Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

Selecting the appropriate legal document template can be quite challenging.

Clearly, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, such as the Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises, which you can use for both business and personal purposes.

You can view the form using the Preview button and read the form description to ensure it is the right one for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to download the Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

- Utilize your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your locality/state.

Form popularity

FAQ

To close a business license in Alaska, you need to follow specific procedures set by state regulations. First, ensure all your business debts are settled, and that you have completed necessary tax filings. Once ready, file a written request with the State Division of Corporations, Business and Professional Licensing to officially cancel your business license. Utilizing resources from uslegalforms can simplify this process and provide the necessary forms.

Selling a business in Alaska involves several important steps. Begin by preparing your financial documents, creating a business valuation, and drafting an Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Marketing your business effectively is crucial, so consider leveraging both online platforms and local networks to reach interested buyers. Engage professionals who specialize in business sales for added guidance.

To sell your business as for sale by owner in Alaska, first gather all necessary legal documents, including the Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises. Market your business through local listings and networking, ensuring that potential buyers understand the benefits and operations. Always maintain transparency in negotiations to build trust and keep the process straightforward.

The best way to sell a business often involves careful planning and expert guidance. You may start by valuing your business, preparing financial statements, and marketing it effectively. Utilizing the Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises can streamline the sale process, ensuring all necessary legal aspects are covered. Consulting with professionals can also enhance your chances of a successful transaction.

Yes, Alaska requires a business license to operate legally. This includes selling a business or conducting any commercial activity. When handling an Alaska Agreement for Sale of Business by Sole Proprietorship with Leased Premises, ensure your licenses are current and valid. Obtaining the appropriate permits helps establish credibility and compliance.

A sole proprietorship is not an independent legal entity. All business assets of a sole proprietorship are titled in the owner's name, and the owner can do anything he wants with the assets. For example, a delivery truck that is used to make deliveries for the business actually belongs to the owner.

To sum it up, when transferring the ownership of a sole proprietorship to another person, the under given steps are a must. Sales of all assets, changing the name of the business, transfer of Goodwill, abiding of all contracts, closing the deal and notifying all required parties and settling all financial accounts.

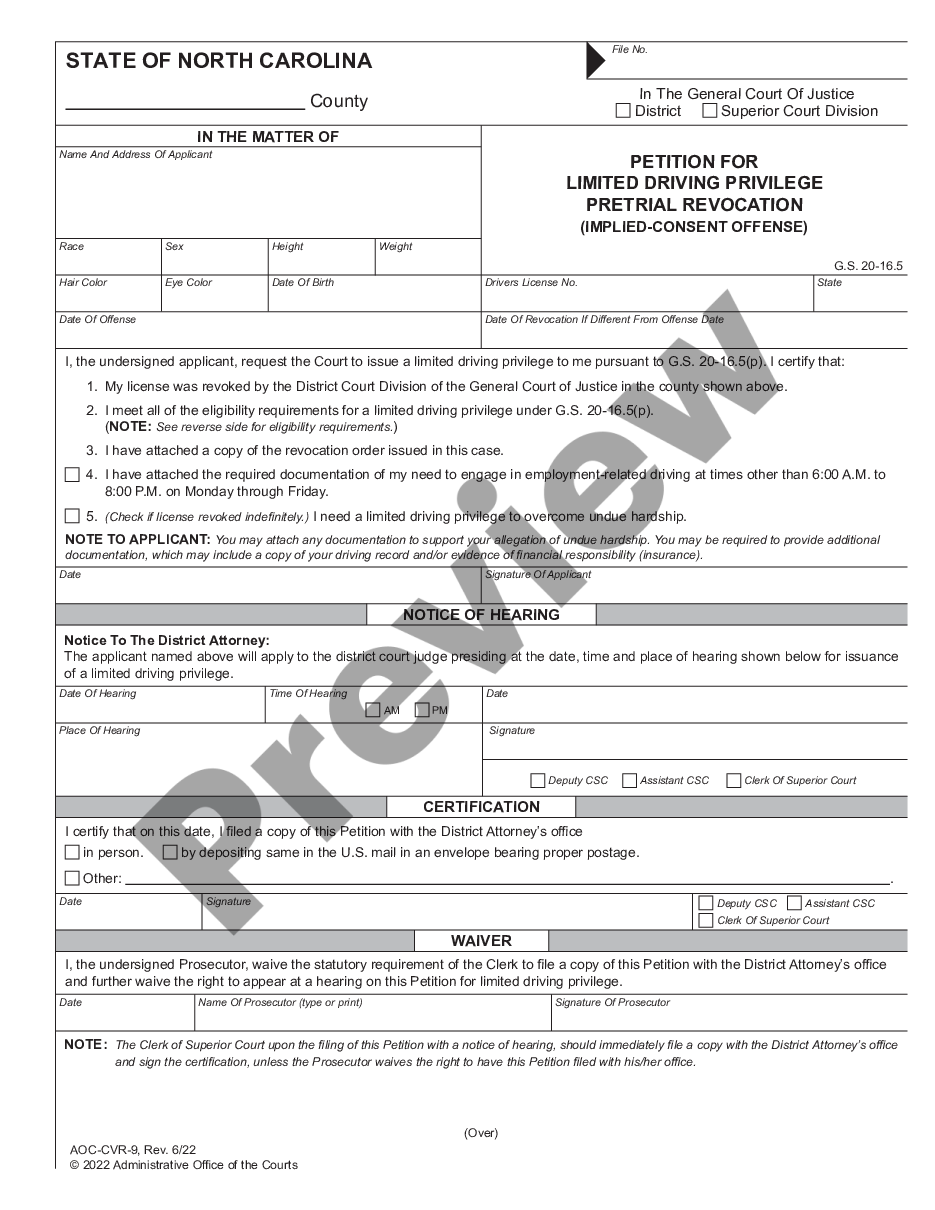

A business purchase agreement should detail the names of the buyer and seller at the start of the agreement. It will also need to include the information of the business being sold, such as name, location, a description of the business and the type of business entity it is.

It can, through its agents, buy, own and sell property in its own name and engage in business activities by entering into contracts with others. It has legal status in a court and can sue and be sued, is legally responsible for its liabilities, and must pay income tax just as a natural person does.

There are generally three options for structuring a merger or acquisition deal:Stock purchase. The buyer purchases the target company's stock from its stockholders.Asset sale/purchase. The buyer purchases only assets and assumes liabilities that are specifically indicated in the purchase agreement.Merger.