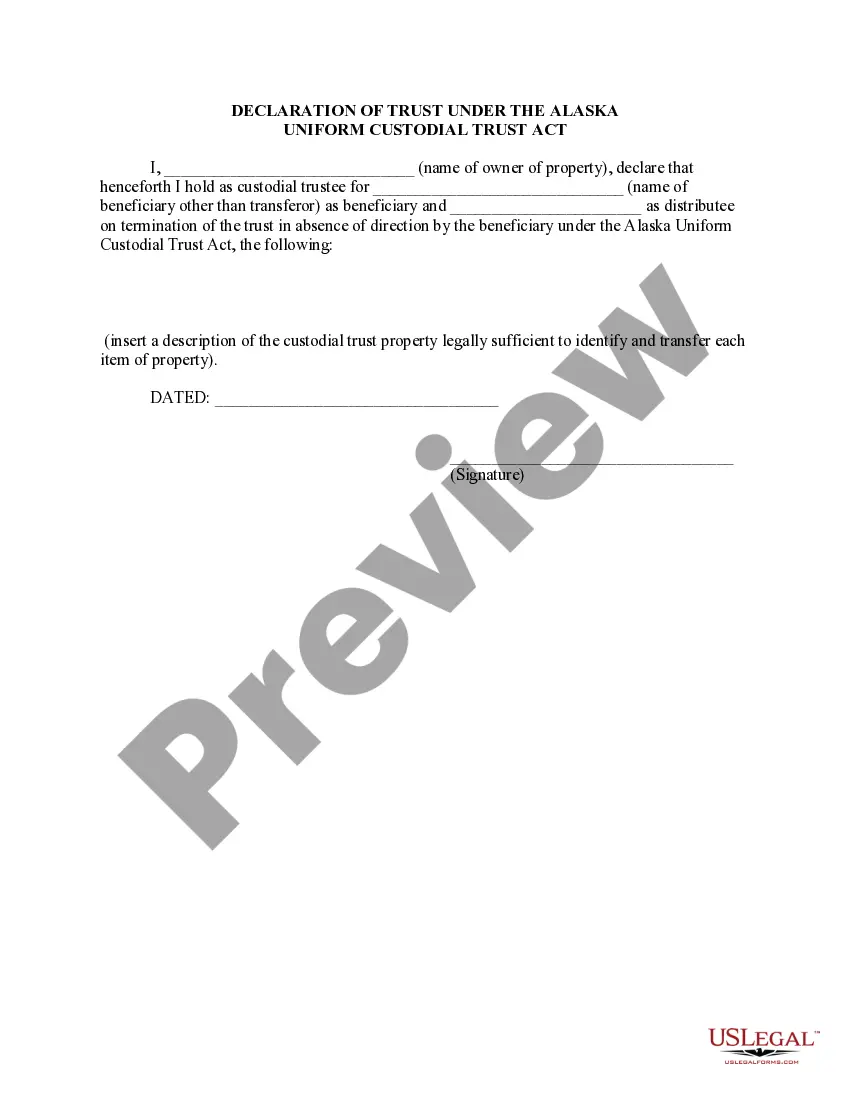

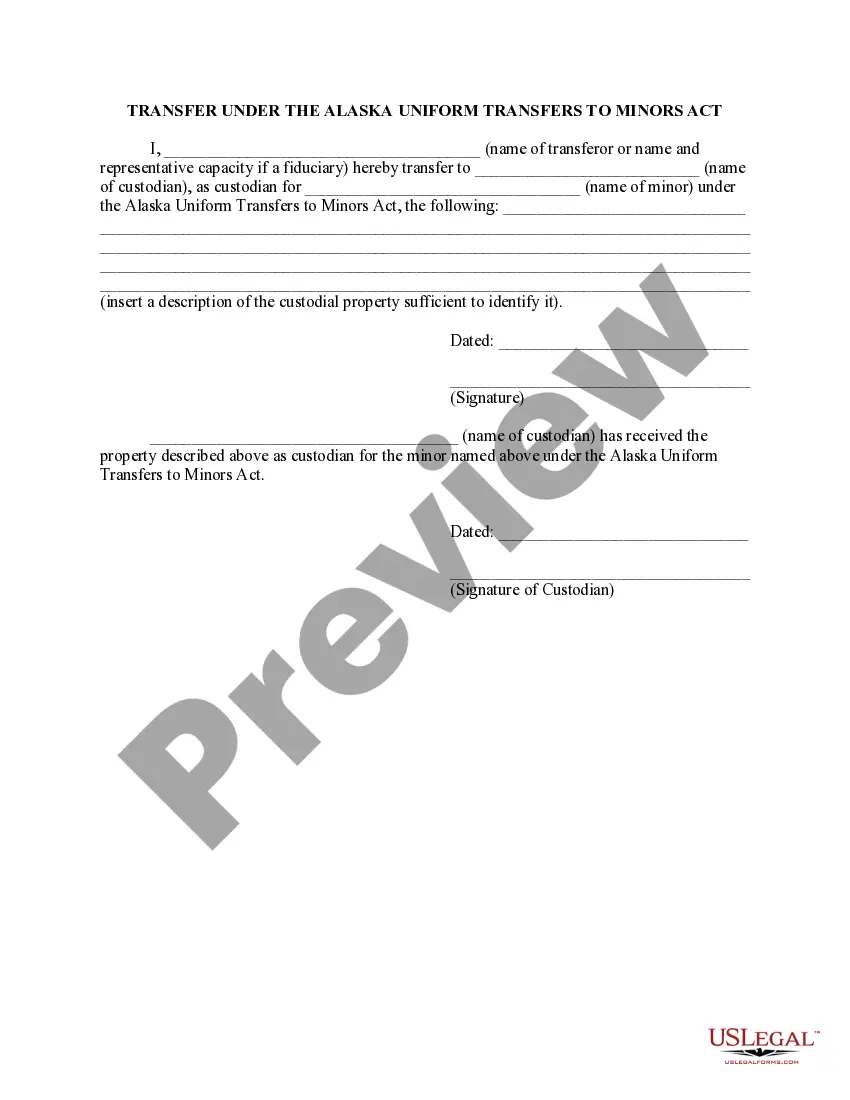

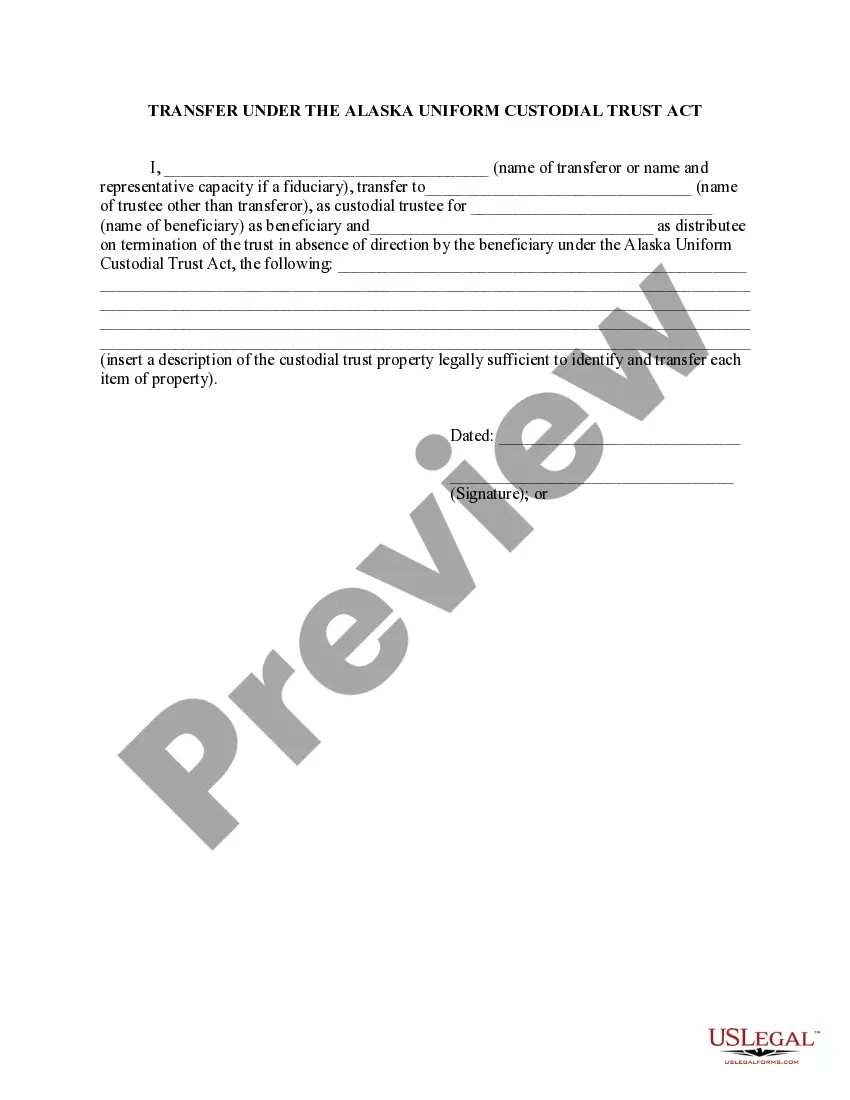

This Tansfer Under the Alaska Uniform Custodial Trust Act form is used to effecuate a transfer of property from one person to the custodial trustee of a trust under the Alaska Uniform Custodial Trust Act. Specific description of the property that is transferred must be made.

Transfer Under the Alaska Uniform Custodial Trust Act

Description

How to fill out Transfer Under The Alaska Uniform Custodial Trust Act?

Employing Transfer Under the Alaska Uniform Custodial Trust Act templates developed by experienced attorneys allows you to circumvent difficulties when completing paperwork.

Simply obtain the template from our site, complete it, and request a lawyer to confirm it.

This can save you considerably more time and expenses than seeking legal advice to draft a document from the beginning for you would.

Utilize the Preview function and review the description (if accessible) to determine if you require this particular example, and if so, just click Buy Now.

