Land Installment Contract

Definition and meaning

A Land Installment Contract is a legal agreement between a vendor (seller) and a vendee (buyer) for the purchase of real property. Under this contract, the buyer agrees to make payments over time while the seller retains the title of the property until the purchase price is fully paid. This type of agreement allows buyers who may not qualify for traditional mortgage financing to obtain property.

Key components of the form

The Land Installment Contract contains several critical components that outline the terms of the agreement:

- Purchase Price: The total amount for the property, including the initial down payment and remaining installments.

- Payment Schedule: Details on how and when payments will be made, including interest rates.

- Taxes and Assessments: Responsibilities for paying property taxes and any assessments that arise after signing the contract.

- Insurance Requirements: Specifications on the types of insurance the buyer must maintain during the contract term.

Understanding these components is essential for both parties to ensure compliance and protect their interests.

How to complete a form

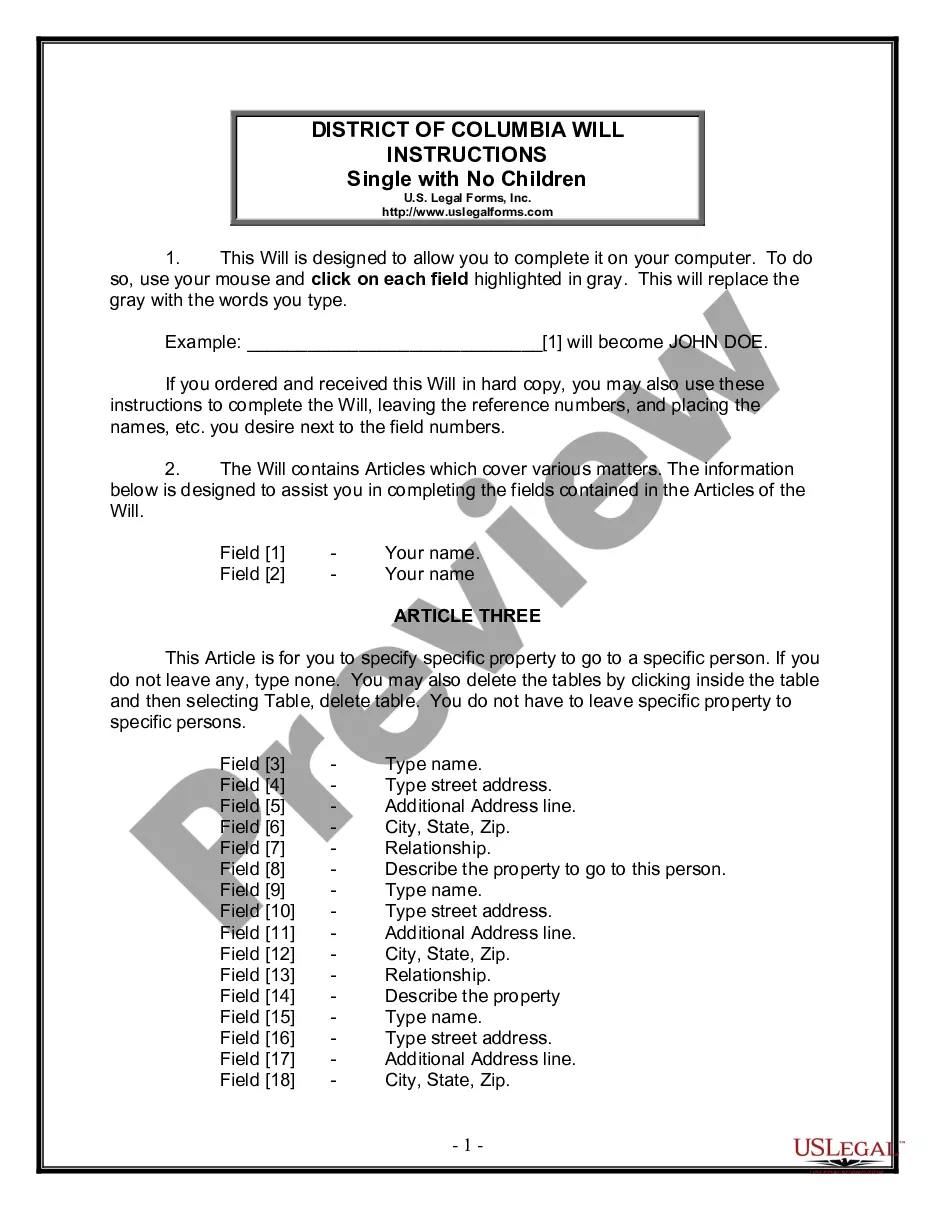

Completing a Land Installment Contract requires attention to detail. Here are the steps:

- Begin with the date of the agreement.

- Fill in the names and addresses of both the vendor and vendee.

- State the purchase price clearly, along with the initial down payment.

- Outline the monthly payment amount and interest rate, and specify the due date for payments.

- Include any relevant terms regarding taxes, insurance, and utilities.

- Have both parties sign the document and consider notarization for additional legal validity.

Ensuring accuracy during this process will help maintain clarity and avoid disputes in the future.

Common mistakes to avoid when using this form

When utilizing a Land Installment Contract, individuals often make several common errors:

- Failing to specify clear payment terms can lead to misunderstandings.

- Omitting important details about taxes and insurance responsibilities could result in unexpected liabilities.

- Not having the contract reviewed by a legal professional may overlook issues that could affect rights.

- Neglecting to properly execute the signing and notarization process may challenge the contract's enforceability.

Awareness of these pitfalls can help ensure that all parties fulfill their obligations under the contract effectively.

Legal use and context

The Land Installment Contract is often used in real estate transactions where buyers may not immediately qualify for traditional loans. This is especially beneficial for first-time buyers or those with limited credit history. This contract offers flexibility; however, it does come with risks, such as the possibility of forfeiture of payments if the buyer defaults. Therefore, understanding its legal implications is crucial for both parties involved.

