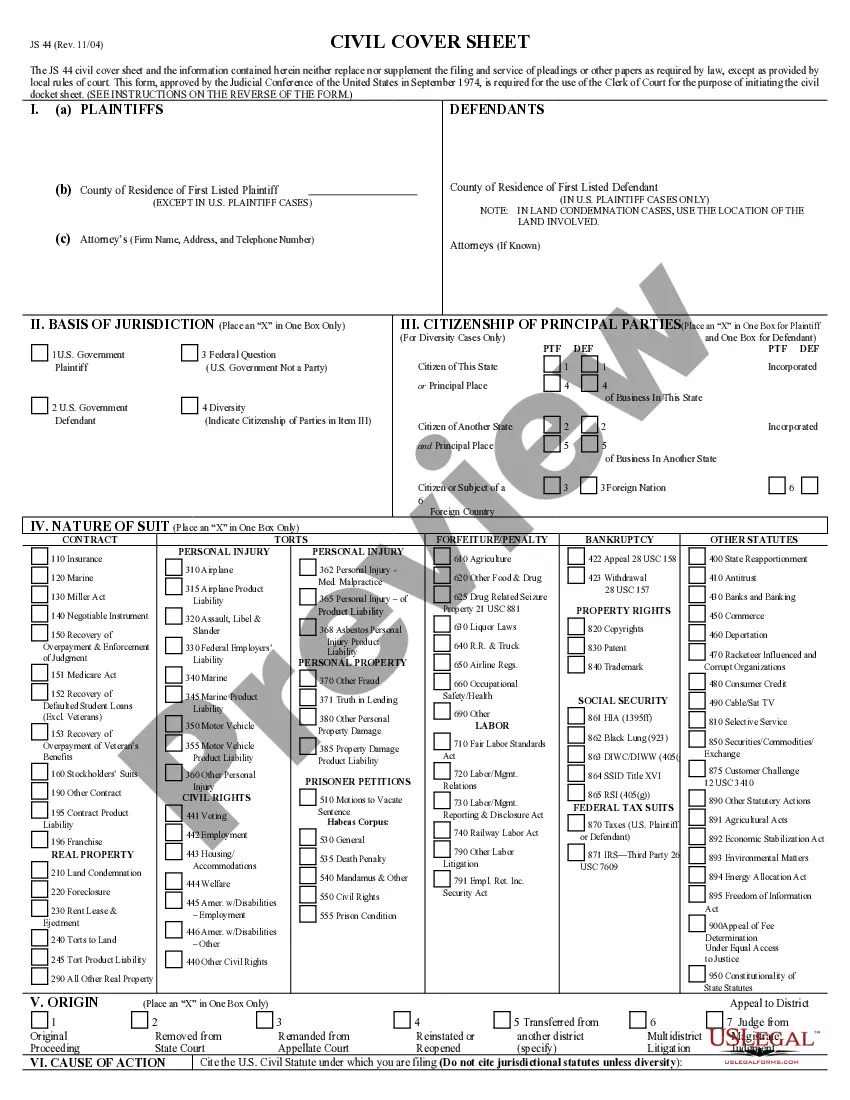

- Make sure to select the correct form for your area/county.

