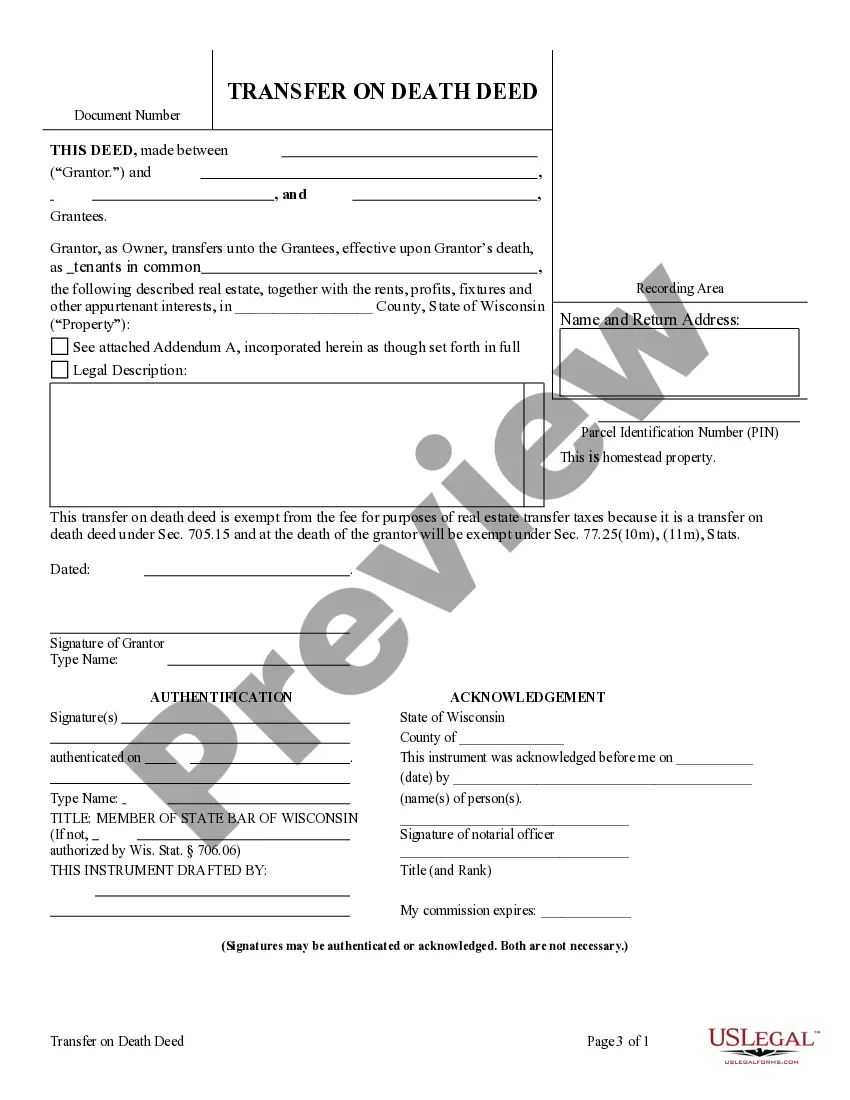

This form is a Beneficiary or Transfer on Death Deed where the Grantor is an individual and the Grantees are three (3) individuals. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. The Deed does NOT have provisions for a successor or secondary contingent beneficiary. This deed complies with all state statutory laws.

Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Individual to Three (3) Individuals does NOT include Alternate Beneficiary Provision

Description

How to fill out Wisconsin Transfer On Death Deed Or TOD - Beneficiary Deed From Individual To Three (3) Individuals Does NOT Include Alternate Beneficiary Provision?

Out of the multitude of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before buying them. Its extensive catalogue of 85,000 samples is categorized by state and use for simplicity. All the documents on the platform have been drafted to meet individual state requirements by accredited lawyers.

If you already have a US Legal Forms subscription, just log in, search for the template, click Download and access your Form name from the My Forms; the My Forms tab holds your downloaded forms.

