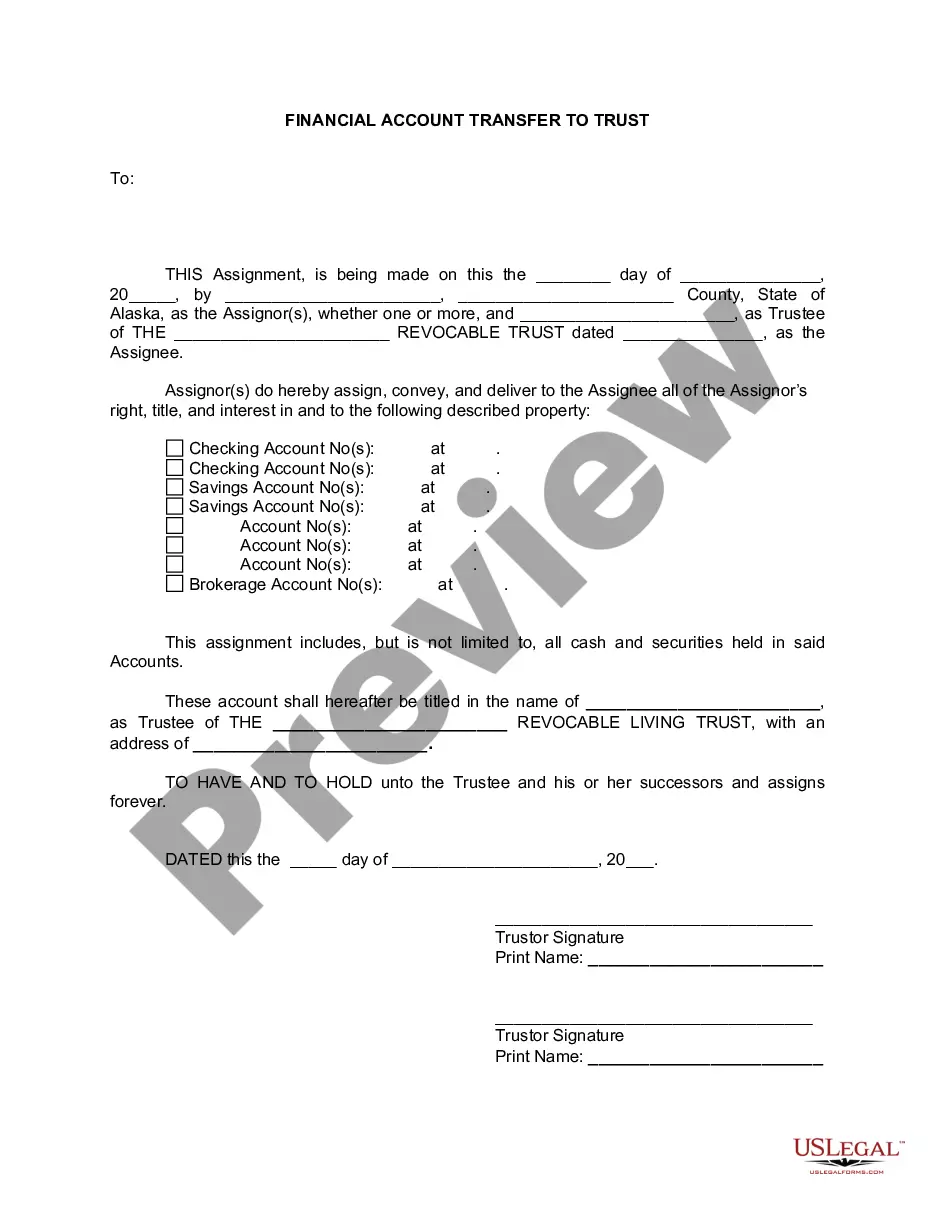

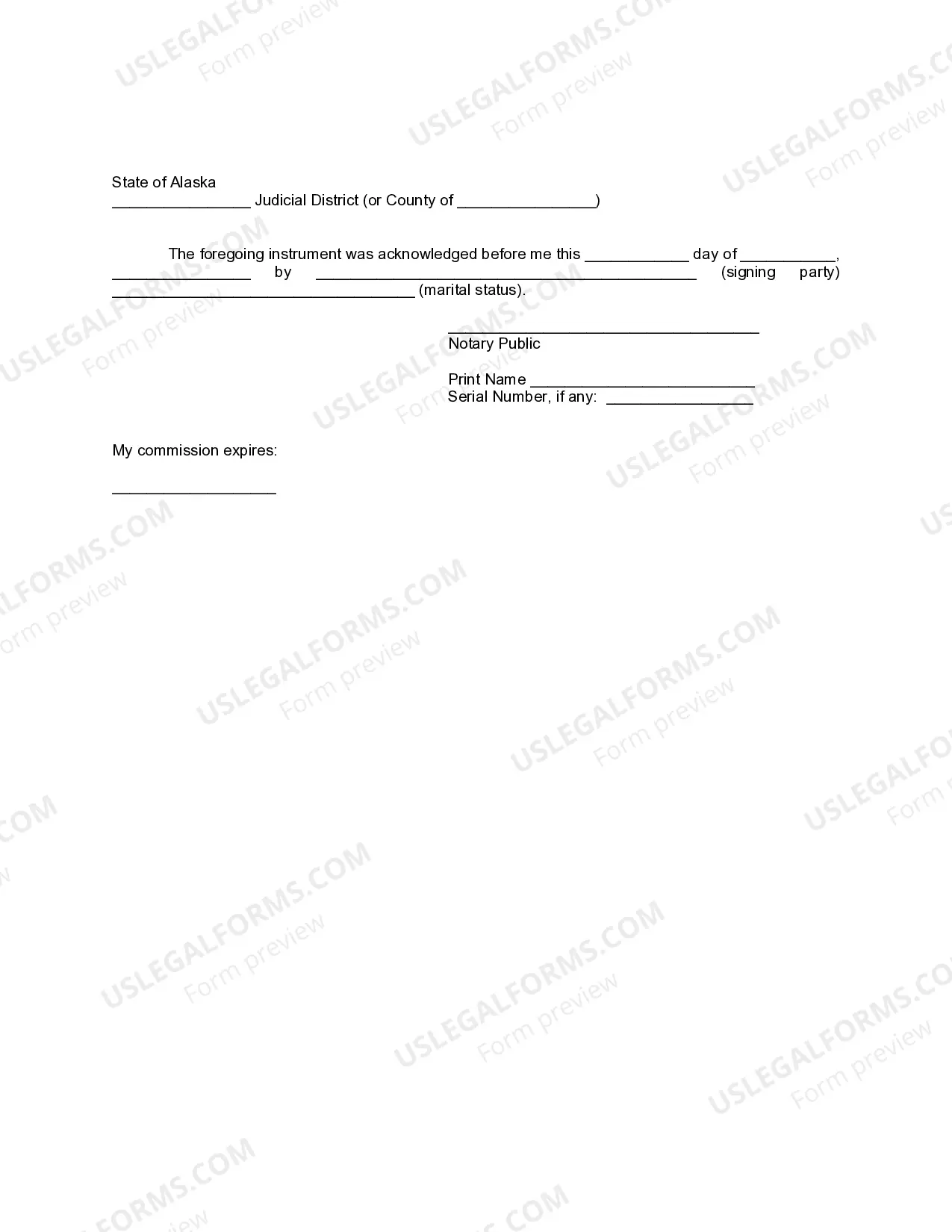

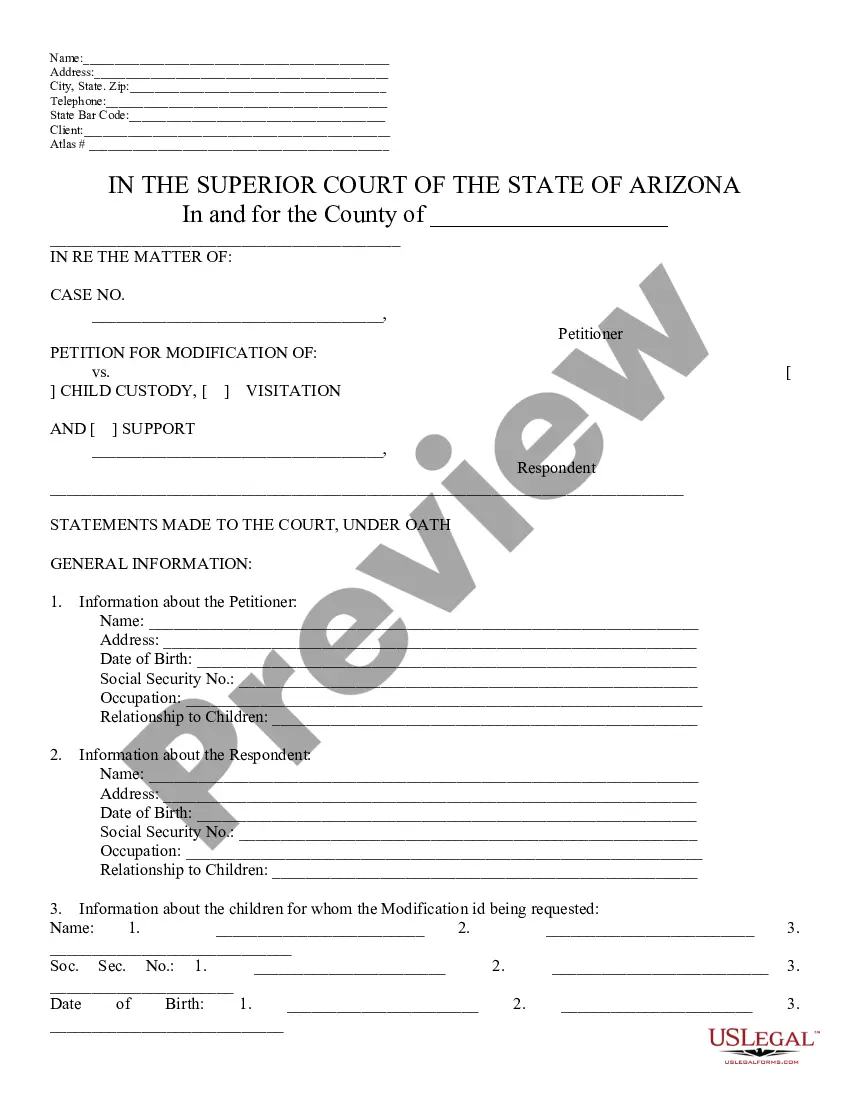

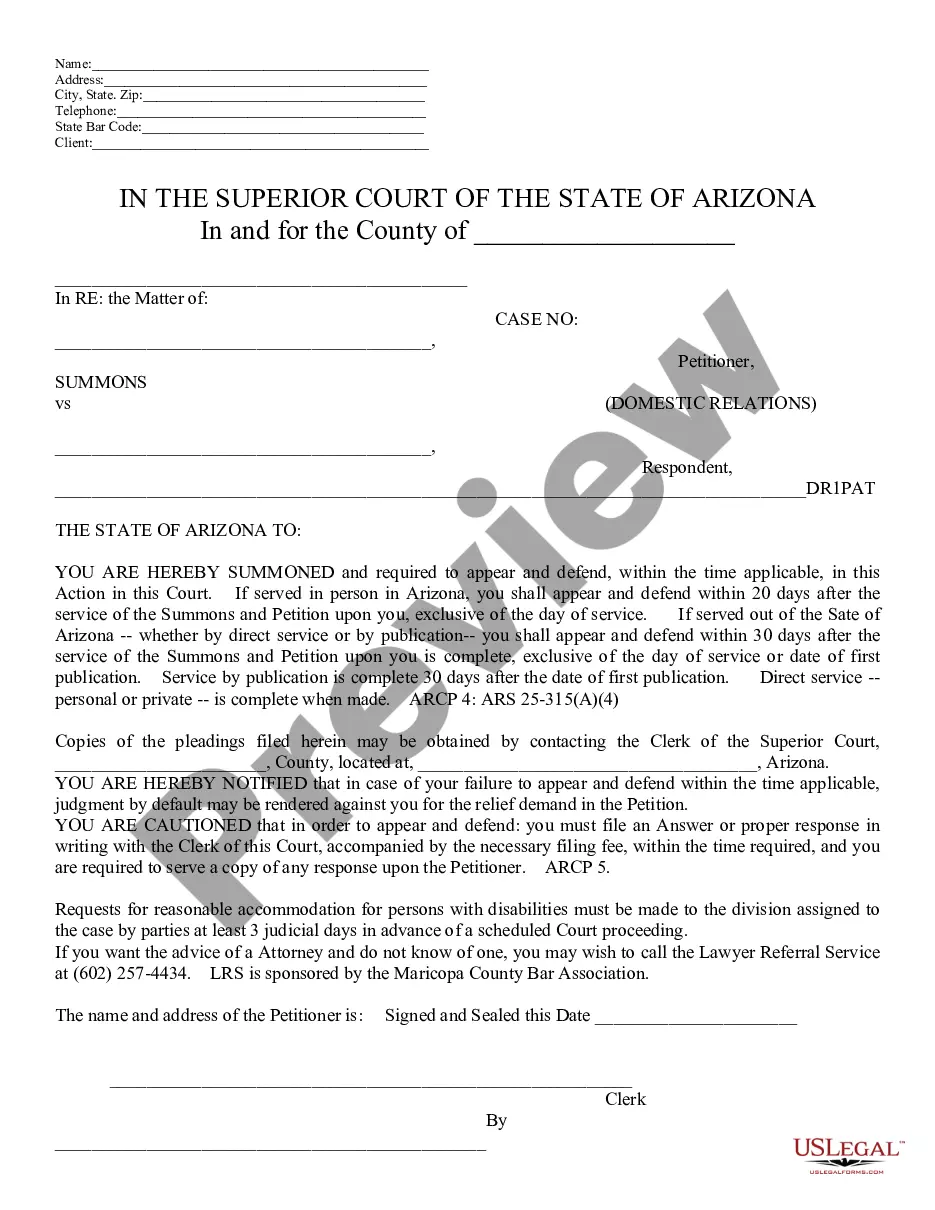

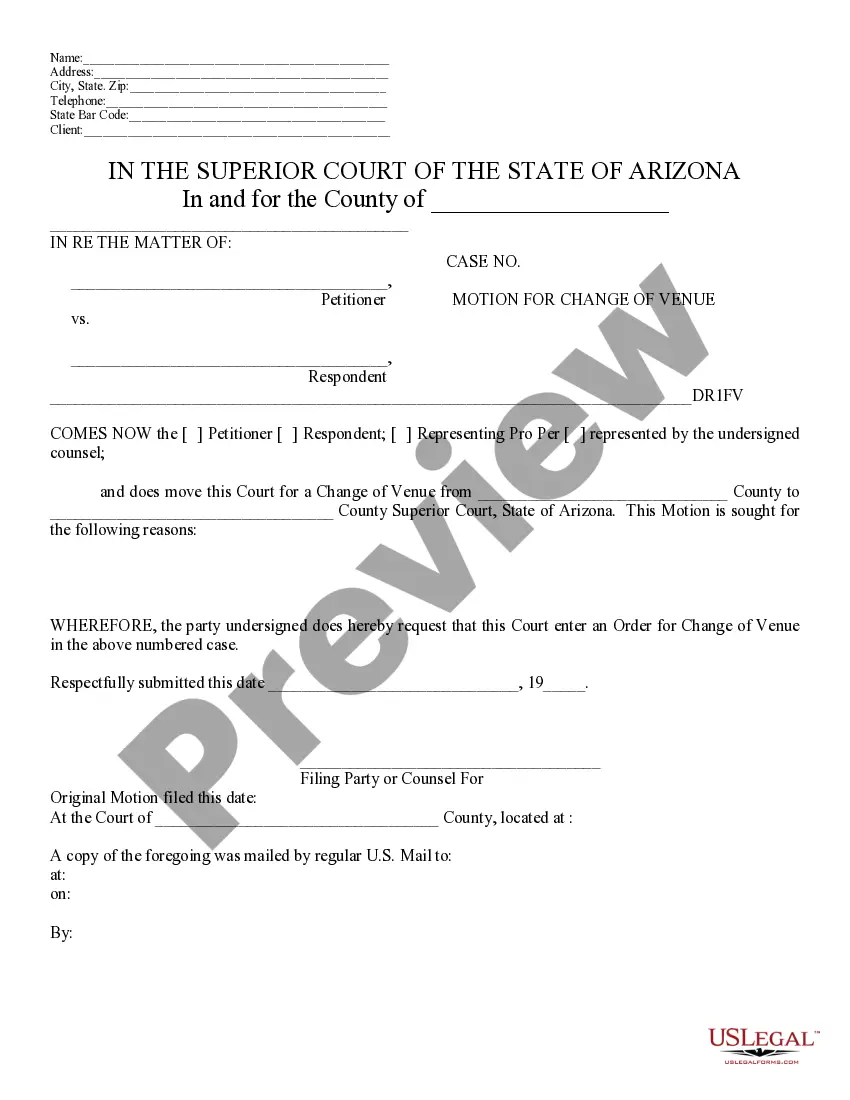

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Alaska Financial Account Transfer to Living Trust

Description

How to fill out Alaska Financial Account Transfer To Living Trust?

Utilizing Alaska Financial Account Transfer to Living Trust templates created by experienced attorneys helps you sidestep complications when filing documents.

Simply obtain the template from our site, complete it, and have a lawyer review it. This process can save you considerably more time and effort than having legal assistance draft a document from scratch for you would.

If you already possess a US Legal Forms subscription, just Log In to your account and return to the sample page. Locate the Download button near the template you are reviewing.

Begin using your credit card or PayPal. Select a file format and download your document. Once you have completed all the previous steps, you’ll be able to fill out, print, and sign the Alaska Financial Account Transfer to Living Trust template. Be sure to verify all entered information for accuracy before submitting it or sending it out. Streamline the document creation process with US Legal Forms!

- After downloading a template, you will find all of your saved documents in the My documents section.

- If you do not have a subscription, it’s not a major issue. Follow the instructions below to register for your account online, obtain, and complete your Alaska Financial Account Transfer to Living Trust template.

- Double-check and confirm that you are downloading the correct state-specific form.

- Utilize the Preview feature and read the description (if available) to determine if you need this specific template; if so, just click Buy Now.

- Search for another template using the Search field if necessary.

- Choose a subscription that fits your requirements.

Form popularity

FAQ

Dmitriy Fomichenko, President, Sense Financial Almost all the major banks offer trust accounts. What you need to do is to call their customer representatives and inquire about the features you require. Some of the options include Bank of America, Wells Fargo, US Bank, and TD Bank.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.