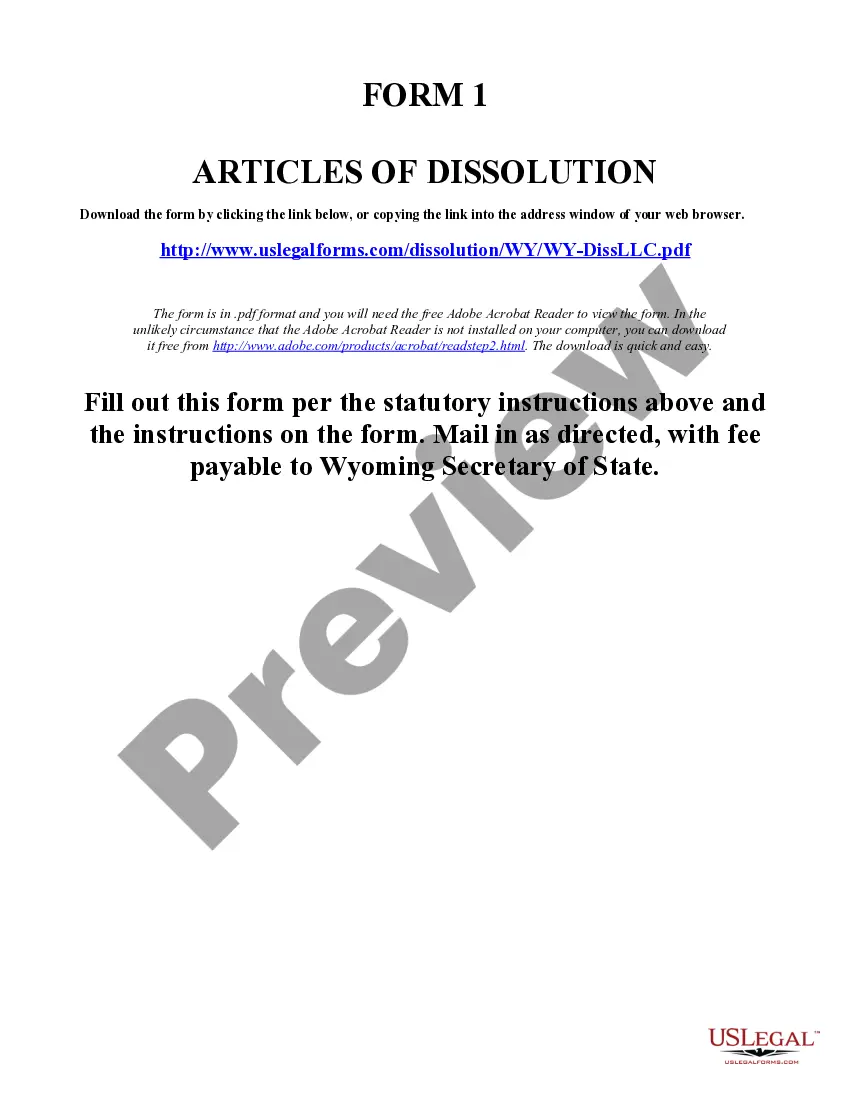

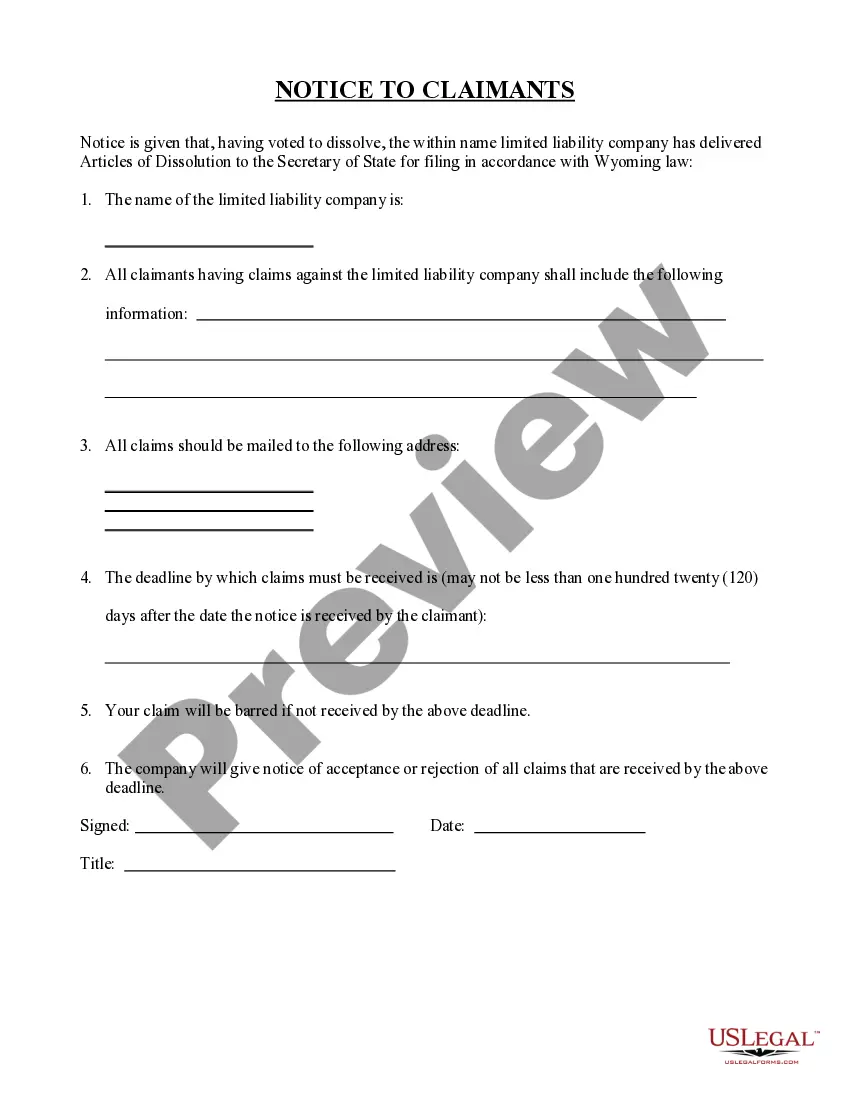

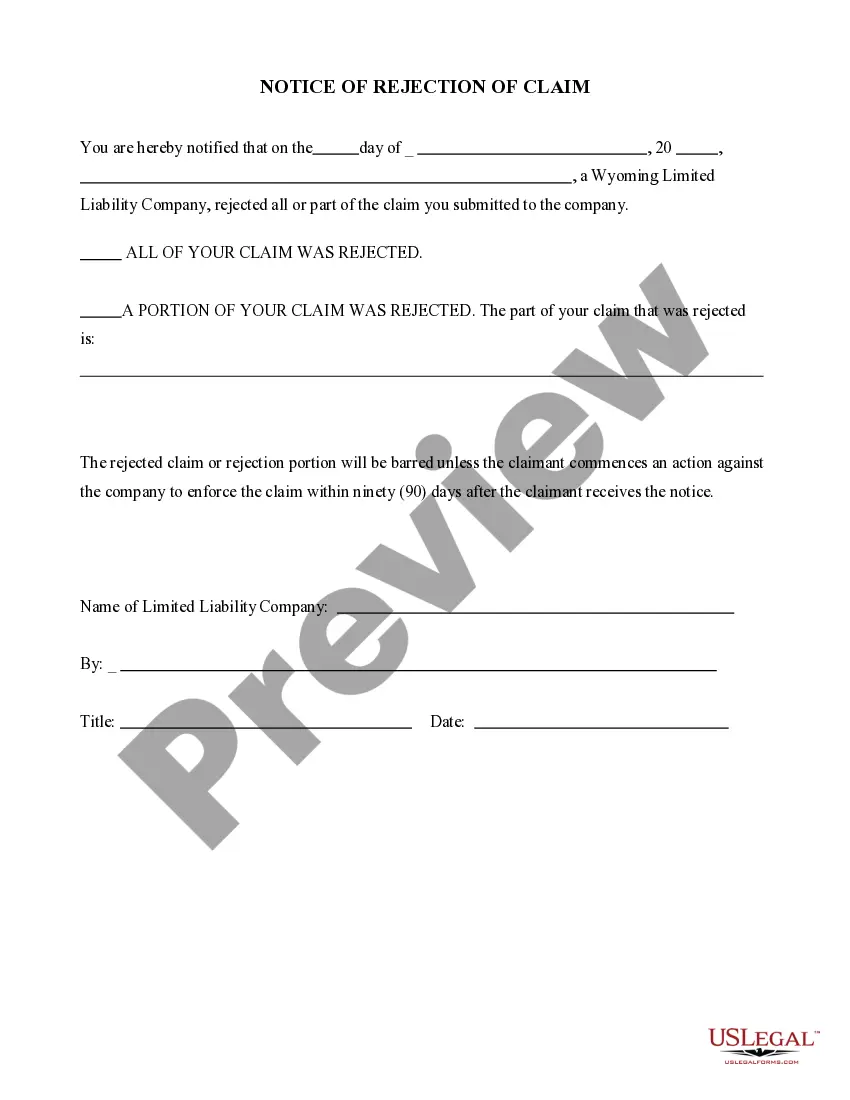

The dissolution package contains all forms to dissolve a LLC or PLLC in Wyoming, step by step instructions, addresses, transmittal letters, and other information.

Wyoming Llc Requirements

Description

How to fill out Wyoming Dissolution Package To Dissolve Limited Liability Company LLC?

Working with legal documents and procedures might be a time-consuming addition to your day. Wyoming Llc Requirements and forms like it often need you to look for them and understand how to complete them correctly. For that reason, if you are taking care of economic, legal, or individual matters, using a thorough and practical online catalogue of forms close at hand will go a long way.

US Legal Forms is the number one online platform of legal templates, offering more than 85,000 state-specific forms and numerous resources to help you complete your documents effortlessly. Check out the catalogue of appropriate documents available with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Protect your document administration processes by using a high quality service that allows you to make any form in minutes with no extra or hidden fees. Just log in to the account, identify Wyoming Llc Requirements and download it right away within the My Forms tab. You can also gain access to previously saved forms.

Would it be the first time utilizing US Legal Forms? Register and set up an account in a few minutes and you’ll gain access to the form catalogue and Wyoming Llc Requirements. Then, follow the steps listed below to complete your form:

- Be sure you have found the proper form by using the Review option and looking at the form information.

- Choose Buy Now when all set, and choose the monthly subscription plan that fits your needs.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience assisting users handle their legal documents. Find the form you require right now and enhance any process without having to break a sweat.

Form popularity

FAQ

LLC Operating Agreement The name and ownership percentage of each LLC member should be included in your operating agreement, and the document should be signed by all members. Since an operating agreement is legally binding, it can be used to prove ownership of your LLC.

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.

Wyoming LLCs must file an annual report and pay the state license tax every year. The report and tax are due by the first day of the month of the LLC's formation. So, if you formed your Wyoming LLC on September 17th of 2022, the report and tax will be due September 1st, 2023, and every year after.

LLC Taxation For Non-Residents Foreigners with a Wyoming LLC are only taxed in the US on income from US sources, which means that income from other countries won't be taxed by the US. But non-US owners of Wyoming LLCs are taxed initially on any US-sourced income at a rate of 30%. This 30% is paid to the IRS.

The specifications required of a Wyoming LLC are: Registration. Registrants must file articles of organization with the Secretary of State by mail. ... Forms and fees. ... Timeline. ... Naming requirements. ... Formation requirements. ... Forms. ... Limited liability company operating agreement. ... Taxes.