Follow the guidelines below to obtain the form:

- Once you find a Form name, make certain it’s the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the template.

- Look for a new sample using the Search field if the one you’ve already found is not appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

Once you’ve downloaded your Form name, you can edit it, fill it out and sign it with an online editor of your choice. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most up-to-date version in your state. Our platform offers easy and fast access to samples that fit both attorneys and their clients.

Form popularity

FAQ

File an Affidavit of Death form, an original certified death certificate, executor approval for the transfer, a Preliminary Change of Ownership Report form and a transfer tax affidavit. All signed forms should be notarized. Pay all applicable fees to get the title deed, which is the official notice of ownership.

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

File a petition in probate court. The first step to transferring the property to the rightful new owners is to open up a case in probate court. Petition the court for sale and convey the property to the purchaser. Next, you must petition the court to sell the property.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

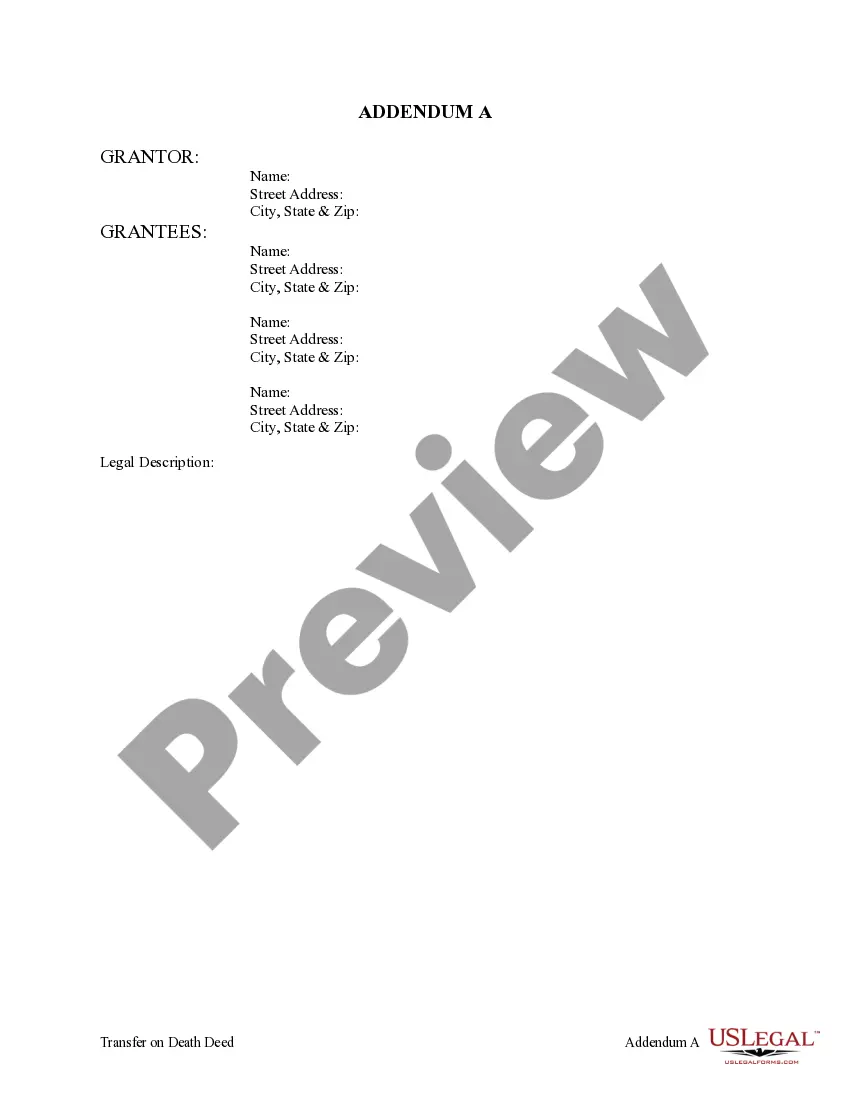

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Wisconsin's Transfer on Death Deed. Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.