Wisconsin Tod Form Withholding

Description

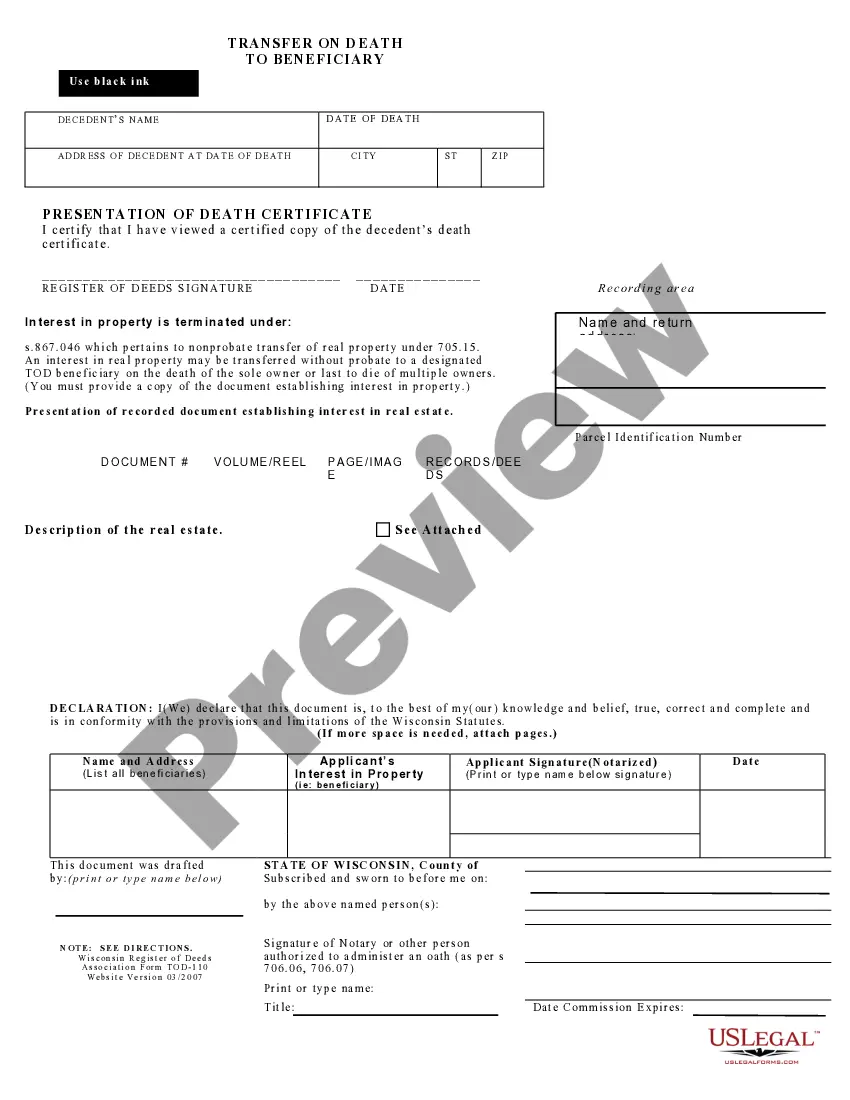

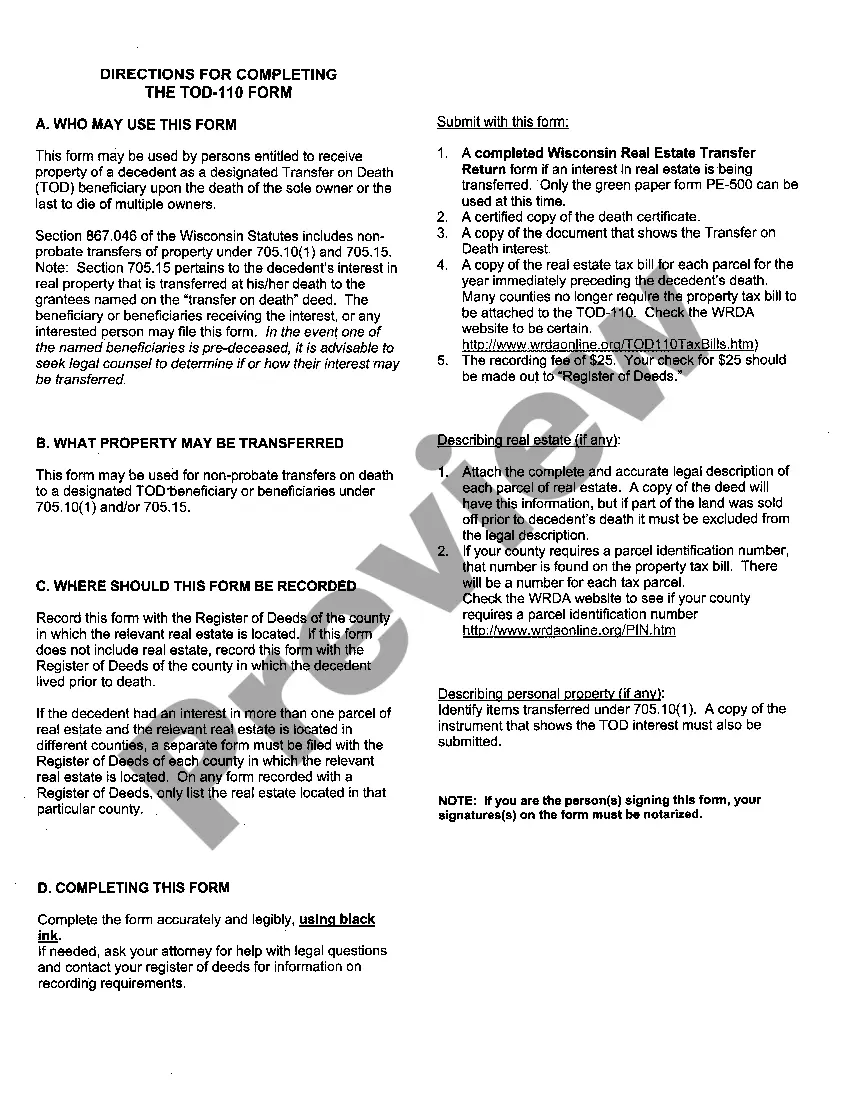

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

Managing legal documents can be daunting, even for the most experienced professionals.

When searching for a Wisconsin Tod Form Withholding and lacking the opportunity to invest time in locating the correct and current version, the experience can be taxing.

US Legal Forms caters to all your requirements, whether they pertain to personal or business paperwork, all in one location.

Utilize advanced tools to complete and manage your Wisconsin Tod Form Withholding.

Here are the steps to follow after locating the form you need: Verify that it is the correct document by previewing it and reviewing its details. Confirm that the form is accepted in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the desired file format, and Download, complete, eSign, print, and dispatch your document. Enjoy the US Legal Forms online library, supported by 25 years of experience and reliability. Simplify your daily document management into a seamless and straightforward process today.

- Tap into a resource library filled with articles, guides, and manuals pertinent to your situation and needs.

- Conserve time and energy in your quest for the documents you require, and use US Legal Forms’ sophisticated search and Preview function to find Wisconsin Tod Form Withholding.

- If you hold a subscription, Log In to your US Legal Forms account, search for the desired form, and obtain it.

- Check your My documents section to view previously downloaded documents and manage your files as you prefer.

- If this is your initial experience with US Legal Forms, create an account to receive unlimited access to all the benefits of the library.

- A comprehensive online form repository could be a significant advantage for anyone looking to address these matters efficiently.

- US Legal Forms is a frontrunner in online legal documentation, offering over 85,000 state-specific legal forms at any moment.

- With US Legal Forms, you gain the ability to access state- or county-specific legal and organizational documents.

Form popularity

FAQ

Wisconsin property owners typically use TOD deeds to bypass the formal probate process. Probate is often cumbersome, costly, and time-consuming. Keeping significant assets like real estate out of an individual's probate estate reduces the burden and expense of estate administration.

In Wisconsin, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed.

A Wisconsin designation of TOD beneficiary, or ?transfer on death deed,? is used to name a person or entity who will receive ownership of a property once the current owner passes away.

705.21 Definitions; transfer on death security registration. In ss. 705.21 to 705.30: (2) ?Beneficiary form" means a registration of a security which indicates the present owner of the security and the intention of the owner regarding the person who will become the owner of the security upon the death of the owner.

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.