Wyoming Child Support Calculated With Overtime

Description

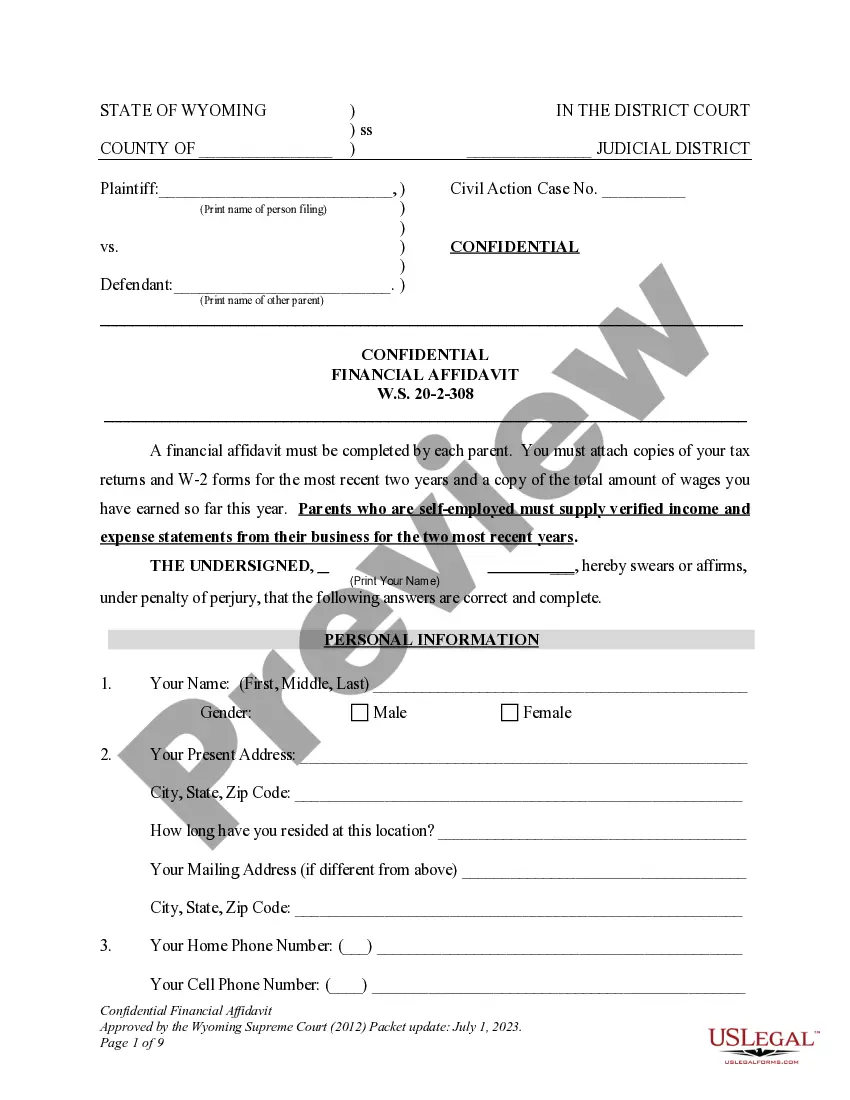

How to fill out Wyoming DWCP 9. Confidential Statement Of Parties For Child Support Order?

There's no longer a justification to waste time searching for legal documents to satisfy your local state obligations.

US Legal Forms has compiled all of them in a single location and made their retrieval easier.

Our website provides over 85k templates for any business and personal legal situations categorized by state and area of application. All forms are properly drafted and validated, so you can be confident in acquiring an up-to-date Wyoming Child Support Calculated With Overtime.

Creating legal documents under federal and state laws and regulations is fast and easy with our library. Try US Legal Forms today to keep your records organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is current before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all saved documents at any moment by accessing the My documents tab in your profile.

- If you haven't previously utilized our platform, the procedure will require a few additional steps to finish.

- Here's how newcomers can locate the Wyoming Child Support Calculated With Overtime in our collection.

- Review the page content carefully to ensure it includes the sample you require.

- To do this, employ the form description and preview options if available.

- Use the Search bar above to find another template if the current one doesn't meet your needs.

- Click Buy Now next to the template title once you identify the suitable one.

- Select your preferred pricing plan and register for an account or Log In.

- Make payment for your subscription with a credit card or via PayPal to continue.

- Choose the file format for your Wyoming Child Support Calculated With Overtime and download it to your device.

- Print your form to complete it manually or upload the sample if you prefer to do it in an online editor.

Form popularity

FAQ

Minnesota law provides guidelines for child support, which include considering both parents' incomes and the child's needs. Unlike some states, Minnesota utilizes an income shares model, factoring in both regular wages and any additional income streams. If you're wondering how Wyoming child support calculated with overtime influences payment calculations, similar principles apply. Consult local resources or use platforms like USLegalForms for assistance navigating these laws.

In Texas, child support is often calculated based on the standard 40-hour workweek unless overtime significantly impacts a parent's earnings. When determining payments, the court considers the parent's average income, which may include overtime earnings. Understanding the nuances of how Wyoming child support calculated with overtime can help clarify obligations for parents living in or moving to Texas. Seek guidance to ensure that you are fully compliant with state regulations.

In Wyoming, child support does not automatically end at 18. Support typically continues until the child graduates high school, but it may last longer if the child has special needs. Understanding how Wyoming child support calculated with overtime can impact payment schedules and amounts is crucial for both parents. Be aware of your obligations and any changes in laws regarding child support duration.

Child support amounts can vary significantly across states. In general, Massachusetts tends to have some of the highest child support payments influenced by substantial costs of living. It is essential for parents to understand how Wyoming child support calculated with overtime can affect their obligations, especially if they work extra hours. Always consult local laws or professionals to get accurate guidance.

You can modify child support in Wyoming whenever there is a significant change in circumstances. This may include changes in income, such as receiving overtime, or changes in the needs of the child. To ensure your Wyoming child support is calculated with overtime considered, it's best to review your situation regularly and seek legal advice if necessary.

The amount of child support that most people receive varies widely based on multiple factors, including income levels and living situations. For instance, in Wyoming, child support calculations include overtime earnings, which can result in different amounts. Understanding the typical ranges can help parents set realistic expectations. If you need assistance navigating these calculations, US Legal Forms is a valuable resource.

Mississippi sets a minimum amount for child support, but the specifics can vary based on the number of children and income. It's essential to consult local guidelines, as they can factor in abilities to earn, including overtime work conditions. For those interested in how Wyoming child support is calculated with overtime, exploring state-specific resources can offer clarity. Utilizing services like US Legal Forms can simplify this process for parents.

In Texas, there is no set maximum for child support; rather, it is based on a percentage of the non-custodial parent's income. However, high earners may have a cap on the amount ordered, which could change depending on various income sources, including overtime. Understanding how other states, like Wyoming, calculate support with overtime can provide insights into similar cases. For detailed calculations, using platforms like US Legal Forms can be beneficial.

Child support calculations often start with a 40-hour work week as a baseline, but this can vary based on individual circumstances. In Wyoming, when factoring in overtime, the income can significantly change. If a parent consistently works more hours, that overtime can increase their total income, impacting how Wyoming child support is calculated with overtime. This adjustment ensures that child support reflects realistic earnings.

In Wyoming, there is no specific grace period for how long a parent can go without making child support payments. The custodial parent can initiate enforcement actions as soon as payments are missed. Staying informed on your rights is essential, especially regarding the implications of your Wyoming child support calculated with overtime.