New Mexico Notice to Lienholder of Mobile Home Judgment - Mobile Home Park Act

Description

Key Concepts & Definitions

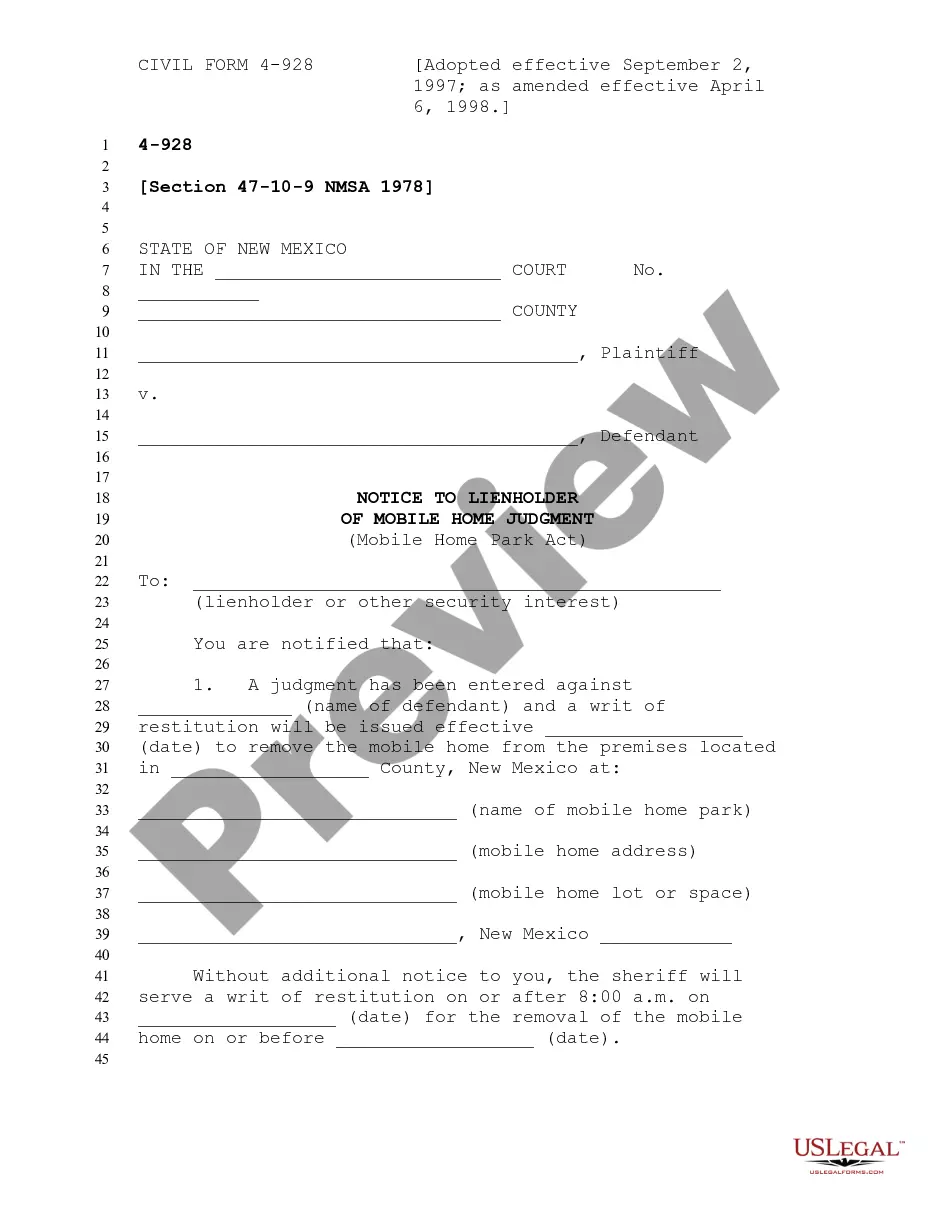

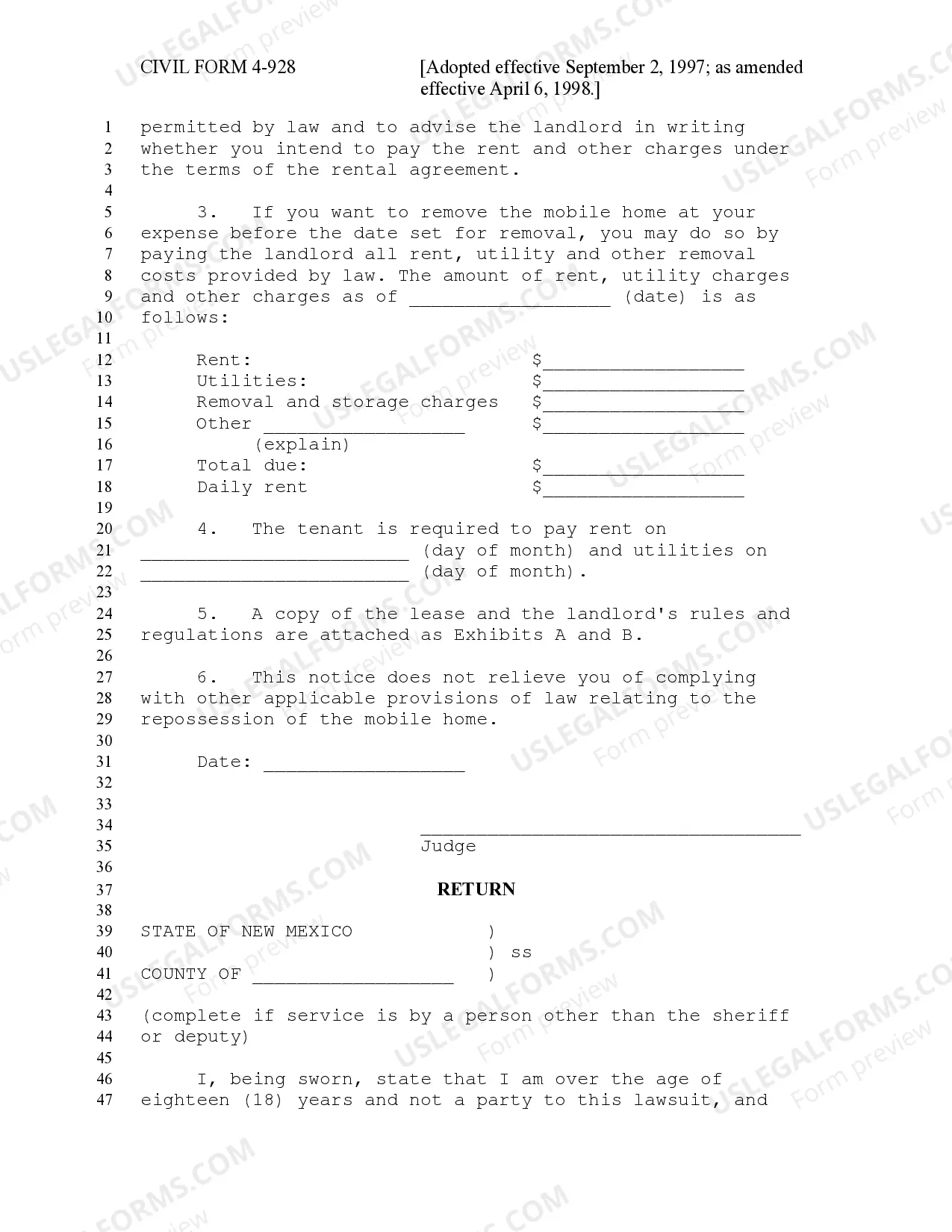

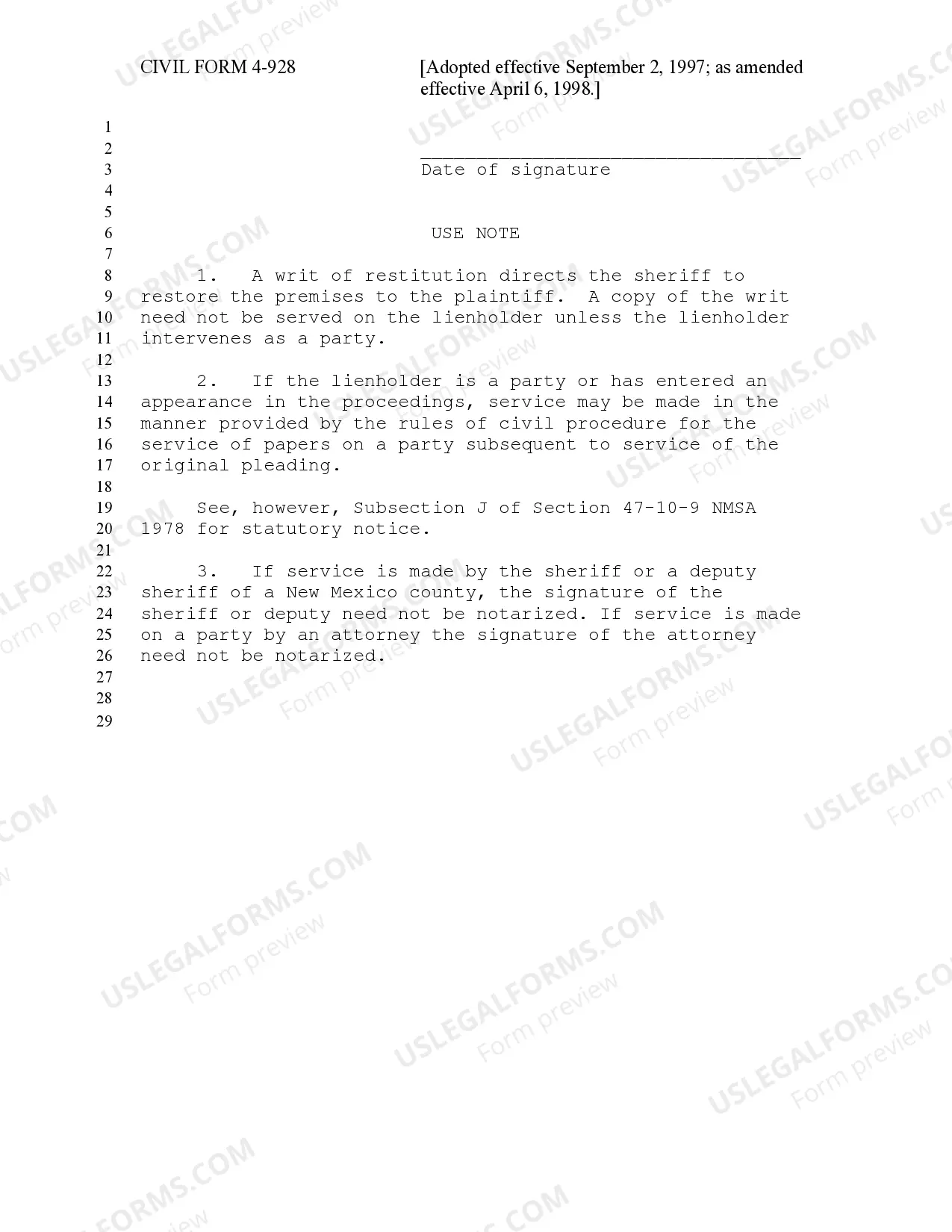

Notice to Lienholder of Mobile Home Judgment: This is a legal notification required to be sent to a lienholder when a judgment has been made concerning a mobile home that they have an interest in. This notice informs the lienholder that they must take certain legal actions to protect their financial interest in the property.

Step-by-Step Guide

- Determine the Need for Notification: Identify if the judgment on the mobile home affects the interests of a lienholder.

- Prepare the Notice: Draft a notice including all relevant judgment details, lienholder's information, and necessary legal directives.

