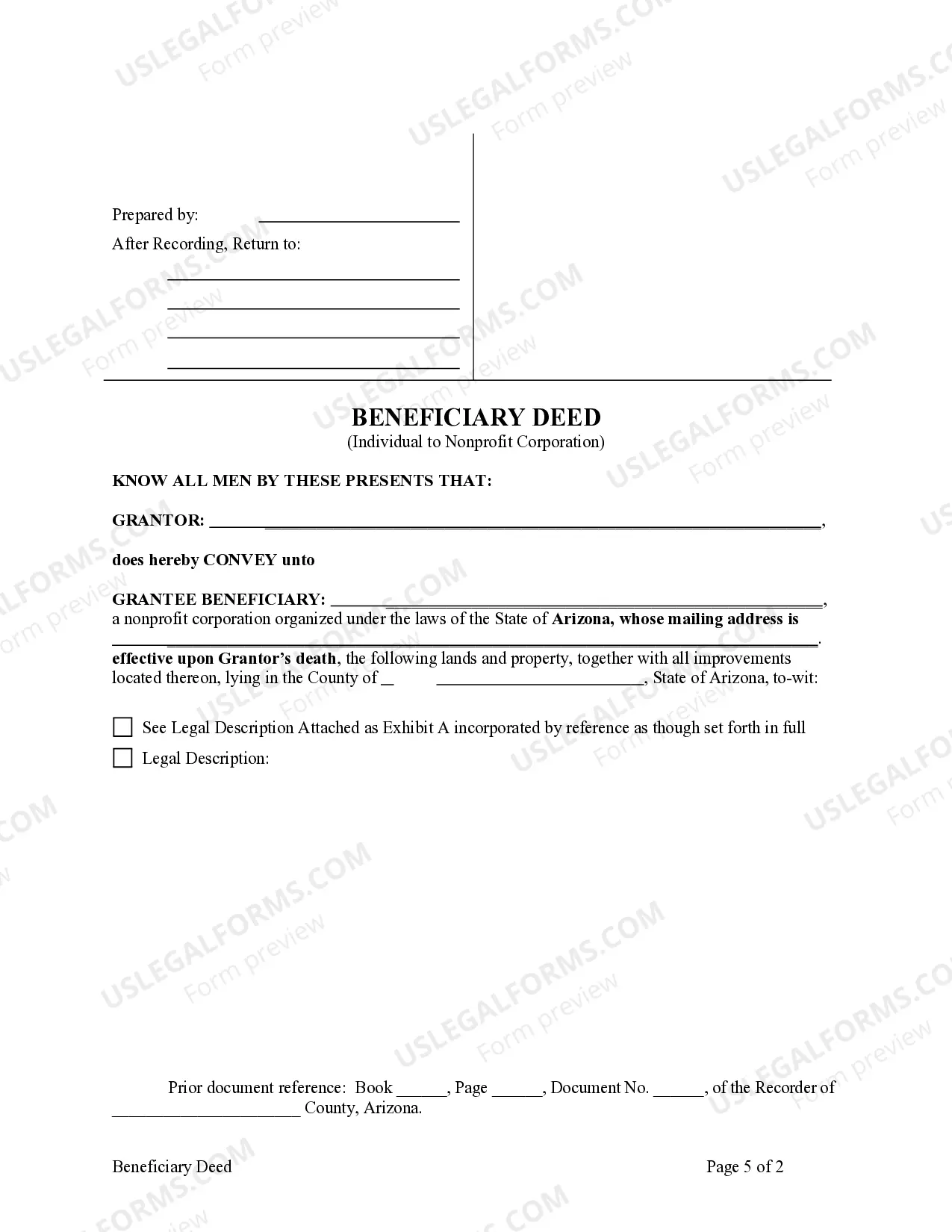

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

If you're seeking accurate Arizona Beneficiary or Transfer on Death Deed templates from an Individual Owner to a Nonprofit Corporation as Beneficiary, US Legal Forms is exactly what you require; obtain documents created and verified by state-authorized legal professionals.

Using US Legal Forms not only alleviates your concerns regarding legal paperwork; you also conserve time, effort, and money! Downloading, printing, and completing a professional document is significantly more affordable than hiring an attorney to handle it for you.

And that's it. With a few simple clicks, you possess an editable Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. After you set up your account, all subsequent transactions will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button you see on the form's page. Then, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and energy searching through numerous forms on various platforms. Obtain professional copies from a single secure platform!

- Initiate by completing your registration by providing your email and setting up a password.

- Follow the guidelines below to create your account and locate the Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary sample to meet your requirements.

- Utilize the Preview option or review the document details (if available) to ensure the sample is suitable.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and pay with a credit card or PayPal.

- Choose an appropriate file format and save the document.

Form popularity

FAQ

To transfer a property deed from a deceased relative in Arizona, start by checking if a Transfer on Death Deed exists. If it does, file the appropriate documentation with the local recorder’s office to officially change the title to the beneficiary. This method aligns with the Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary regulations. If you need specific forms or instructions, uslegalforms provides comprehensive tools to assist you through this process.

To transfer a title from a deceased person in Arizona, you generally need to determine if a Transfer on Death Deed was executed. If there is a deed naming a beneficiary, you must complete and file a Notice of Beneficiary form with the county recorder's office. This process ensures that the Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary functions correctly. For further guidance, consider using uslegalforms, which offers resources tailored for this type of title transfer.

The best way to transfer property after death is through an Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. This method allows for an efficient transfer without going through probate. By naming a nonprofit corporation as the beneficiary, you ensure that the property goes directly to your chosen organization, streamlining the entire process.

To transfer a property deed from a deceased relative in Arizona, you need to obtain the death certificate and the existing deed. You must complete an Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary if it was not already executed. If needed, legal assistance can smooth the process, especially when navigating court proceedings for property transfer.

To transfer a property deed in Arizona, you must prepare a new deed that reflects the intended transfer and then record it with the county recorder's office. If you are considering using an Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, this method allows for a smooth transition without court involvement. Ensure all parties involved are properly informed and document any necessary approvals. Utilizing platforms like uslegalforms can simplify creating and filing the required documents.

Yes, Arizona does allow a transfer on death deed, enabling property owners to designate beneficiaries who will inherit the property upon their death. By using an Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, you can bypass the probate process entirely. This deed is a powerful tool for estate planning, providing peace of mind that your property will go to your chosen nonprofit organization efficiently and effectively.

After the death of a spouse in Arizona, you may need to change the deed associated with the property. If you have an Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary in place, it can facilitate the transfer without going through probate. For changes, gather the necessary documentation, including the death certificate, and file a new deed with the county recorder. This action can help clarify ownership and prevent potential disputes.

To transfer title on death in Arizona, you can use an Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. This deed allows the property to be transferred directly to the designated nonprofit upon your passing, avoiding probate. First, you must complete the deed form, sign it in front of a notary, and record it with the county recorder. This straightforward process can simplify transferring ownership and ensure your wishes are honored.