Lien Release Form From Bank

Description

How to fill out Wyoming Lien Waiver?

- Log into your US Legal Forms account if you are a returning user, ensuring your subscription is active. If it has expired, renew according to your payment plan.

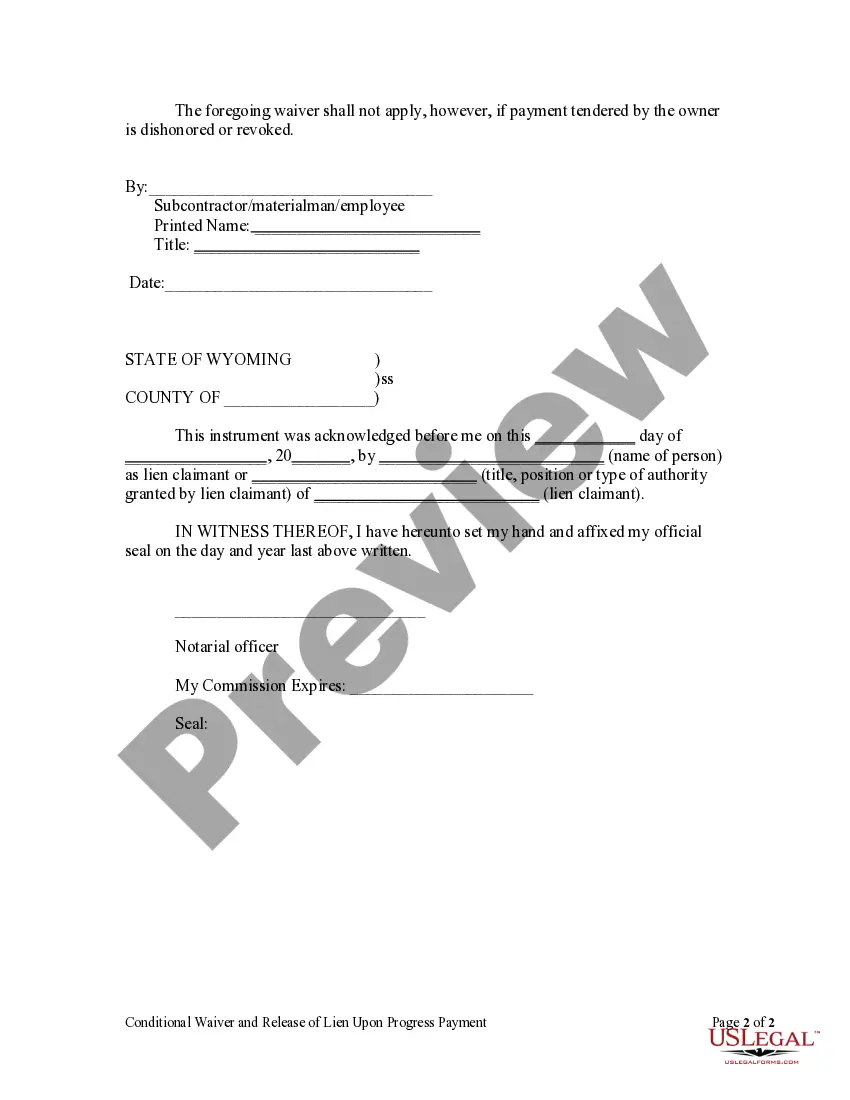

- For first-time users, explore the extensive library of legal documents by checking the form description and preview mode to verify you have selected the correct lien release form.

- Use the Search function if necessary to find alternative templates that comply with your local jurisdiction requirements.

- Purchase the document by selecting the Buy Now option and opting for a subscription plan that suits you. Creating an account will grant you access to a wealth of resources.

- Complete the checkout process by entering your payment information via credit card or PayPal to finalize your purchase.

- Download your lien release form and save it to your device. You can also access it anytime from the My Forms section in your profile.

US Legal Forms empowers individuals and attorneys to seamlessly execute legal documents with a user-friendly library of over 85,000 editable forms. With a robust collection that exceeds competitors, you can trust that you will find the documents you need.

In conclusion, utilizing US Legal Forms for your lien release form from bank enables you to efficiently manage your legal needs while ensuring accuracy. Start creating legally sound documents today!

Form popularity

FAQ

To get a copy of a lien release, reach out to the institution that issued the lien, whether it's a bank or a credit union. Be prepared to provide your account information and proof of payoff. Utilizing uslegalforms can assist you in navigating this process by offering templates to help request your lien release form from bank easily.

To obtain your lien release letter, contact the bank that issued the lien and request the necessary documentation. You may need to provide proof of debt payment and other supporting documents. Once the bank processes your request, they will issue a lien release form, confirming that the lien has been lifted. Ensure you keep this document for your records.

In Alabama, a lien can remain on your property until it is satisfied or released. Typically, if the debt is unpaid, the lien may last for several years, which can vary based on the type of lien. This period can hinder your ability to sell or refinance until resolved. You can expedite the process by requesting a lien release form from the bank.

Yes, a lien on your house can create complications, especially when selling or refinancing your property. It indicates that there are outstanding debts associated with your home. Addressing the lien promptly is essential, as it can affect your credit score and limit your financial options. Obtaining a lien release form from the bank can help clear your title and provide peace of mind.

To remove a lien from your bank, you'll typically need to obtain a lien release form from the bank that placed the lien. This form confirms that your debt is cleared and the lien is no longer in effect. Make sure to gather all necessary documents, such as proof of payment. Once you have the lien release form signed, you can then file it with your local county recorder's office.

Removing a legal hold from your bank account involves identifying the cause of the hold and addressing it directly with the involved parties. Typically, you'll need to work with creditors or legal entities to resolve the issue. Once resolved, request a lien release form from the bank to officially lift the hold and regain access to your funds.

To remove the lien amount from your bank account, start by contacting the creditor to discuss the issue. Once the matter is settled, ask for a lien release form from the bank, which you'll need to file with them. Completing this process will eliminate the lien and restore your account access.

After a bank releases a lien, it's important to confirm that the release has been properly documented. You should receive official paperwork confirming the release, so keep this for your records. Additionally, review your bank account to ensure the lien is resolved fully, allowing you to access your funds freely.

To complete a lien release, you must fill out the lien release form from the bank, providing details such as the lienholder's information and account details. Next, gather any supporting documents that prove the debt has been settled or that the lien is no longer valid. Finally, submit the completed form and documents to your bank for processing.

To remove a lien from your bank account, you first need to obtain the lien release form from the bank that issued the lien. Once you have the form, fill it out with the required information and submit it to your bank. The bank will process your request and formally release the lien, allowing you to access your funds without restrictions.