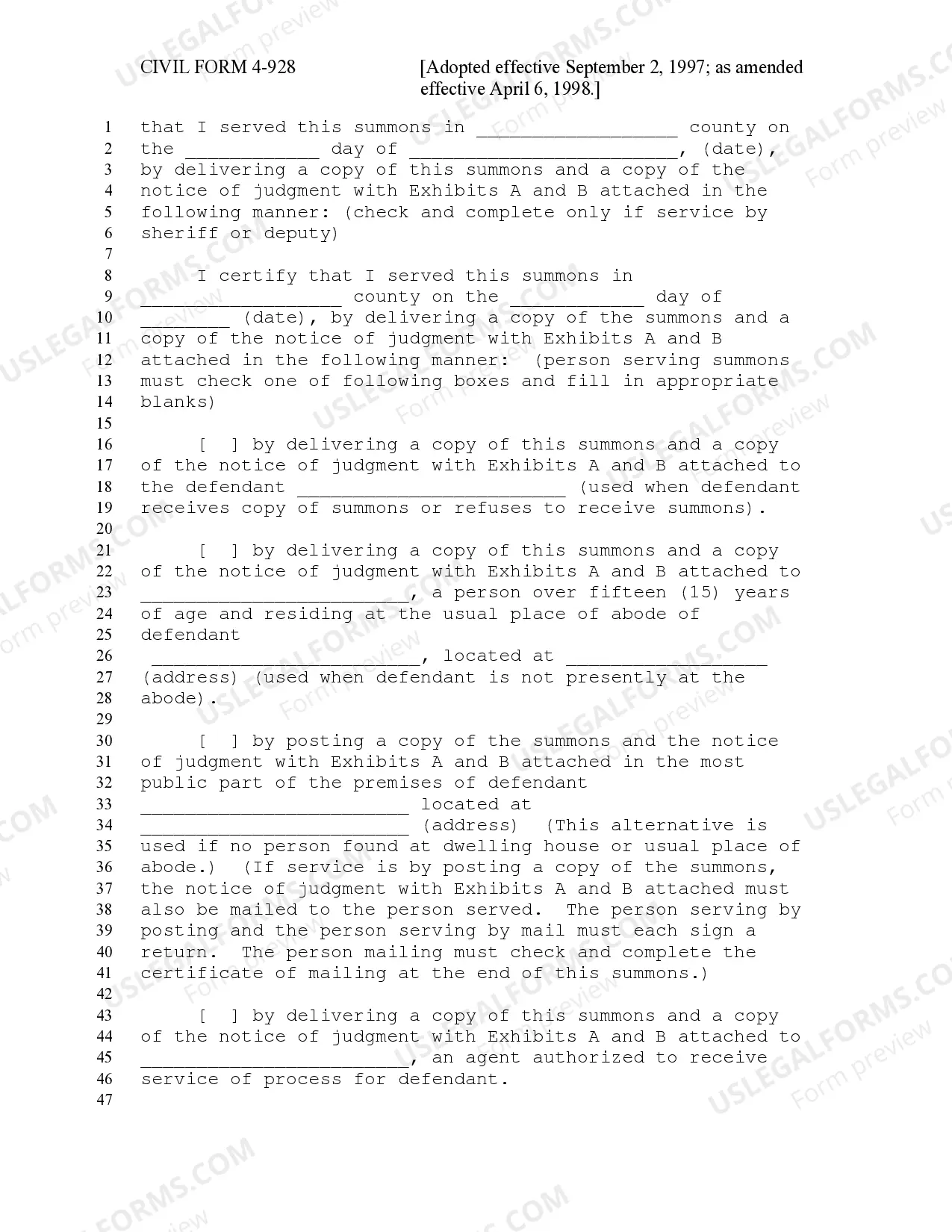

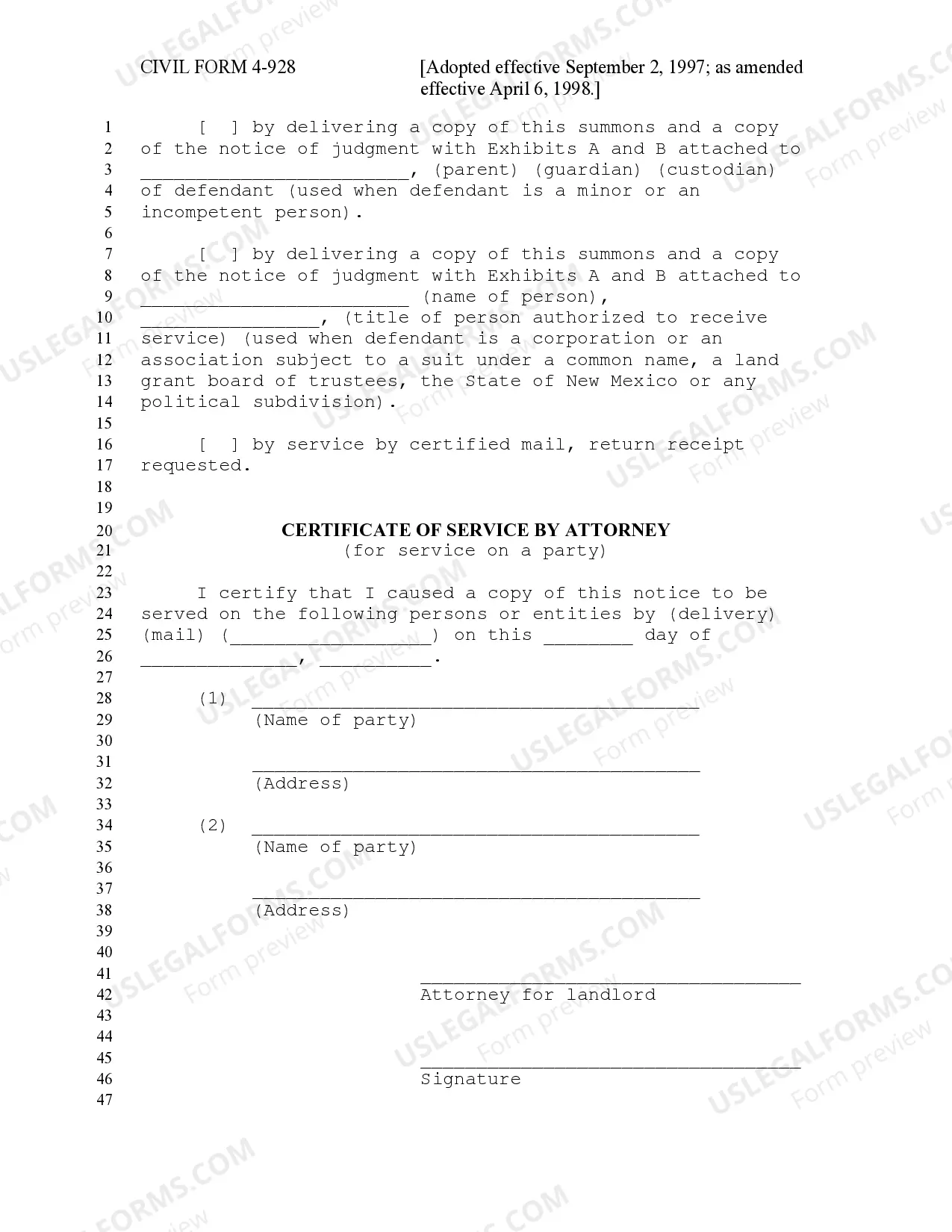

- Verify Legal Requirements: Ensure that the notice meets all state-specific legal requirements for format, content, and delivery method.

- Send the Notice: Send the notice to the lienholder through the legally prescribed method, often certified mail.

- Confirm Receipt: Obtain confirmation of receipt to ensure the lienholder has been properly informed and to comply with legal standards.

Risk Analysis

- Legal Risks: Failing to notify a lienholder could result in legal penalties or a compromised legal position in future proceedings.

- Financial Risks: Improper notification could leave the lien unsettled, affecting future sale or transfer of the mobile home.

- Reputational Risks: Poor handling of such notifications can damage the reputation of the parties involved, especially in smaller communities or specialized industries.

Key Takeaways

- Always check state-specific legal requirements for sending a notice to lienholders.

- Ensure clear, professional, and timely communication to protect all parties' interests.

- Maintain records of all communications and responses related to the judicial notice.

