File Lien On House

Description

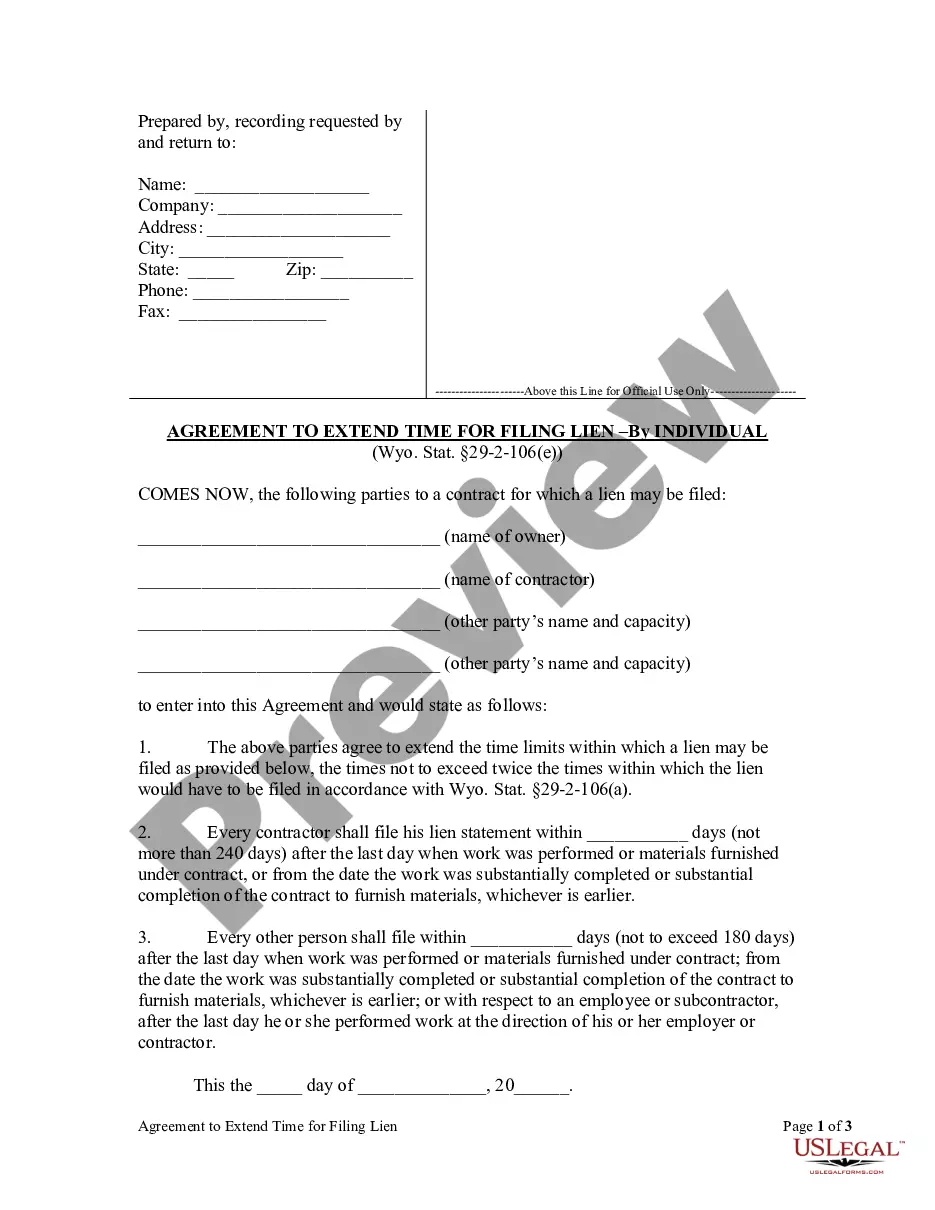

How to fill out Wyoming Agreement To Extend Time For Filing Lien - Individual?

- Log in to your U.S. Legal Forms account if you're a returning user and download the lien form template by clicking the Download button. Ensure your subscription is active; renew if necessary.

- For first-time users, start by checking the Preview mode and reviewing form descriptions. Confirm that you've selected the document that aligns with your needs and complies with local laws.

- If any discrepancies arise, use the Search feature to find the correct document tailored to your requirements. Proceed only when satisfied with your selection.

- Purchase the document by clicking the Buy Now button and choosing your subscription plan. You'll need to create an account for full access.

- Complete your transaction by entering your credit card details or using PayPal to finalize your subscription.

- Download and save the lien form to your device for completion. You can also access it anytime from the My Forms section in your account.

U.S. Legal Forms offers one of the most robust collections of legal documents at competitive prices. With over 85,000 customizable forms, you can be sure to find what you need.

Complete your legal task efficiently and accurately with U.S. Legal Forms today! Visit their site to get started.

Form popularity

FAQ

In Minnesota, both individuals and businesses can file a lien on property if they have a legitimate claim. This can include contractors seeking payment for services provided. To simplify the process and ensure accuracy, consider using platforms like uslegalforms to learn how to file a lien on a house.

