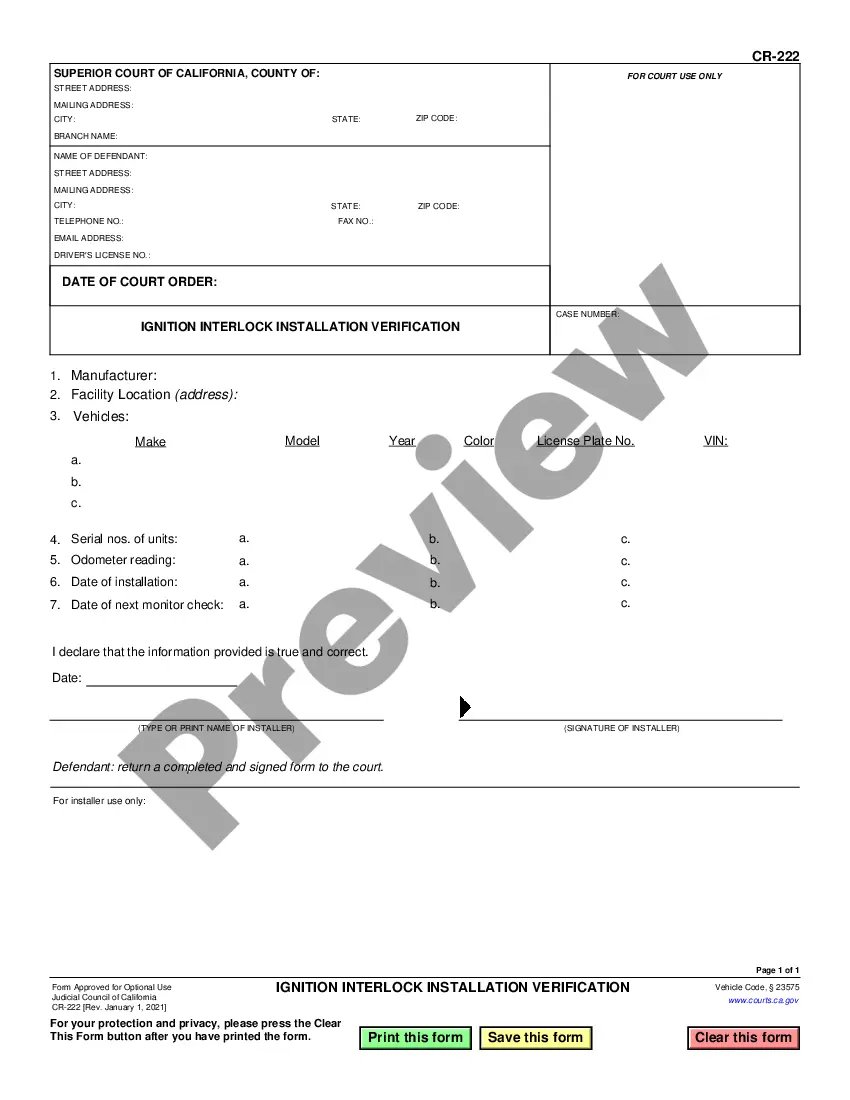

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

You might spend numerous hours online attempting to locate the authentic document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legitimate forms that are evaluated by experts.

You can easily download or print the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary using my services.

If available, use the Preview button to check the document template as well.

- If you have a US Legal Forms account, you may Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

A significant mistake parents often make when setting up a trust fund is failing to clearly communicate their intentions and plans to their beneficiaries. Properly utilizing the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary ensures that beneficiaries understand their rights and responsibilities. Transparency and guidance can prevent misunderstandings and ensure the trust serves its purpose effectively.

Alaska's trust laws are designed to offer flexibility and protection to those setting up trusts. Under these laws, individuals can establish trusts that include provisions for the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary, ensuring that beneficiaries receive their intended assets securely. These laws allow for greater control over how assets are distributed and managed.

The public trust doctrine in Alaska refers to the principle that certain natural resources must be preserved for public use. This doctrine plays an essential role in land and resource management while considering the rights of trust beneficiaries. Understanding this doctrine helps individuals navigate the complexities of using Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary.

While many states offer favorable trust laws, Alaska is often regarded as having some of the most beneficial regulations for setting up trusts. With features like the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary, individuals can enjoy enhanced privacy and asset protection. It’s essential to consider your specific needs when evaluating trust laws across different states.

Alaska does not impose a state income tax on trusts or individuals. This means that trusts established in Alaska can provide beneficial tax advantages under the laws governing the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary. Those involved in trust management can retain more income, which is advantageous for beneficiaries.

A beneficiary release form allows a beneficiary to formally accept an inheritance and relinquish any claims they may have regarding that inheritance. This form serves to clarify ownership and protect the interests of all parties involved. By utilizing the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary, beneficiaries can facilitate a clear and confident transition of assets.

A receipt and release of trustee signifies that the trustee has received assets from a trust and releases any further claims on those assets by the beneficiary. This documentation is vital in maintaining transparency during estate settlements. Using the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary helps streamline this process, ensuring all parties understand their rights and obligations.

A receipt and release form is a legal document that provides proof of receipt of property or funds while also releasing the party involved from future claims. It plays a significant role in ensuring that both the trustee and beneficiary agree on the terms of asset distribution. By incorporating the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary, you can maintain an efficient record of inheritance transactions.

Receipt release refers to the act of formally acknowledging the receipt of assets while relinquishing any further claims on those assets. This process is important in the context of estate management and ensures that the granting of rights is documented. The Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary encapsulates this essential process, ensuring clarity in legal transactions.

A receipt and release form PDF is a digital document that records the acknowledgment of received assets and the release of claims. This document is often used by beneficiaries after receiving their inheritance, ensuring both parties have a clear record of the transaction. Utilizing the Alaska Release by Trustee to Beneficiary and Receipt from Beneficiary in a PDF format simplifies these processes and enhances accessibility.