Who should use this form

This form is suitable for:

- Individuals looking to purchase property but unable to secure traditional financing.

- Sellers who wish to provide flexible payment options to buyers.

- Investors interested in alternative arrangements for acquiring properties.

Utilizing this contract can facilitate property transactions that may not be possible under conventional means.

Form popularity

FAQ

A land contract should spell out the purchase price, down payment, payment schedule, installment amount, interest rate, loan term and balloon payment amount, if applicable. Responsible party for home repairs. The buyer and seller agree upfront on who will make and pay for home repairs.

Negotiate the basic terms. State the purpose of the contract and the identity of the parties on the first page. Identify the property using its legal description. State the amount of the down payment if any. List the purchase prince, the interest rate, and the total purchase price (purchase prince plus total interest.)

Which of the following BEST describes a land contract or installment contract? The answer is a method of selling real estate whereby the purchaser pays in regular installments while the seller retains title. An installment contract combines elements of both a sale and a finance document into one legal instrument.

An installment agreement requires the buyer of real estate to pay the seller the purchase price in installments over time; the buyer takes immediate possession of the property but the seller retains legal title as security until the buyer pays in full.

The good: Fast, cheap, easy Again, land contracts can be a simple, low-cost way to buy a home, especially when you can't qualify for a traditional mortgage loan. That's why nonprofits use them to make homeownership a reality for those of us with modest incomes and credit problems.

Introduction. An installment contract (also called a land contract or articles of agreement for warranty deed or contract for deed) is an agreement between a real estate seller and buyer, under which the buyer agrees to pay to the seller the purchase price plus interest in installments over a set period of time.

The seller retains legal title to the real property until the purchaser fully pays off the loan, at which point the seller records a deed transferring legal title to the purchaser. A purchaser under an installment land contract is usually not protected by foreclosure statutes as with a mortgage or deed of trust.

A land contract is a real estate transaction in which a buyer finances a property by making installment payments to the seller. The buyer gains access to the home, but the seller maintains the legal title until the buyer pays off the loan.