In Maryland, various entities can file a lien, including creditors, contractors, and the government for unpaid taxes. This action typically protects their interests in unpaid debts. For assistance, consider learning how to file a lien on a house through user-friendly resources.

Yes, you can put a lien on a house you own, but it must be done legally through the proper channels. This can involve filing specific documents in your local jurisdiction. If you're uncertain about the process, platforms like uslegalforms can guide you on how to file a lien on a house.

When a lien is placed on you, it typically restricts your ability to sell or refinance your property without settling the debt first. This situation may affect your credit score and increase financial difficulty. To avoid or manage this, understanding how to file a lien on a house correctly is crucial.

In Rhode Island, a lien generally stays on your property for ten years. This timeline can vary depending on the type of lien. After this period, a lien may be removed if not renewed. It’s essential to know this when considering how to file a lien on a house.

There is no universally set minimum amount to file a lien on a house in Minnesota; however, the claim needs to be substantial enough to justify the legal procedure. Lenders and contractors typically seek liens for amounts that are meaningful to ensure recovery. Always check specific state guidelines and consult with legal help when necessary.

To put a lien on someone's property in Minnesota, start by gathering all necessary documentation that supports your claim. Then, prepare and file the appropriate lien form with the county recorder’s office, along with any required fees. It’s beneficial to clearly outline the nature of the debt, which will help you effectively file a lien on a house.

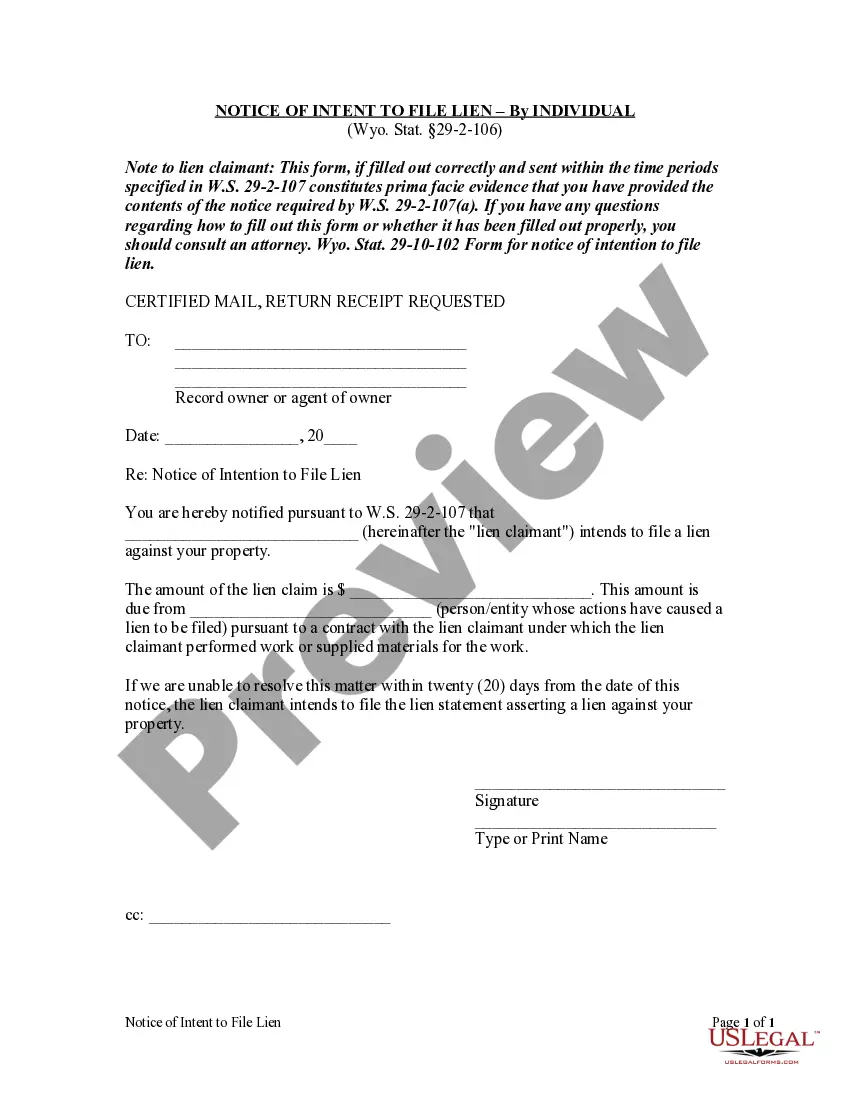

To file a lien on a house, certain conditions must be met. You must have a legitimate reason for the lien, such as unpaid work or services rendered. Additionally, the lien must be recorded properly and within the required timeframe to be legally enforceable.

In Minnesota, the rules for filing a lien on a house are established by state law. To file a lien, you must provide clear documentation of the debt or obligation, and you typically need to file this with the county recorder’s office. It’s important to follow all legal procedures and deadlines to ensure that your intent to file a lien on a house is valid and enforceable.

If someone puts a lien on your house, you should take immediate action to address the issue. First, obtain records to verify the lien and its legitimacy. Next, consider discussing the matter with the creditor to resolve the outstanding debt. If necessary, seek professional legal advice, and depending on the scenario, you may want to look into how to file lien on house as a protective measure.