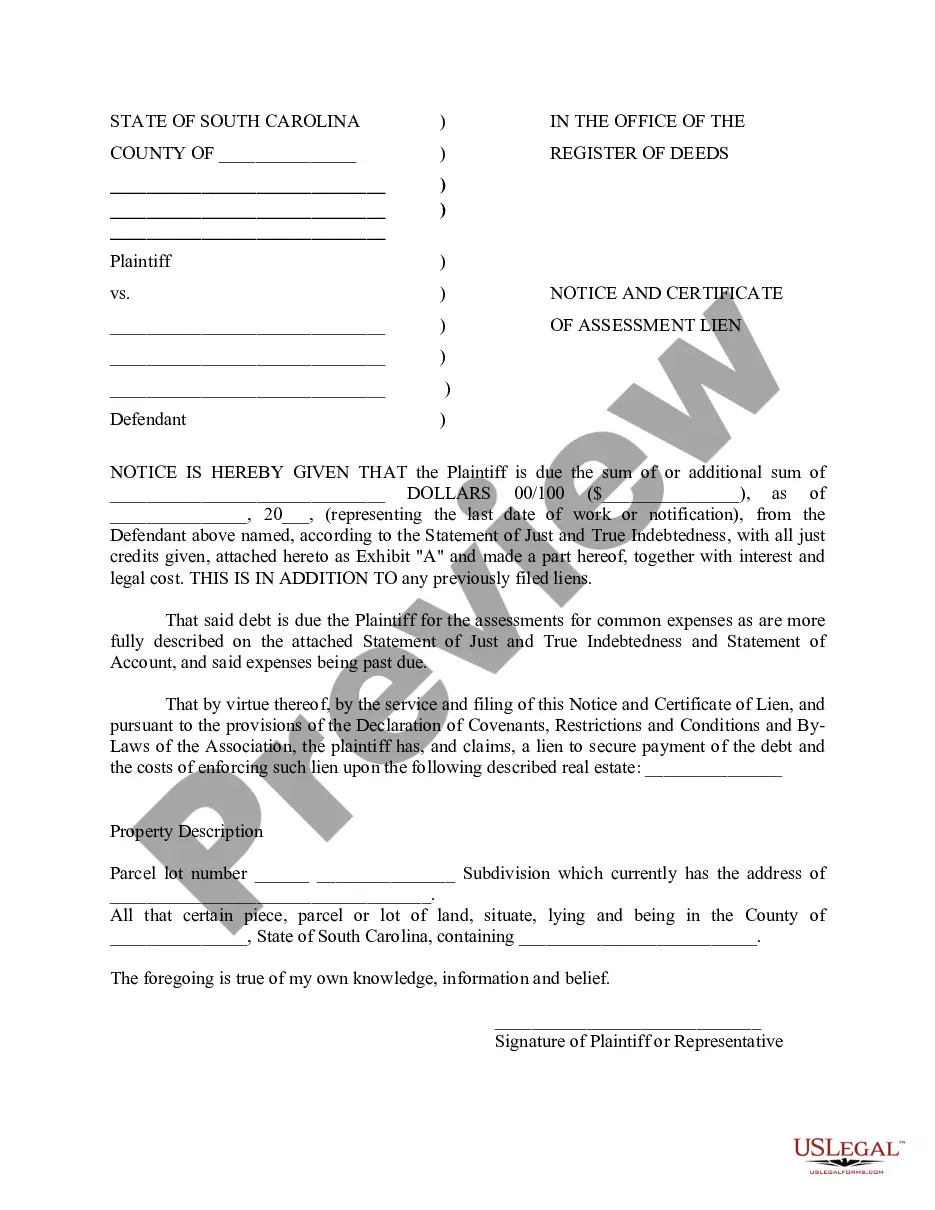

Notice and Certificate of Assessment Lien - South Carolina

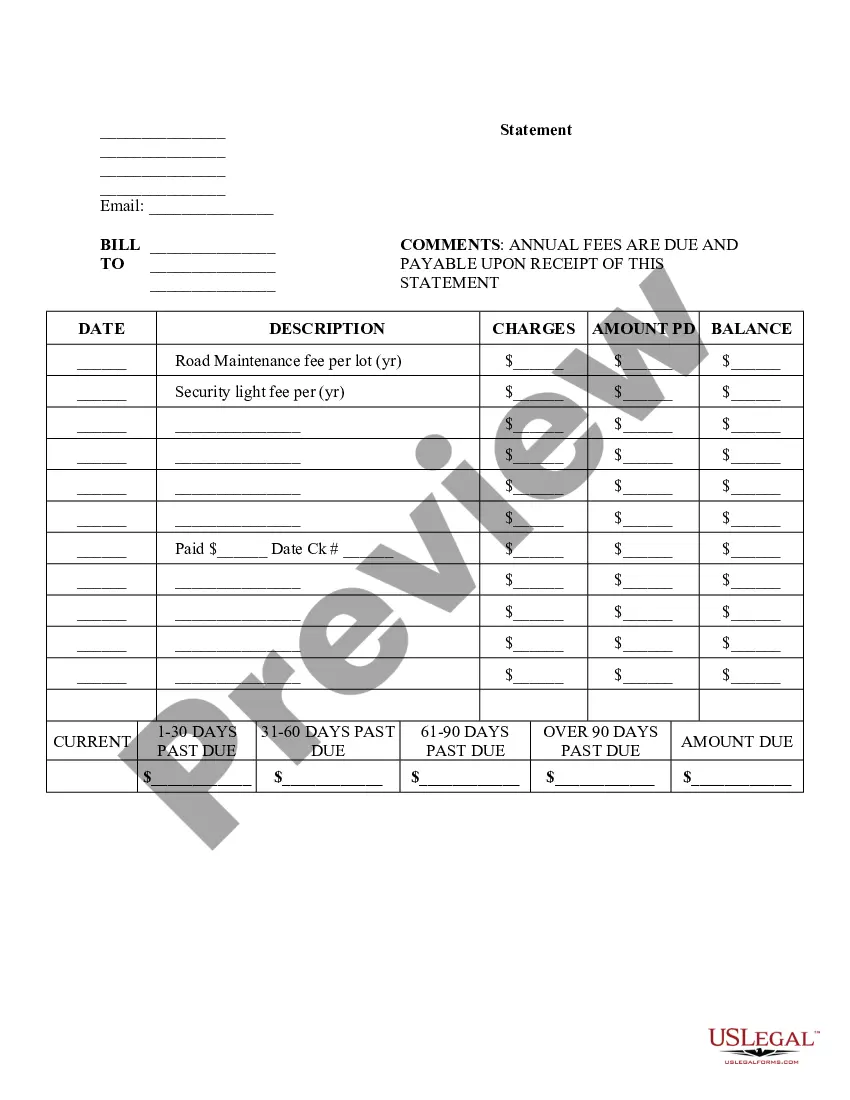

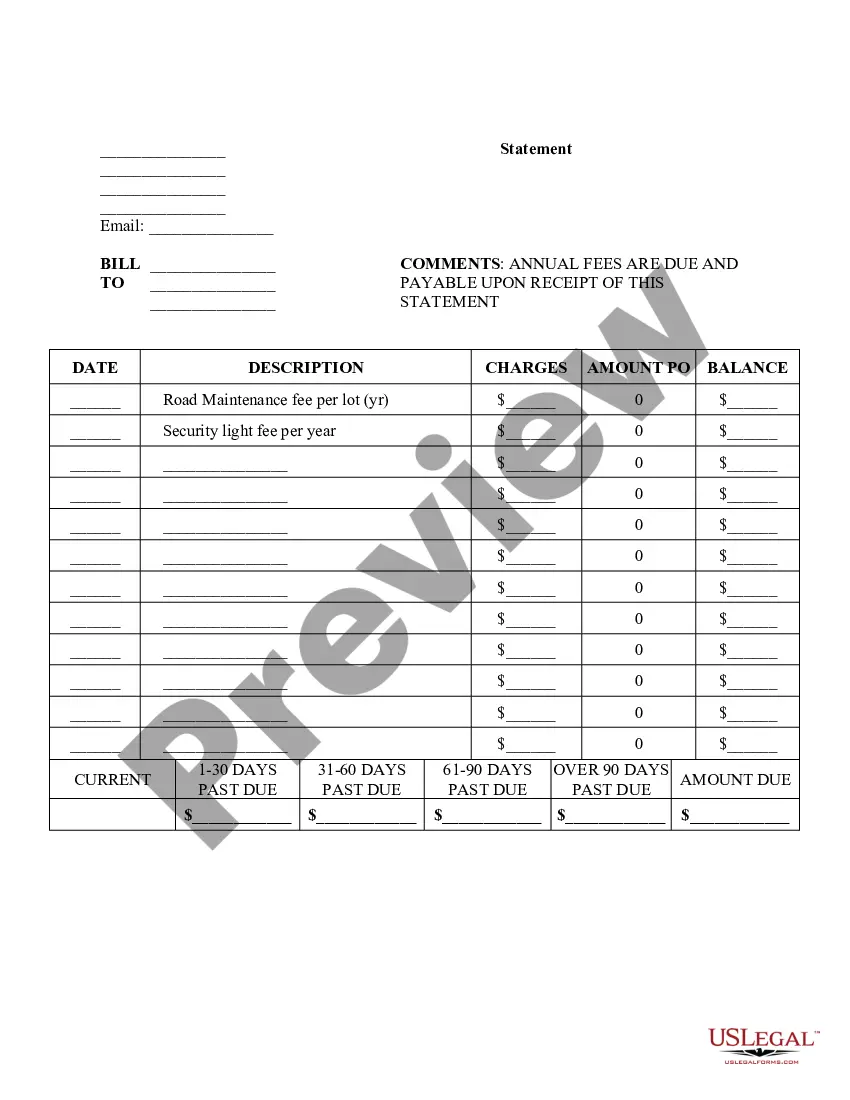

Description

How to fill out South Carolina Notice And Certificate Of Assessment Lien?

Creating papers isn't the most easy task, especially for people who rarely deal with legal papers. That's why we recommend using correct South Carolina Notice and Certificate of Assessment Lien samples created by professional lawyers. It gives you the ability to avoid difficulties when in court or handling official organizations. Find the samples you want on our website for top-quality forms and correct explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will automatically appear on the template web page. After getting the sample, it’ll be stored in the My Forms menu.

Customers without a subscription can easily get an account. Follow this simple step-by-step help guide to get the South Carolina Notice and Certificate of Assessment Lien:

- Make certain that the form you found is eligible for use in the state it’s needed in.

- Confirm the file. Use the Preview feature or read its description (if offered).

