Lien Filing Codes For New York

Description

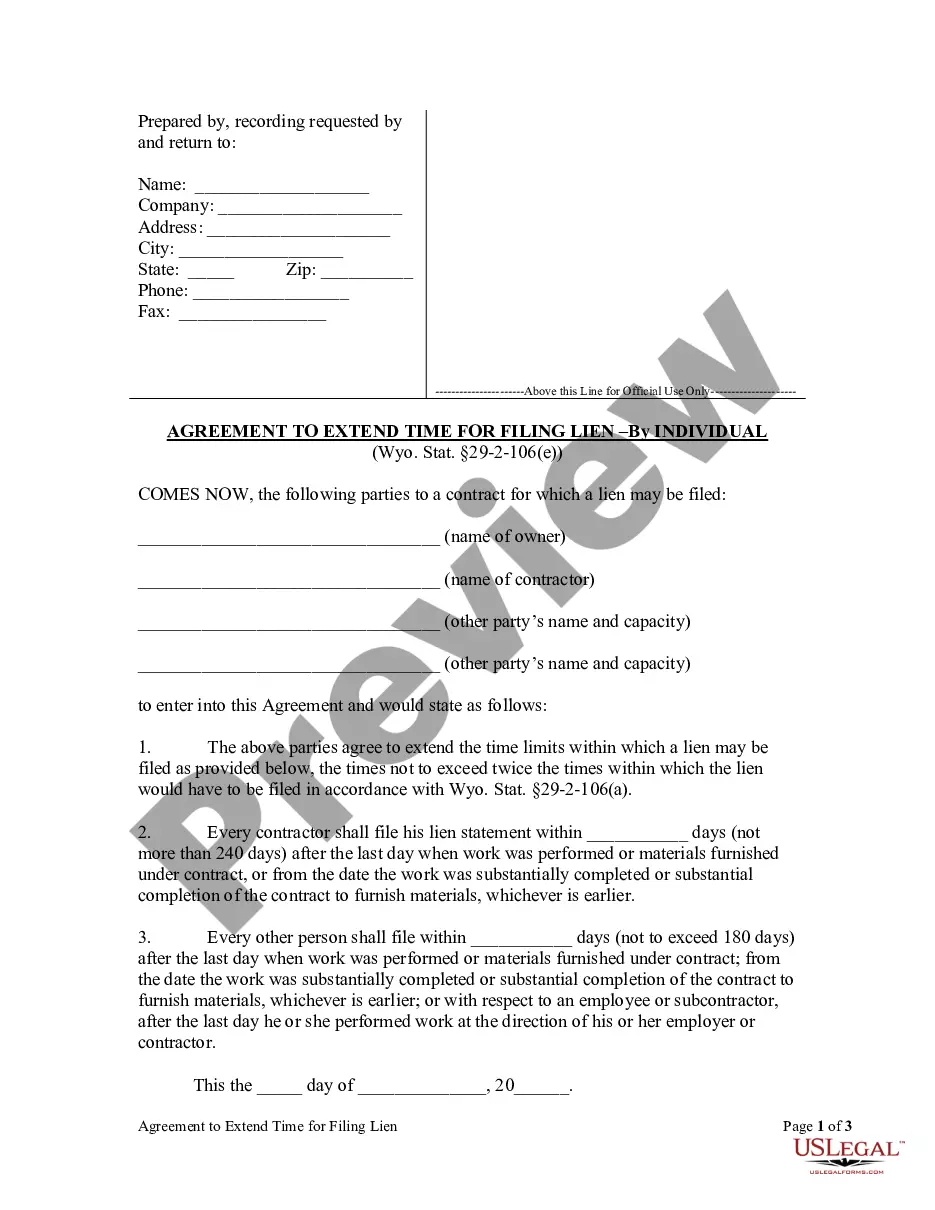

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- If you're a returning user, log into your account and locate the form template you need. Ensure your subscription is active; renew it if necessary.

- For first-time users, start by reviewing the form preview and description carefully. Confirm that it meets your requirements and complies with New York's lien filing codes.

- If the selected template doesn't fit your needs, use the Search tab to find the correct form. Once located, proceed by confirming its suitability.

- Purchase the document by clicking on the Buy Now button. Choose your preferred subscription plan and create an account to gain full access to the legal library.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Download your completed form and save it to your device. You can also access it later in the My Forms section of your profile.

US Legal Forms empowers you to execute legal documents with ease, providing an extensive collection of over 85,000 fillable forms that are adaptable to your needs.

With expert assistance available for form completion, you can ensure that your documents are precise and legally sound. Start experiencing the benefits today and simplify your legal process!

Form popularity

FAQ

Yes, New York does utilize the Electronic Lien and Title (ELT) system as part of its efforts to modernize vehicle title processes. This system facilitates quicker and safer management of lien filing codes for New York. Participants benefit from reduced paperwork and faster processing times, enhancing the overall experience for lienholders. If you need clarity on how to navigate the ELT system, US Legal Forms offers valuable resources.

Yes, New York State utilizes the Electronic Lien and Title (ELT) system, making it easier to manage lien filing codes for New York. This program allows lienholders to electronically submit and receive title information, creating a more efficient workflow. By participating in the ELT program, both lenders and vehicle owners can benefit from faster service and more secure documentation. For assistance in understanding ELT processes, US Legal Forms is a reliable resource.

The Electronic Lien and Title (ELT) system is used by several states across the country, including Florida, Texas, and Maryland. Each state has its own specific lien filing codes for New York and various other jurisdictions. This system offers benefits such as quicker processing times and enhanced security for lien holders. If you find yourself navigating through these systems, US Legal Forms can assist you in understanding ELT requirements.

Yes, New York does offer electronic titles, which streamlines the process of lien filing codes for New York. Electronic titles help in reducing paperwork, making it easier for individuals and businesses to manage their vehicle registrations. This system can significantly speed up the processing of liens and related transactions. Utilizing platforms like US Legal Forms can simplify your experience with electronic titles in New York.

A lien code is a specific designation that categorizes the type of lien filed against a property or asset. These codes provide essential information about the lien’s nature, such as whether it’s related to taxes, loans, or contractor claims. Familiarizing yourself with lien filing codes for New York is crucial for understanding how they impact your property and obligations. US Legal Forms offers comprehensive resources to help you decode and manage these important legal aspects.

'My lien' usually refers to a claim or right one party has over another party's property as security for a debt or obligation. In other words, it represents your ownership interest in an asset until the debt is satisfied. By understanding lien filing codes for New York, you can better navigate your rights regarding your lien. If you need clarity, US Legal Forms offers tools to help you manage and understand your lien situation.

To discharge a lien in New York, you typically need to settle the underlying debt associated with the lien. Once payment is made, you must request a lien release from the creditor, who will then file the necessary documentation to remove the lien. Knowing the lien filing codes for New York can facilitate this process and ensure you're following the proper steps. If you want assistance, platforms like US Legal Forms can provide guidance and resources.

In New York, most liens remain on a property for a duration of 10 years if not renewed or discharged. However, certain liens may have different terms based on their specific nature and requirements outlined by lien filing codes for New York. Regularly reviewing your property’s status can help you manage these liens effectively.

In New York, public records include various documents such as property deeds, liens, court decisions, and business filings. These documents provide transparency and are accessible to the public, allowing property owners and potential buyers to conduct thorough research. Knowing what these records are can help you make more informed decisions regarding your property.

Yes, liens are considered public record in New York. This means that anyone can access and review the records of liens filed against properties. Understanding how to navigate these records, including familiarizing yourself with lien filing codes for New York, can help you protect your property rights.