Alaska Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

It is feasible to spend time online attempting to locate the legal documents format that satisfies the state and federal requirements you require.

US Legal Forms offers a vast array of legal forms that are evaluated by experts.

You can download or print the Alaska Sample Letter for Compromise on a Debt from our service.

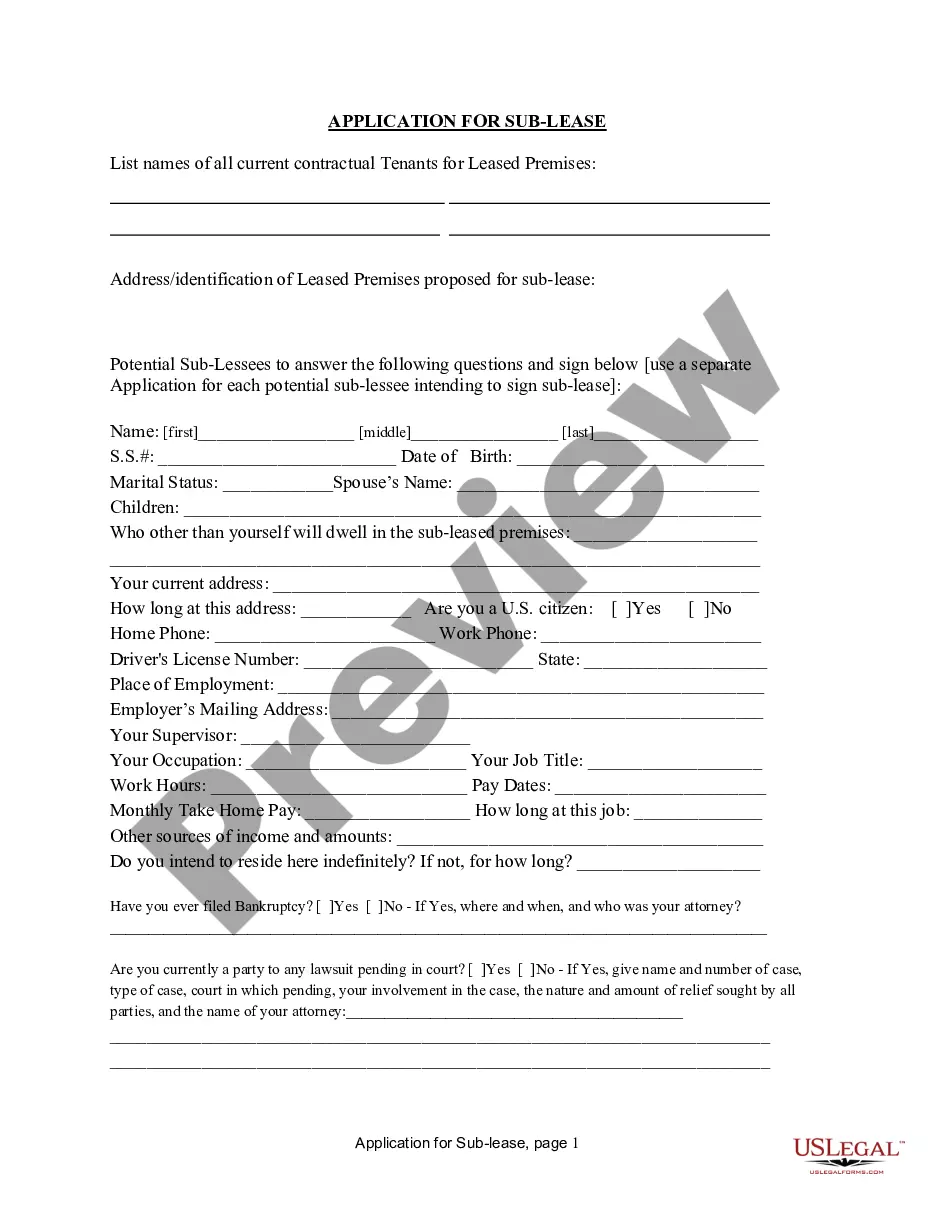

If available, use the Review button to examine the document format as well.

- If you already have a US Legal Forms account, you can Log In and press the Download button.

- Afterward, you can complete, edit, print, or sign the Alaska Sample Letter for Compromise on a Debt.

- Every legal document format you buy is yours indefinitely.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

- First, ensure you have selected the correct document format for the area/city that you choose.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

A reasonable offer to settle a debt usually ranges from 30% to 70% of the total amount owed, depending on the creditor's policies and your financial situation. Before making an offer, assess your financial circumstances, and consider what you can realistically afford. Engaging with creditors can often lead to better settlement terms, and using an Alaska Sample Letter for Compromise on a Debt can help you formulate a balanced offer.

An example of a debt dispute letter should start with your contact information and the date. You need to specify the debt you are contesting and detail the reasons for your dispute, such as inaccuracies or misunderstandings. Provide any supporting documentation that could bolster your case. For inspiration, refer to an Alaska Sample Letter for Compromise on a Debt, which can help you articulate your points effectively.

To complete a debt validation letter, start by including your contact information and the date. Clearly state that you are requesting validation of the debt and outline the specific details of the debt collection, such as the balance and the creditor's details. It's crucial to request verification according to the Fair Debt Collection Practices Act. An Alaska Sample Letter for Compromise on a Debt can serve as a helpful reference for drafting your letter.

An example of a dispute letter for a debt includes clearly stating the errors you believe exist, along with your personal details. You should also cite the debt amount and provide evidence for your claims. The Alaska Sample Letter for Compromise on a Debt serves as an excellent guide to create an effective dispute letter that conveys your concerns.

Writing a letter to get out of debt involves outlining your financial situation and proposing a repayment plan. Be honest and offer realistic amounts. The Alaska Sample Letter for Compromise on a Debt can serve as a valuable resource, helping you draft a persuasive letter that aims for a favorable outcome.

When asking for verification of debt, provide specific details about the debt in question. Mention your rights under the Fair Debt Collection Practices Act. You can use the Alaska Sample Letter for Compromise on a Debt as a template to structure your request, ensuring it is clear and concise.

To write a proof of debt letter, clearly state the debt amount and any relevant account numbers. Include your personal information and the creditor's details. By utilizing the Alaska Sample Letter for Compromise on a Debt, you can ensure that your letter is properly structured and effectively communicates your request.

To write a letter requesting proof of debt, you should clearly state your request and provide your account information, if applicable. Politely ask the collection agency to send you the documentation that verifies the debt they claim you owe. Utilizing an Alaska Sample Letter for Compromise on a Debt can streamline this process and make your request more effective.

Writing a good debt settlement letter involves being clear and concise about your offer to settle a debt for less than you owe. Start by stating your financial situation and your willingness to negotiate. Incorporating an Alaska Sample Letter for Compromise on a Debt can guide you in structuring your letter properly, ensuring that you include all necessary details to encourage acceptance from the creditor.

The 777 rule is an informal guideline that suggests you should not make payments to a debt collector unless they provide proof of the debt. It encourages you to request verification, which protects you from paying debts you may not owe. Understanding this rule is essential for negotiating your debts, and you can use an Alaska Sample Letter for Compromise on a Debt to communicate effectively with creditors.