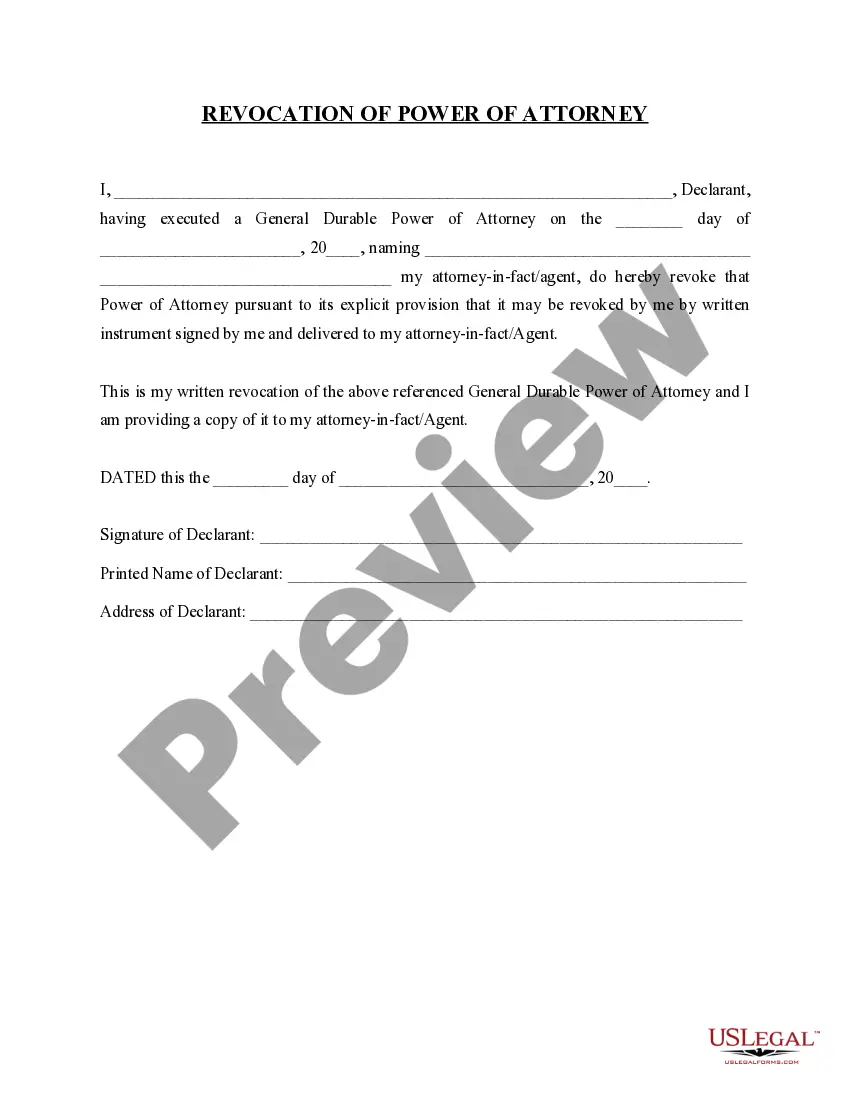

- Click the Preview button to review the details of the form.

- Examine the form summary to ensure you have picked the right document.

- If the form does not satisfy your requirements, use the Search box at the top of the screen to find the one that does.

- When you are satisfied with the form, verify your choice by clicking on the Purchase now button.

- Next, choose the pricing plan you prefer and provide your information to create an account.

Form popularity

FAQ

As an independent contractor, you will typically need to fill out a W-9 form to provide your taxpayer information to the hiring entity. Additionally, consider drafting an Alaska Contract for Part-Time Assistance from Independent Contractor to outline your work terms. This combined approach helps ensure you meet tax obligations and have a solid agreement in place. Always keep records of submitted forms and contracts for your files.

