Alaska General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

You can invest time on the Internet attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that can be examined by professionals.

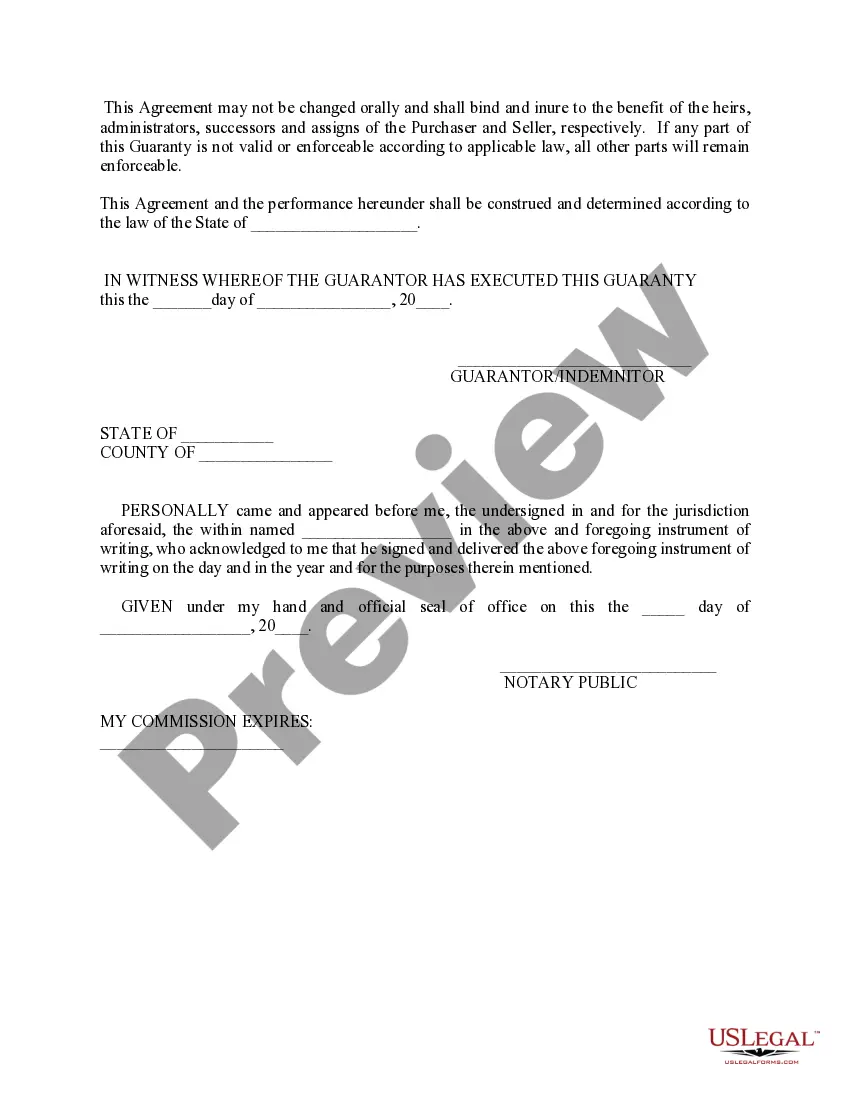

You can indeed obtain or print the Alaska General Guaranty and Indemnification Agreement from our service.

If available, utilize the Preview button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Alaska General Guaranty and Indemnification Agreement.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the document description to confirm you have selected the appropriate form.