- Click Buy Now if this template is the thing you need or go back to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after completing these straightforward steps, you are able to complete the sample in your favorite editor. Double-check completed data and consider requesting a lawyer to examine your South Carolina Notice and Certificate of Assessment Lien for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

As a result, many seniors pay no South Carolina income tax. In addition, homeowners at age 65 are exempt from property tax on the first $50,000 of the value of their legal residence, once they apply for the Homestead Exemption at their local county auditor's office.

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

If this bill is not paid, state law requires the Treasurer's Office to send a suspension on your vehicle and/or driver's license for non-payment of taxes to the Department of Motor Vehicles. This suspension is lifted when the tax obligation on the vehicle is satisfied, however, the S.C.

According to Ted Thomas, an authority on tax lien certificates and tax deeds, 21 states and the District of Columbia are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina,

As South Carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Investors usually receive anywhere from 3% - 12% back in interest or receive the deed outright on the property. For those looking for ROI in a short time period, tax sales are certainly something to consider.

The winner of a tax lien certificate is typically the investor willing to accept the lowest interest rate.But that rarely happens: The taxes are generally paid before the redemption date. The interest rates make tax liens an attractive investment.

A lien is a legal claim against your property to secure payment of your tax debt, while a levy actually takes the property to satisfy the tax debt.When filed, the Notice of Federal Tax Lien is a public document that alerts other creditors that the IRS is asserting a secured claim against your assets.

In South Carolina, if you become delinquent in paying your property taxes, the late amounts become a lien on your home. The tax collector can then sell your home a tax sale to satisfy the lien.

A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. 1feff Tax lien certificates are generally sold to investors through an auction process.