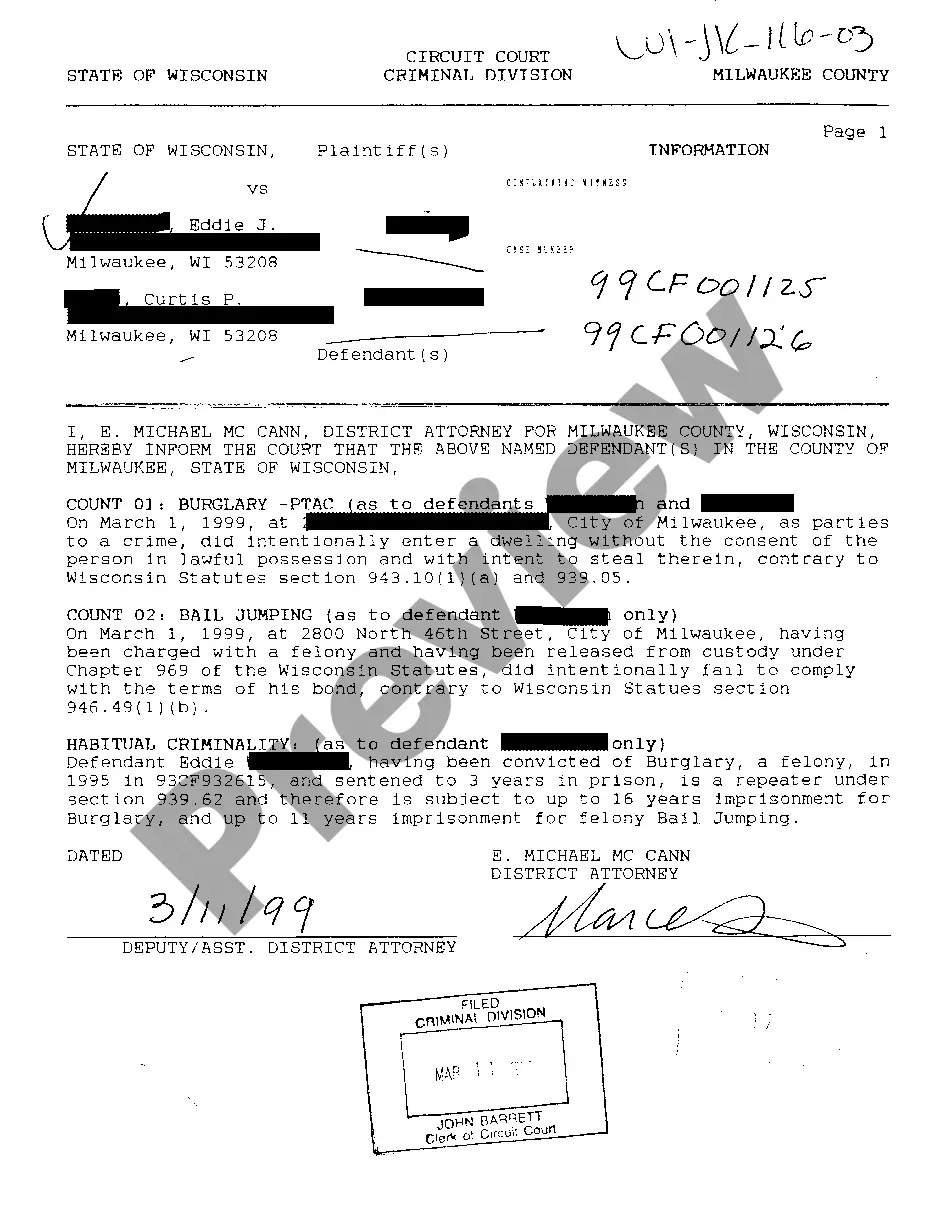

While you can technically work as a 1099 employee without a formal contract, it is not advisable. An Alaska Contract for Part-Time Assistance from Independent Contractor serves as an essential document to clarify your relationship with the hiring party. Without it, you may face issues related to payment and work expectations. For your protection, always ensure that you have a contract outlining the terms of your engagement.

Filling out an independent contractor agreement involves several straightforward steps. Start by gathering necessary details, such as the scope of work, payment terms, and deadlines. Use an Alaska Contract for Part-Time Assistance from Independent Contractor template for guidance. After drafting the contract, ensure both parties review the terms, make any needed adjustments, and sign the document to finalize it.

If you do not have a contract, you risk ambiguity about the expectations and responsibilities of both parties. An absence of an Alaska Contract for Part-Time Assistance from Independent Contractor can lead to disputes, payment issues, and potential legal trouble. Without a contract, it may be difficult to enforce your rights or seek remedies if things do not go as planned. To safeguard your interests, always use a formal agreement.

Yes, independent contractors should always have a contract in place. An Alaska Contract for Part-Time Assistance from Independent Contractor clearly outlines the terms of your working relationship. It protects both parties by defining expectations, deliverables, and payment details. Having a written agreement can prevent misunderstandings and disputes down the line.

Certainly, as an independent contractor, you have the freedom to set your own hours. When you establish an Alaska Contract for Part-Time Assistance from Independent Contractor, you decide when and how much you work. This autonomy allows you to balance your personal and professional commitments effectively. It also encourages you to deliver your best work, as you can choose to work during your most productive hours.

Yes, a part-time employee can receive a 1099 form if they work as an independent contractor. When you work under an Alaska Contract for Part-Time Assistance from Independent Contractor, you are essentially operating your own business. This means you can manage your own finances, including taxes, and you will receive a 1099 form if you earn over $600 in a calendar year. It's important to clarify your working relationship and responsibilities upfront.

Yes, you can work part-time as a contractor under an Alaska Contract for Part-Time Assistance from Independent Contractor. This type of arrangement allows individuals the flexibility to manage their time and commitments. Not only can you choose the hours you work, but you can also take on various projects that fit your schedule. This approach benefits both you and your clients, as it fosters a mutually advantageous working relationship.

Typically, the business or individual hiring the contractor creates the independent contractor agreement. This party usually defines the project terms, timelines, and payment details. For an Alaska Contract for Part-Time Assistance from Independent Contractor, it’s advisable to use reliable templates available on uslegalforms. They provide easy-to-follow agreements that meet legal requirements and expectations.

Yes, you can absolutely be a part-time independent contractor. The flexibility of contract work allows individuals to engage in part-time projects while managing other commitments. An Alaska Contract for Part-Time Assistance from Independent Contractor will provide clarity on the terms of engagement. Using uslegalforms can help you draft a suitable agreement tailored for part-time work.