Form popularity

FAQ

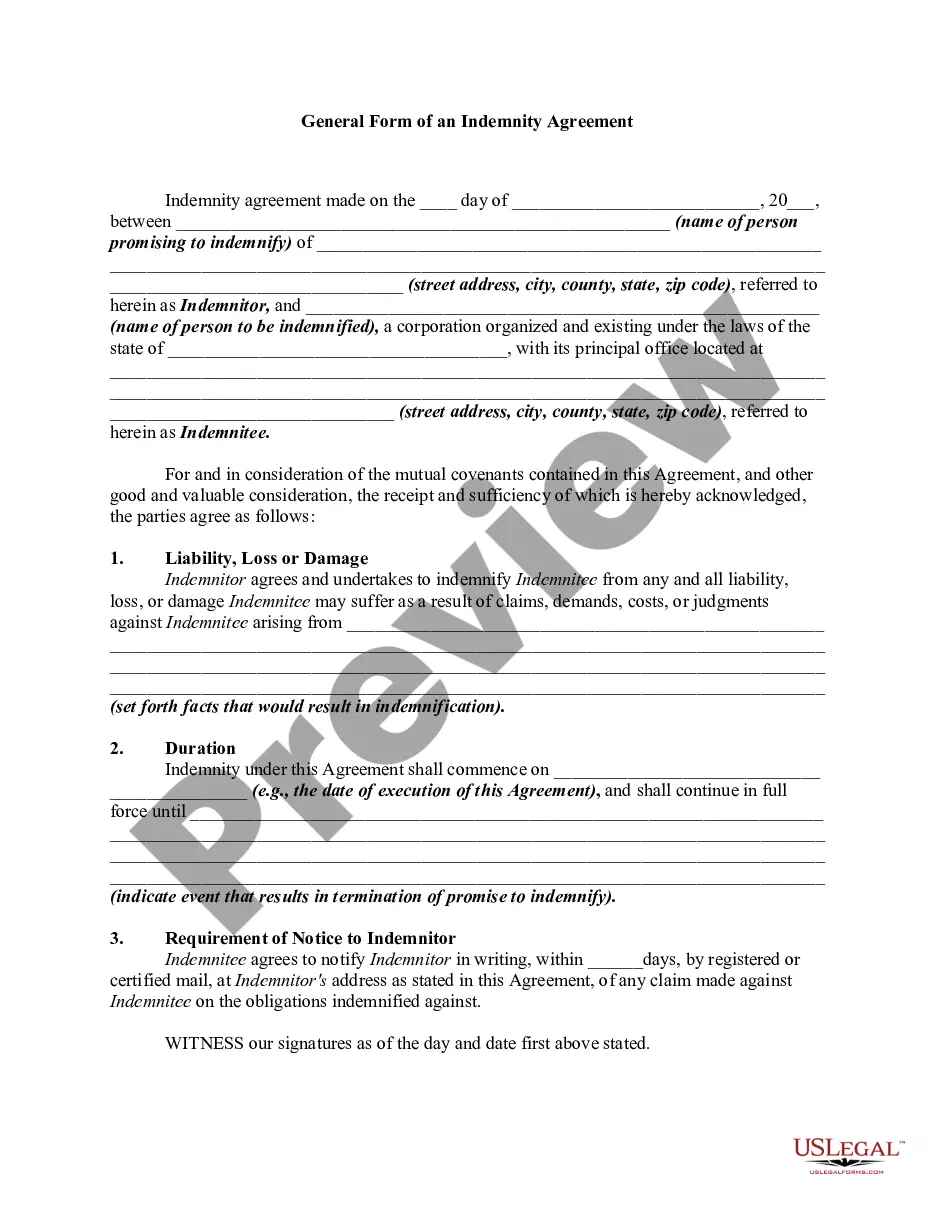

The contract of indemnity is the contract where one person compensates for the loss of the other. Contract of guarantee is a contract between three people where the third person intervenes to pay the debt if the debtor is at default in paying back.

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

In order for a guarantee to be valid it must meet certain requirements. There are no formal requirements for creating a valid indemnity, so it could be oral, or in writing but not signed.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. Indemnity is a contractual agreement between two parties. In this arrangement, one party agrees to pay for potential losses or damages caused by another party.

Indemnification clauses are clauses in contracts that set out to protect one party from liability if a third-party or third entity is harmed in any way. It's a clause that contractually obligates one party to compensate another party for losses or damages that have occurred or could occur in the future.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.