Lease Purchase Agreement for Business

Definition and meaning

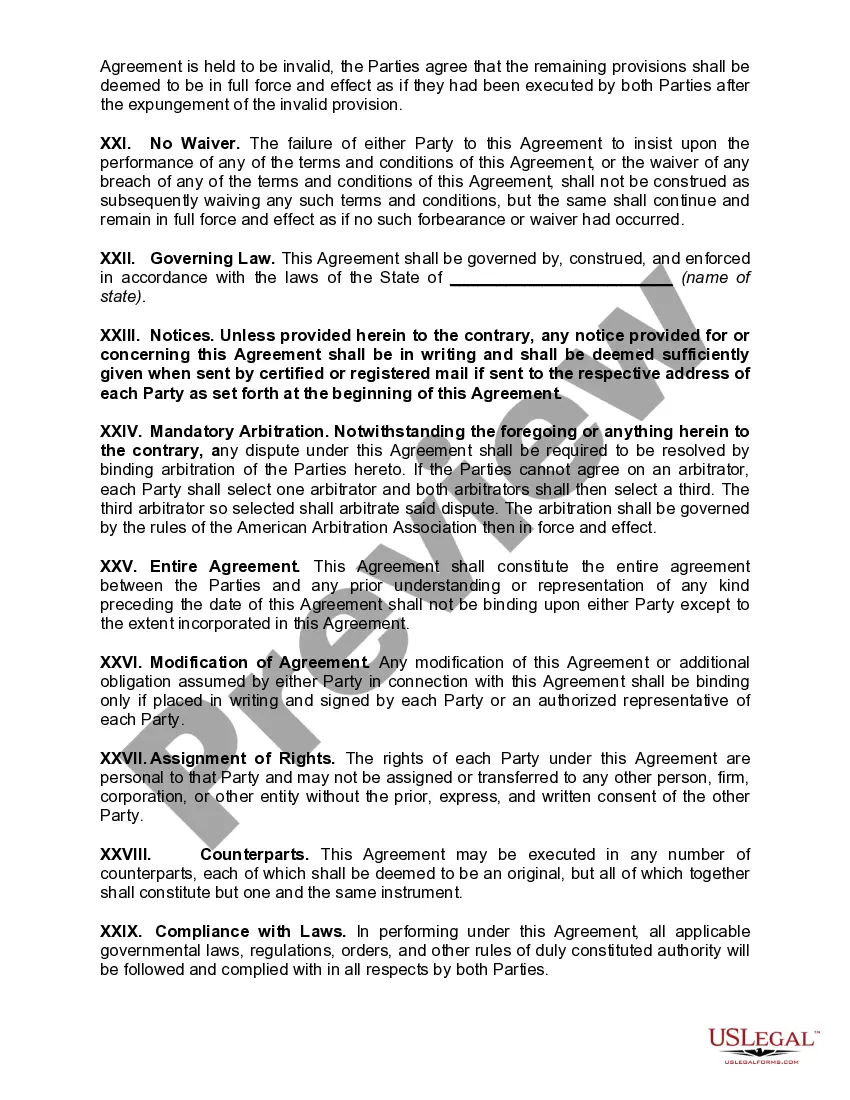

A Lease Purchase Agreement for Business is a legally binding document that outlines the terms under which a lessor allows a lessee to lease a property with the intention of purchasing it at a later date. This agreement typically includes details such as the duration of the lease, the payment structure, and the conditions under which the purchase may occur. Such agreements are common in commercial real estate and serve as a way for businesses to secure property without an immediate full purchase.

Key components of the form

This Lease Purchase Agreement generally includes several vital sections:

- Description of the Premises: Identifies the property being leased.

- Term: Specifies the duration of the lease agreement.

- Rent: Details the amount of rent and payment schedule.

- Use of Premises: Defines acceptable uses for the leased property.

- Entry on Premises by Lessor: Outlines conditions under which the lessor may access the property.

How to complete the form

Filling out the Lease Purchase Agreement requires careful attention to detail. Follow these steps:

- Fill in the date at the top of the document.

- Enter the names of both the lessor and lessee as they appear on official documents.

- Provide detailed property information, including the address and specific descriptions.

- Specify the term of the lease, including start and end dates.

- Indicate the total rent amount and payment schedule.

- Include any additional conditions or clauses that are relevant.

Common mistakes to avoid when using this form

When completing and signing a Lease Purchase Agreement, it is important to be aware of common pitfalls, such as:

- Failing to clearly define all terms related to rent and duration.

- Leaving sections blank or incomplete, which may lead to misunderstandings later.

- Neglecting to include a detailed description of the premises, which could impact usage rights.

- Overlooking signatures or dates, which are crucial for the validity of the agreement.

Who should use this form

This form is ideal for businesses that are considering leasing a property with an option to buy. Specifically, it is beneficial for:

- Businesses looking to expand or relocate without immediate large capital investment.

- Entrepreneurs who want to secure a business location while assessing the market.

- Companies that may have potential cash flow limits but are confident in future purchasing.

Form popularity

FAQ

Document everything in writing. Keep a written record of everything that is agreed on, and be careful to use the right terms in the agreement. Consult an attorney. Use separate agreements. Keep the term short. Take a security deposit. Pay like an owner. Factor in repair costs. Don't give large rent credits.

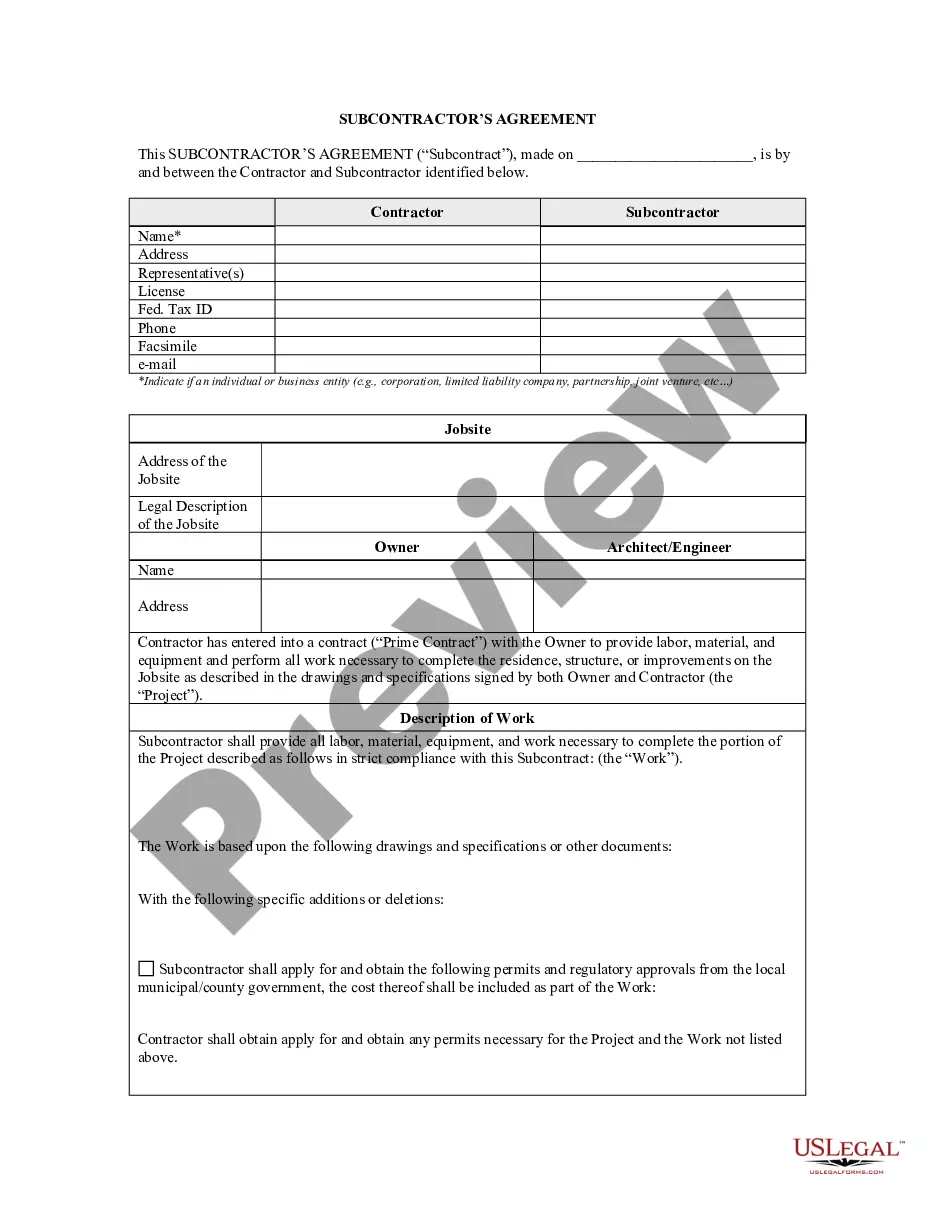

The Introduction. The beginning of the lease agreement should contain the name of the landlord and tenant, as well as a statement of the agreement into which they are entering. Rent. Deposit. Taxes. Property Insurance. Utilities and Amenities. Remodeling and Improvements. Repairs and Maintenance.

The California Residential Lease Agreement-With Option to Purchase is a form used specifically for a purchase agreement that begins as landlord-tenant lease agreement.

Name the parties. A simple rental agreement form needs to name the parties signing the lease and where they live. Describe the premises. Define the term of the lease. Set how much rent is owed. Assign a security deposit amount. Finalize the lease.

You sign one of two types of agreements. You and the landlord set a purchase price. You pay an option fee. You decide how long the rental term will be. Maintenance roles will be defined. Your monthly payment covers rent and down payment savings. When the rental term nears its end, you apply for a mortgage.

In a standard Lease-Purchase Contract, the two parties agree to a lease period during which rent is paid, and the terms of the sale at the end of the lease period, including sale price. Often, the contract is structured in two parts, one representing the lease term and the other a contract of sale.

Under California law, a lease does have to be in writing to be enforceable, but only when the lease is for a period of more than a year.There is, however, an additional legal doctrine called partial performance which does make oral contracts enforceable even if they are covered by the Statute of Frauds.

A lease purchase agreement in real estate is a rent-to-own contract between a tenant and a landlord for the former to purchase the property at a later point in time. The renter pays the seller an option fee at an agreed-upon purchase price, giving them exclusive rights to buy the property.