- If you already possess a US Legal Forms subscription, just Log In to your account and navigate back to the form page.

- Locate the Download button close to the templates you are reviewing.

- After you download a file, you will find all your saved templates in the My documents section.

- If you do not have a subscription, it’s not a huge issue.

- Simply follow the steps below to register for your account online, acquire, and complete your Transfer Under the Alaska Uniform Custodial Trust Act template.

- Verify and ensure that you’re obtaining the correct state-specific form.

Form popularity

FAQ

An Alaska Trust is an irrevocable trust which allows the grantor to transfer assets to his trust and to be a beneficiary to whom the trustee can distribute trust property. If the trust is not obligated to distribute trust assets to the grantor/beneficiary, the assets will not be subject to his or her creditors' claims.

If a will or trust is successfully contested (i.e., declared invalid), then the court throws out the will or trust. This places your family in the position it would have been without the challenged will or trust, either reverting to a previously executed will or no will at all.

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.

If the probate court does not agree with your claim that the trust is invalid, then the assets will be distributed as outlined in the document. However, if you win your trust contest, the trust will be deemed invalid and the assets will be distributed in accordance with state intestate succession laws.

It is generally considered more difficult to challenge a living trust than to contest a will.To successfully contest a will, a person must prove that the testator, the person creating the will, either lacked the capacity to have the will drafted or they were subject to undue influence by a beneficiary.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.

A trust can be contested for many of the same reasons as a will, including lack of testamentary capacity, undue influence, or lack of requisite formalities. The beneficiaries may also challenge the trustee's actions as violating the terms and purpose of the trust.