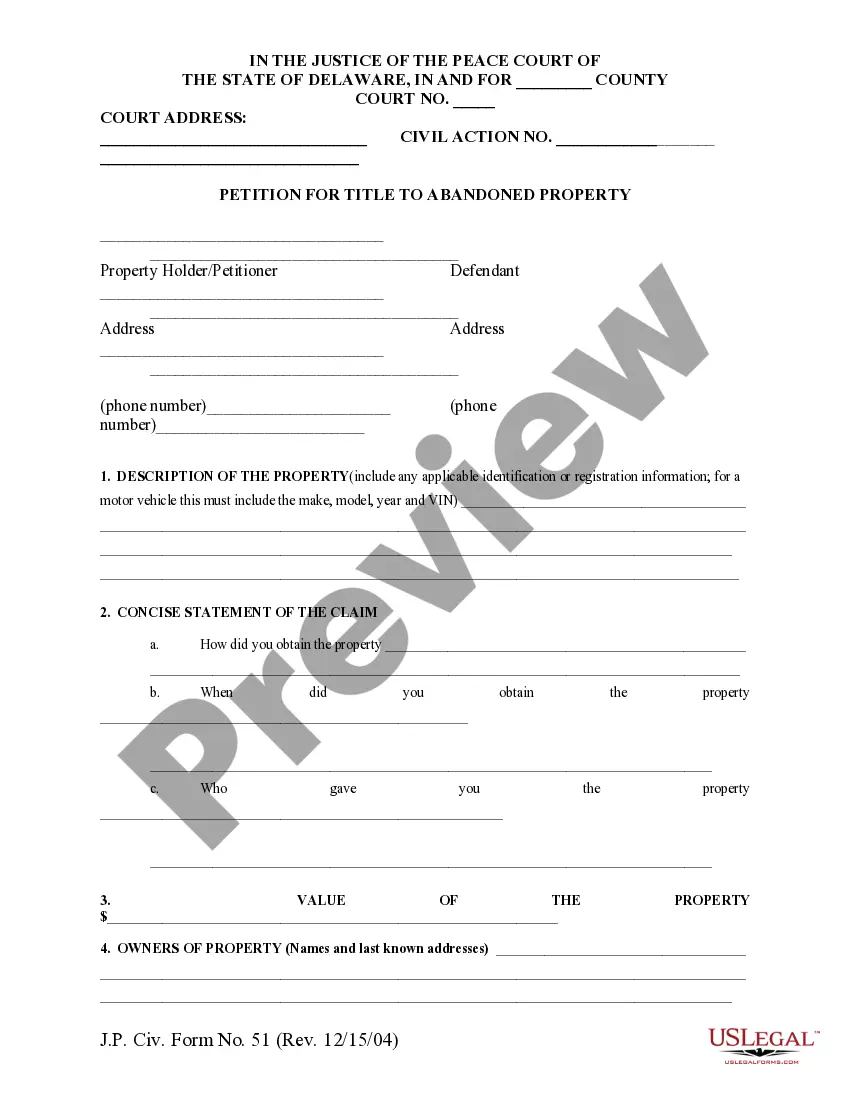

How to fill out New Mexico Notice To Lienholder Of Mobile Home Judgment - Mobile Home Park Act?

US Legal Forms is a special system to find any legal or tax document for submitting, such as New Mexico Notice to Lienholder of Mobile Home Judgment - Mobile Home Park Act. If you’re sick and tired of wasting time seeking appropriate examples and spending money on file preparation/attorney charges, then US Legal Forms is precisely what you’re looking for.

To reap all of the service’s advantages, you don't need to install any software but just pick a subscription plan and create an account. If you already have one, just log in and look for the right sample, save it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need New Mexico Notice to Lienholder of Mobile Home Judgment - Mobile Home Park Act, take a look at the recommendations listed below:

- Double-check that the form you’re taking a look at applies in the state you want it in.

- Preview the sample and look at its description.

- Click on Buy Now button to get to the register page.

- Choose a pricing plan and carry on signing up by entering some info.

- Select a payment method to complete the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you are unsure regarding your New Mexico Notice to Lienholder of Mobile Home Judgment - Mobile Home Park Act sample, contact a lawyer to check it before you send or file it. Get started hassle-free!

Form popularity

FAQ

In most cases, after your lien has been filed your customer resolves their account and you need to remove a lien. Once you have received payment in full, or a settlement amount, and the funds have cleared then you are obligated to remove the lien, You can contact Lien-Pro directly to remove liens.

The lien gives the creditor an interest in your property so that it can get paid for the debt you owe. If you sell the property, the creditor will be paid first before you receive any proceeds from the sale. And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

If a vehicle is part of a financing agreement, the legal owner will be the individual or entity that provides the financing, and is referred to as the lienholder. The registered owner is responsible for maintaining compliance with DMV laws and regulations.

A lienholder is a lender that legally has an interest in your property until you pay it off in full. The lender which can be a bank, financial institution or private party holds a lien, or legal claim, on the property because they lent you the money to purchase it.

If you are financing your car through a bank, private lender, or dealership, they are the lienholder. The lienholder owns your car while you make payments on it. If you default on the loan, the lienholder can repossess the vehicle.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more: