Complex Will - Max. Credit Shelter Marital Trust to Children

Description

Key Concepts & Definitions

The complex will max credit shelter marital trust is a strategic estate planning tool commonly used in the United States. It integrates elements of testamentary trusts designed to maximize the estate and gift tax exemption limits while providing for the surviving spouse and future generations. This trust type blends the concepts of a 'credit shelter trust' (also known as a bypass or family trust), which utilizes the federal estate tax exemption up to its limit, with a 'marital trust', designed to benefit the surviving spouse and defer estate taxes until after their death.

Step-by-Step Guide

- Consult with an Estate Planning Attorney: Establish your estate planning objectives and discuss the benefits of a complex will max credit shelter marital trust.

- Analyze Financial Situation: Review assets, liabilities, and tax implications with a financial advisor to determine how much to allocate to the trust.

- Draft the Trust Document: Work with your attorney to draft the legal documents that include the terms of the trust.

- Funding the Trust: Decide how the trust will be funded, possibly with real estate, stocks, or cash.

- Execute the Will and Trust: Ensure all legal formalities are properly followed to create valid documents.

- Manage the Trust: Appoint a trustworthy trustee and possibly a trust protector to manage and oversee the trust effectively.

Risk Analysis

While a complex will max credit shelter marital trust offers significant tax advantages and can provide for ongoing familial support, it is not without risks:

- Overfunding Risk: Overfunding the credit shelter trust might inadvertently deprive the surviving spouse of necessary assets for living expenses.

- Compliance Fails: Failure to comply with legal standards can result in significant legal battles or dissolution of the trust.

- Changes in Law: Shifts in federal tax laws may affect the trusts efficiency and intended tax benefits.

Key Takeaways

Creating a complex will max credit shelter marital trust requires careful planning and advice from professionals to ensure that it meets an individual's unique circumstances and goals. Properly set up, this strategy can shelter assets from high estate taxes, while providing financial security for a surviving spouse.

Frequently Asked Questions

What assets are suitable for funding a trust? Common assets include real estate, stocks, bonds, and cash.

How often should an estate plan be reviewed? Estate plans should be reviewed every 3-5 years or after major life events such as marriage, divorce, the birth of a child, or the death of a beneficiary.

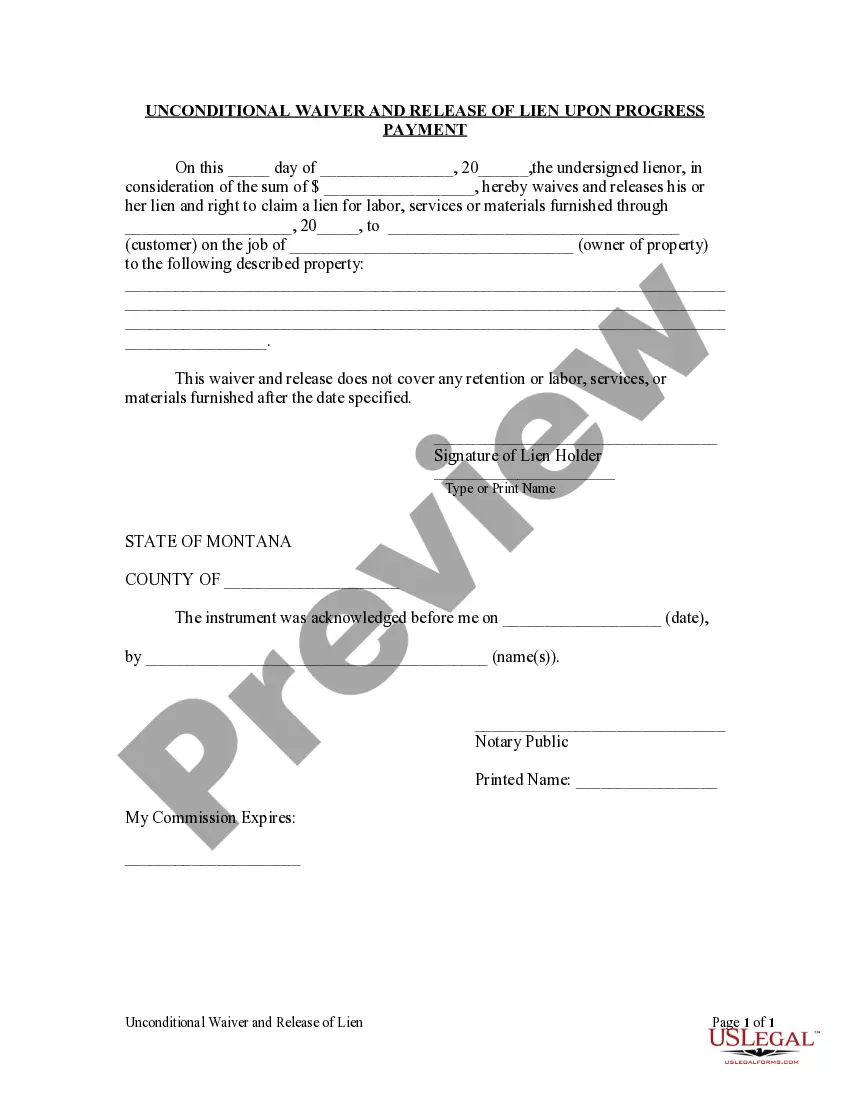

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

When it comes to drafting a legal form, it is easier to leave it to the experts. However, that doesn't mean you yourself can’t find a sample to use. That doesn't mean you yourself can not get a sample to use, however. Download Complex Will - Max. Credit Shelter Marital Trust to Children from the US Legal Forms web site. It gives you numerous professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. Once you’re signed up with an account, log in, look for a specific document template, and save it to My Forms or download it to your gadget.

To make things easier, we’ve included an 8-step how-to guide for finding and downloading Complex Will - Max. Credit Shelter Marital Trust to Children quickly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Press Buy Now.

- Select the appropriate subscription for your needs.

- Create your account.

- Pay via PayPal or by debit/bank card.

- Select a preferred format if several options are available (e.g., PDF or Word).

- Download the file.

As soon as the Complex Will - Max. Credit Shelter Marital Trust to Children is downloaded you may complete, print and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

A trust is traditionally used for minimizing estate taxes and can offer other benefits as part of a well-crafted estate plan. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.

Revocable Trusts. Irrevocable Trust. Asset Protection Trust. Charitable Trust. Constructive Trust. Special Needs Trust. Spendthrift Trust. Tax By-Pass Trust.

Two main types of trusts: Revocable and irrevocable trust All trusts fall into one of two categories: revocable or irrevocable.

Livings Trusts. A living trust is usually created by the grantor, during the grantor's lifetime, through a transfer of property to a trustee. Testamentary Trusts. Irrevocable Life Insurance Trust. Charitable Remainder Trust.

Assets of minor children should always be held in trust. You do not want children under 18 inheriting assets. While they are under 18, their guardian or conservator will control the money for them.

Less than 2 percent of the U.S. population receives a trust fund, usually as a means of inheriting large sums of money from wealthy parents, according to the Survey of Consumer Finances. The median amount is about $285,000 (the average was $4,062,918) enough to make a major, lasting impact.

Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

A trust gives you the ability to name specific beneficiaries, and once you do, your intentions cannot be changed after the fact. This means that you will be able to specifically name your children as beneficiaries of the trustand even exclude certain children if that is your choiceand your wishes will be carried out.