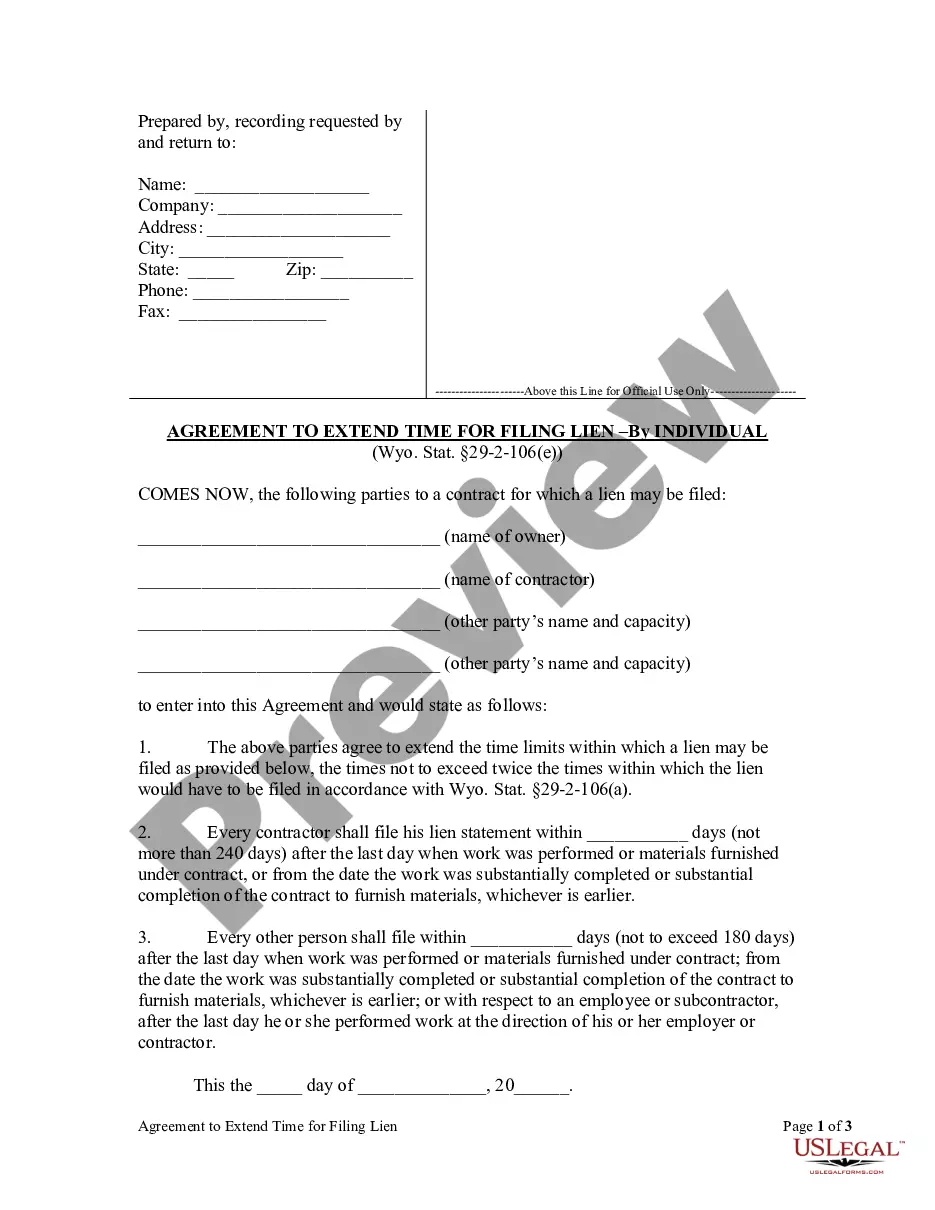

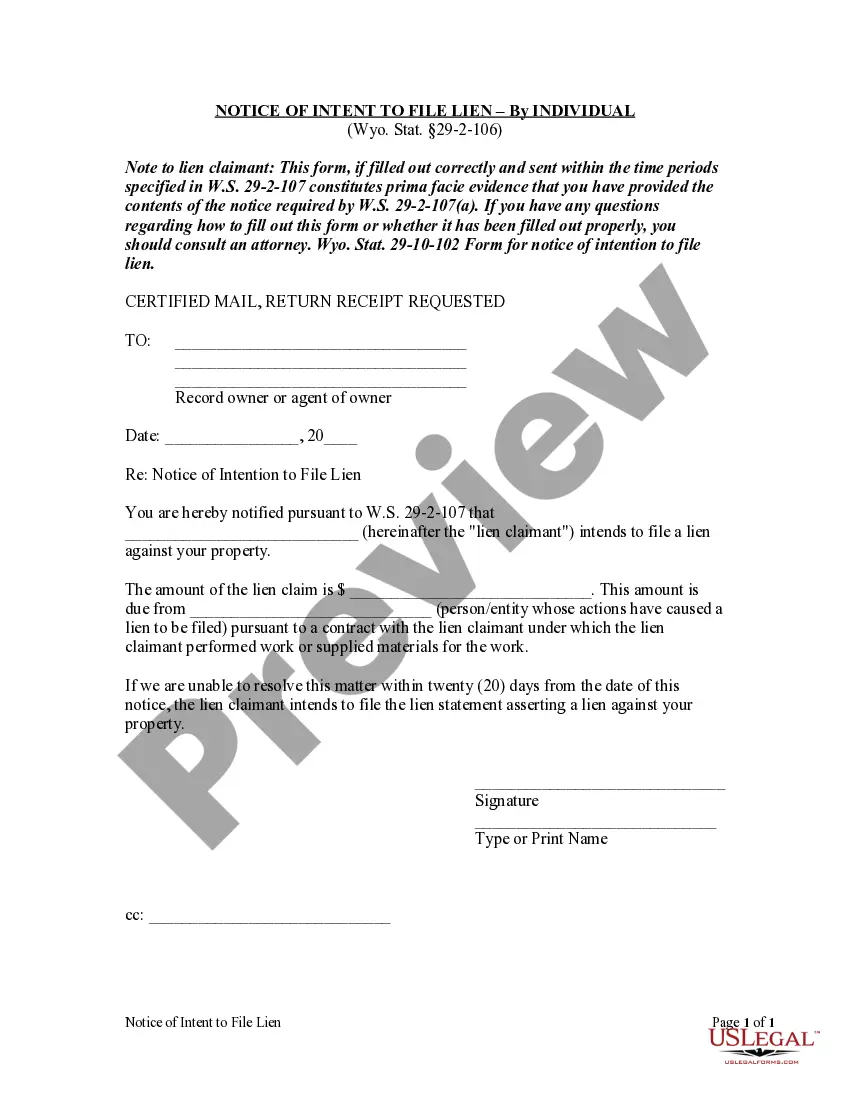

This Agreement to Extend Time For Filing Lien is for use by individual parties to a contract for which a lien may be filed to agree to extend the time limits within which a lien may be filed, the times not to exceed twice the times within which the lien would have to be filed in accordance with Wyo. Stat. §29-2-106(a).

Filing A Lien For Unpaid Hoa Dues

Description

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- If you are already a member of US Legal Forms, log into your account and access the required form template from your library. Click the Download button to save it to your device, ensuring your subscription is current.

- For first-time users, begin by reviewing the Preview mode and description of the form. Confirm that it meets your specific needs and complies with local laws and regulations.

- If you need an alternative form, utilize the Search feature at the top. This will help you find the most suitable template for your situation before advancing to purchase.

- Proceed by selecting the Buy Now button associated with the desired document. Choose a subscription plan that best fits your requirements, and create an account to access the full library.

- Complete your purchase by entering your credit card information or opting for PayPal for a swift transaction.

- Download the completed form and save it on your device. You can later access it in the My Forms section whenever needed.

After following these steps, you'll have your lien form ready to go. US Legal Forms not only simplifies legal processes but also ensures that you have access to over 85,000 editable legal documents and professional advice for a secure experience.

Take control of your HOA's financial health today! Visit US Legal Forms for your legal documentation needs.

Form popularity

FAQ

Homeowners Associations generally do not directly report to credit bureaus, but filing a lien for unpaid HOA dues can lead to negative credit implications. If the lien progresses to a judgment, that judgment may be reported, impacting your credit score. Consequently, staying on top of your HOA payments can prevent future complications. Consider using platforms like USLegalForms to understand your rights and options regarding HOA dues.

Filing a lien for unpaid HOA dues can significantly impact your credit score. Once a lien is placed, it can make it difficult to secure loans or favorable interest rates. Additionally, this negative mark can remain on your credit report for several years, affecting your ability to obtain credit. To avoid such consequences, it is crucial to address unpaid dues promptly.

Yes, an HOA lien can negatively impact your credit score if the association takes action, such as pursuing a judgment against you. Credit agencies categorize unpaid debts as delinquent accounts, which lowers your overall creditworthiness. Being proactive in resolving unpaid dues is essential to avoid these consequences. Filing a lien for unpaid HOA dues may also alert you to potential legal actions that could affect your financial standing.

An HOA lien is a legal claim that the homeowner's association places on the property due to unpaid dues or assessments. This type of lien can secure the association's right to collect the owed amounts, often leading to foreclosure if the debt remains unpaid. Understanding the implications of an HOA lien is crucial for homeowners. Filing a lien for unpaid HOA dues helps the association enforce compliance and protect its financial interests.

To effectively push back against your HOA, start by reviewing your association's governing documents, which outline your rights and responsibilities. Next, communicate your concerns in writing, clearly stating your position and the reasons behind it. Finding like-minded neighbors can amplify your voice when addressing HOA issues. Remember, understanding your rights related to filing a lien for unpaid HOA dues can also strengthen your case.

In Texas, the statute of limitations for an HOA lien is typically four years. This means that the HOA has four years from the date the payment was due to file a lien for unpaid HOA dues. Understanding this timeframe can help homeowners navigate their responsibilities and protect their rights regarding property.

Homeowners' Associations (HOAs) cannot directly force you to sell your house. However, if you fall behind on your dues, they can file a lien for unpaid HOA dues, which may lead to foreclosure. It is crucial to stay informed about your dues and respond to any notices promptly to avoid this situation.

Several types of liens exist, including mortgage liens, judgment liens, and HOA liens. The specific context of your financial situation will determine which kind is relevant. Filing a lien for unpaid HOA dues is a specific action that an association may take to recover uncollected fees. Understanding these different types of liens can help homeowners navigate their responsibilities more effectively.

Yes, a HOA lien can affect your credit score if it goes to collections or results in foreclosure. While filing a lien for unpaid HOA dues does not directly impact your credit score initially, unresolved dues can lead to more serious consequences. It's essential to address any outstanding HOA dues promptly to avoid negative repercussions on your credit history. Maintaining good standing with your HOA can help you protect your financial health.